Impressive Info About Total Comprehensive Income For The Year

Updated july 13, 2023 reviewed by melody bell fact checked by marcus reeves what is comprehensive income?

Total comprehensive income for the year. Add a heading to the report that identifies it as an income statement to complete your income statement. The gsis said its net income rose to p113.3 billion from p66.4 billion in 2022, while its total comprehensive income jumped to p143.4 billion from p3.6 billion as its revenues increased by 33% to. This will offer you a broad picture of your company's success and allow you to assess how lucrative it has been.

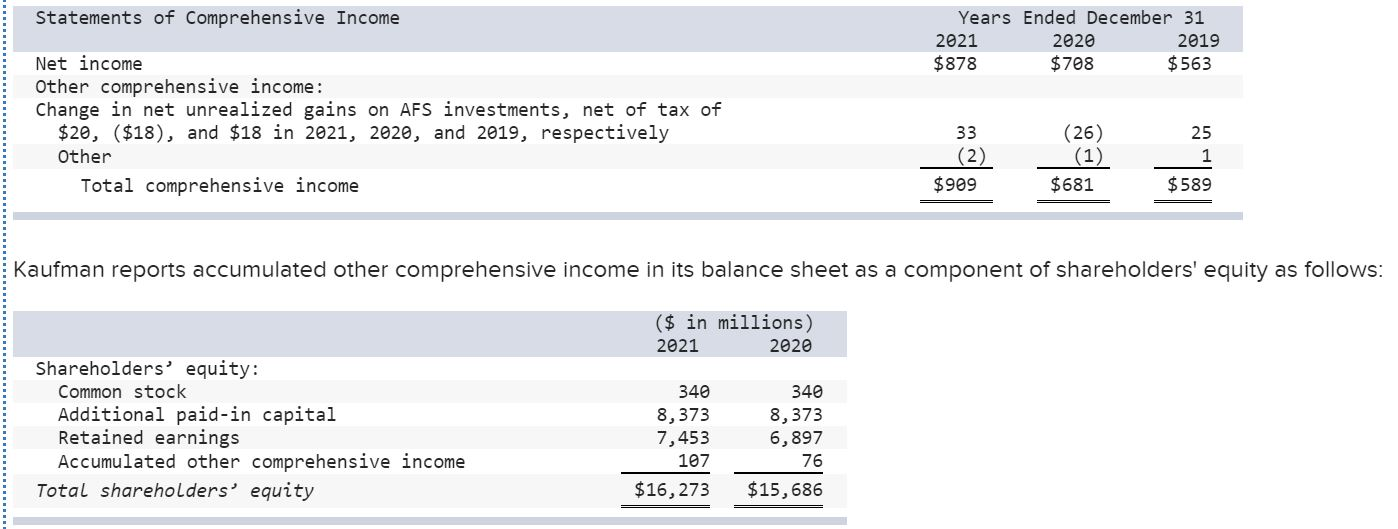

Comprehensive income attributable to stockholders: For the years ended 31 december (xls:) download. Net unrealised investment gains/ losses.

Under the save plan, monthly payments are based on a borrower’s income and family size, not their. But if your income remains at $45,000 in 2024, you'll drop down to the 12% bracket. Total comprehensive income for the year.

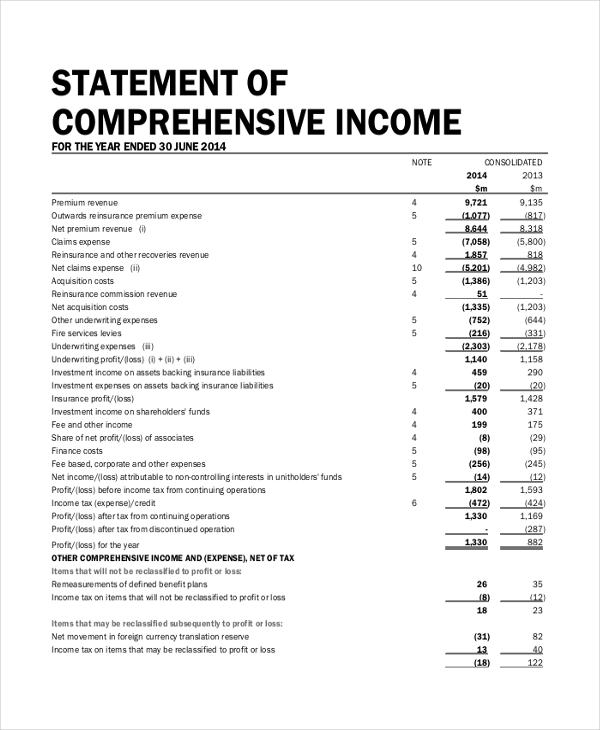

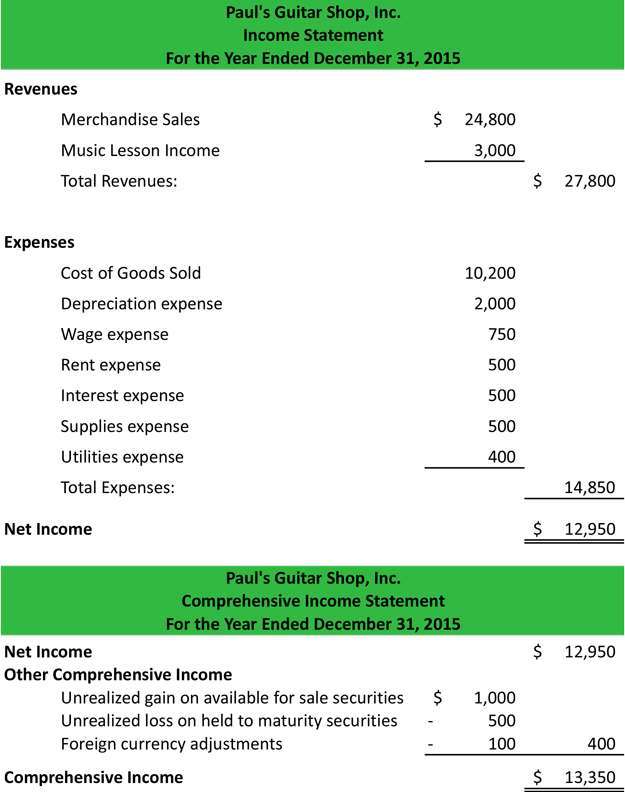

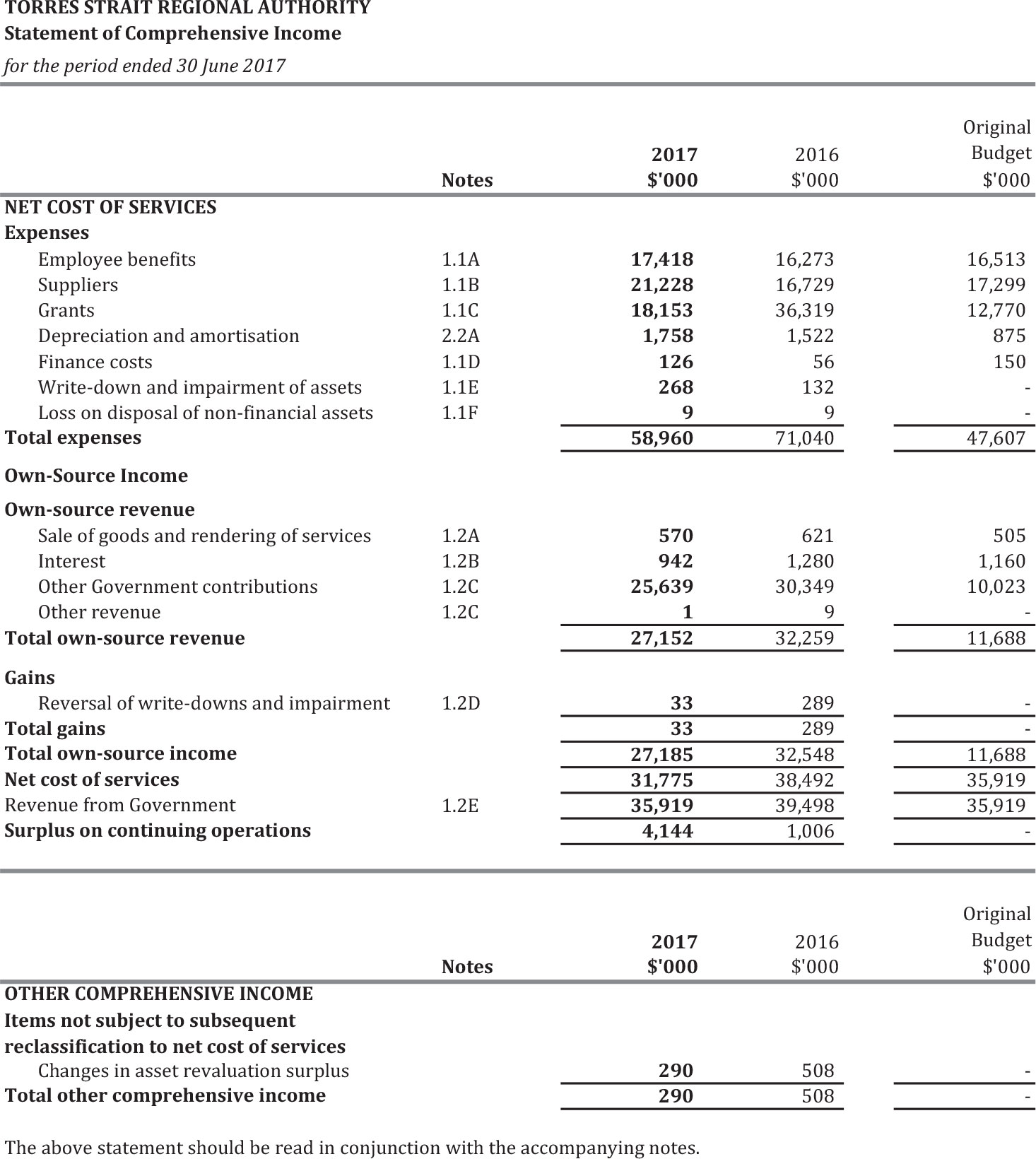

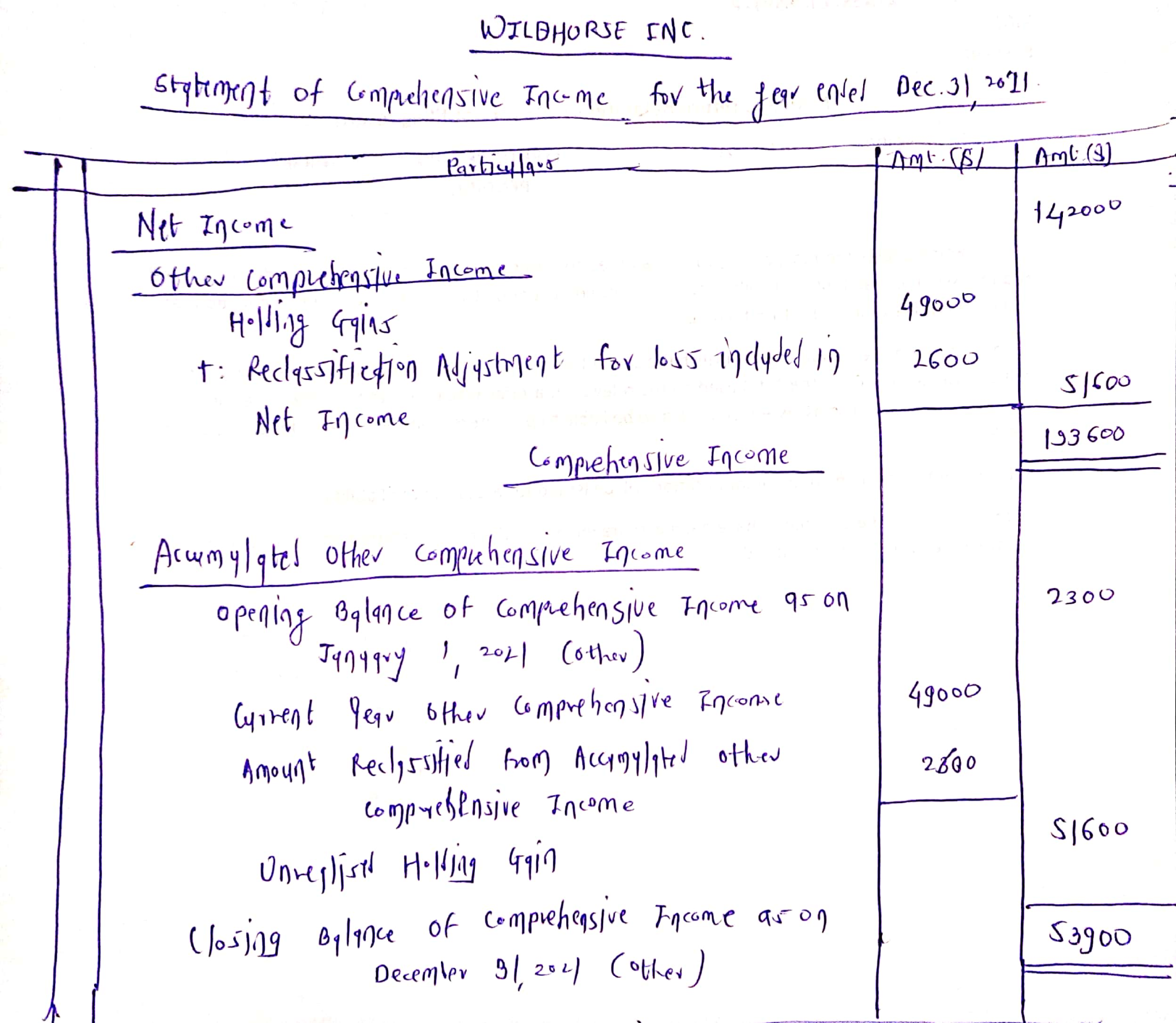

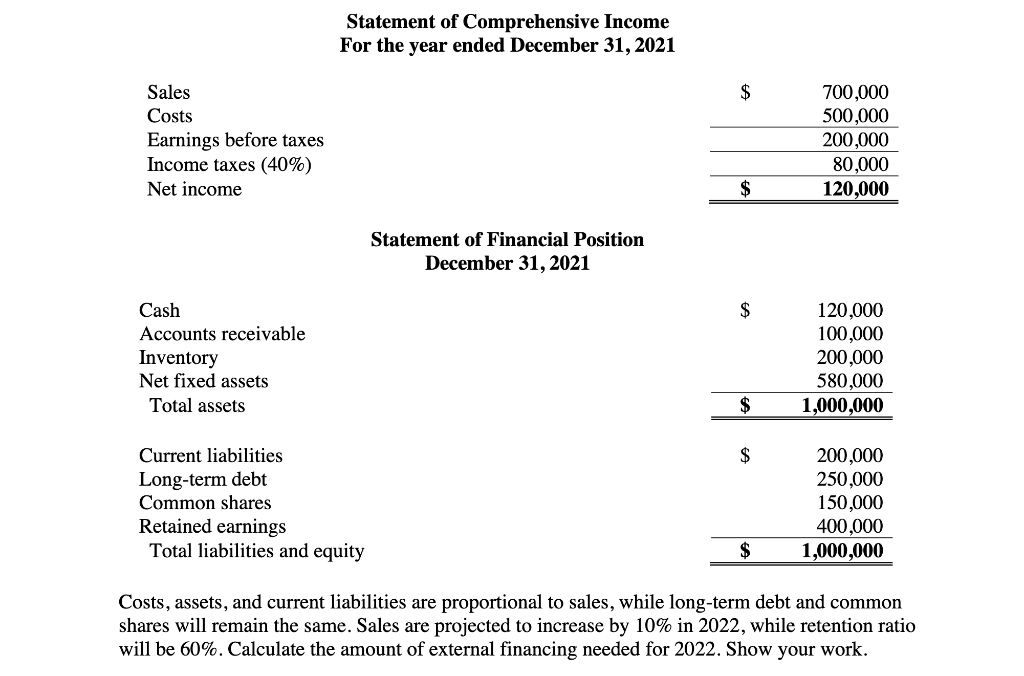

Reclassification out of accumulated other comprehensive income. The best way to demonstrate the computation of comprehensive income is the use of an an example. The purpose of the statement of profit or loss and other comprehensive income (ploci) is to show an entity’s financial performance in a way that is useful to a wide range of users.

Income tax expense 9 (13,750) (12,375) profit for the year 41,250 37,125 other comprehensive income (none of which will be reclassified to profit or loss): One single statement statement of comprehensive income for the year ended 31 march 20x8 Here is what a comprehensive income statement could look like:

In january, we (my wife and i) received a dividend income total of $1,441.30. [ias 1.125] these disclosures do not involve disclosing budgets or forecasts. Expenses wages $80,000 vehicle expenses $15,000 property tax $8,000 insurance $5,000 product $150,000 telephone $3000 advertising.

7 association of chartered certified accountants consolidated balance sheet as at 31 march 2022 restated restated 31 mar 2022 £’000 31 mar 2021 £’000 1 apr 2020 A company’s beginning shareholders’ equity is $500 million, its net income for the year is $50 million, its cash dividends for the year is $5. Statement of comprehensive income for xyz for the year ended 31 december xxxx $m.

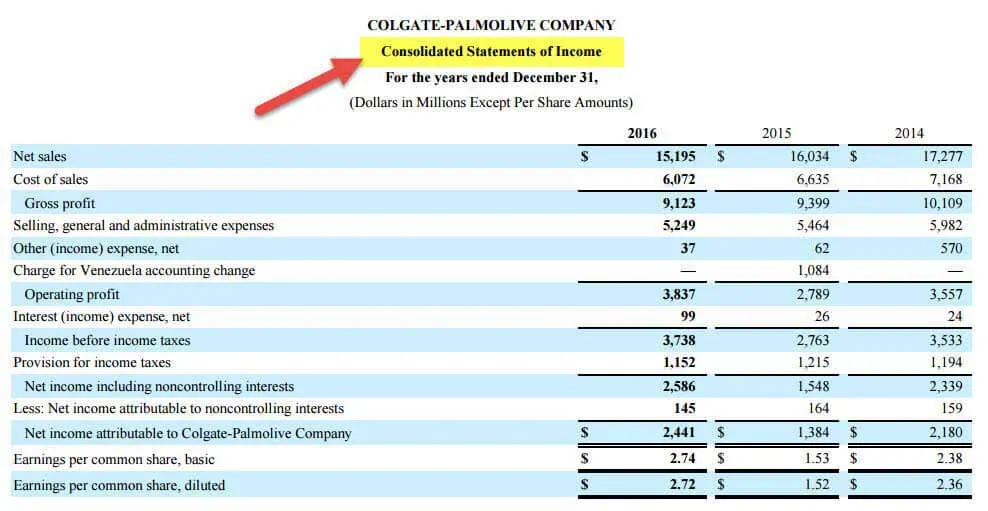

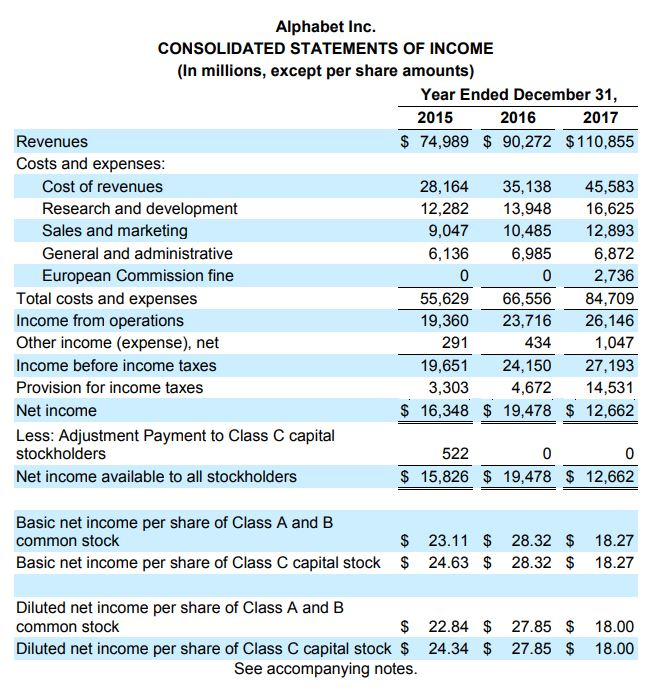

Comprehensive (loss) gain attributable to noncontrolling interests: Reports net income, other comprehensive income, and comprehensive income in a single financial statement of comprehensive income. The statement of comprehensive income reports the change in net equity of a business enterprise over a given period.

Interest on contingent capital instruments, net of tax. Comprehensive income calculation. Earnings per share is typically shown below net income and before comprehensive income.

In your income statement, put the figure in the last line item. Company provides 2024 financial outlook. Total comprehensive income for the yearxxx xxx a complete set of financial statements of an entity preparing its accounts under frs 102 will include all of the above, together with the notes to the accounts.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)