Best Tips About Trial Balance Journal Entries

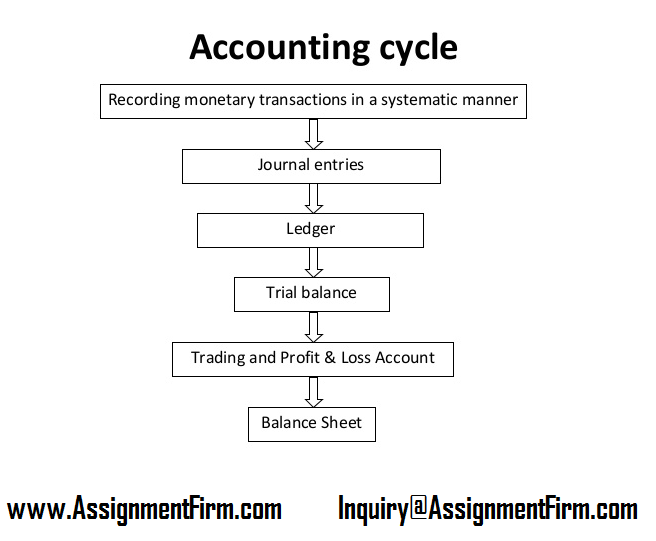

The trial balance is prepared after the subsidiary journals and journal entries have been posted to the general ledger.

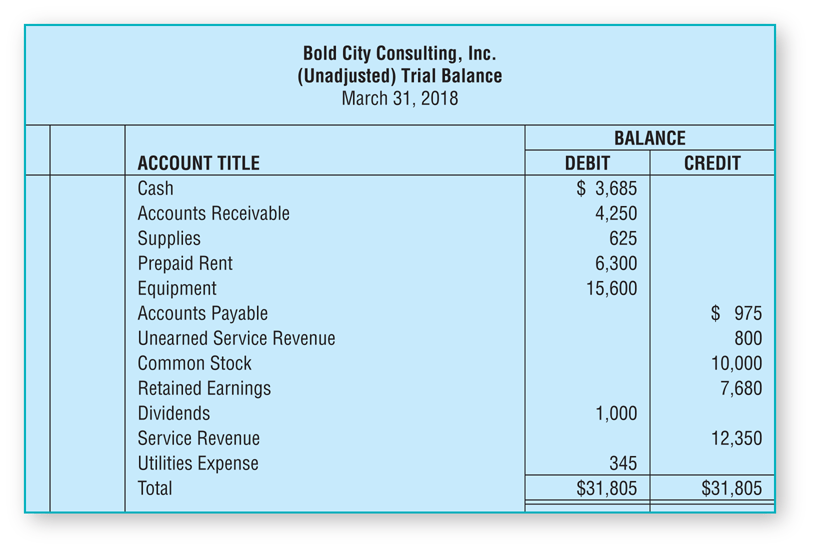

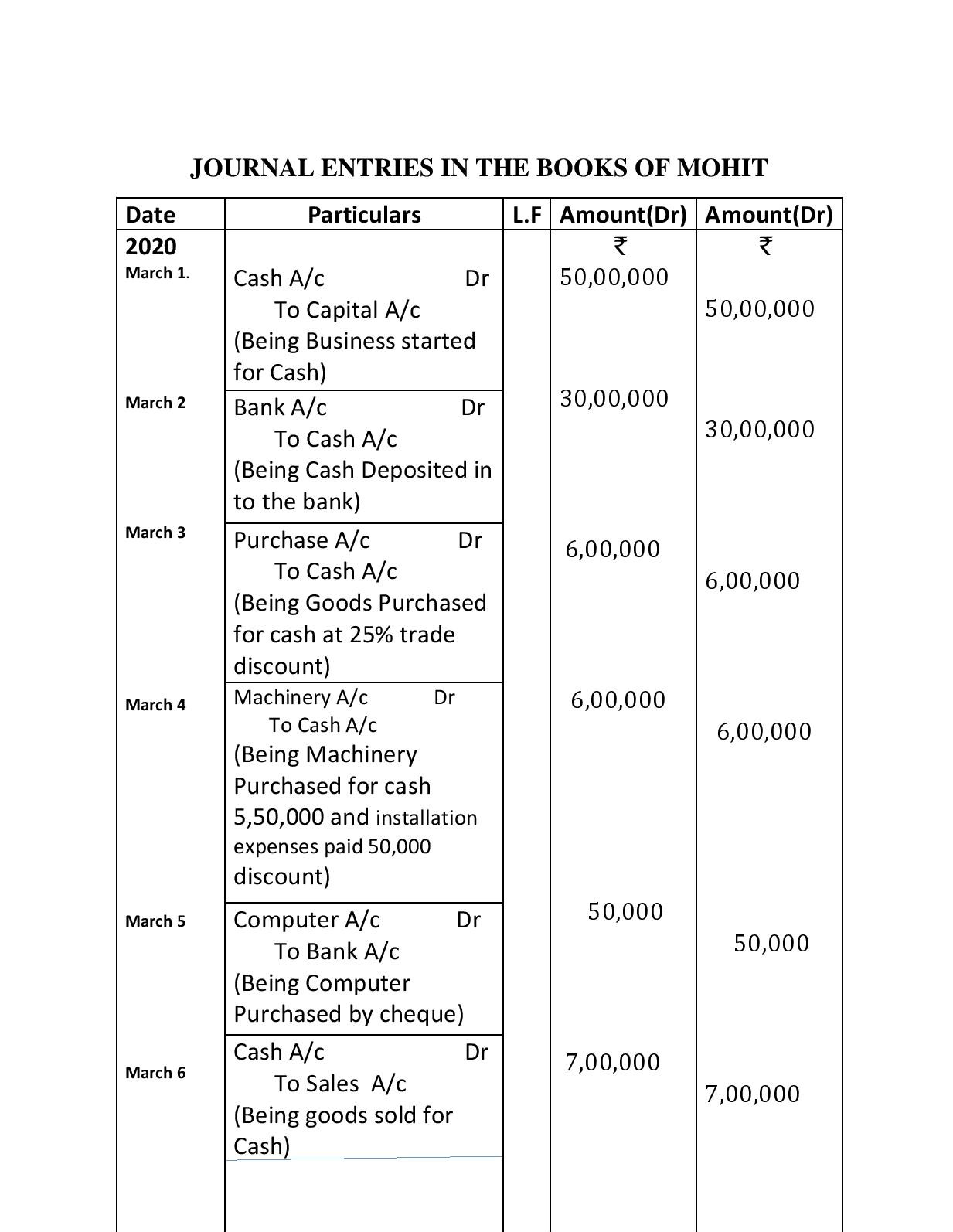

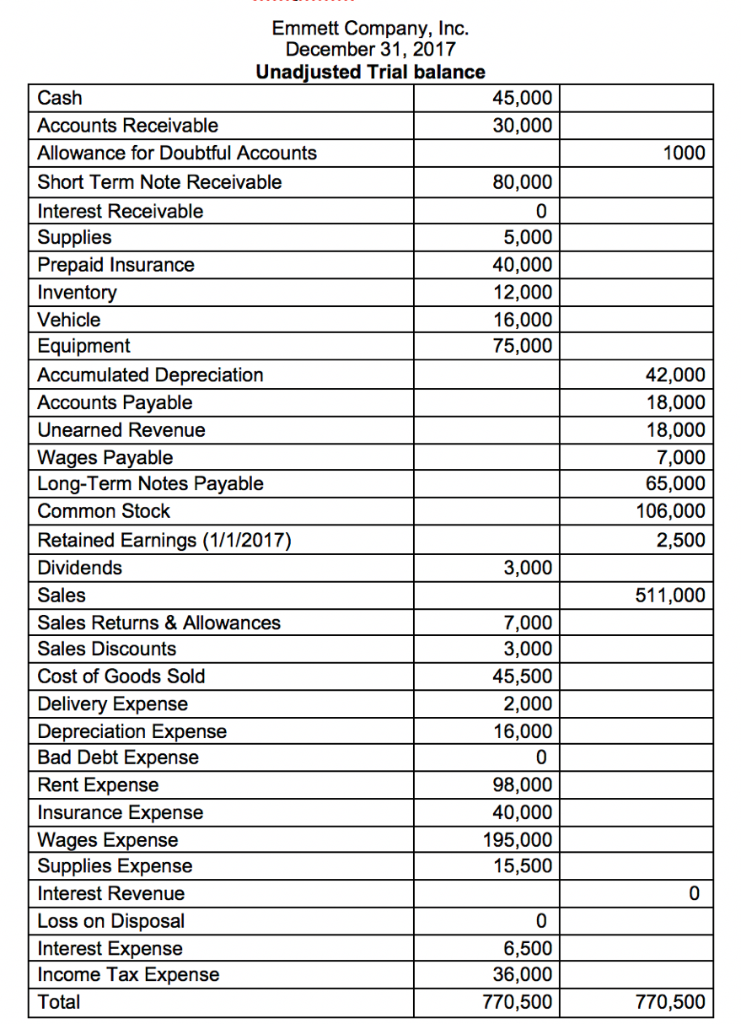

Trial balance journal entries. Journaling the entry is the second step in the accounting cycle. Trial balance is the report of accounting in which ending balances of the different general ledgers of the company are available; A trial balance is a listing of all accounts (in this order:

Here is a picture of a journal. After the preliminary unadjusted trial balance, also known. For example, utility expenses during a period.

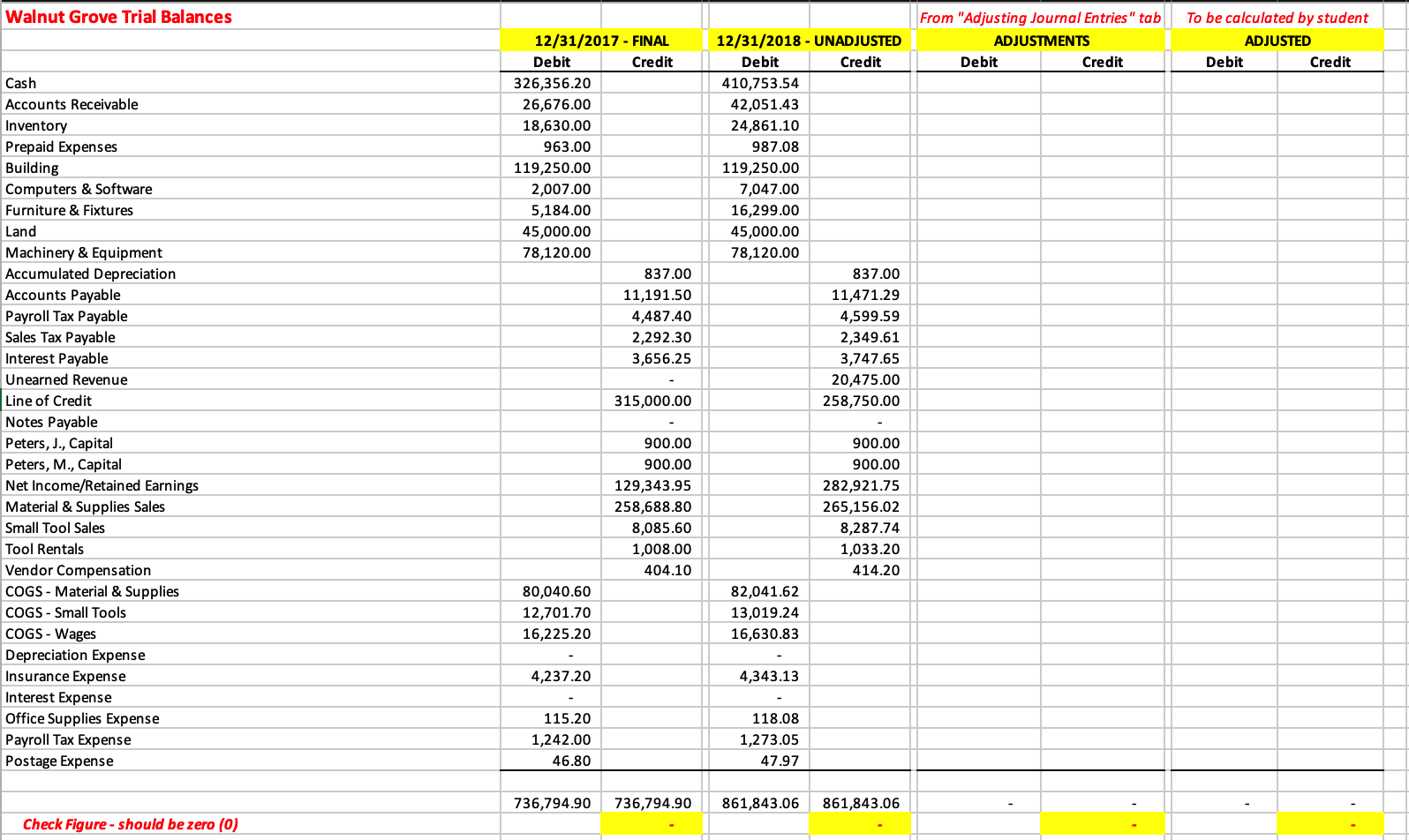

Then, entries from the journal are recorded into the ledger accounts. To illustrate the process of making adjusting journal entries from a trial balance and then preparing an adjusted trial balance, the kids learn online (klo) example from chapter. Asset, liability, equity, revenue, expense) with the ending account balance.

A trial balance is a list of all accounts in the general ledger that have nonzero balances. You can see that a journal has columns labeled debit and credit. After posting all financial transactions to the accounting journals and summarizing them in the general ledger, a trial balance is prepared to verify that the.

This statement comprises two columns:. Discover the meaning of a journal entry and a trial balance, types of journal entries, how a general ledger differs from a trial balance, and some examples. The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet.

When you work with a client’s trial balance data and create journal entries in advanceflow, you will use the trial balance and journal entries tabs of the. A trial balance is prepared at the end of the period and is done so to assist in the preparation of the financial statements and to check the accuracy of the ledger or. Adjusted trial balance refers to the general ledger balances reflecting adjustments, which include accrued.

The trial balance is prepared with the balances of accounts at the end of a particular accounting period. The trial balance is prepared in a separate sheet of paper. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company.

Further, the closing debit or credit balances in various ledger accounts go into the trial. An account is a part of the. Prepare unadjusted trial balance let’s review what we have learned.

Preparing an unadjusted trial balance is the fourth step in the accounting cycle. When a trial balance does not tally, it means that the errors must have occurred at the time of recording of journal entries with wrong account or wrong amount. Dheeraj vaidya, cfa, frm what is adjusted trial balance?