Can’t-Miss Takeaways Of Tips About Difference Between Financial Reporting And Statements

The three major financial statement reports.

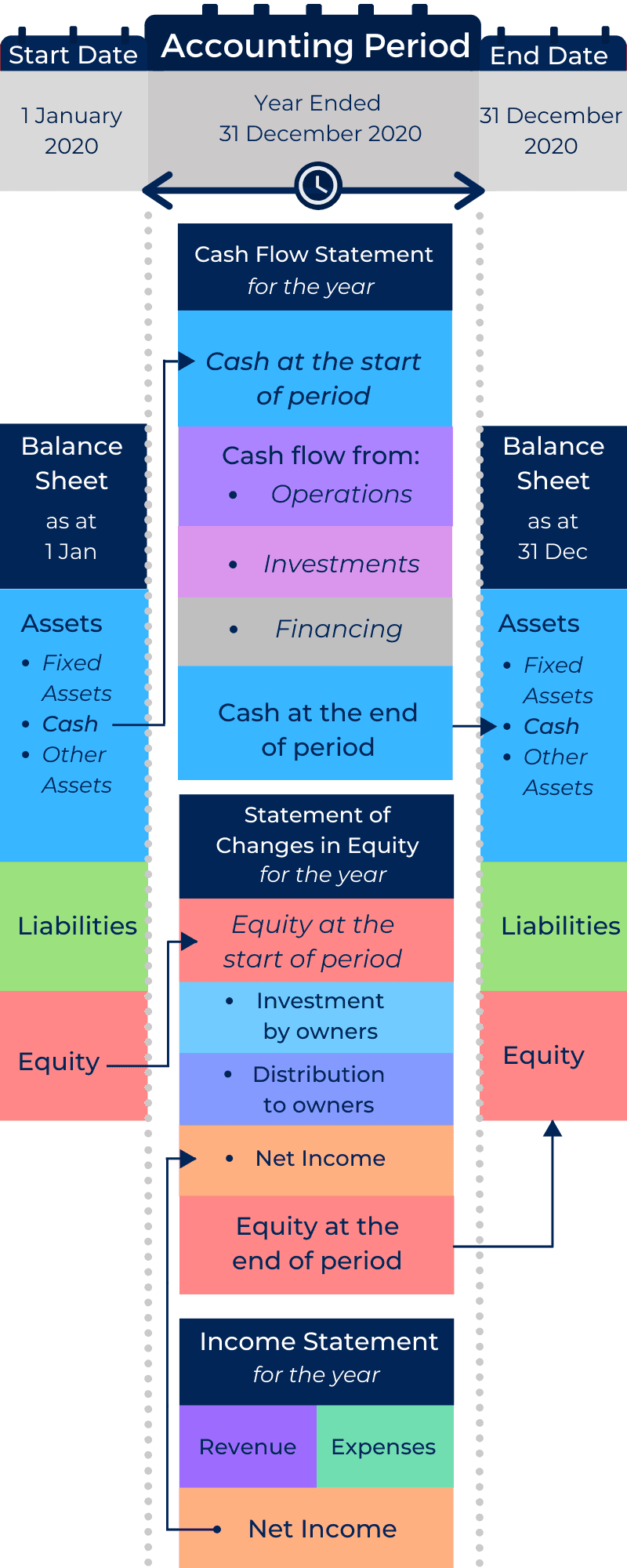

Difference between financial reporting and financial statements. Some of the most common ones include: John taggart for the new york times. Also known as profit and loss, an income statement is a financial analysis report that shows the company’s income and expenses over a given period with a focus on four key elements:

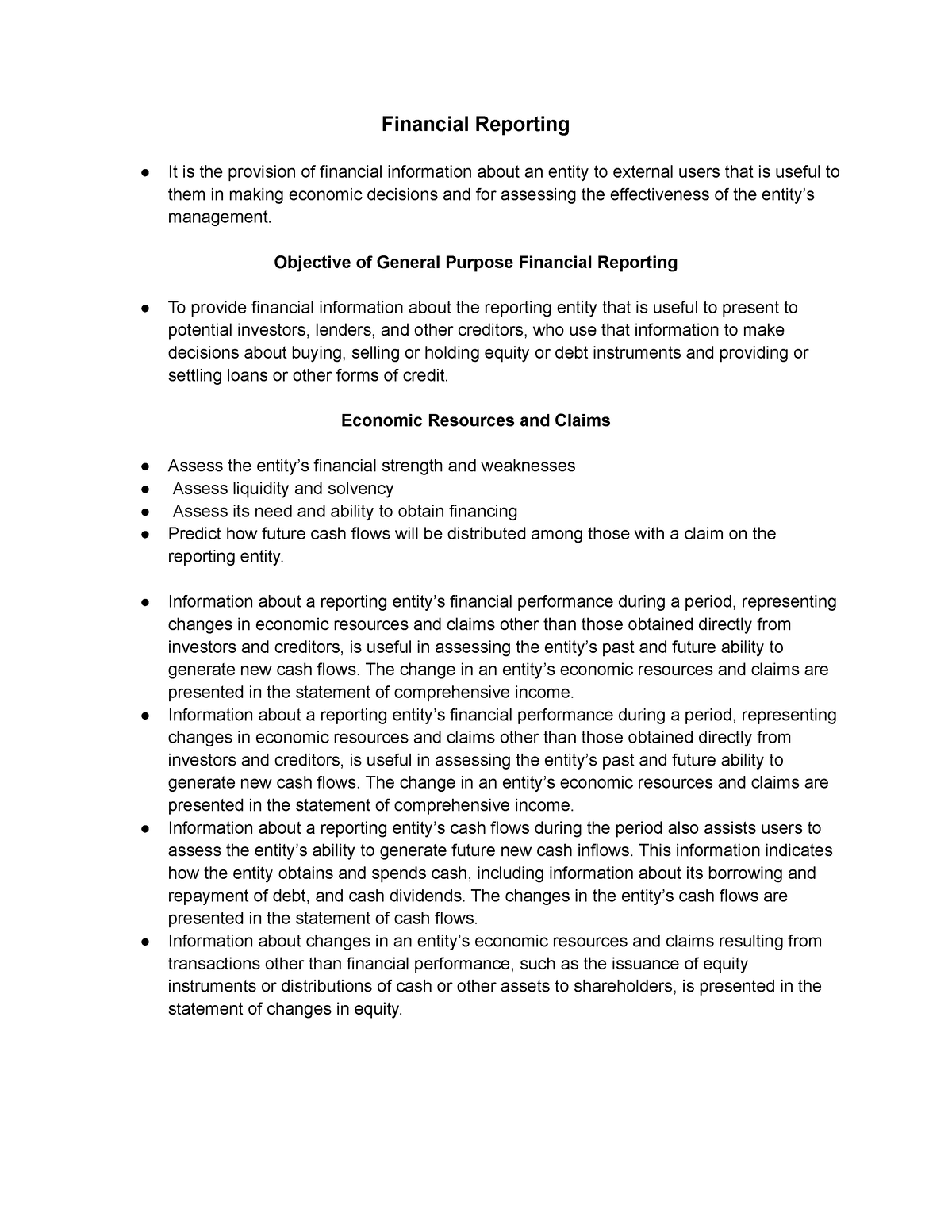

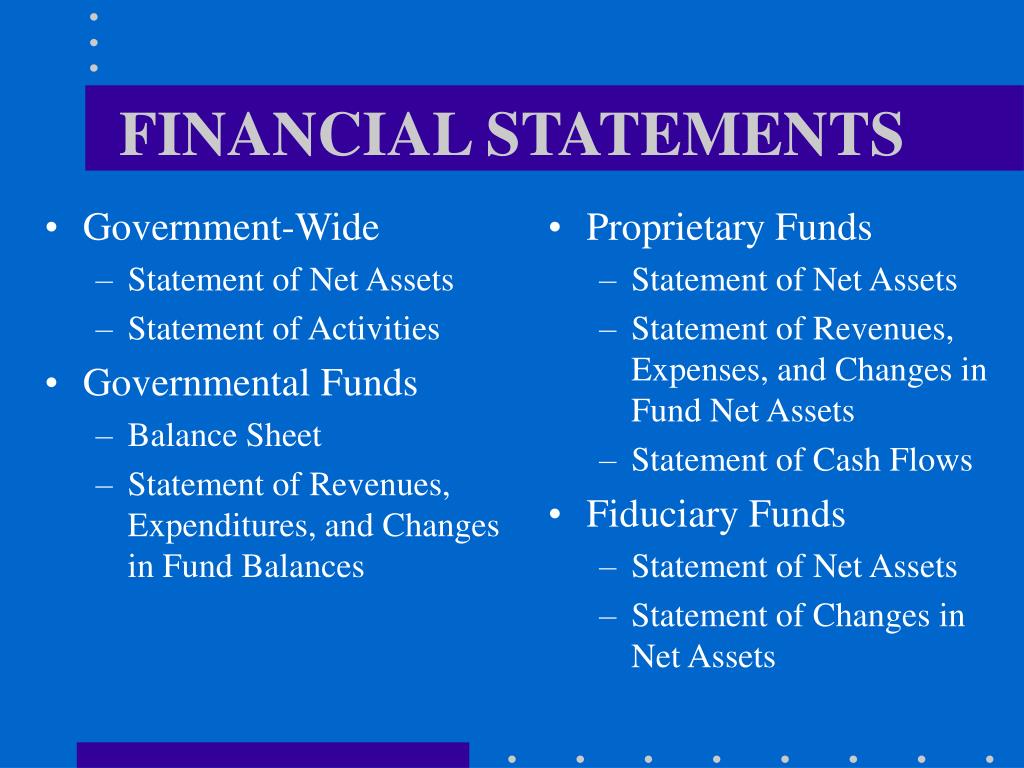

The three core financial statements are 1) the income statement, 2) the balance sheet, and 3) the cash flow statement. The upcoming discussion will update you about the difference between financial reporting and financial statements. Financial statements are a central feature of financial reporting.

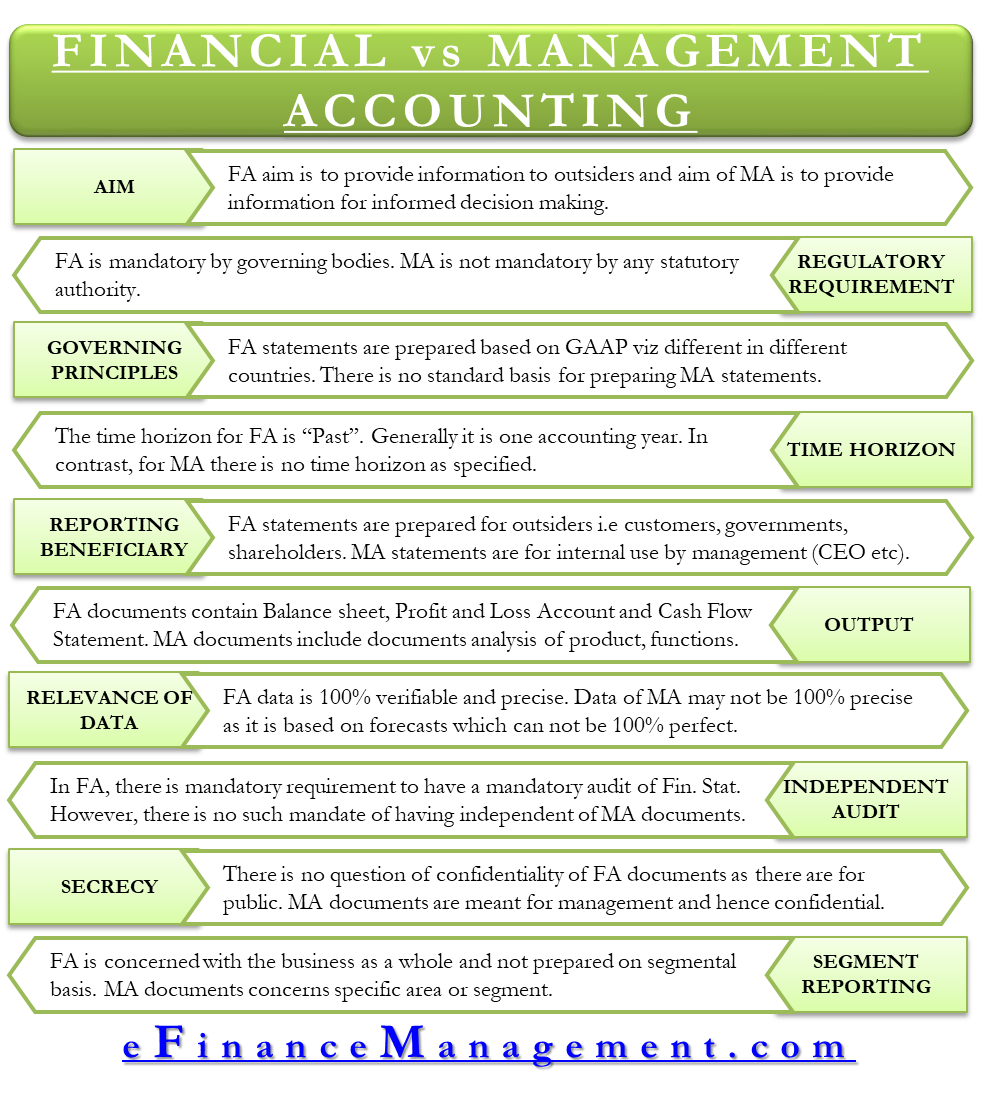

Compiling information — financial reporting is for compiling all information, which isn’t possible with financial accounting. Business analysts, financial analysts, financial analysts, and financial managers use financial reports and statements to acquire information about a company’s. In other words a financial report is about the transactions that have financial effects.

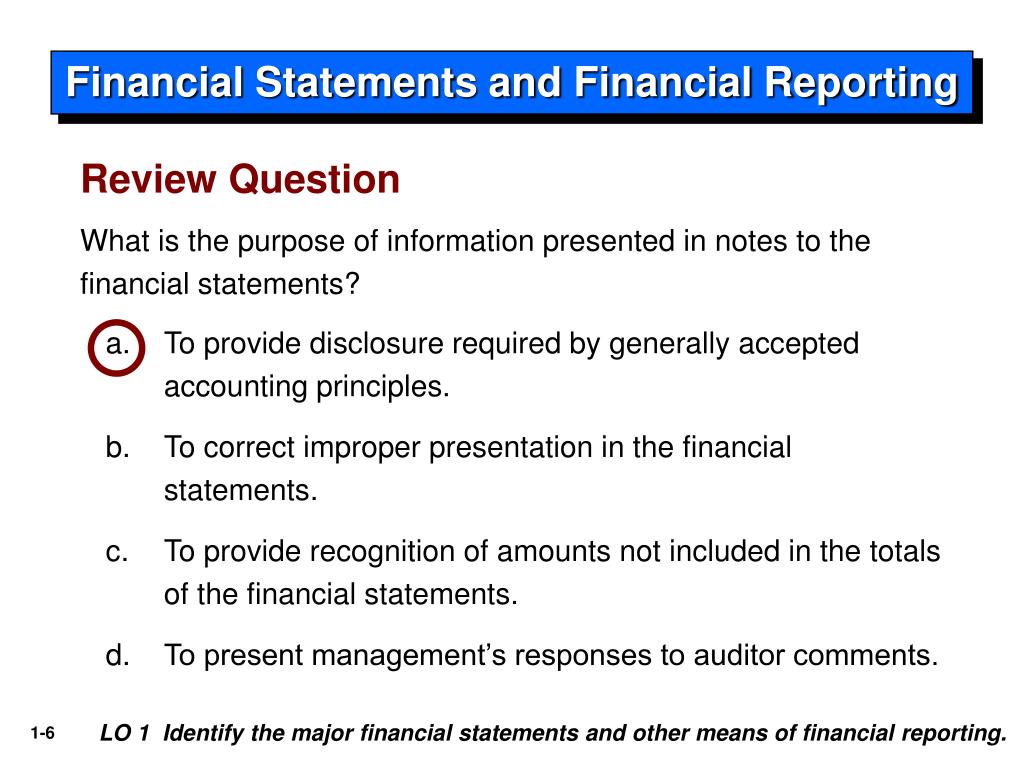

Our industry is unique in many ways and so is the application of this contrast. Financial reports gather important financial information for distribution to the public. Annual reports and financial statements are essential tools for businesses to communicate their financial performance and provide stakeholders with a comprehensive overview of their.

Differences between financial statements and… may 26 2022 accounting & finance all firms are required to produce financial statements and yearly reports. In finding that the defendants were able to purchase the old post office in washington, d.c., through their use of the fraudulent financial statements, justice engoron rules that the. Financial statement = scorecard there are millions of individual investors worldwide, and while a large percentage of these investors have chosen mutual funds as the vehicle of choice for.

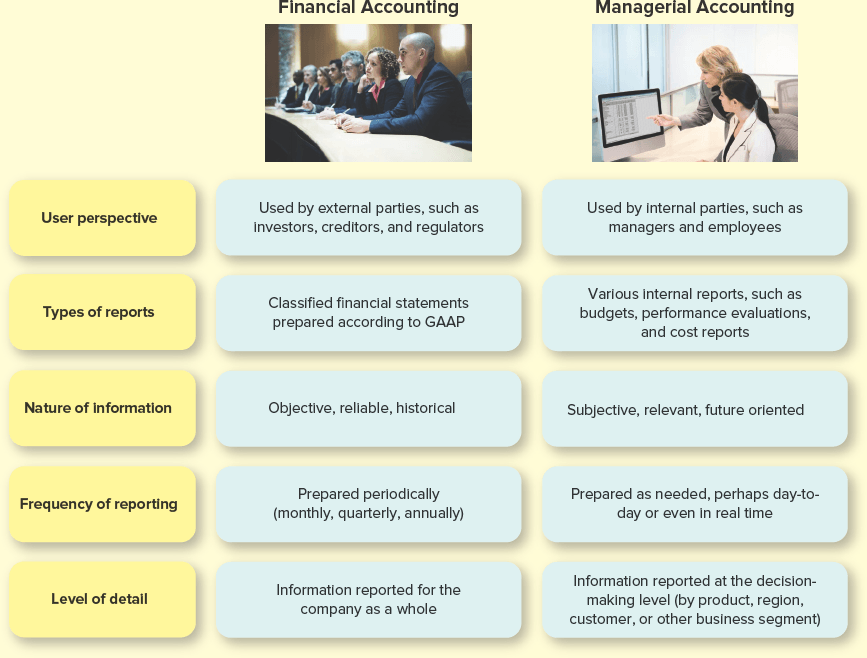

Analysing — accounting is for generating and storing financial information to be later analysed via financial reporting. Financial reporting is intended to help track a business’s income, cash flow, profitability, and overall viability in the long run—but it needs to be done correctly. The difference between the four financial statements.

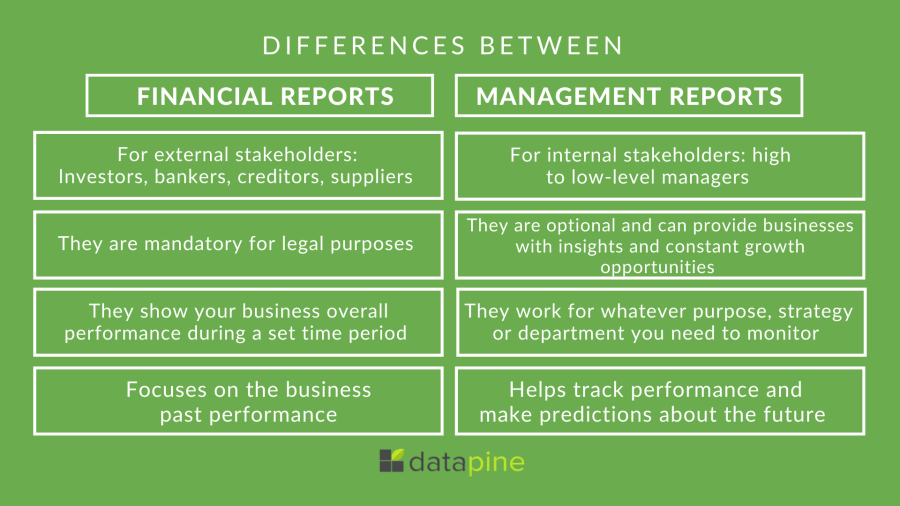

External financial reporting involves compiling and reporting financial information for distribution among shareholders and potential investors. Financial reporting encompasses the standard weekly, monthly, and quarterly reports that companies receive each month. But in accounting, there are some differences between financial reporting and financial statements.

Financial reporting what is financial reporting? The financial statements are used by investors, market analysts, and creditors to evaluate a company's financial health and earnings potential. The materiality refers to the significance of the expense item in the context of the financial statements.

A quarterly report is a summary or a collection of a company's financial statements, such as balance sheets and income statements, issued every three months. Describe the uses of comparing financial statements over time. Quarterly earnings that are then distributed via press releases, conference calls, or.

Financial statements, on the other hand, are the financial institution’s portrait, capturing its financial snapshot at a specific moment or over a defined period. Scope a financial report contains information on a variety of related topics, as opposed to a financial statement, such as a balance sheet or cash flow statement, which contains information specific to one topic. Financial reporting and financial statements article shared by: