Awesome Info About Pro Forma Financial Statements Are Format Of Opening Balance Sheet

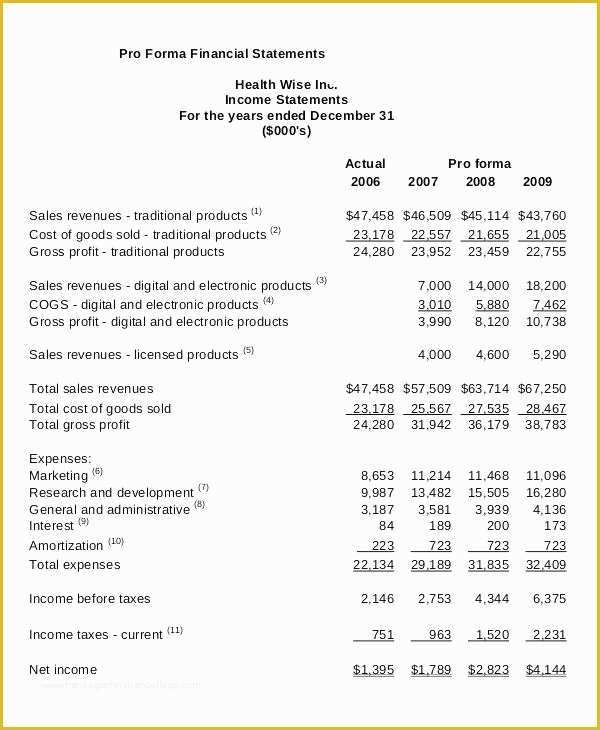

These form the basis for more specific statements like risk assessment analysis and mergers and acquisitions.

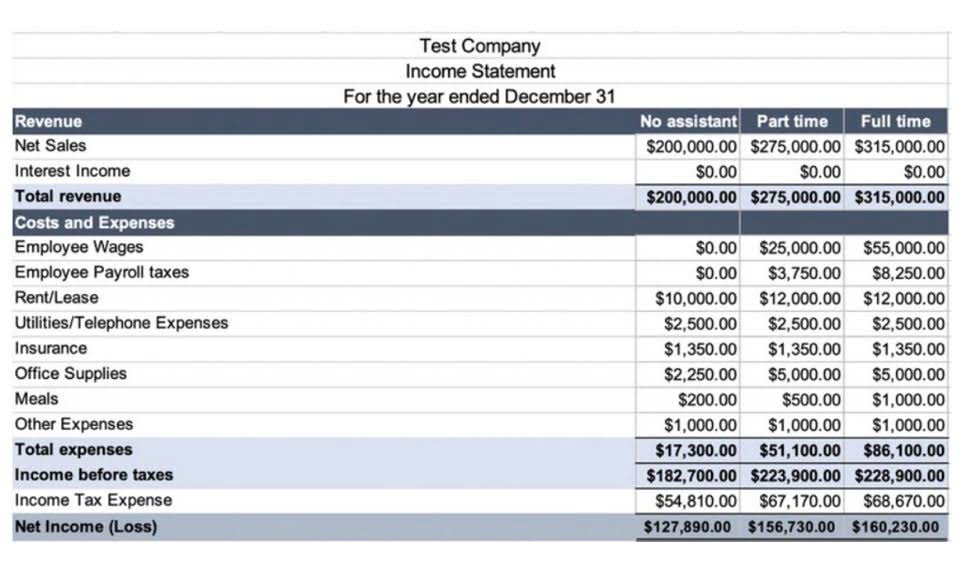

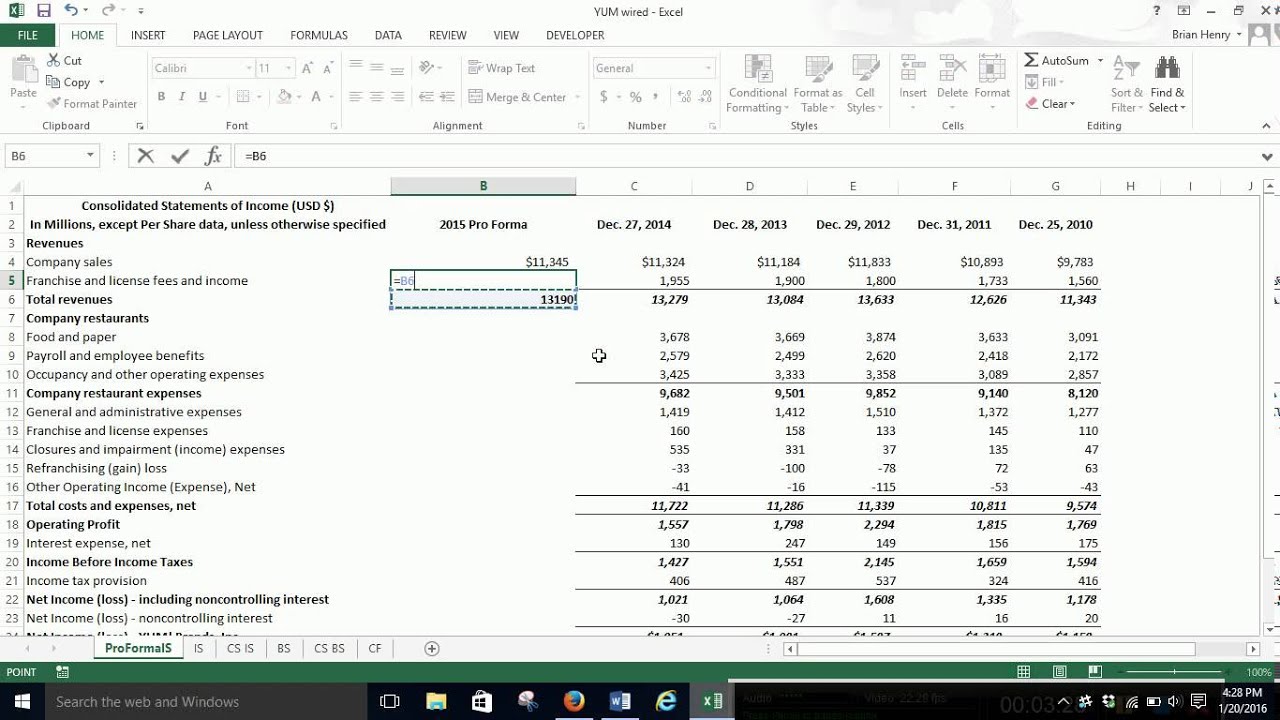

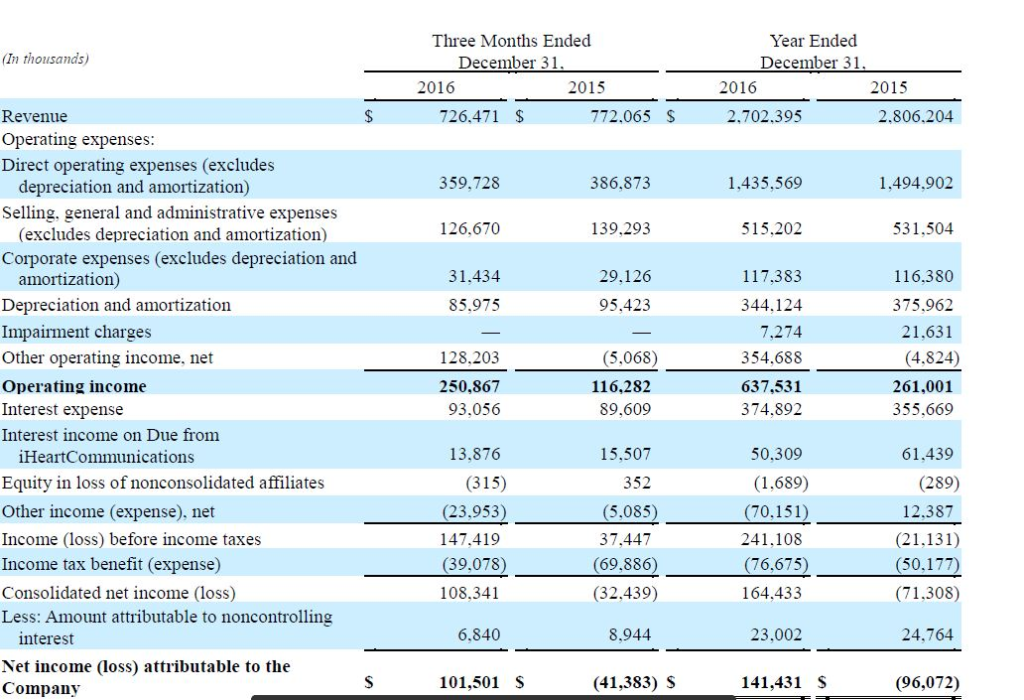

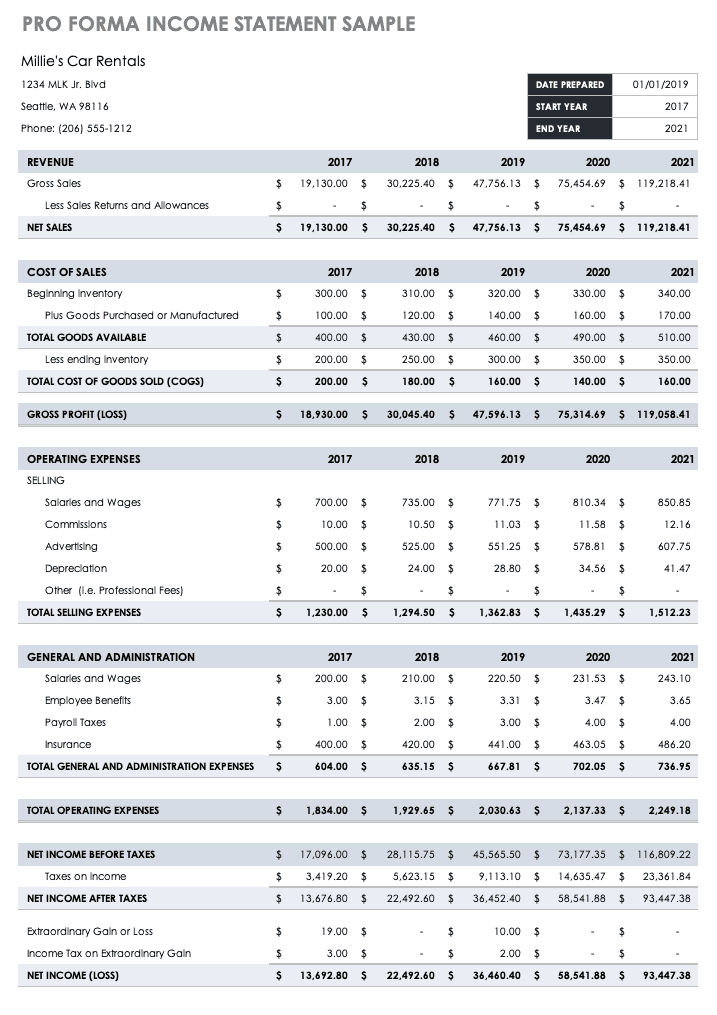

Pro forma financial statements are format of opening balance sheet. Working capital management unit 4: There are three main documents in pro forma financial statements: Income sheet, balance sheet, and cash flow statement.

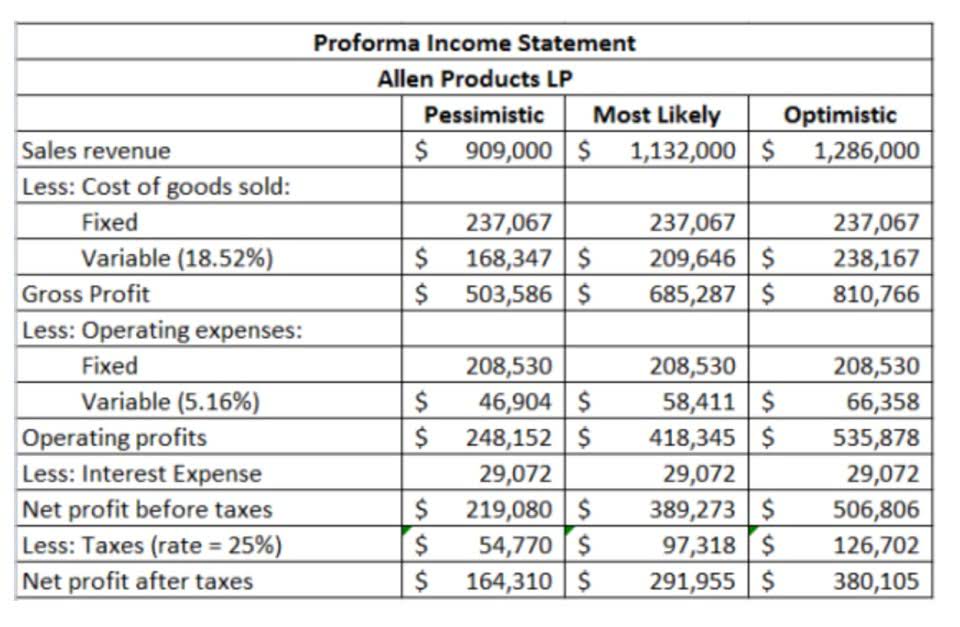

This financial statement is not prepared in accordance with generally accepted accounting standards (gaap). There are three main types of pro forma statements: Since the term “pro forma” refers to projections or forecasts, it can apply to a variety of financial statements, including:

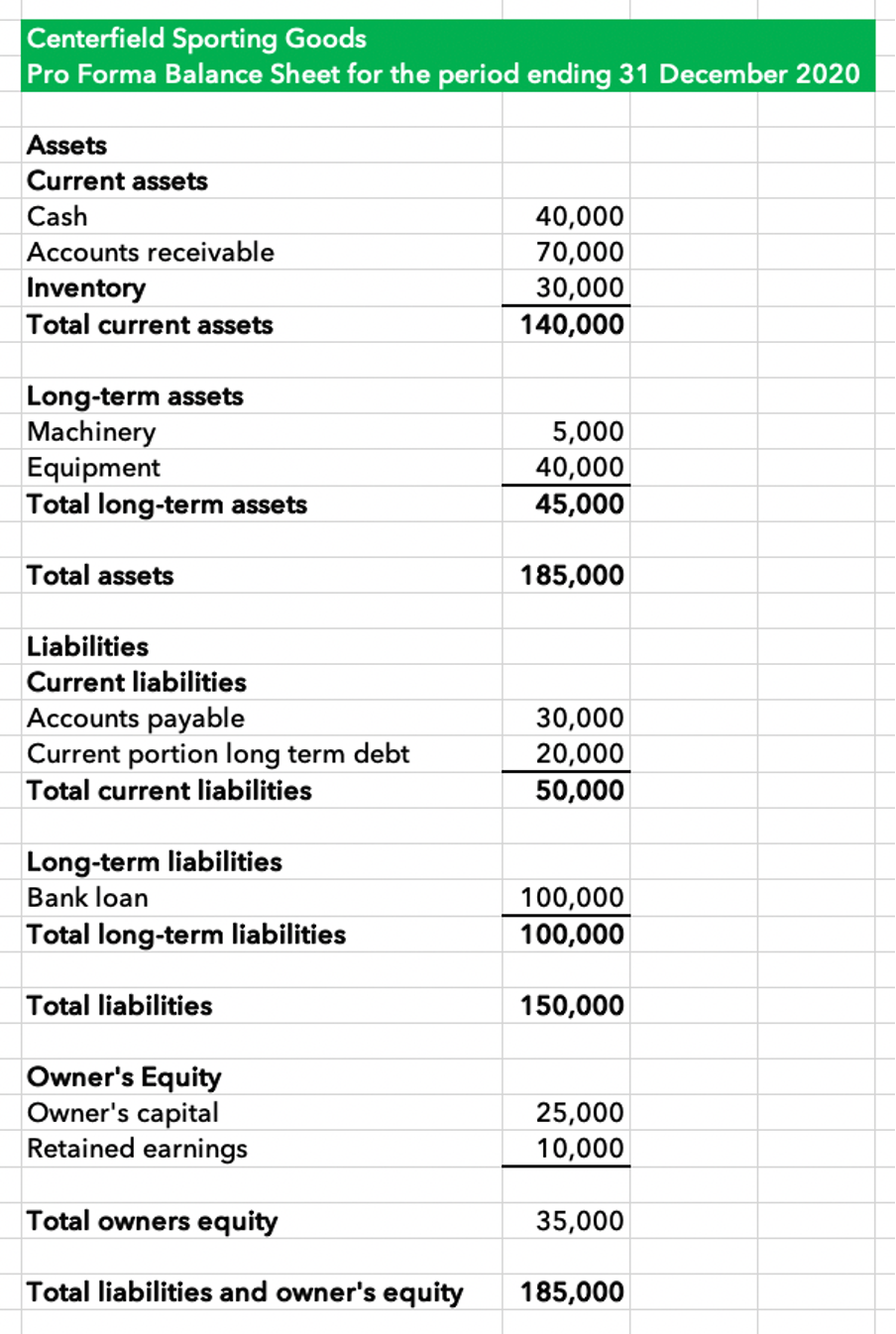

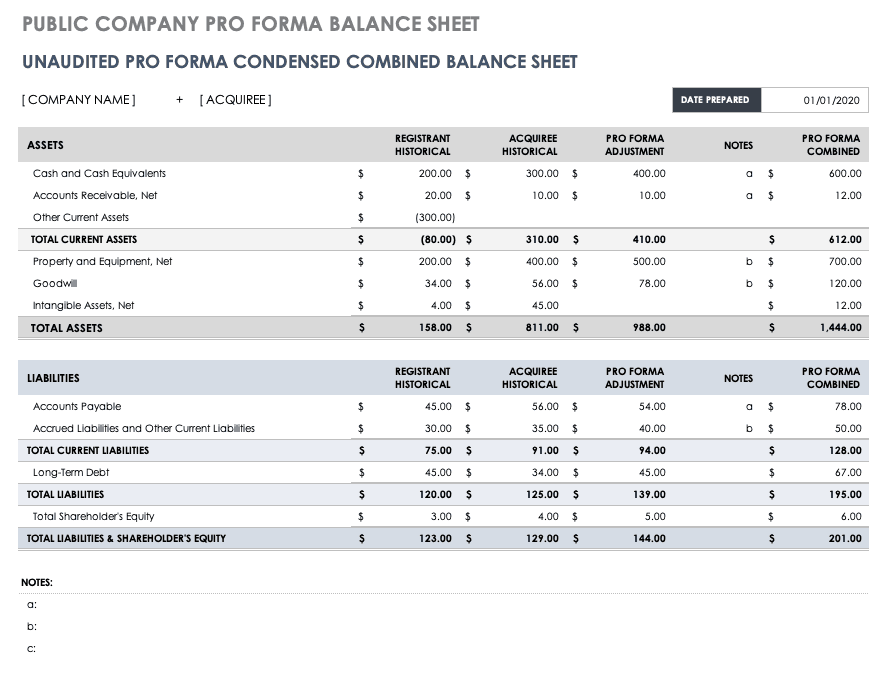

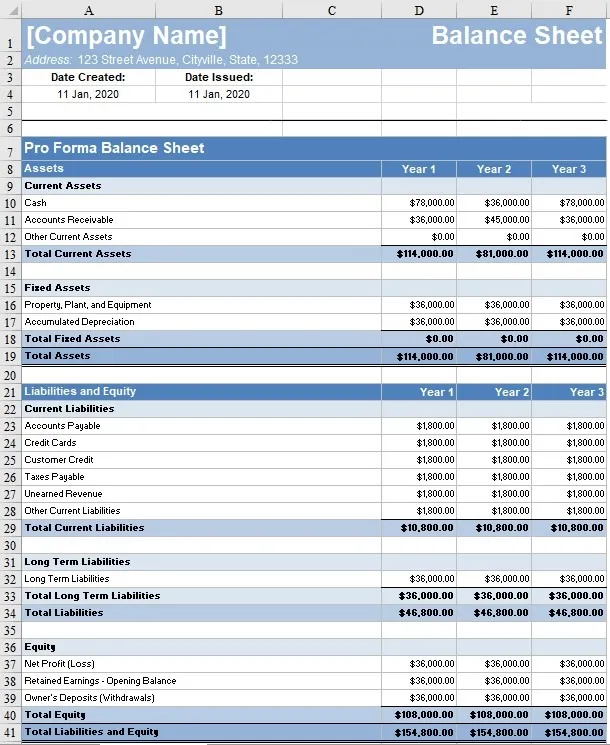

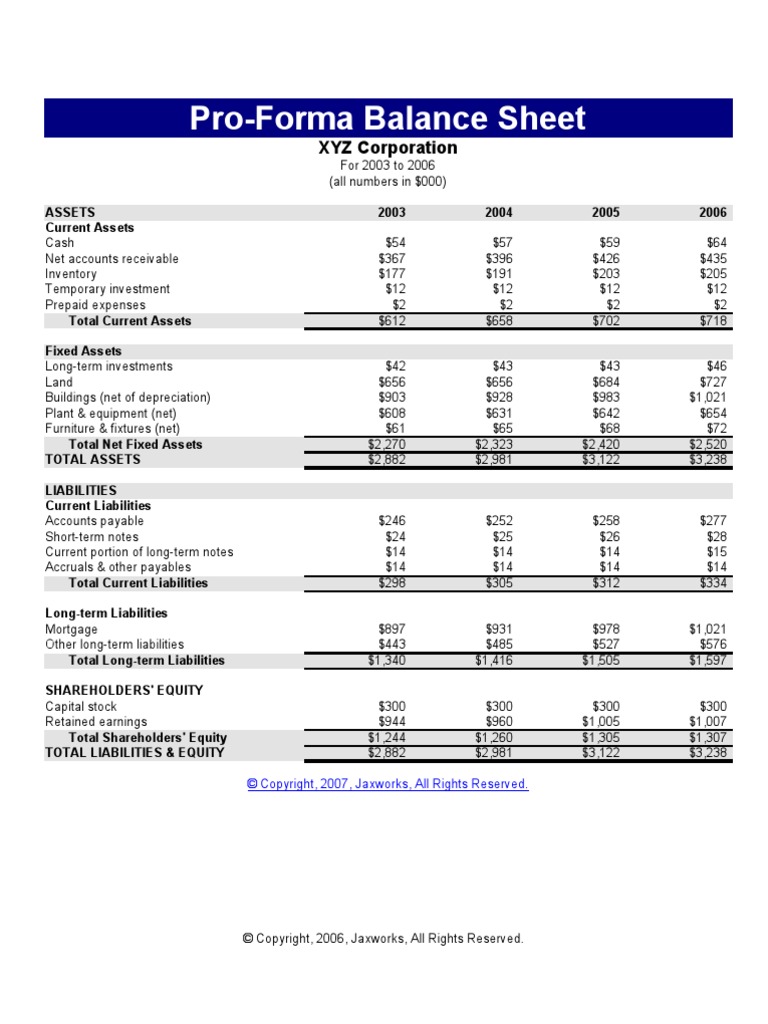

A pro forma balance sheet is a financial statement that details a business's estimated balance sheet at a given future date. A pro forma balance sheet is a financial document that discloses a business’s assets, liabilities, and equity at a specific point in time. A pro forma balance sheet is similar to a historical balance sheet, but it represents a future projection.

What types of pro forma financial statements are commonly used? Bookkeeping pro forma financial statements: Stocks, bonds, and financial markets unit 6:

Other forms and content disclosures: This allows investors and partners to see the financial status of the company at the end of the fiscal year. The unique identifier of the contact party.

Balance sheets, income statements, and statements of cash flow. Pro forma’s contain running balances for the assets, liabilities, and equity we wish to have in the future. Condensed balance sheet (typically, as of the end of the most recent period) that includes historical balance sheets of the acquiror and target, applicable pro forma adjustments, and pro forma results in a columnar format

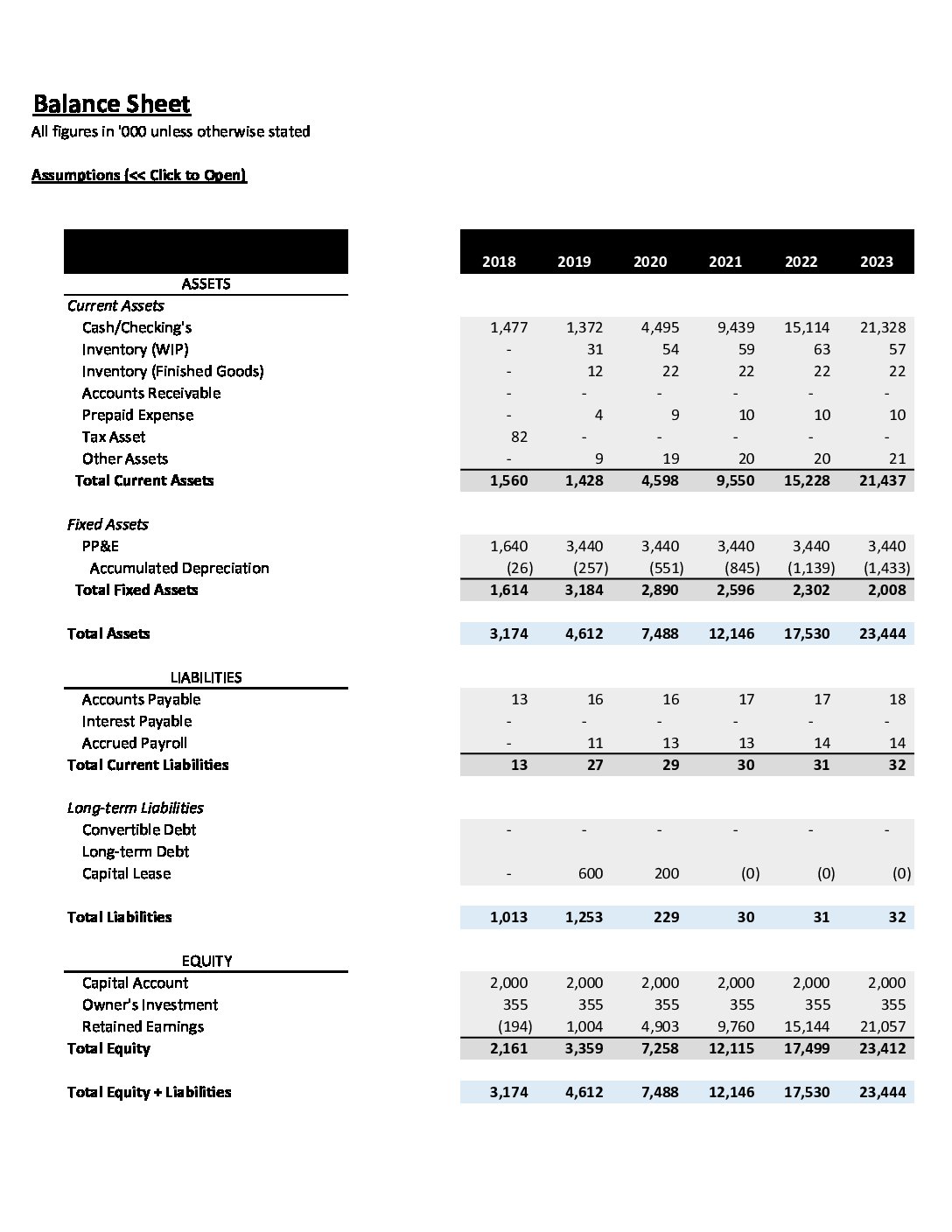

If the value is y, then the financial reports are pro forma numbers. Of the four main financial statements, only the statement of changes in equity is not used in pro forma. Time value of money unit 5:

Inc defines pro forma financial statements as “the process of presenting financial projections for a specific time period in a standardized format.”. Example of pro forma financial statement Let’s take a deep dive into the world of pro forma statements, incorporating the crucial aspects of your financial documents like income.

Growing just for the sake of growing doesn’t always yield favorable income for the firm. Pro forma balance sheets are used to project how the business will be managing its assets in the future. Documents in pro forma financial statements.

It is considered more of a balance sheet projection. Indicates if the financial reports are pro forma numbers. Pro forma budget documents a budget anticipates the inflow of projected revenues and the outflow of funds for a defined future.