Beautiful Info About Bank Loan Current Liabilities

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)

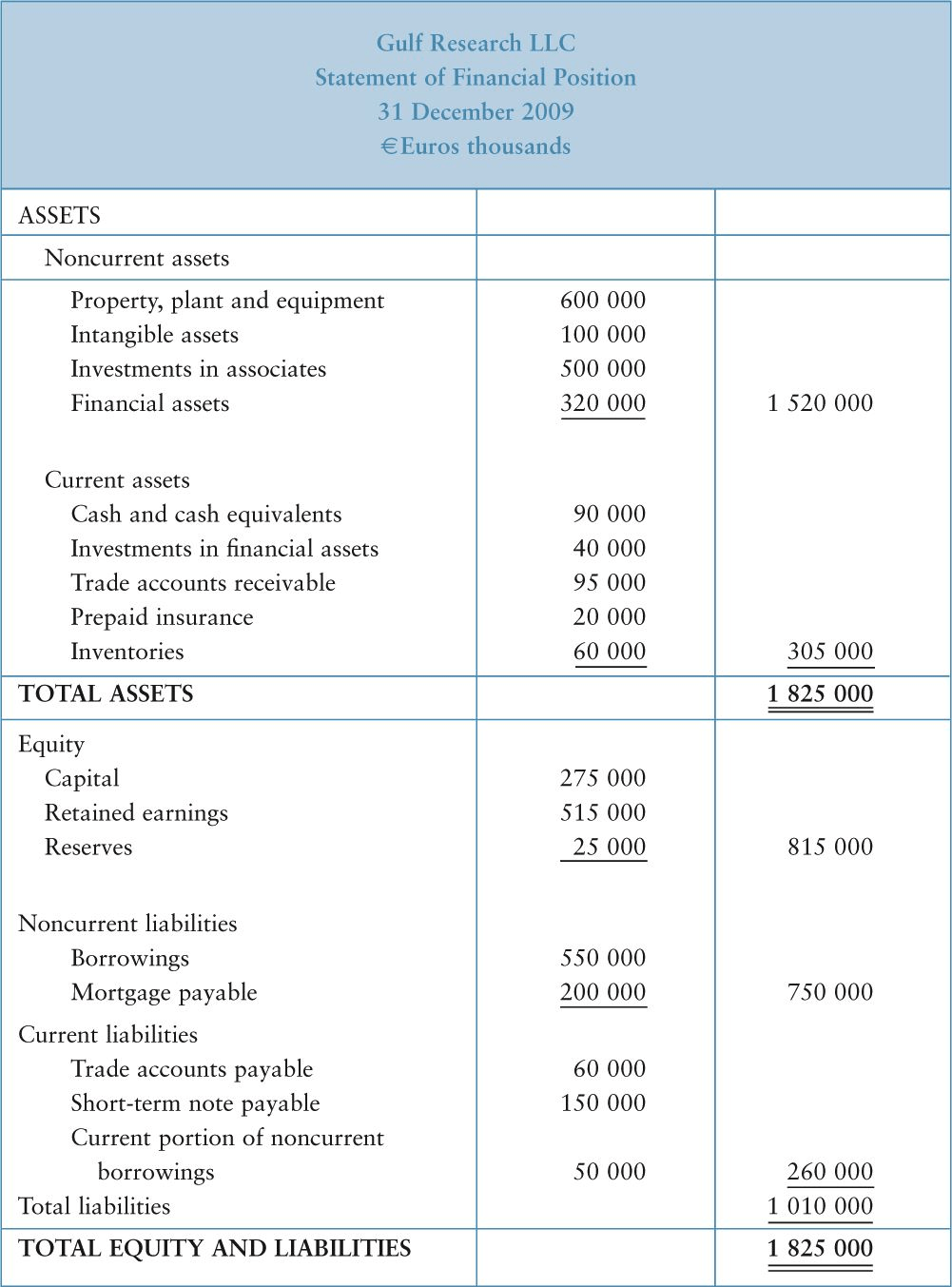

Ias 1 presentation of financial statements requires.

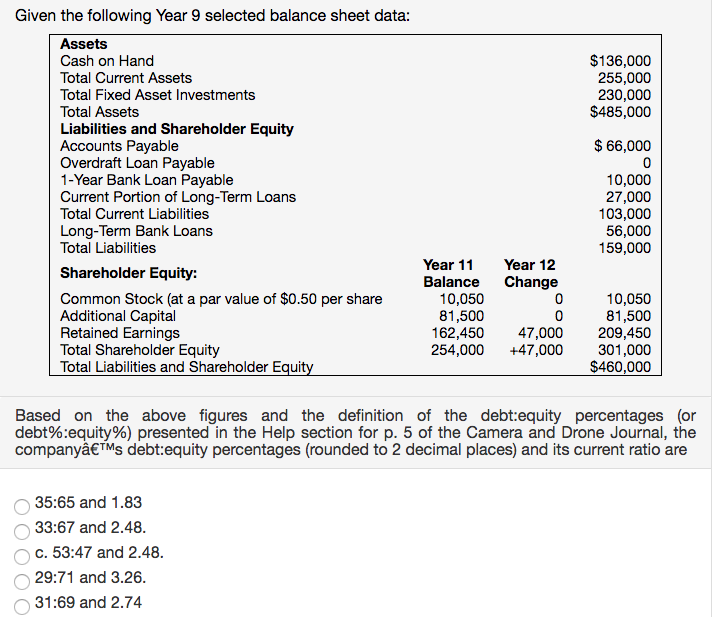

Bank loan current liabilities. (aapl) for its fiscal year 2021. Banks arrange their assets and liabilities in order of liquidity. Current liabilities are typically paid off using current assets like.

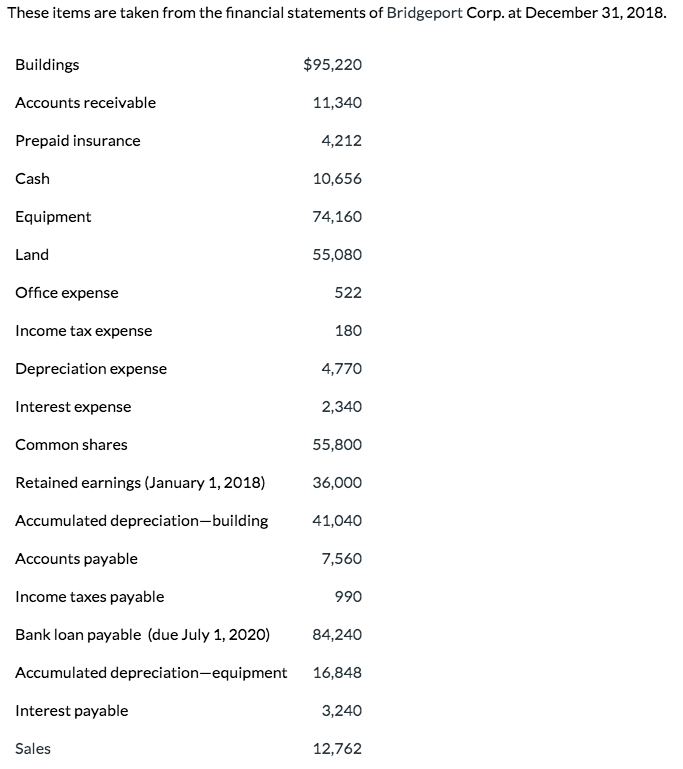

What are current assets and current liabilities for banks? Updated on march 13, 2023 fact checked why trust finance strategists? Current liabilities are financial obligations of a business entity that are due and payable within a year.

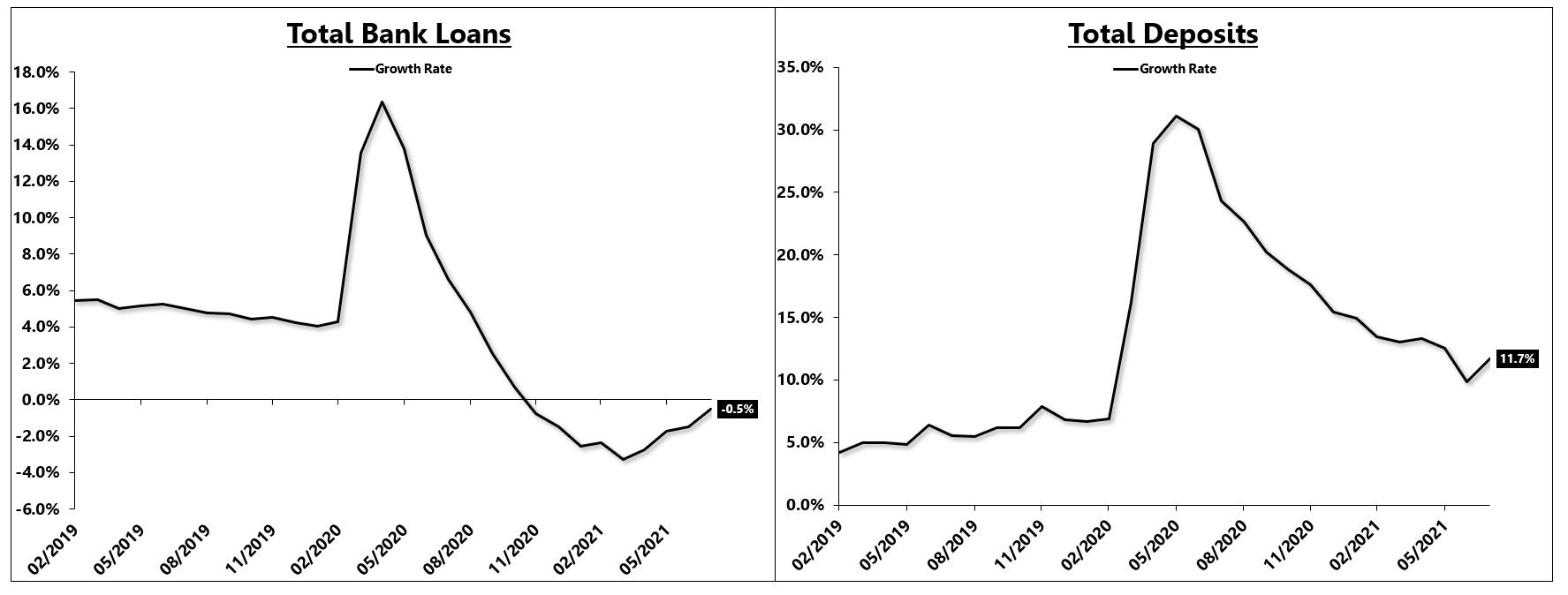

This is an increase of around $20 billion from the year prior. Liability management is the practice by banks of maintaining a balance between the maturities of their assets and their liabilities in order to maintain liquidity. They are not required to break them up.

Table of contents is a loan a current asset? Types of liabilities include for example bank. If the lender has the right to recall the loan on demand at any time and without any cause, the.

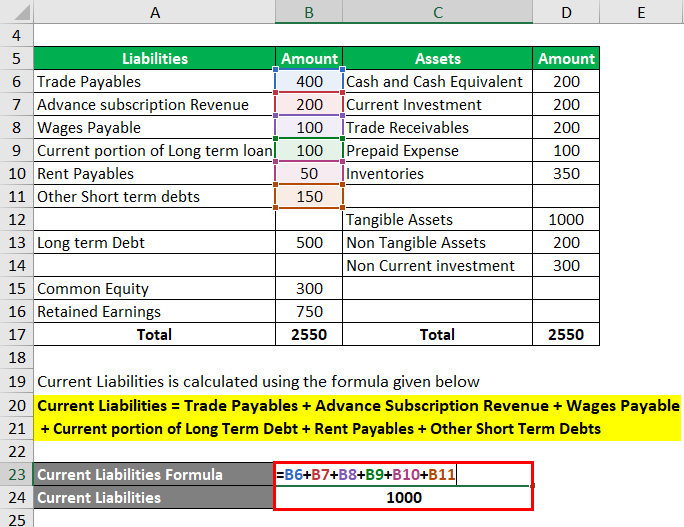

To account for current liabilities, a company must record them. Current portion of bank loan. Current liabilities :

Current liabilities can include known liabilities such as payroll liabilities, interest payable, and other accrued liabilities. The risk of an unexpectedly high level of loan defaults can be especially difficult for banks because a bank’s liabilities, namely the deposits of its customers, can be withdrawn. A liability occurs when a company has undergone a transaction that has.

For example, if a loan is to be repaid in 3 years’ time,. Q1 how to calculate current liabilities? Current liabilities are the obligations of the company which are expected to get paid within one year and include liabilities such as accounts payable, short term loans, interest.

Current liabilities totaled $125.483 billion for the period. The current liabilities section of a balance sheet shows the debts a company owes that must be paid within one year. Liability is a present obligation of the enterprise arising from past events.

Current liabilities examples are accounts payable, taxes payable, salaries, loans, and other existing debts. These debts are the opposite of.