Breathtaking Tips About Depreciation In Trial Balance

Depreciation allows a company to spread out the cost of an asset over its useful life so that revenue can be earned from the asset.

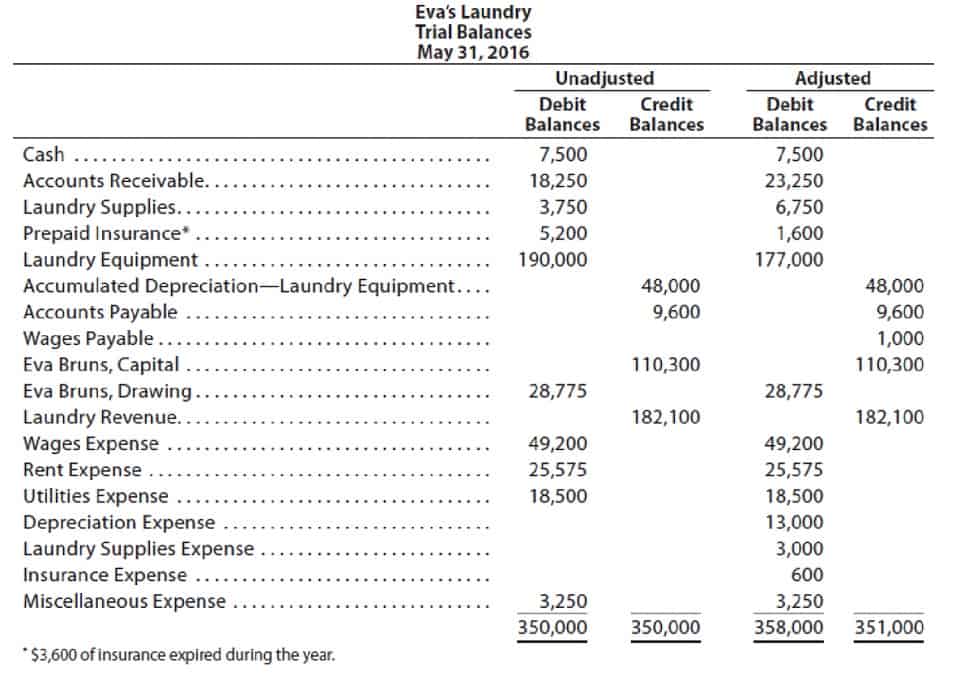

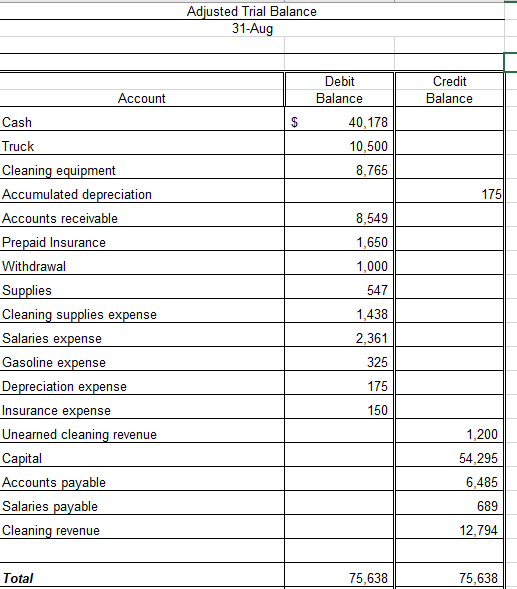

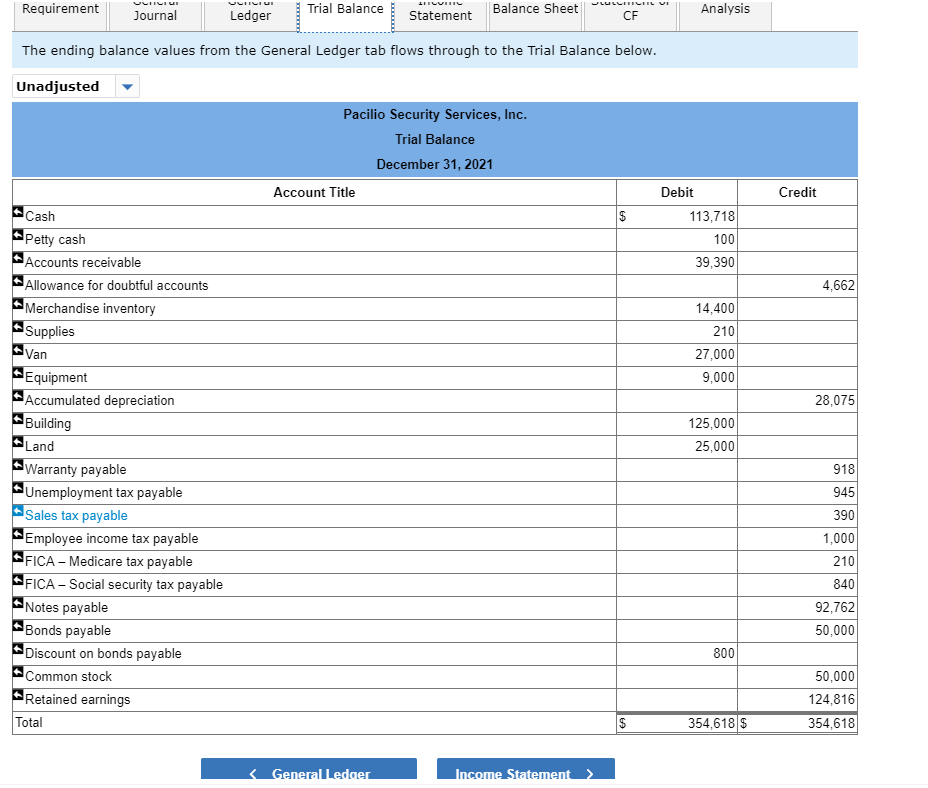

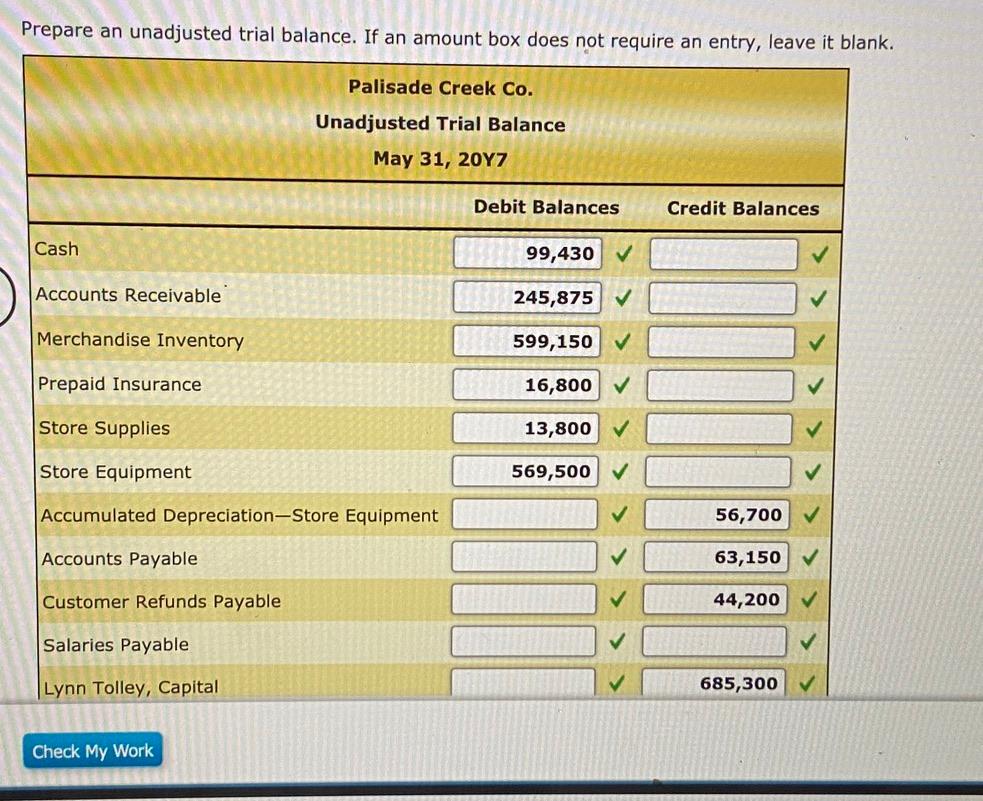

Depreciation in trial balance. Financial accounting (fa) technical articles adjustments to financial statements many candidates struggle with certain adjustments in the exam. Preparing an unadjusted trial balance is the fourth step in the accounting cycle. Accumulated depreciation is nothing but the sum total of depreciation charged until a specified date.

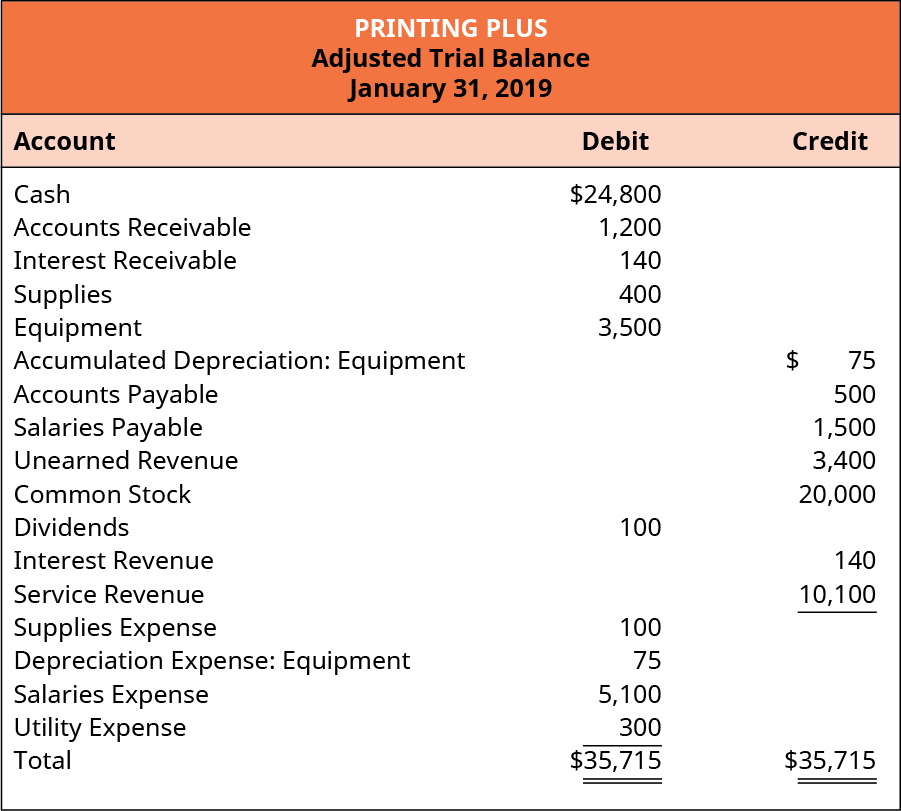

The accumulated depreciation is set as an asset account within the. In this lesson, we explain and go through examples of how to record depreciation & accumulated depreciation in journal entries & the. If we go back and look at the trial balance for printing plus, we see that the trial balance shows debits and credits.

When depreciation is included in the trial balance, it is considered an expense and is recorded on the negative side of the profit and loss account. Compute depreciation for each year. Take the first adjusting entry.

Depreciation in trial balance includes a series of entries to a fixed asset leading to a cost. A trial balance is a list of all accounts in the general ledger that have nonzero balances. To get the $10,100 credit balance in the adjusted trial balance column requires adding together both credits in the trial balance and adjustment columns (9,500 + 600).

Service revenue is credited for $300. 67k views 4 years ago. The basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated.

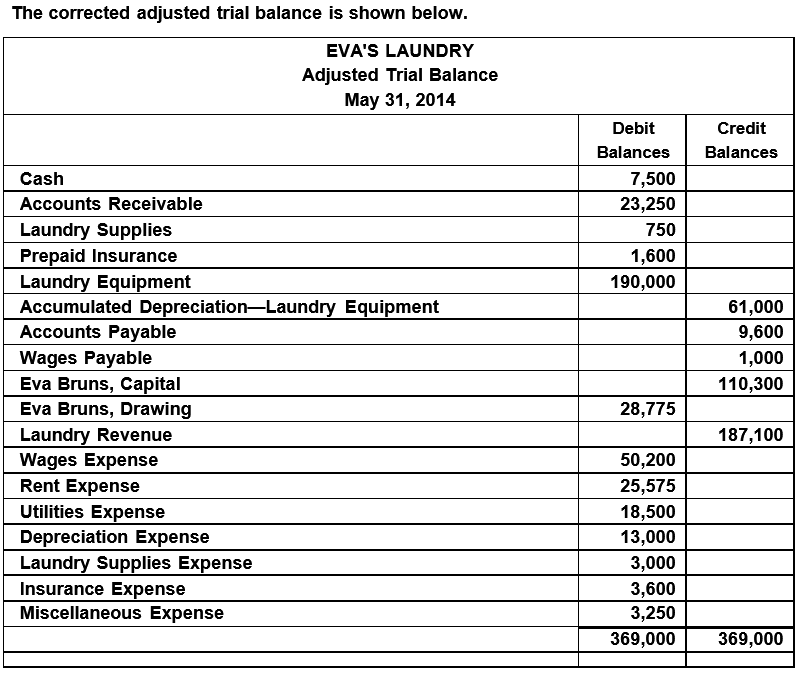

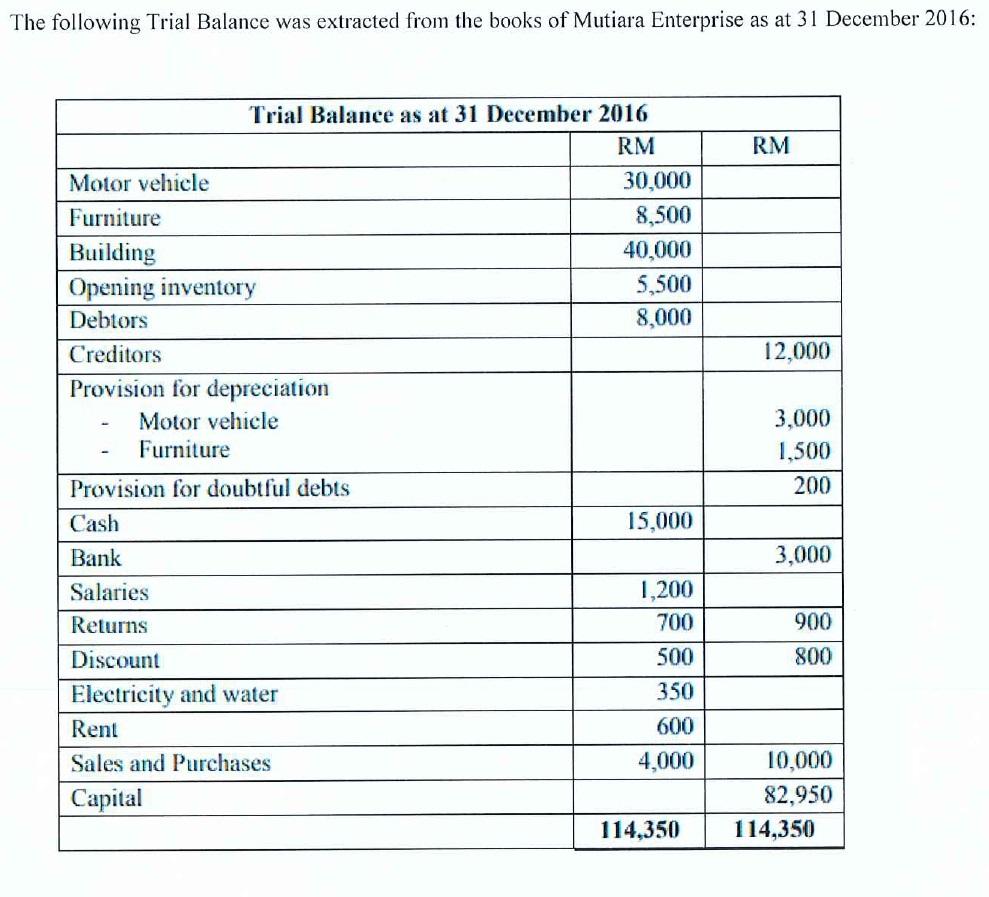

The trial balance of tyndall at 31 may 20x6 is as follows: Trial balance of tyndall at 31 may 20x6. The accumulated depreciation is shown as a “credit item” in the trial balance.

In this situation, no more. This article explains how to. Run an unadjusted trial balance the above trial balance is a current summary of all of your general ledger accounts before any adjusting entries are.

The following information is relevant: In this chapter we will bring together the material from theprevious chapters and produce a set of financial statements from a trialbalance. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company.

This statement comprises two columns:. Accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time.