Can’t-Miss Takeaways Of Tips About Ppp Financial Statement Disclosure

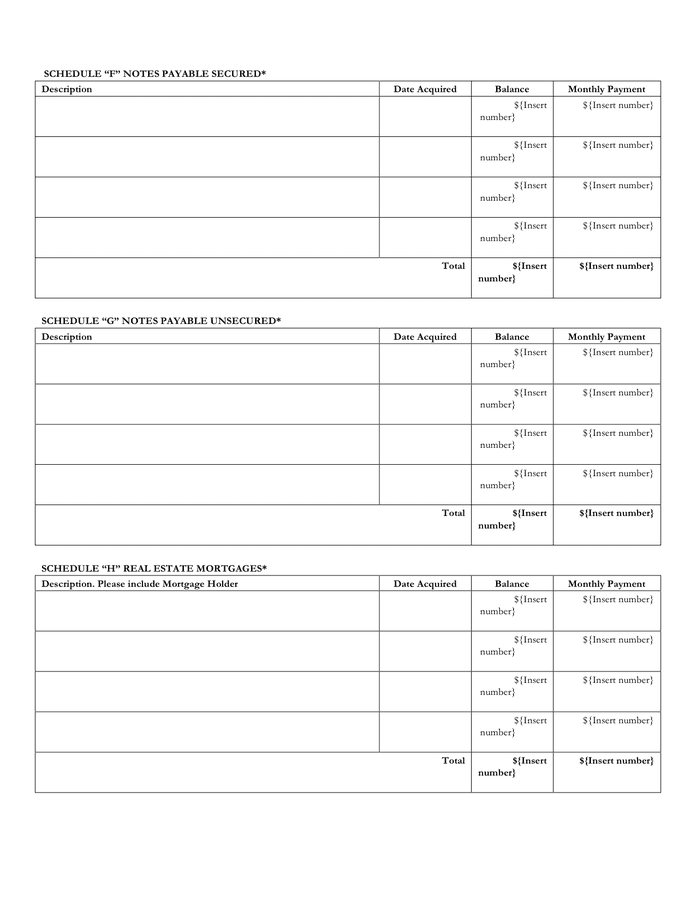

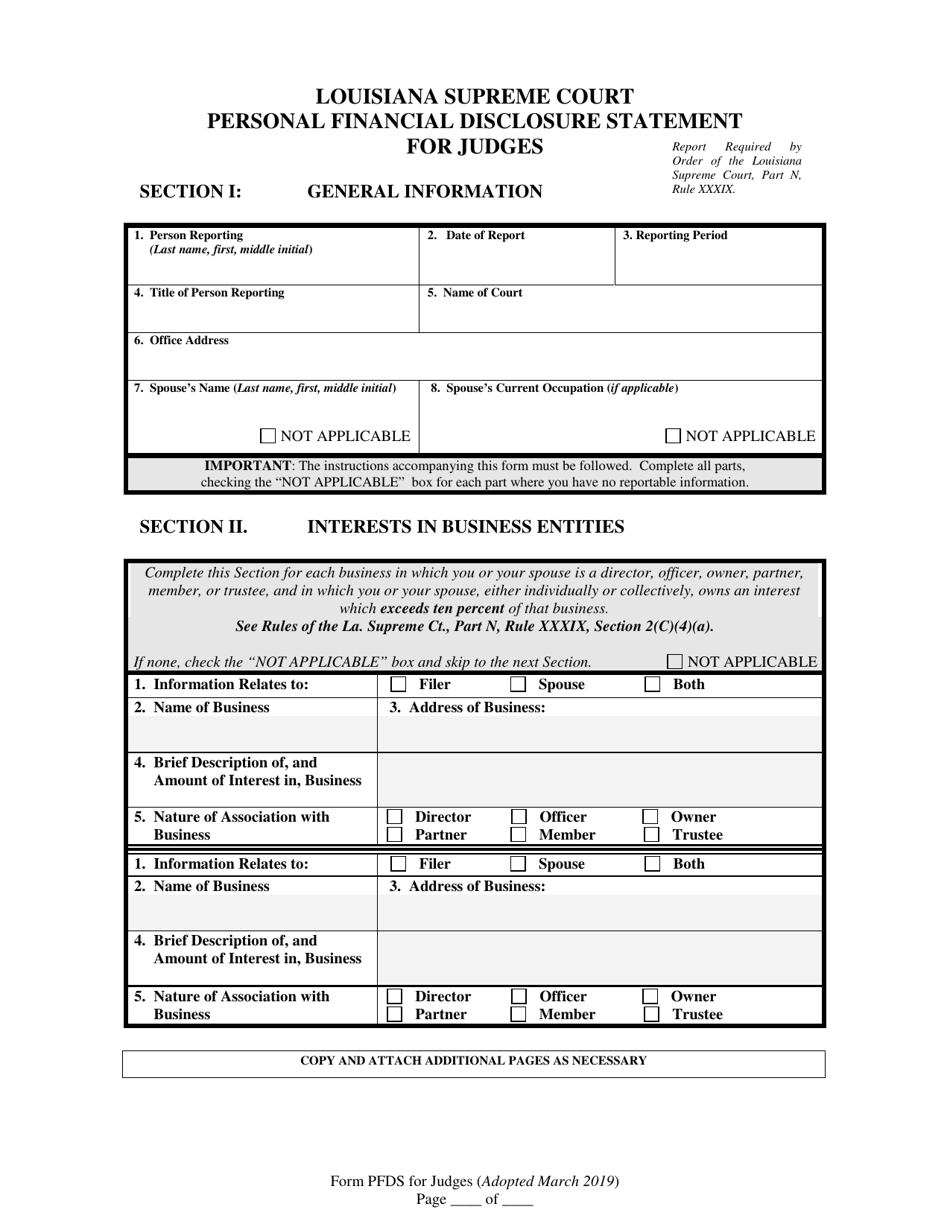

Footnote disclosure the footnote disclosures should include, but are not limited to:

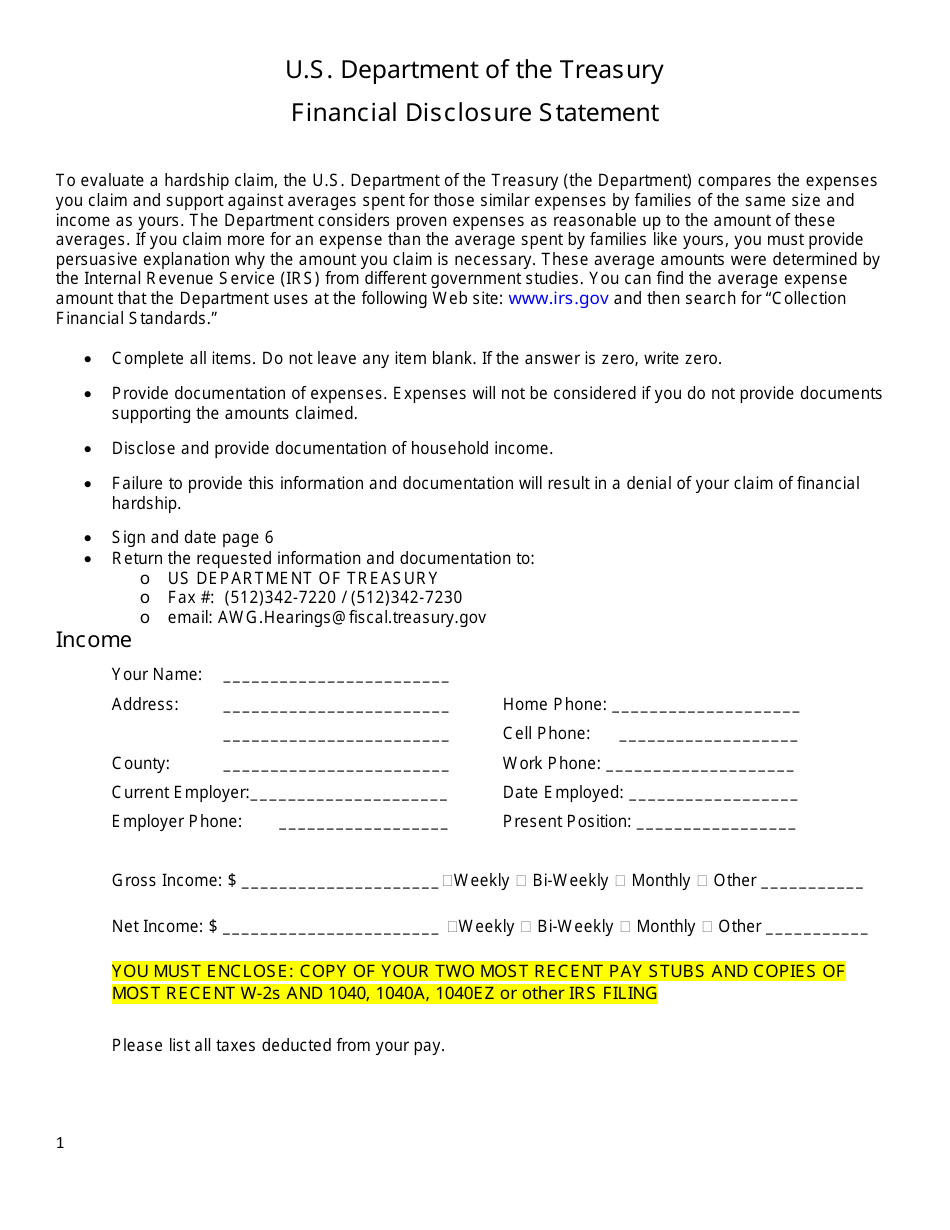

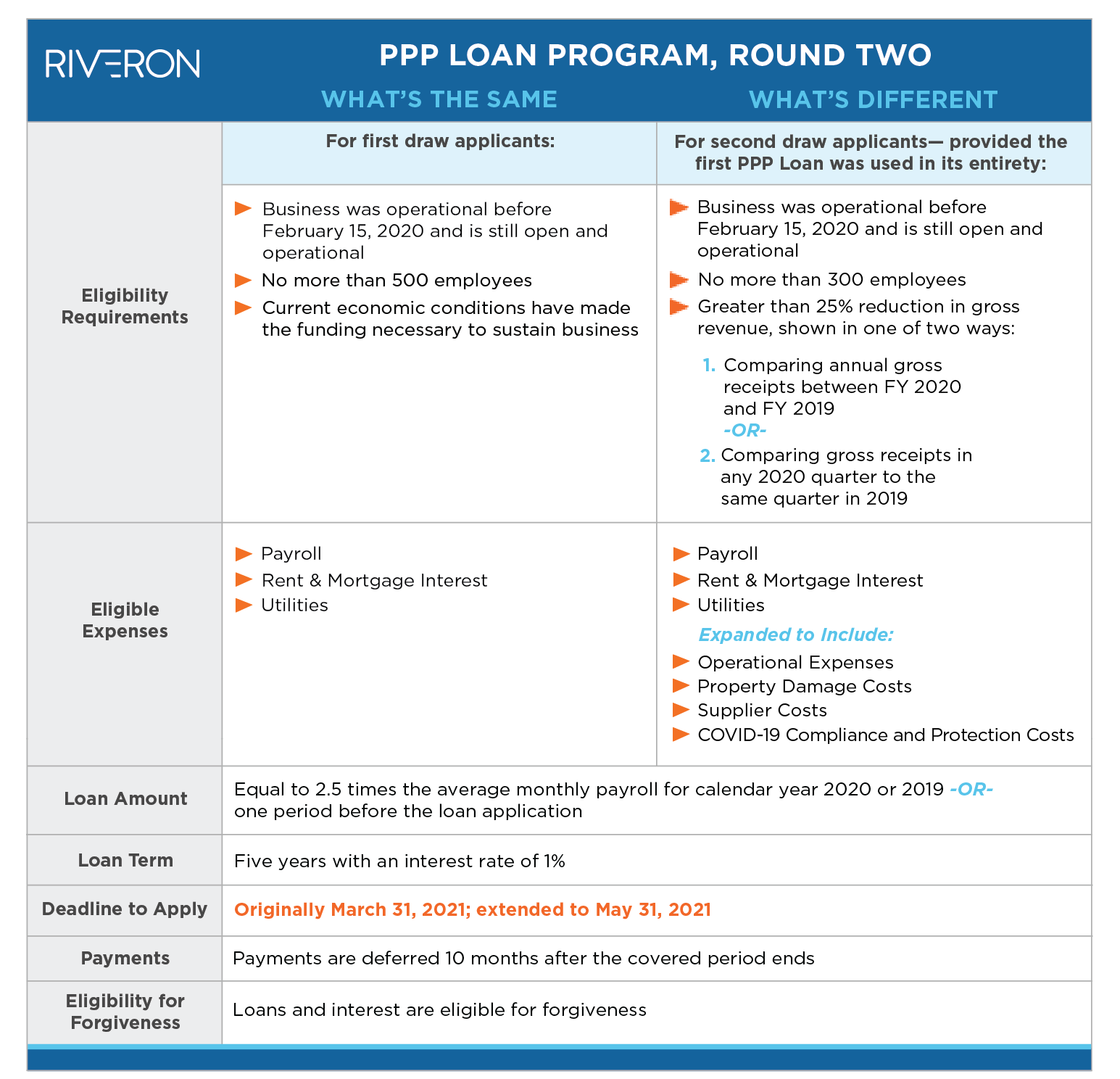

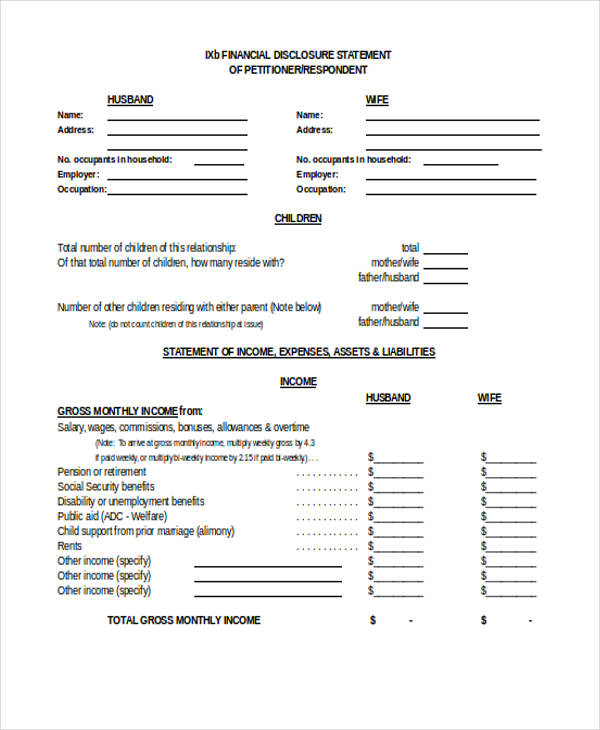

Ppp financial statement disclosure. 4 are you wondering about ppp and eidl accounting? Possible future standard setting by the iasb 4. Description of the ppp loan and amount awarded from the program.

Twenty four weeks is the covered period, unless you received your loan before. Derecognition of the trade payable 6. Fasb asc 470 debt model the debt model follows traditional loan accounting.

The paycheck protection program (“ppp”) was established as part of the coronavirus aid, relief and economic security act (“cares act”) and it provides loans to qualifying. On the quarterly and annual statements, note 11 is the appropriate place to disclose a ppp loan. Outflows from financing activities and cash paid for interest would appear as an additional disclosure item on the cash flow statement.

The ppp loan proceeds would be recorded as. Repayments would be considered a financing cash outflows; Regardless of the accounting approach followed by a borrower, if the ppp loan is material to the financial statements, the borrower should disclose in the footnotes how the ppp loan was accounted for and where the related amounts are presented in.

You have 10 months to file for forgiveness from the end of your covered period. A nongovernmental entity may account for a paycheck protection program (ppp) loan as a financial liability in accordance with fasb asc topic 470, debt, or. Key financial reporting considerations for supplier financing arrangements 5.

Well, you've come to the right place. Financing of ppp projects 13. Types of government financial reporting briefly describes the three types of government financial accounting and reporting—government financial statistics,.

Disclosures should include issue date, face amount, carrying. The psc presents herewith the audited financial statements of the g ppp for the year ended 31 st december, 2016 and report thereon as follows: What disclosures are required under.

Ppp loans can potentially be recorded under different accounting standards which results in different journal entries and disclosures as well.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.39.54AM-4a117e7e494c422ca6480746c97612a8.png)