Beautiful Work Info About Prepare An Unadjusted Trial Balance

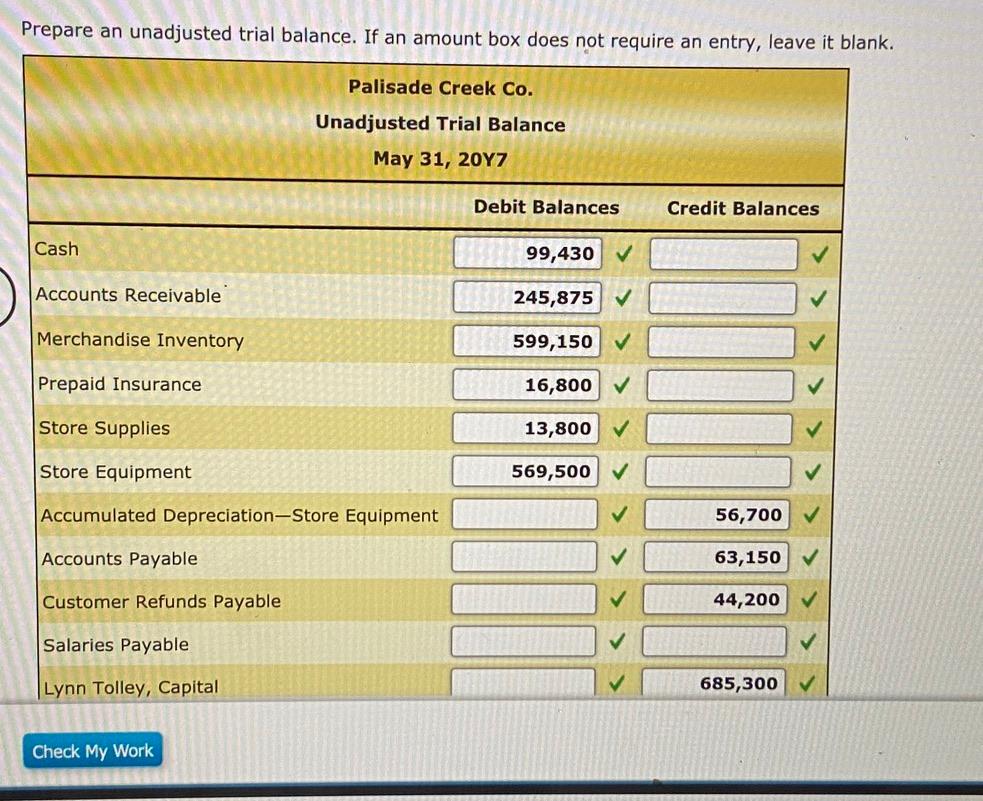

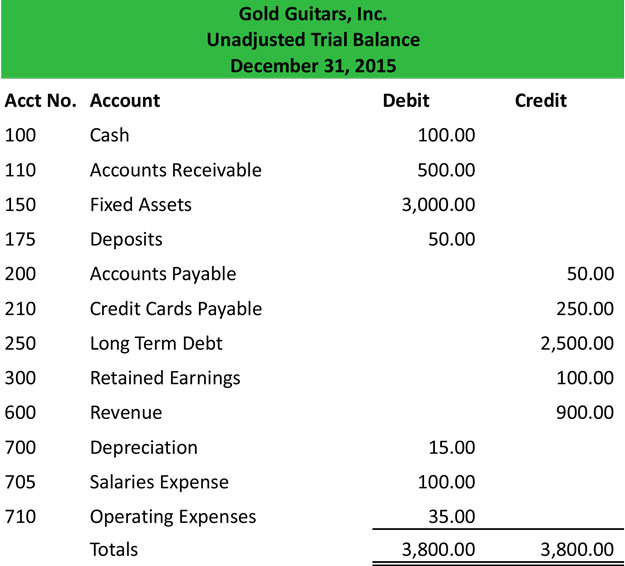

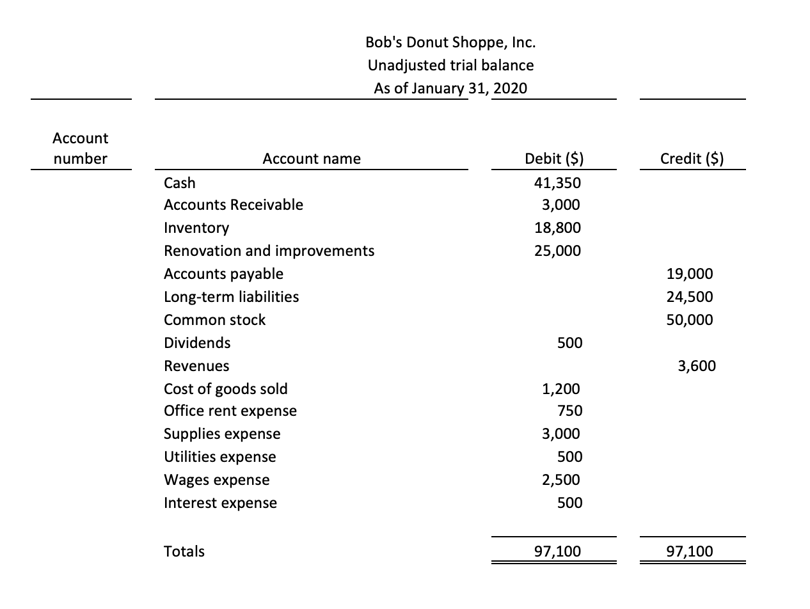

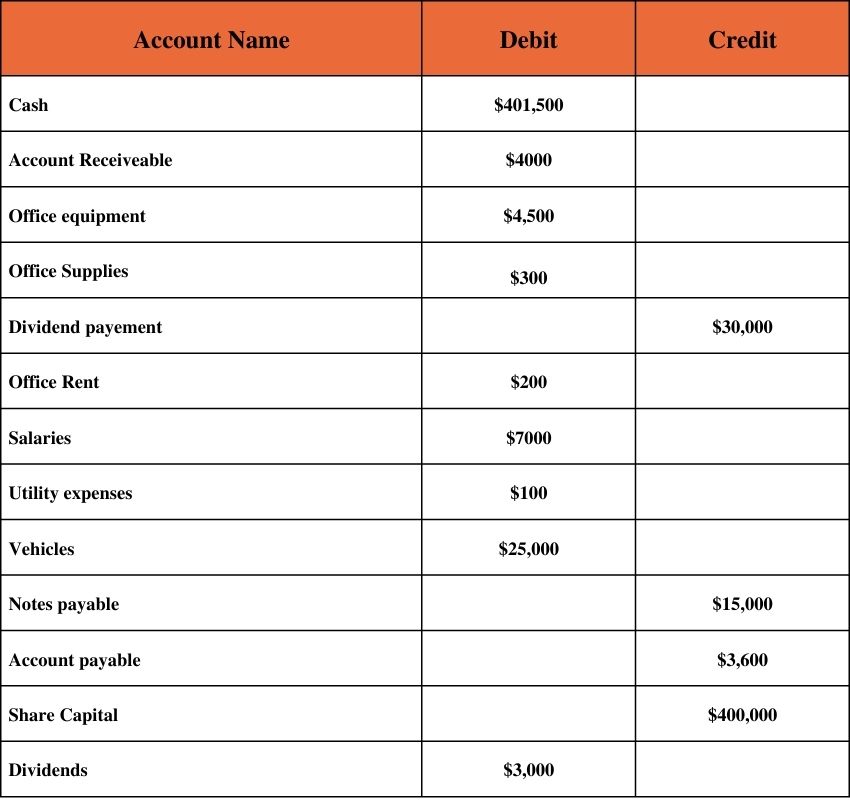

Create a master list of accounts (assets, liabilities, equity, revenue & expenses) used in your company’s accounting system.

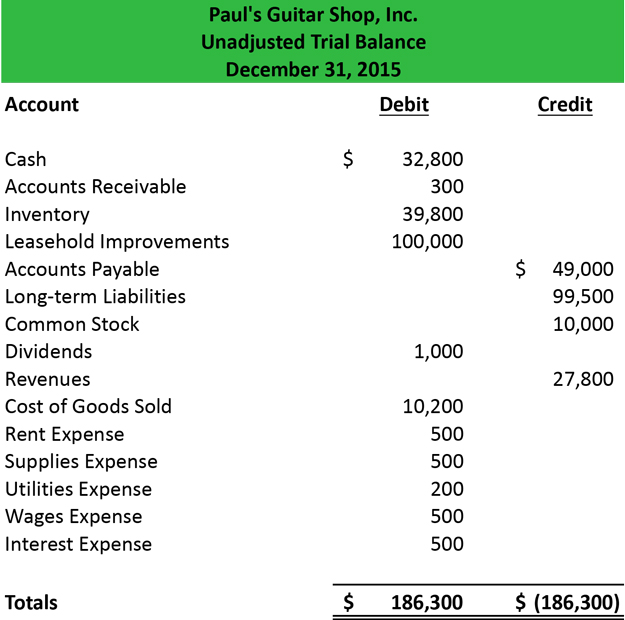

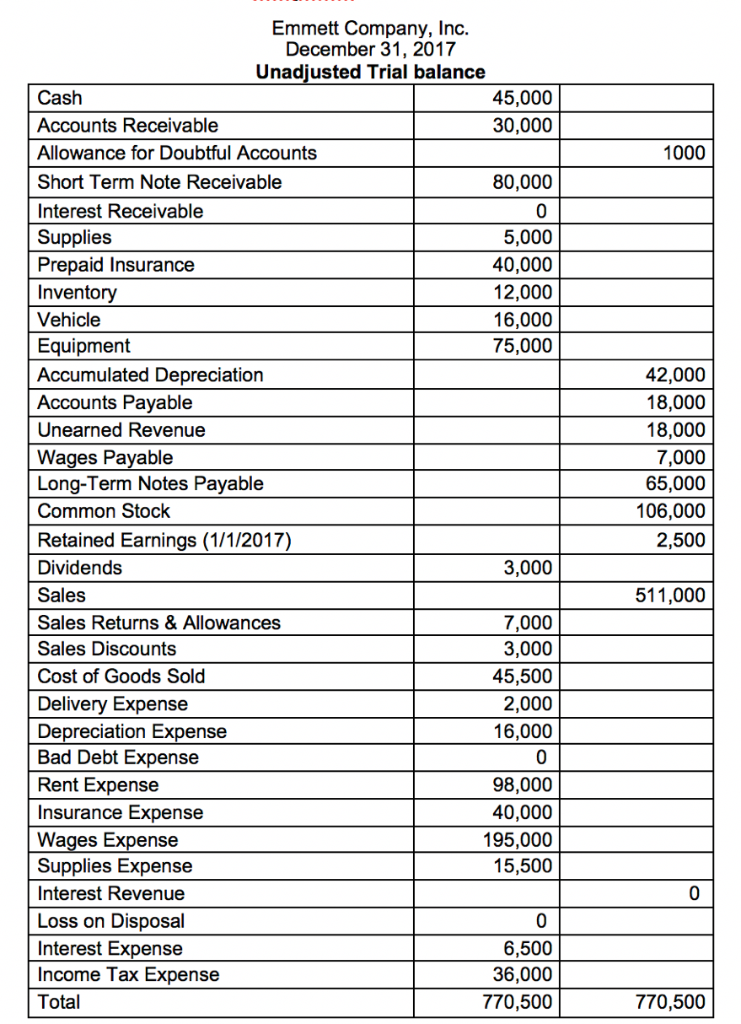

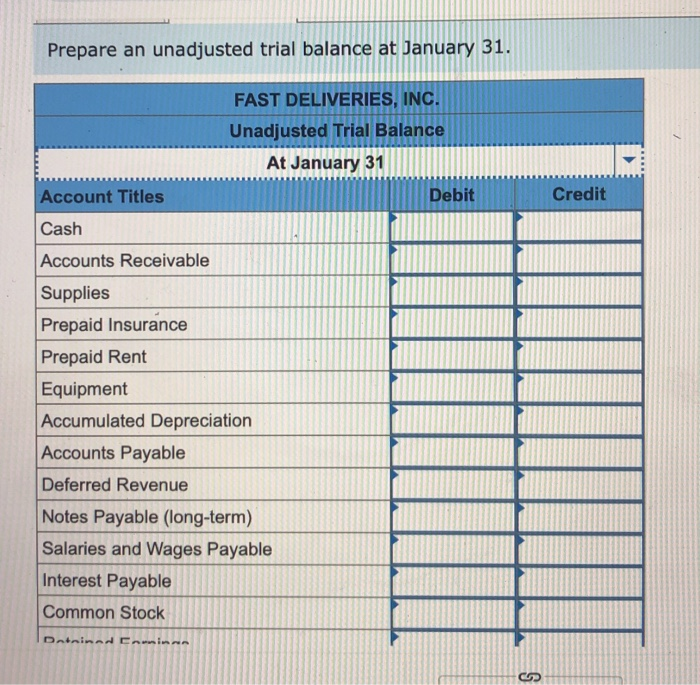

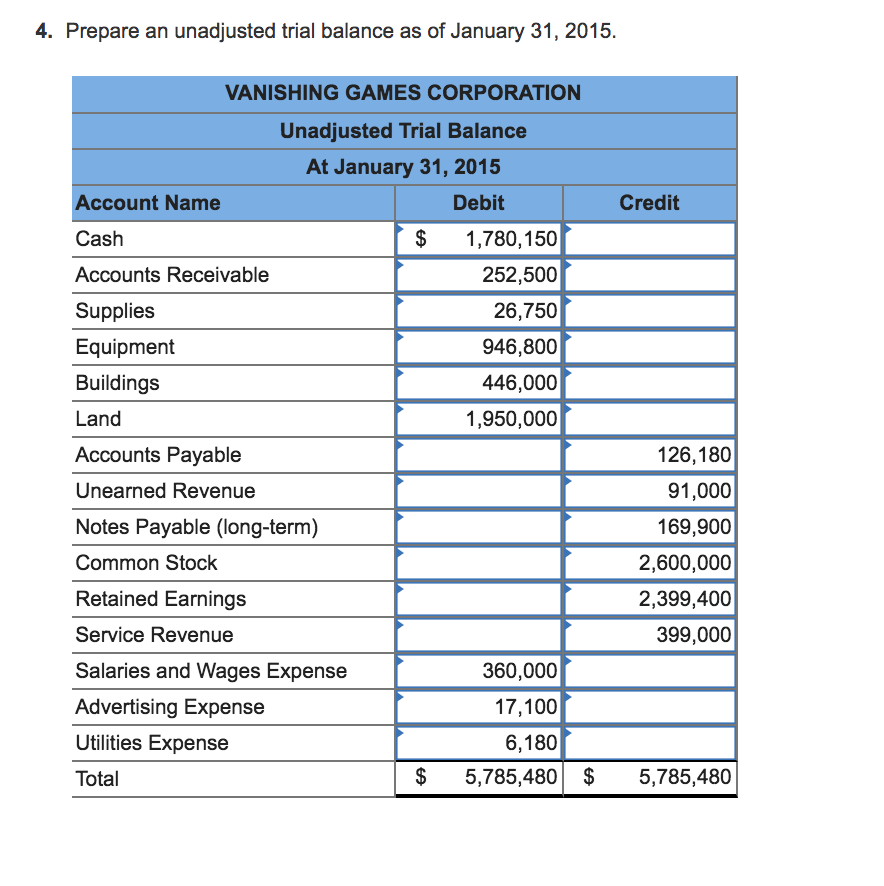

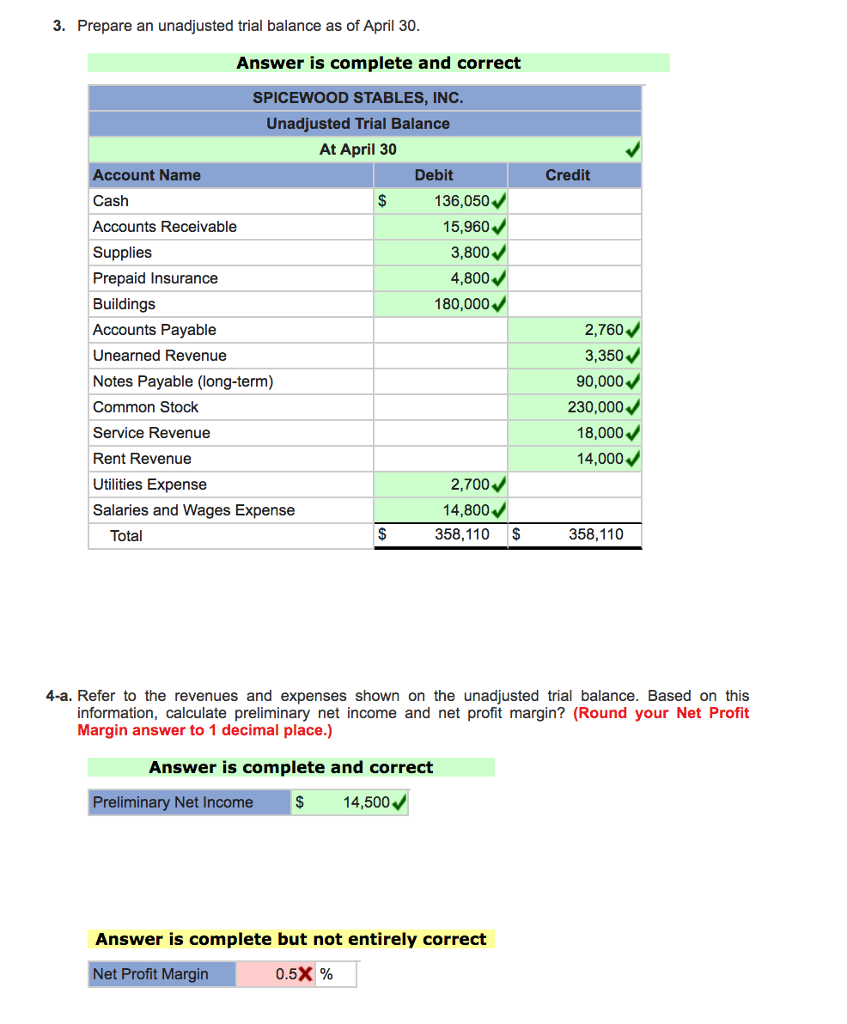

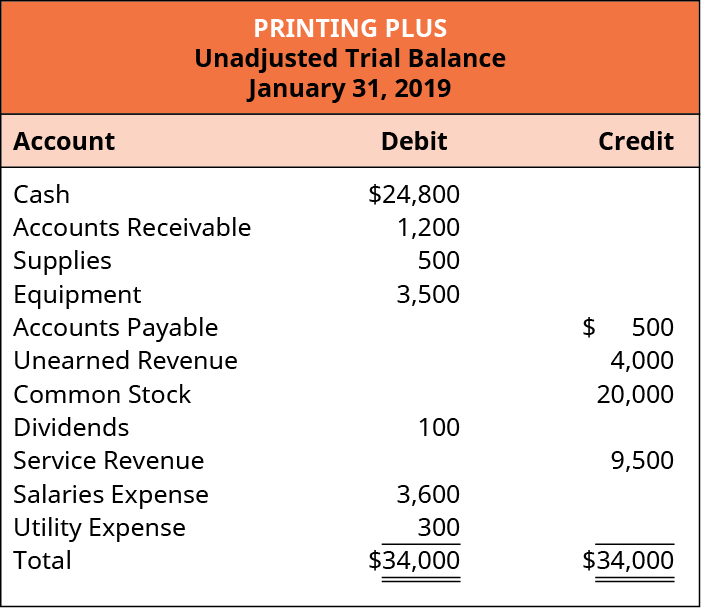

Prepare an unadjusted trial balance. In our detailed accounting cycle, we just finished step 5 preparing adjusting journal entries. Because this trial balance is prepared before the adjusting entries, it is not a suitable reference to prepare financial statements. What is an unadjusted trial balance?

In other words, a trial balance which is prepared at the first instance before making any sort of adjustments in the record is called an unadjusted trial balance. The first four steps in the accounting cycle are (1) identify and analyze transactions, (2) record transactions to a journal, (3) post journal information to a ledger, and (4) prepare an unadjusted trial balance. Preparing financial statements is the seventh step in the accounting cycle.

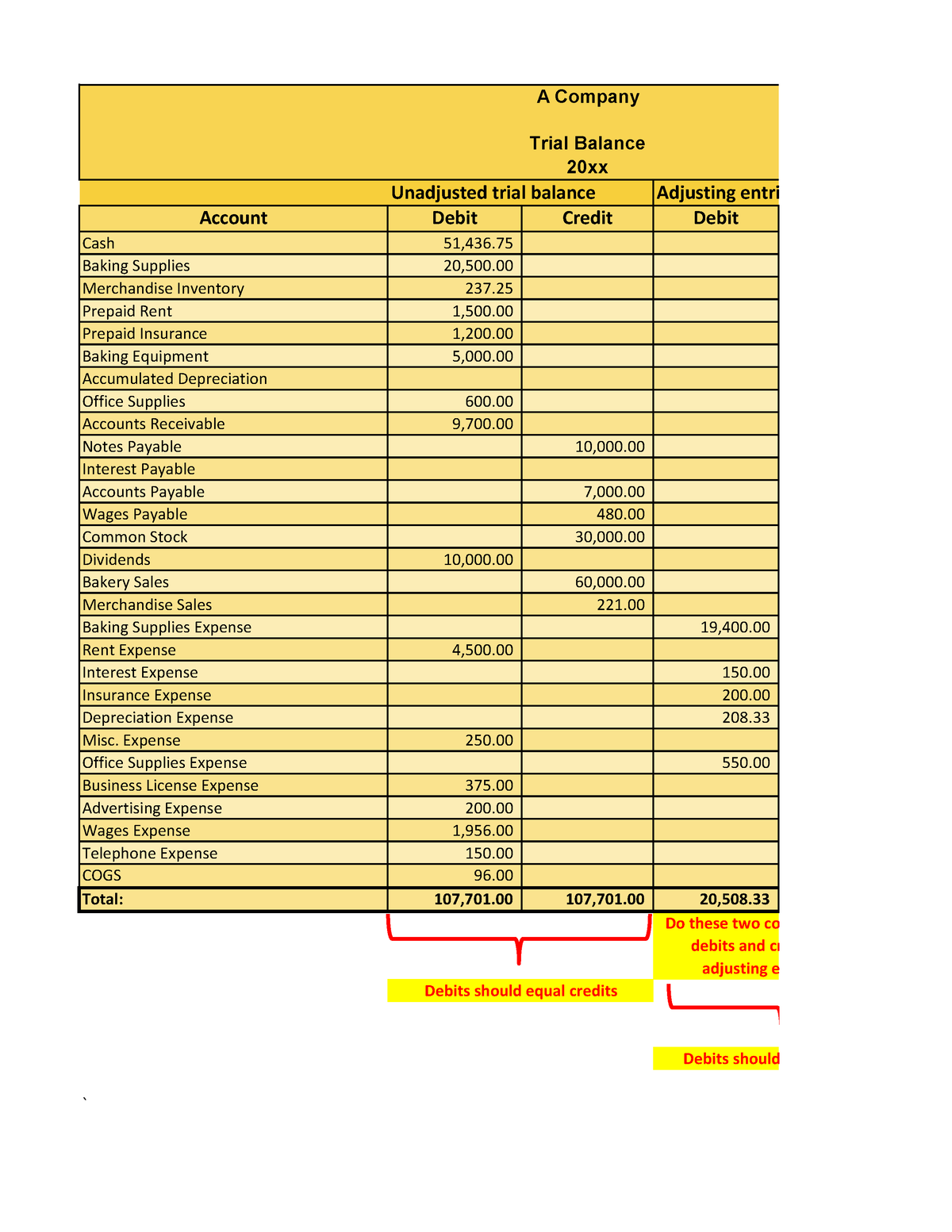

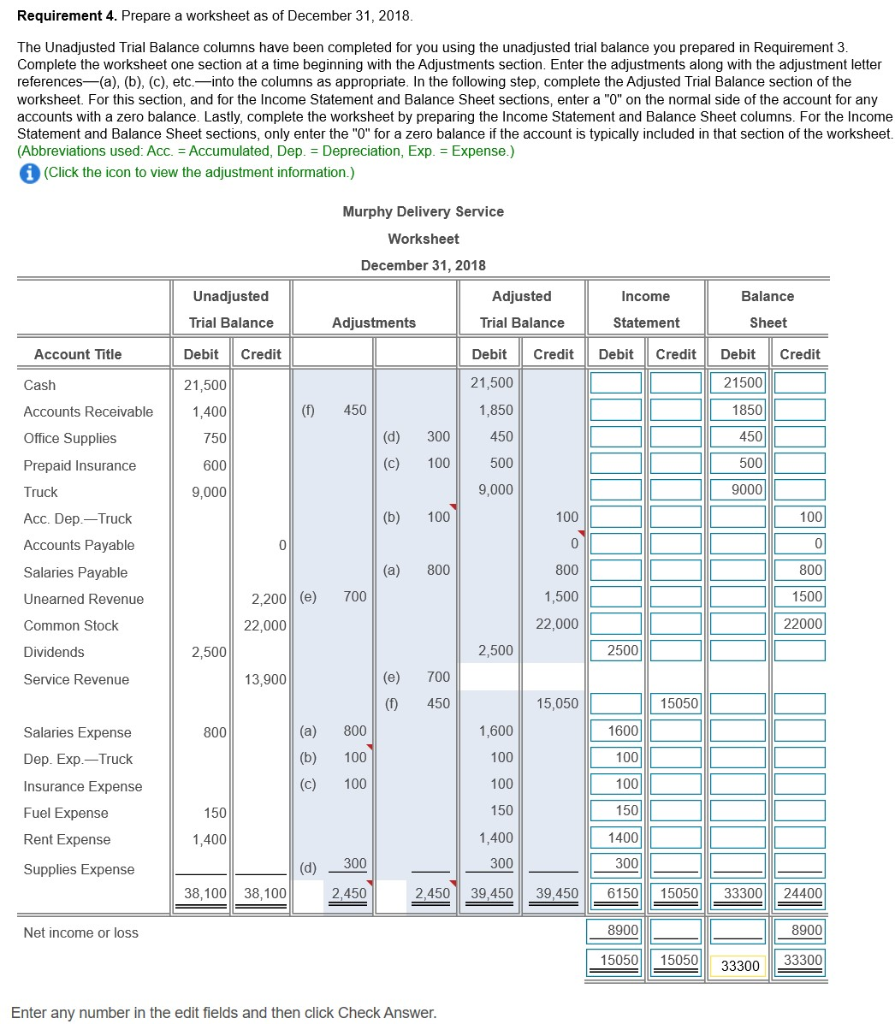

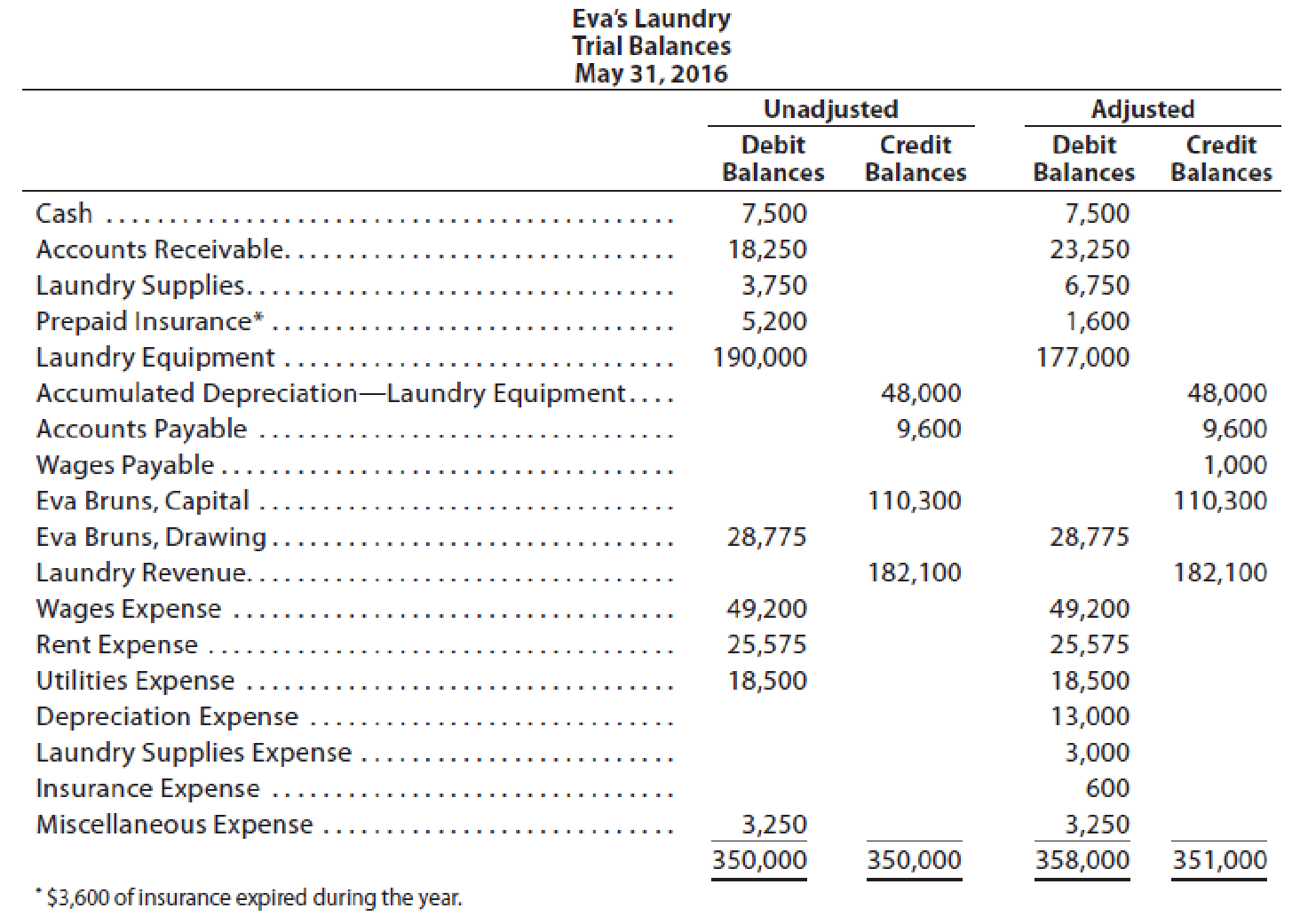

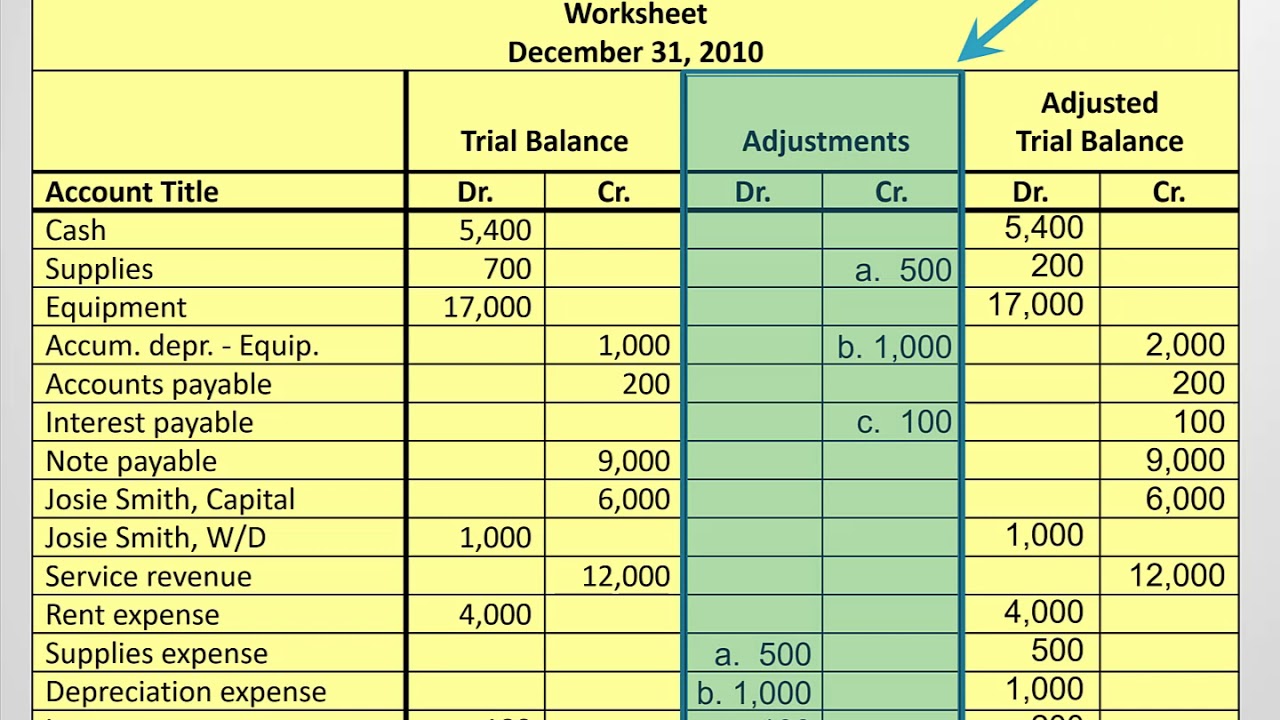

The unadjusted trial balance in. The next step is to record information in the adjusted trial balance columns. It should look exactly like your unadjusted trial balance, save for any deferrals, accruals, missing transactions or tax adjustments you made.

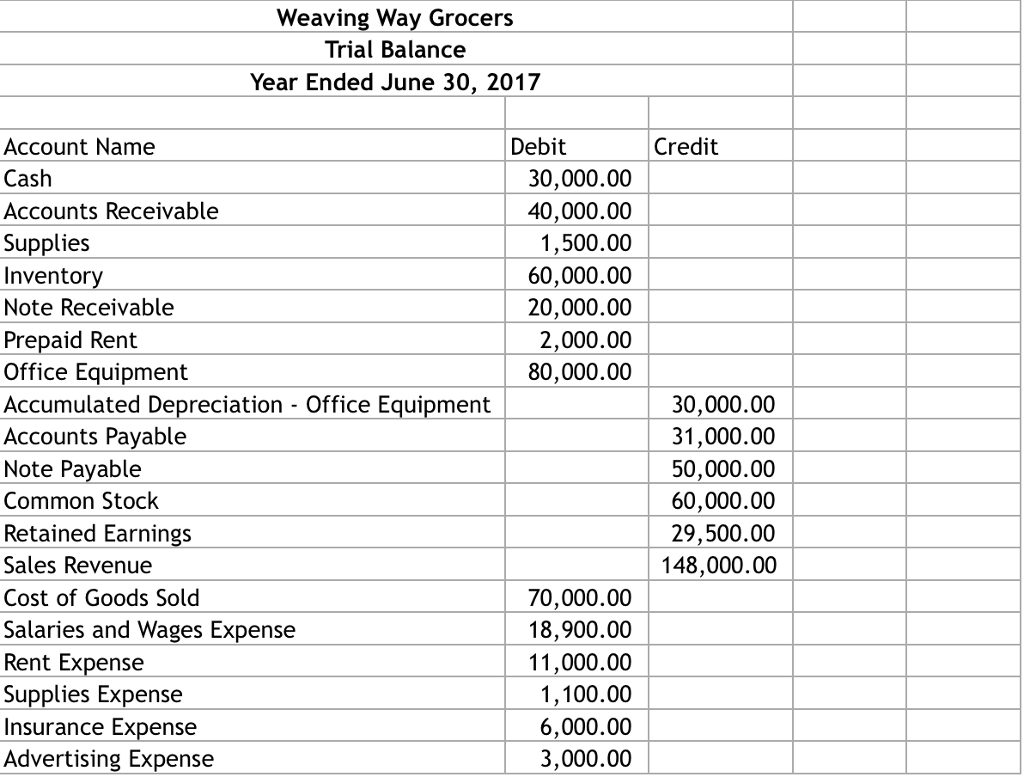

This provides an initial summary of your general ledger accounts prior to entering any adjusting entries. There are several steps in the accounting cycle that require the preparation of a trial balance: Enlist the accounts and write the balances in respective debit and credit columns.

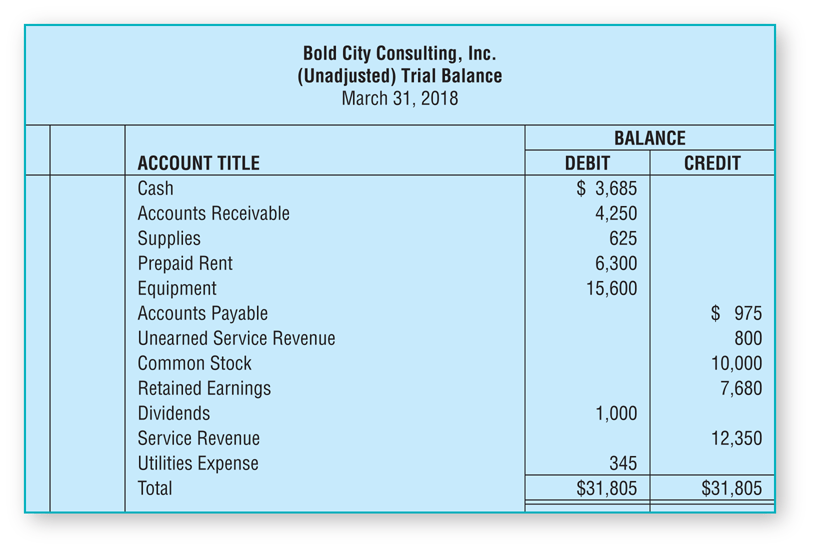

The unadjusted trial balance is the listing of general ledger account balances at the end of a reporting period, before any adjusting entries are made to the balances to create financial statements. An unadjusted trial balance is prepared after posting entries into the general ledger to proceed with the accounting cycle/process. This error must be fixed before starting the new period.

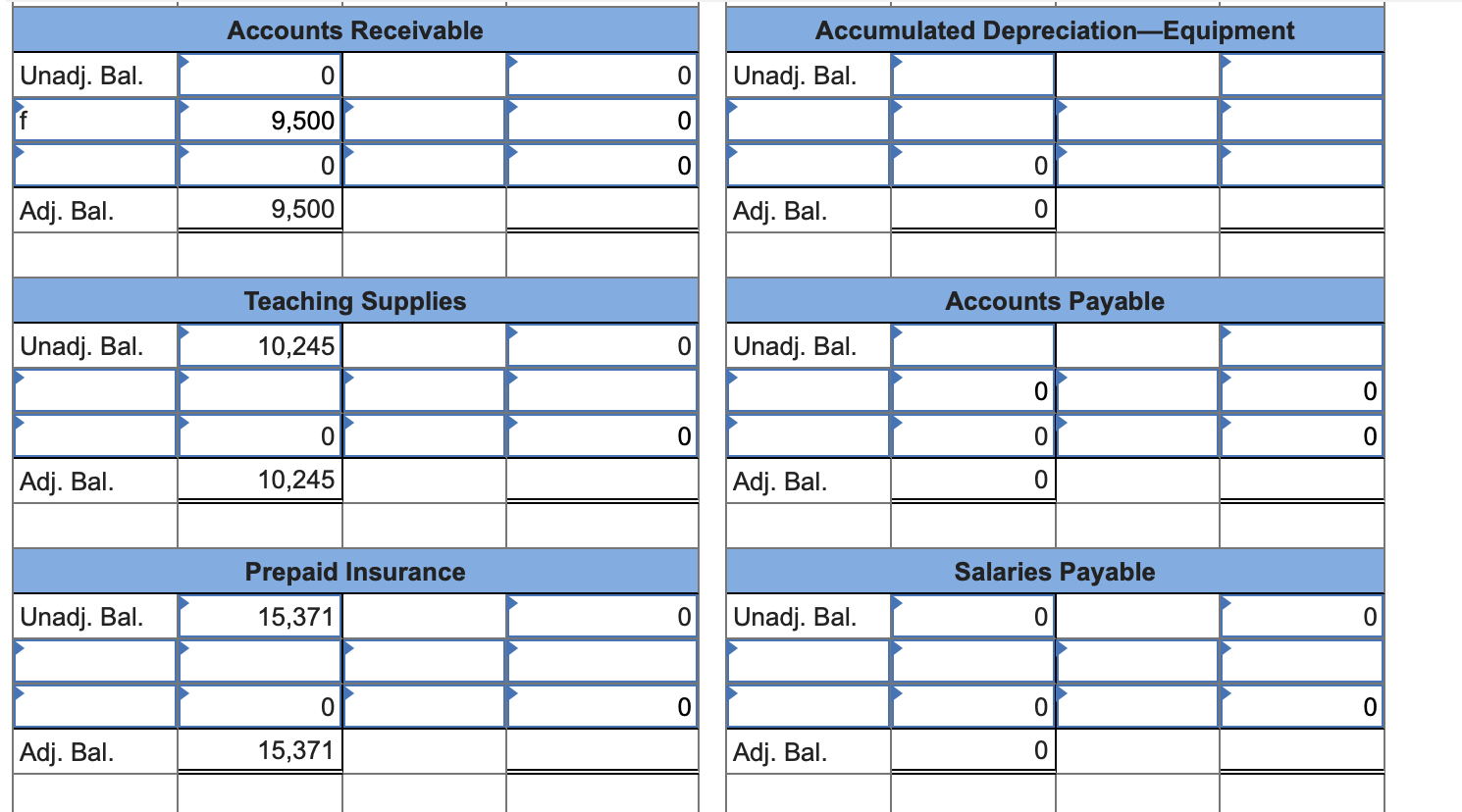

Posting accounts to the unadjusted trial balance is quite simple. Notice how we start with the unadjusted trial balance in each account and add any debits on the left and any credits on the right. The unadjusted trial balance is prepared at the end of the reporting period as a rough draft of the financial transactions, which are organized in order later on in the form of financial statements, which are more reliable and accurate.

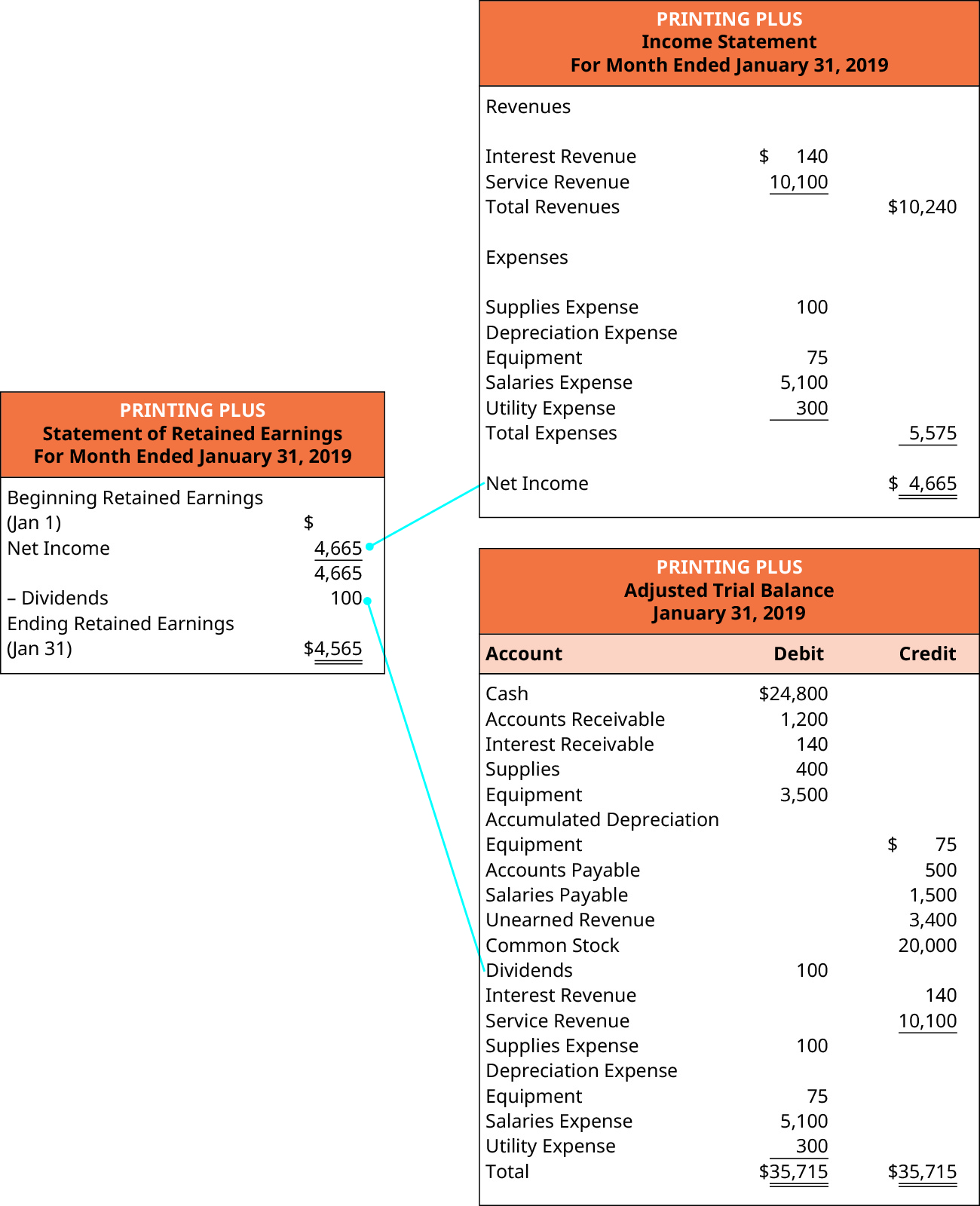

Basically, each one of the account. Once the posting is complete and the new balances have been calculated, we prepare the adjusted trial balance. Calculate the total balance of the debit and credit side if the total of.

An income statement, a statement of retained earnings, a balance sheet, and the statement of cash flows. We begin by introducing the steps and their related documentation. All the ledger accounts with debit balances are shown in the left column and those with credit balances are shown on the.

To get the numbers in these columns, you take the number in the trial balance column and add or subtract any number found in the adjustment column. An unadjusted trial balance is displayed in three columns: Run an unadjusted trial balance.

An unadjusted trial balance refers to and means the listing of all the closing balances appeared in ledgers before incorporating adjusting entries therein. The next step is to post the adjusting journal entries. Instead, you can consider it an organized listing of the gl accounts.