Simple Info About Form No 26as

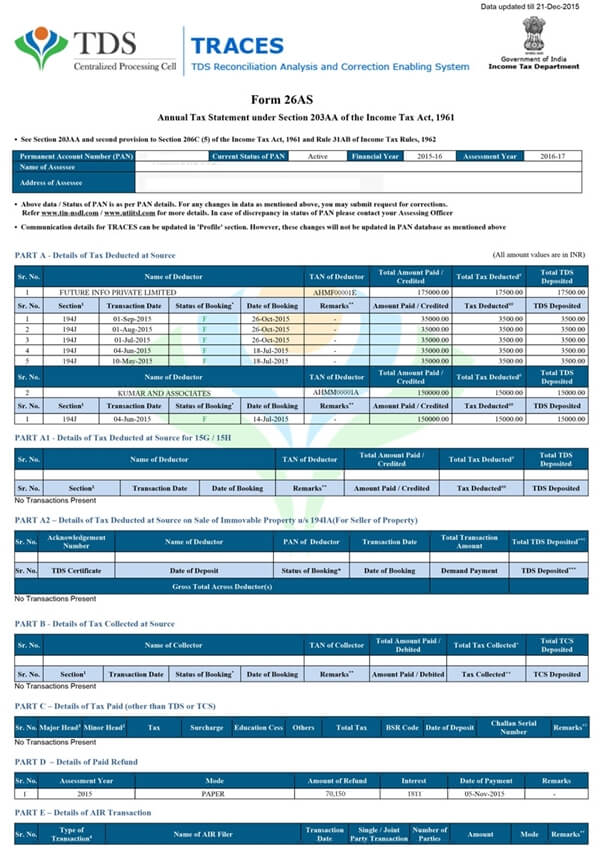

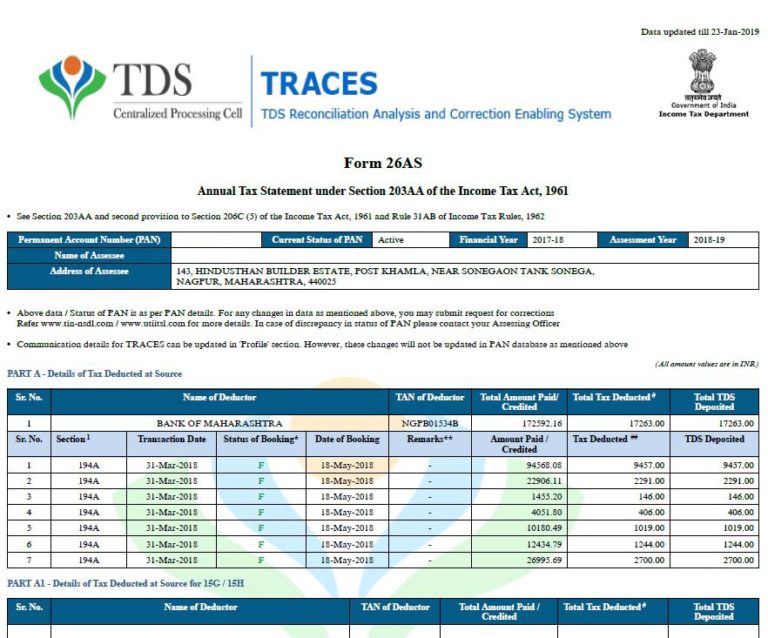

Form 26as, or the annual statement or tax credit statement, is a consolidated statement issued by the income tax department of india.

Form no 26as. What information available in form 26as? A taxpayer’s form 26as is a declaration that lists all amounts withheld as tds or tcs from their different income sources. It records all the details of tax deducted for your pan at various sources.

Following are the major information. You are accessing traces from outside india and therefore, you will require a user id with password. Form 26as means a tax credit statement and is an important document for taxpayers.

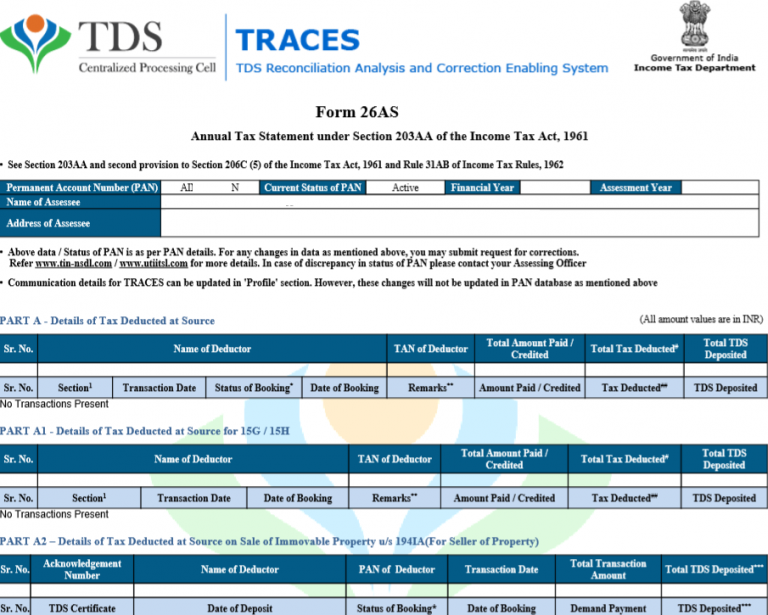

Here are some steps to easily download form 26as on the new income tax portal. Form 26as and annual information stat. The revised form 26as, known as annual information statement contains following information:

26as full form is annual information statement (ais). Over the past few years, the tax filings in india have become digital and due to the requirement of furnishing a permanent. 26as in its new form is set to be the major information displayer which was not the part of the due diligence for.

Click on ' login ' and enter the 'user id' which can be either pan or aadhar number and click on ' continue '. Information related to income earned/tds/tds/taxes. It also shows information about high.

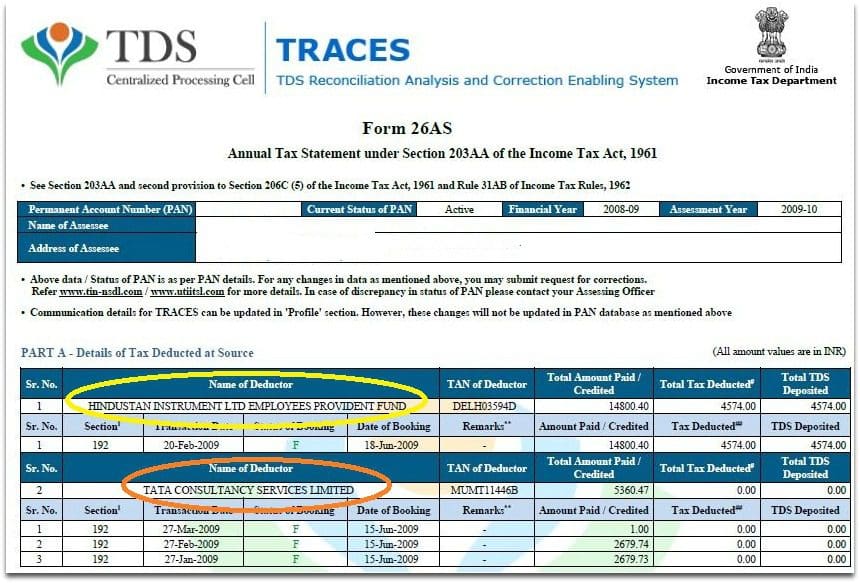

Check before you file your income tax returns one of the most common documents which every taxpayer must check before finalizing income tax return is. All the details of collected tax by the person who is collecting. Form 26as includes the information on all the deducted tax on the income of deducted.

The website provides access to the. 26as which has got a new look and contents. Now, it is form no.

The tax credit statement (form 26as) is an annual statement that consolidates information about tds, advance tax paid by the assessees, and tcs. Form 26as is an important document for filing income tax return (itr).

![[PDF] Revised 26AS Form PDF Download InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/revised-26as-form-3463.jpg)