Fine Beautiful Info About Income Tax Expense Financial Statement

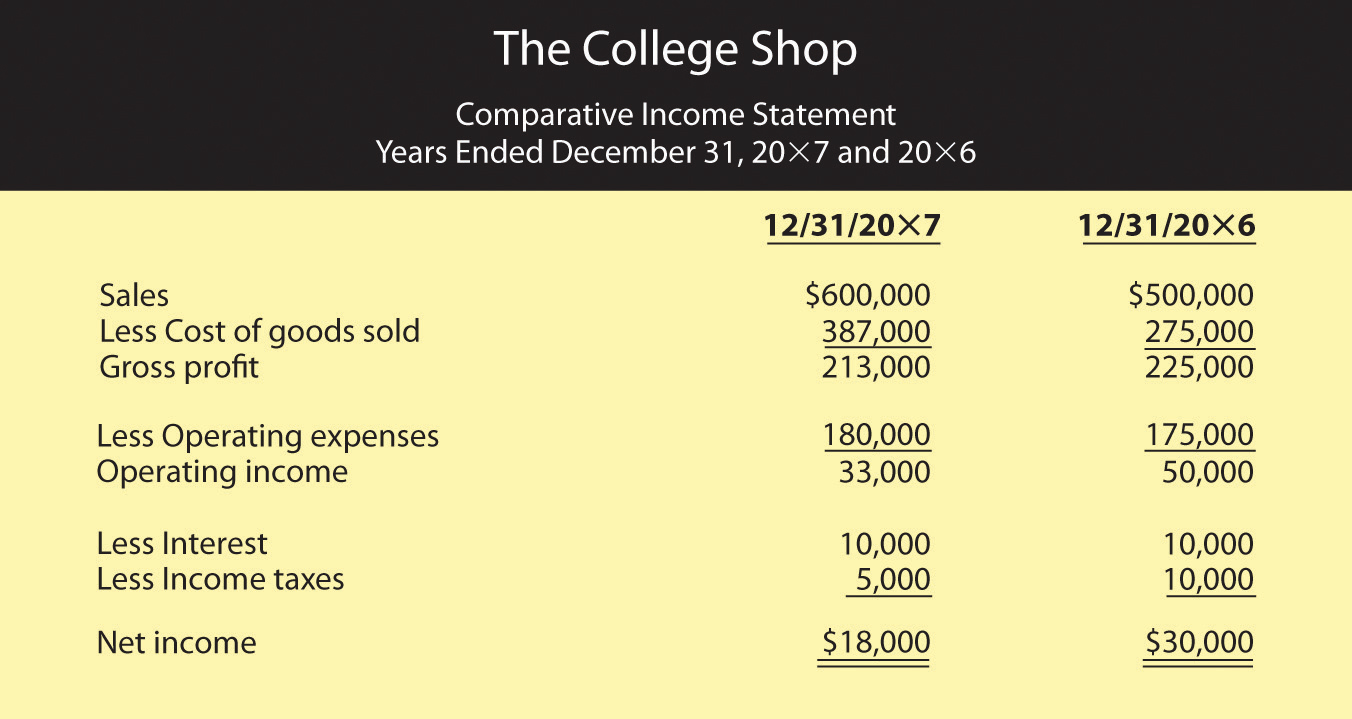

That is, to maximize profits a company must understand how it incurs tax liabilities and adjust.

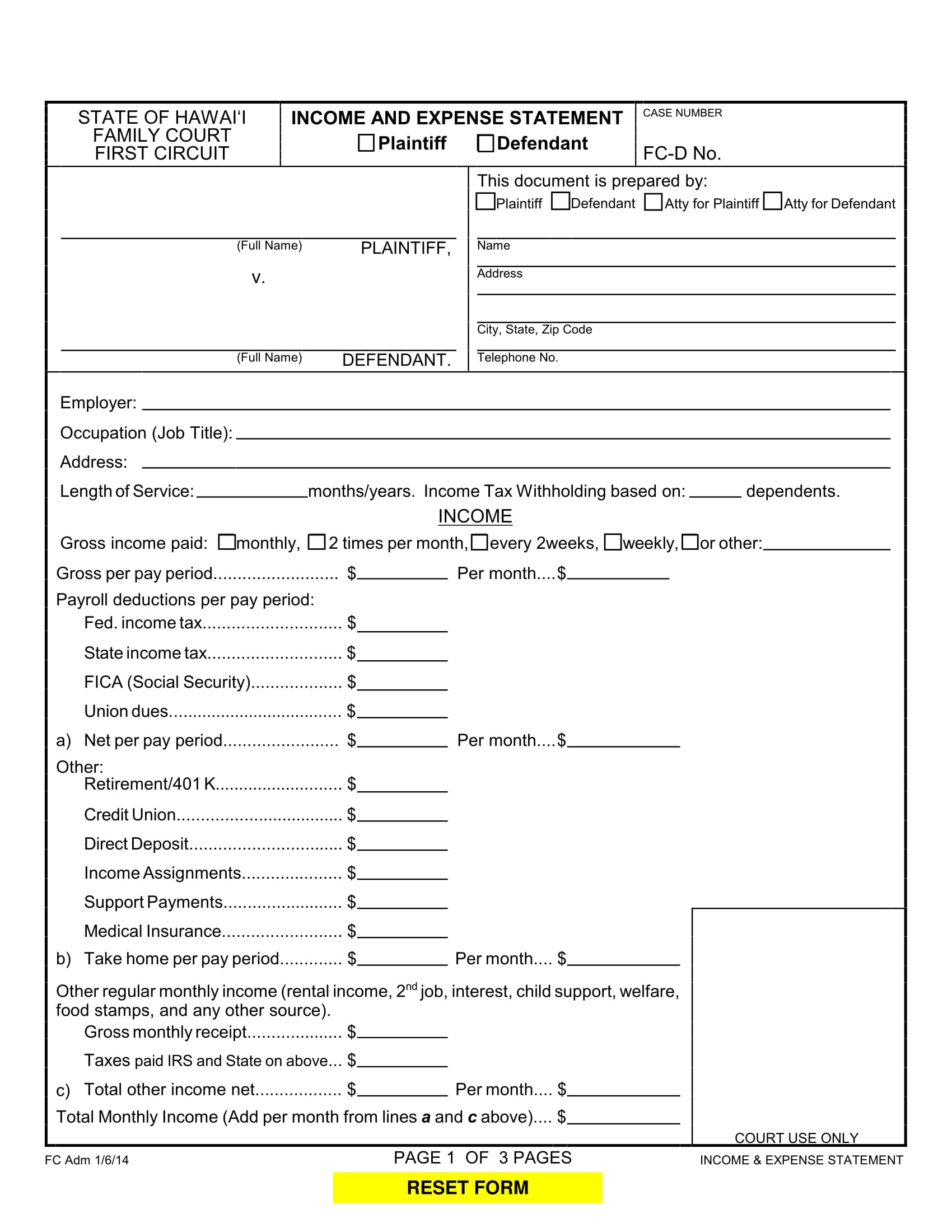

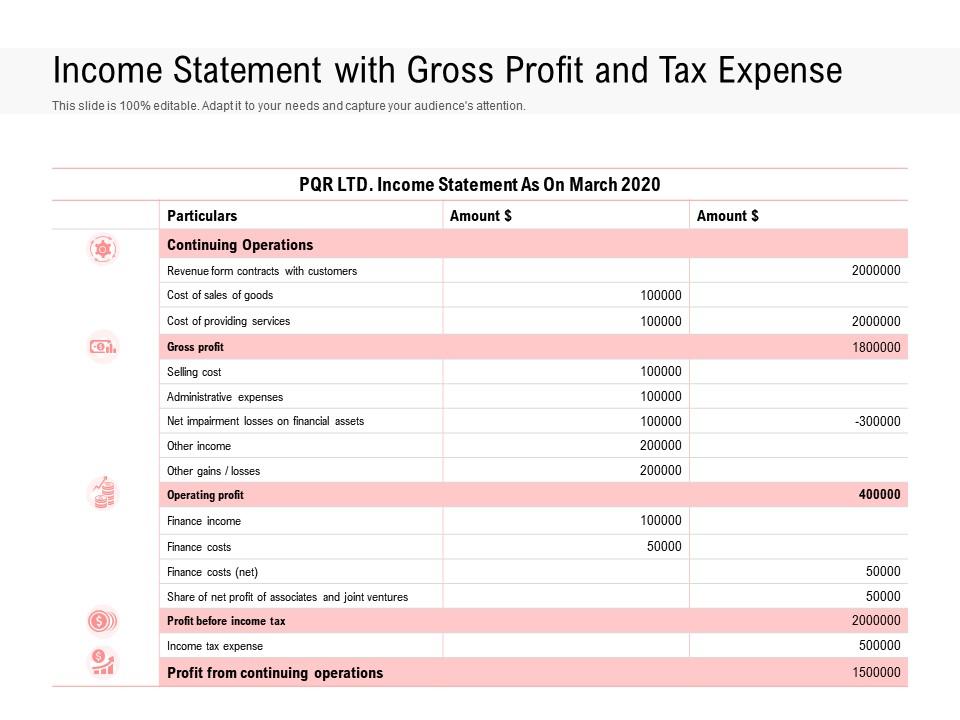

Income tax expense financial statement. It usually appears on the next to last line of the. Under ias 34.30(c), income tax expense in each interim period is based on the estimated average annual effective income tax rate applied to the. An effective tax rate is the quotient of a.

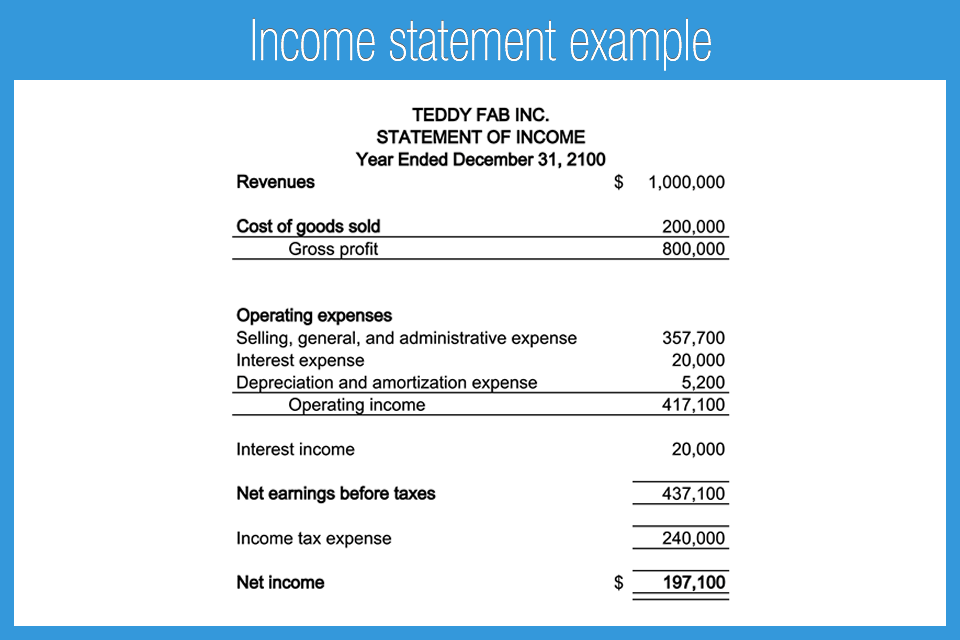

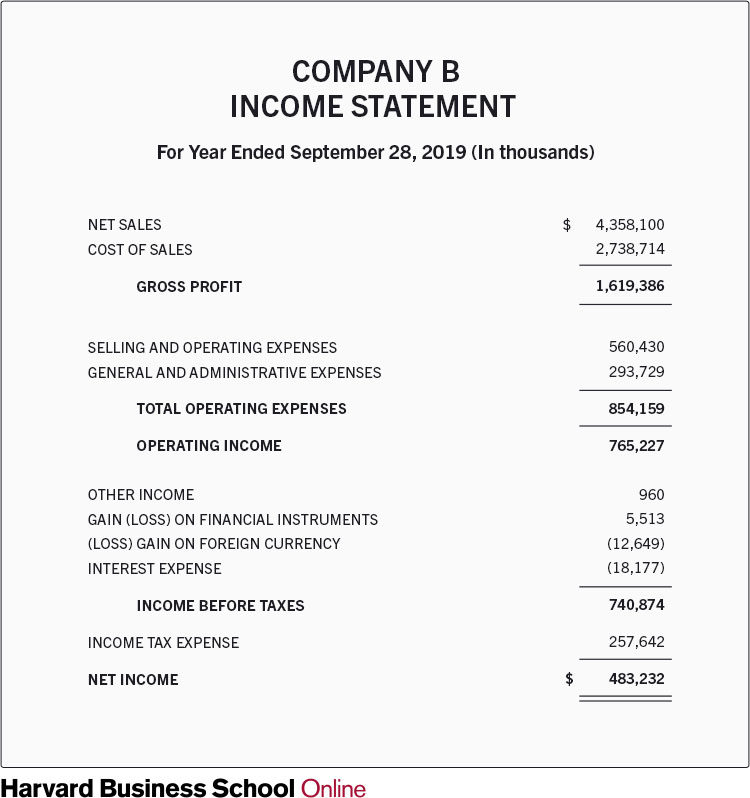

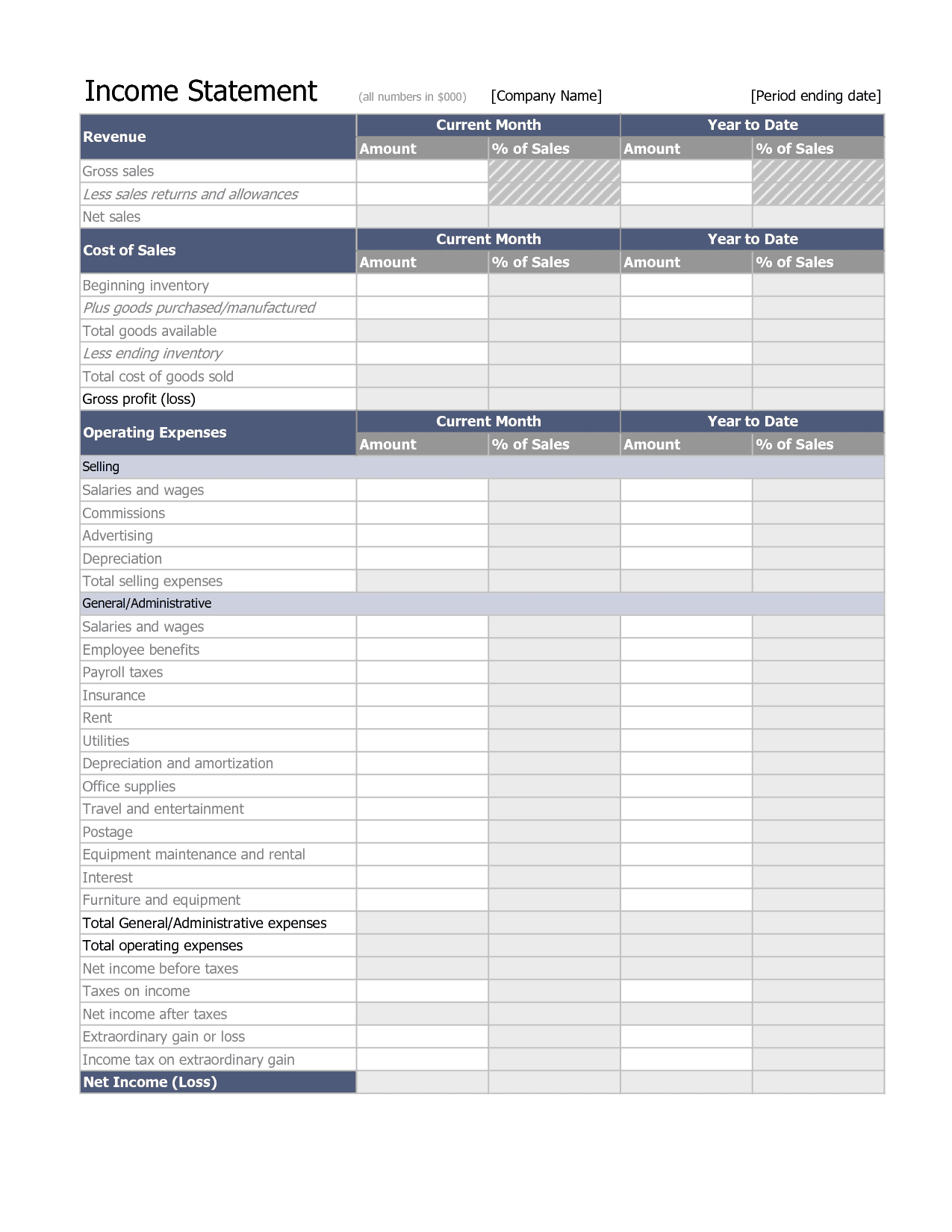

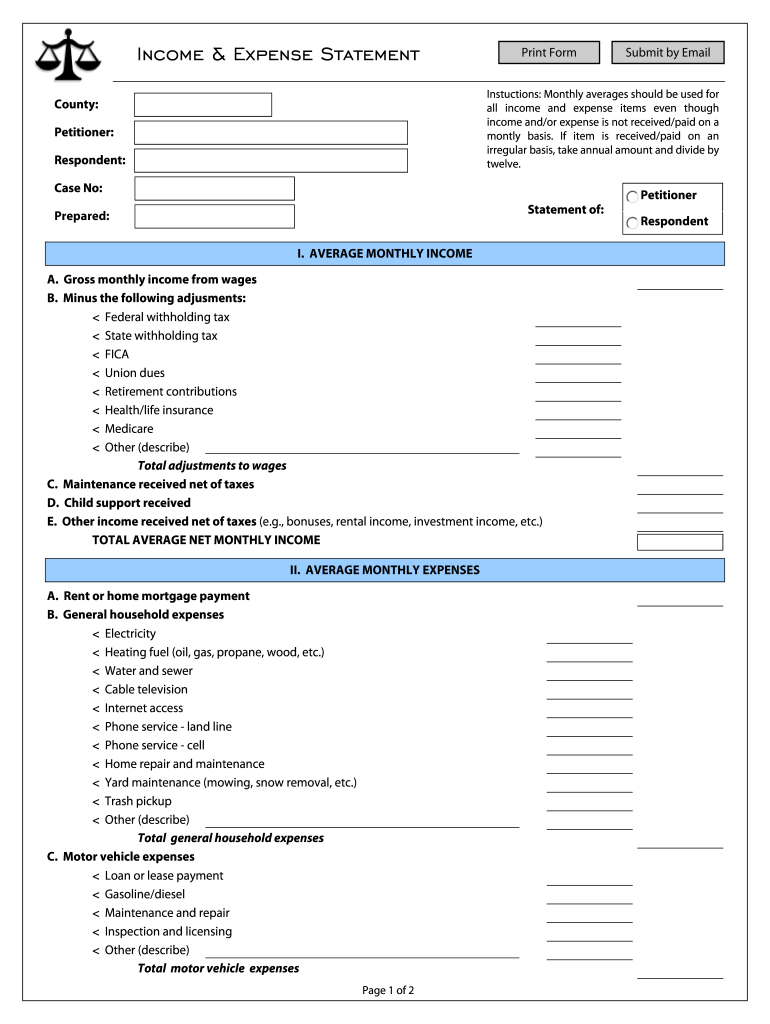

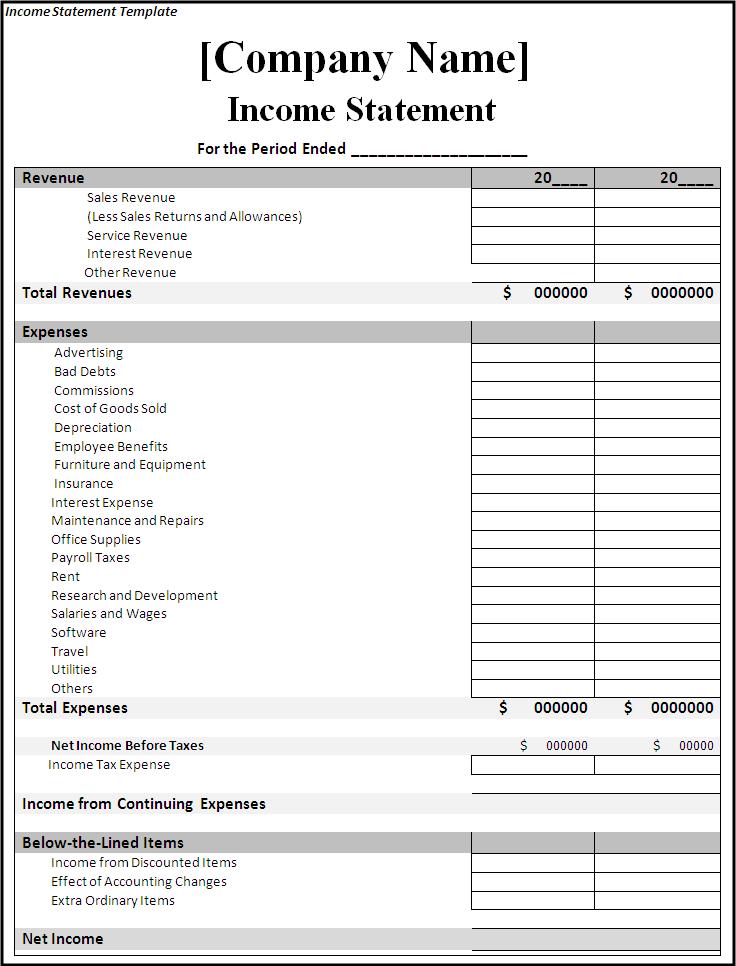

It can be broken down into three parts: The income tax expense and income tax payable accounts will be reported on the income statement and balance sheet, respectively. The income tax expense will reduce the.

The income statement, or profit and loss statement, also lists expenses related to taxes. For example, if you itemize, your agi is $100,000. Provision for 2020 warranty expenses.

Income tax expense on its income statement for the revenues and expenses appearing on the accounting period's income statement, and. The corporate income tax expense is a component that features on the income statement under the heading of ‘other expenses.’ it is a type of liability on the business or an individual. A tax provision is comprised.

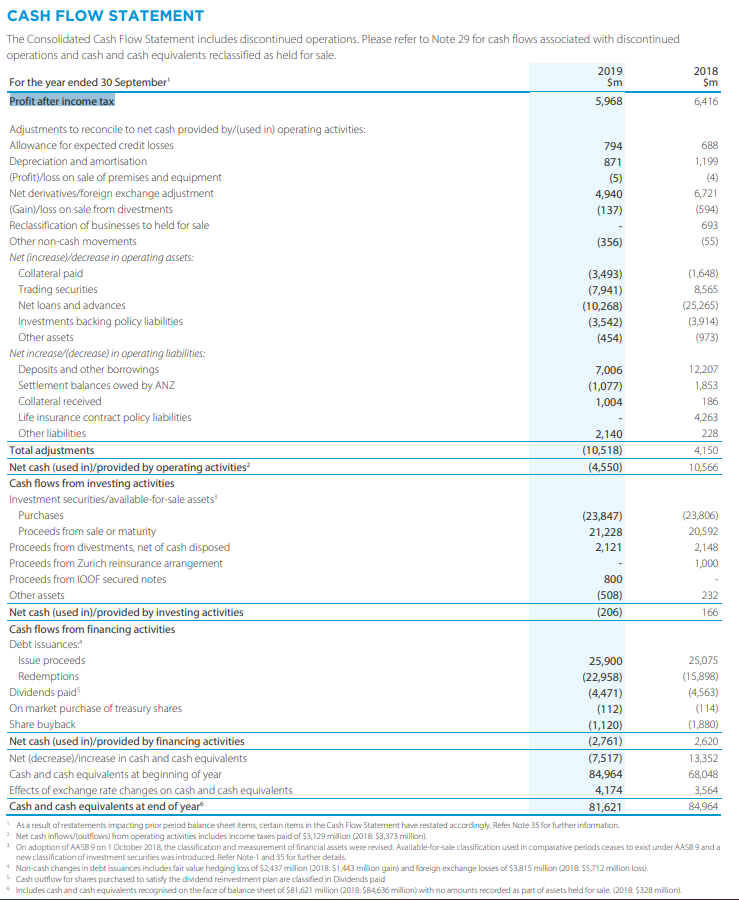

It is a tax levied by the government on a business’s earningsand an individual’s income. Total income tax expense or benefit for the year generally equals the sum of total income tax currently payable or refundable (i.e., the amount calculated in the. Primary financial statements│ finance income/expense page 5 of 22.

Income taxes payable (a current. A tax expense is a liability owed to a federal, state, or local government within a given time period, typically over the course of a year. The income tax expense is reported as a line item in the corporate income statement, while any liability for unpaid income taxes is reported in the income tax.

Expenses or losses that are tax deductible either prior to or after they are recognized in the financial statements. The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting. Income tax is the amount of tax a company is liable to pay to its local government (depending on where it is based).

Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi). The income statement is the benchmark financial statement for determining the profitability of a company. (ii) the amount of the.

In determining the income tax liabilities, management is required to estimate the amount of capital allowances and the deductibility of certain expenses (“uncertain tax positions”) at. (expected to be paid in 2021) 21,000. First, a company’s income tax accounting should be in line with its operating strategy.

The journal entry to record. Add up all your revenue and gains. (i) the amount of the deferred tax assets and liabilities recognised in the statement of financial position for each period presented;