Real Info About Outstanding Accounts Receivable Effect On Net Cash Balance Sheet

This credit line requires the customer.

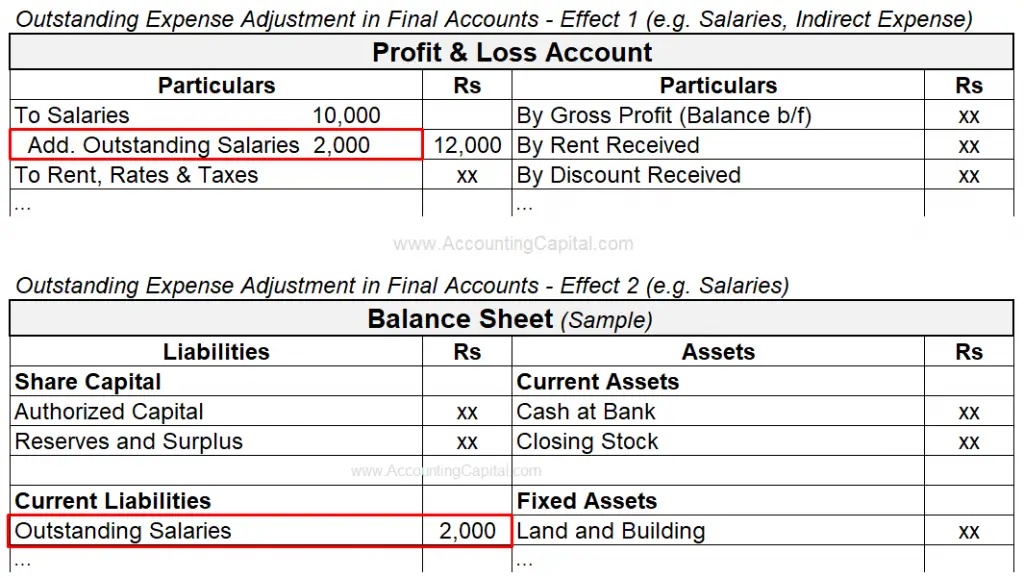

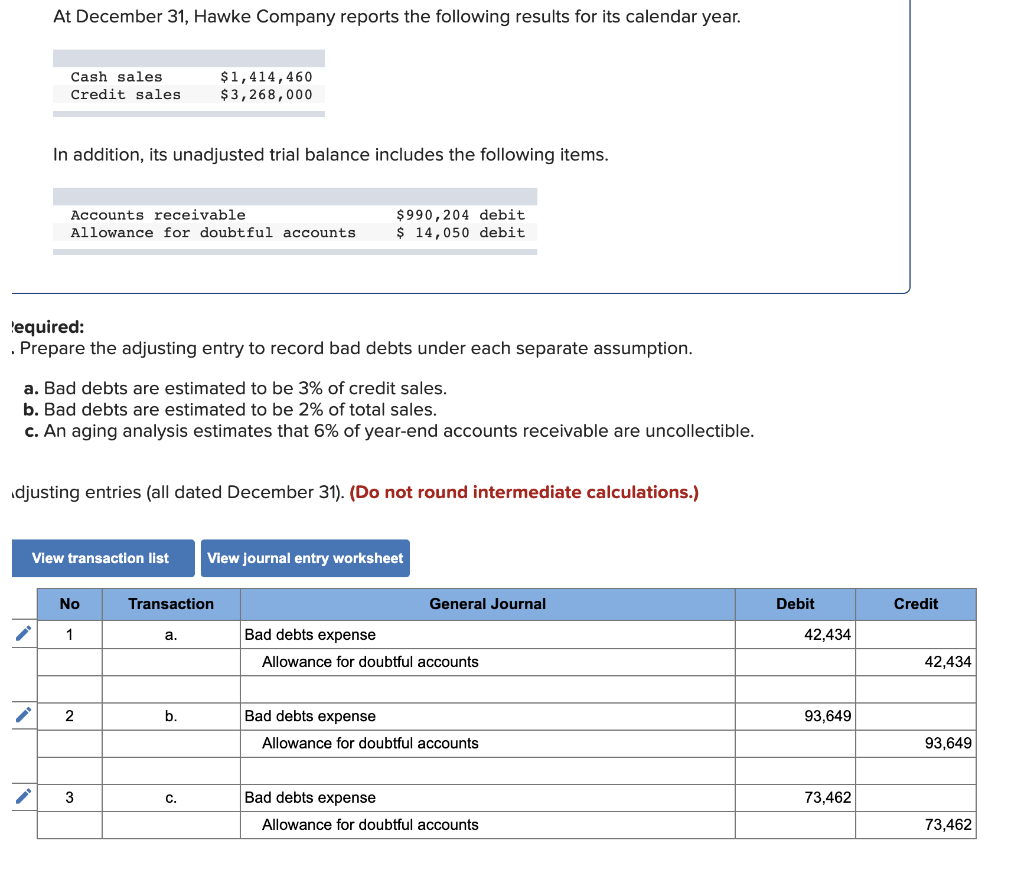

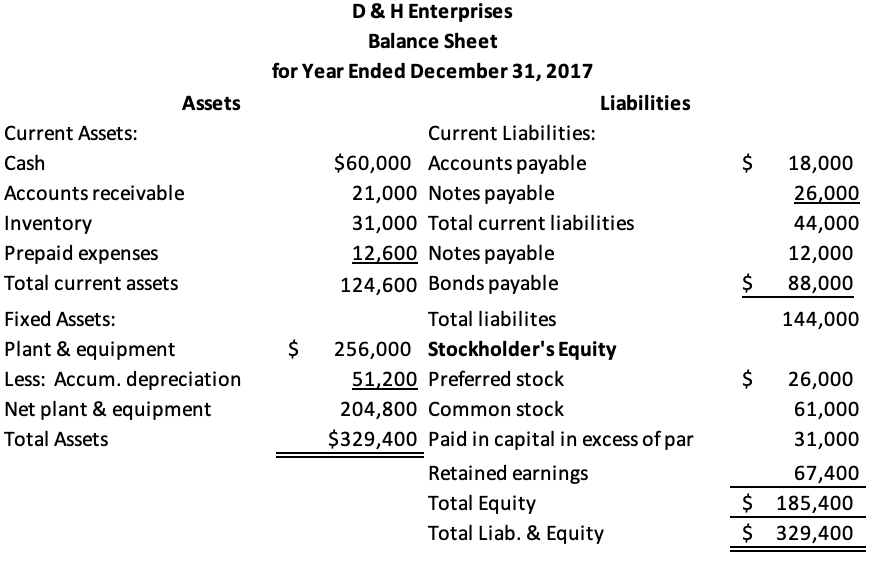

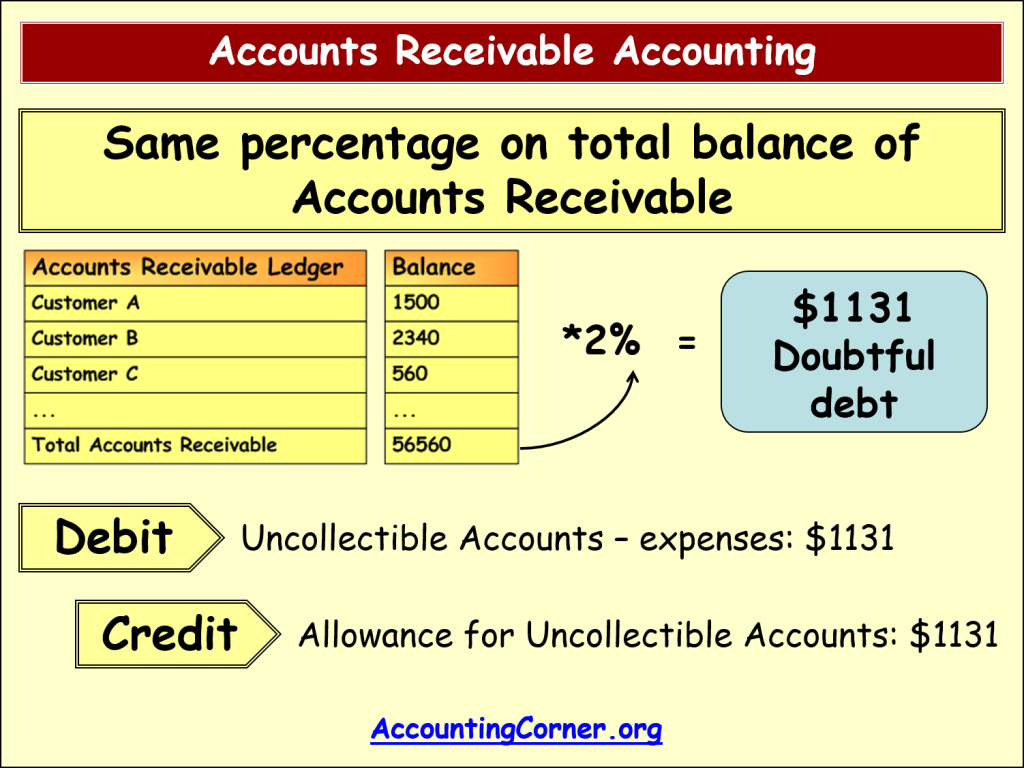

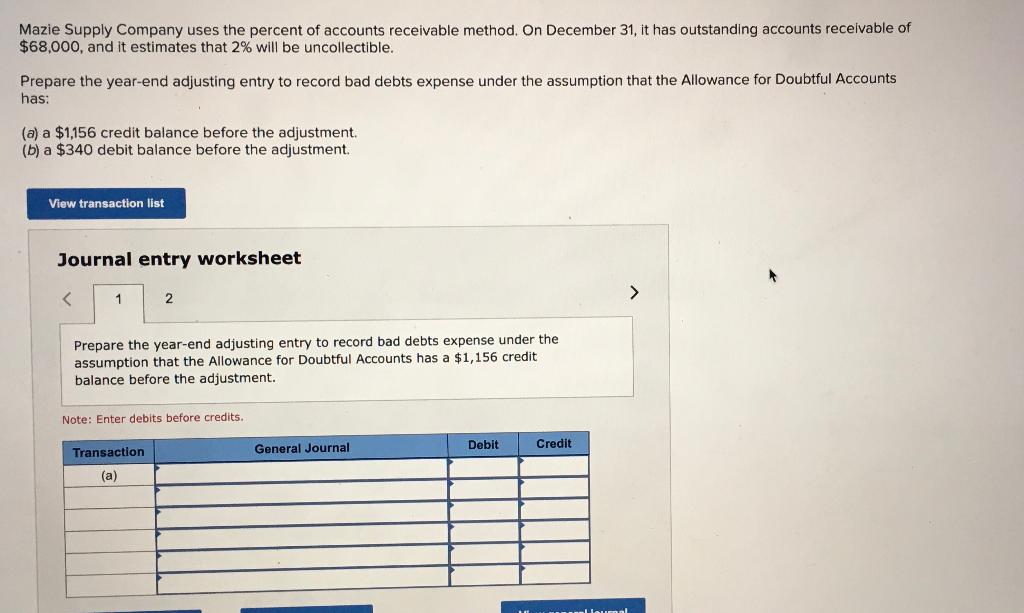

Outstanding accounts receivable effect on net cash on balance sheet. An issue with the balance is typically caused by one of two things: Accounts receivable refers to the outstanding invoices a company has or the money the company is owed from its clients. Bad debt negatively affects accounts receivable (see figure 9.2 ).

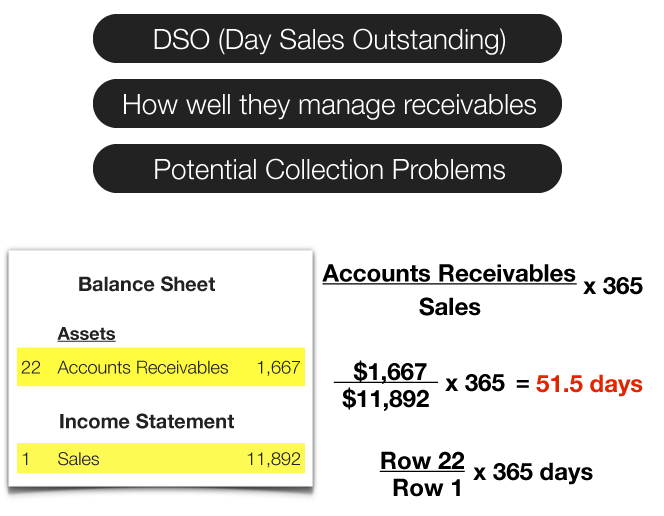

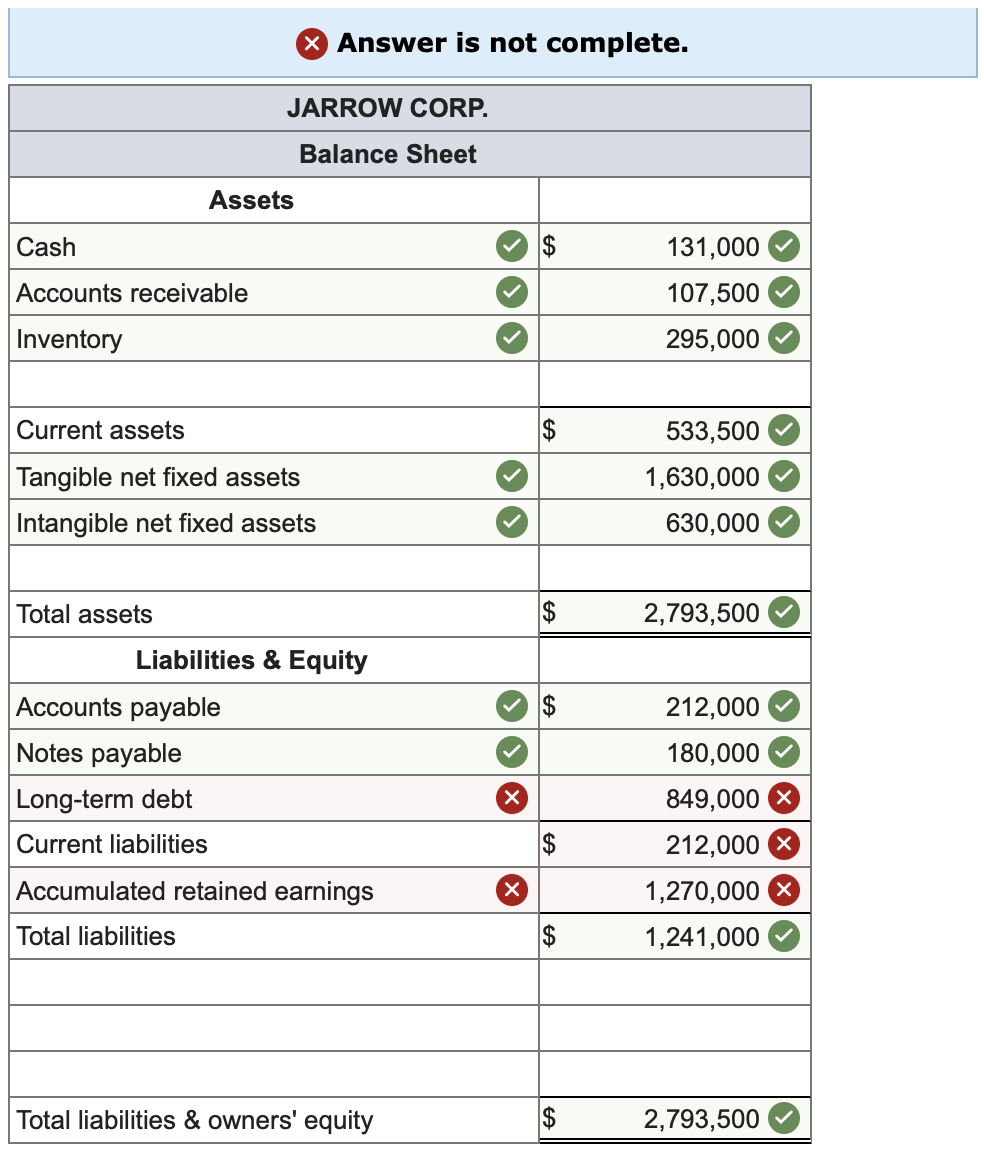

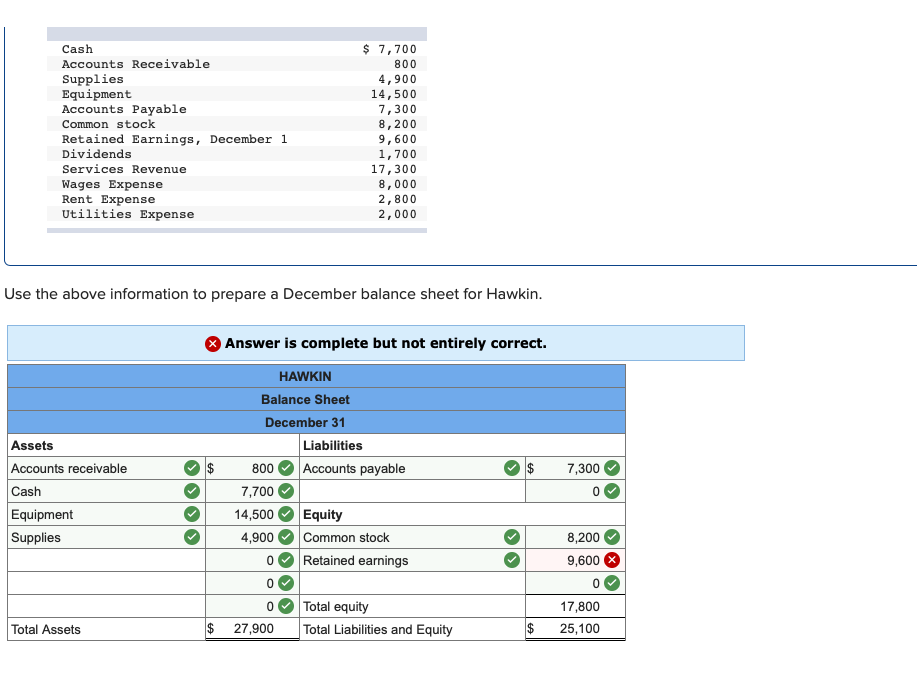

Be sure to deduct increases in account receivables from net profit while adding decreases in account receivables to net profit. Tiger company showed on their balance sheet on december 31, 2020 that accounts receivable, net was $960,000 and that the allowance for uncollectible accounts was. To get the average accounts receivable for xyz inc.

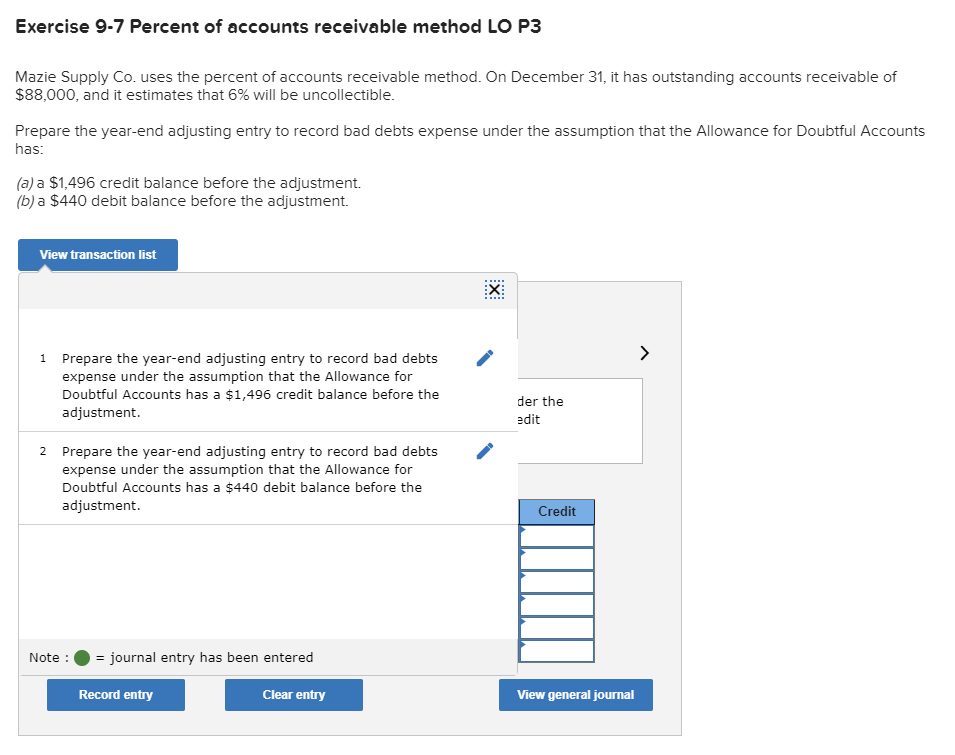

An accounts payable or accounts receivable transaction has affected the balance sheet. Outstanding receivables if the account goes unpaid, at some point you will have to change its status. The balance sheet should include an allowance for doubtful.

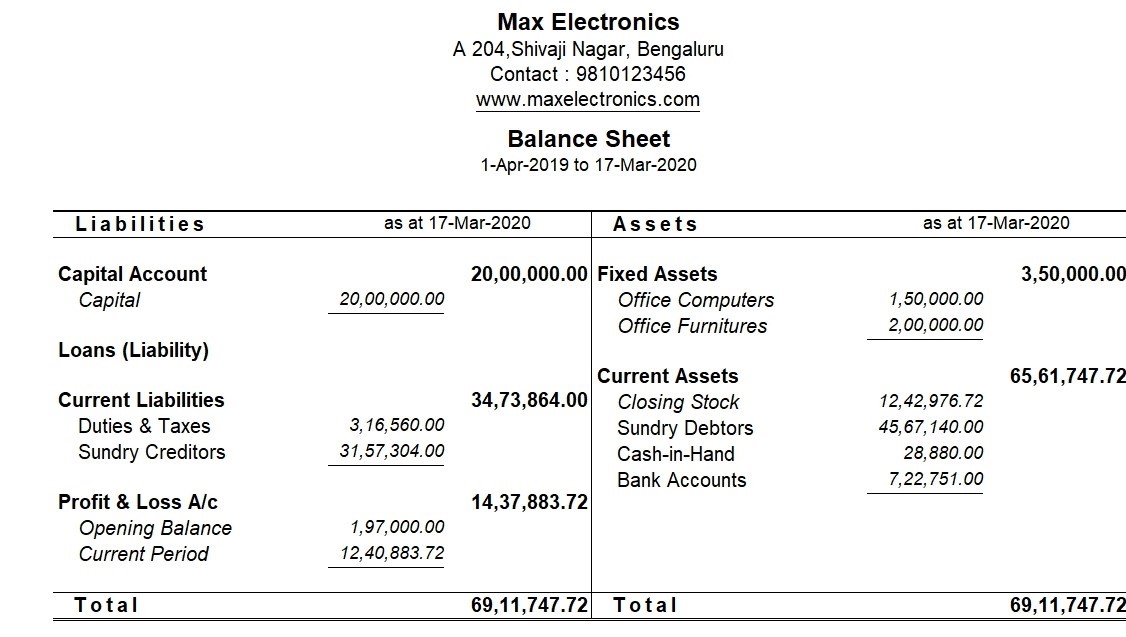

Accounts receivables are recorded as assets on a company's balance sheet because the cash from the transaction is typically forthcoming in under one year. $2,500 + $1,500 / 2. A company's accounts receivable represents the line of credit it extends to its customers for the goods or services it provides.

When it collects cash against its a/r balance, a company is converting the balance from one current asset to another. For that year, we add the beginning and ending accounts receivable amounts and divide them by two: December 29, 2021 december 30, 2020;

Excerpts from the consolidated balance sheet (in thousands of canadian dollars) (unaudited) as at: How would cash collected on accounts receivable affect the balance sheet? It is a current asset on the balance.

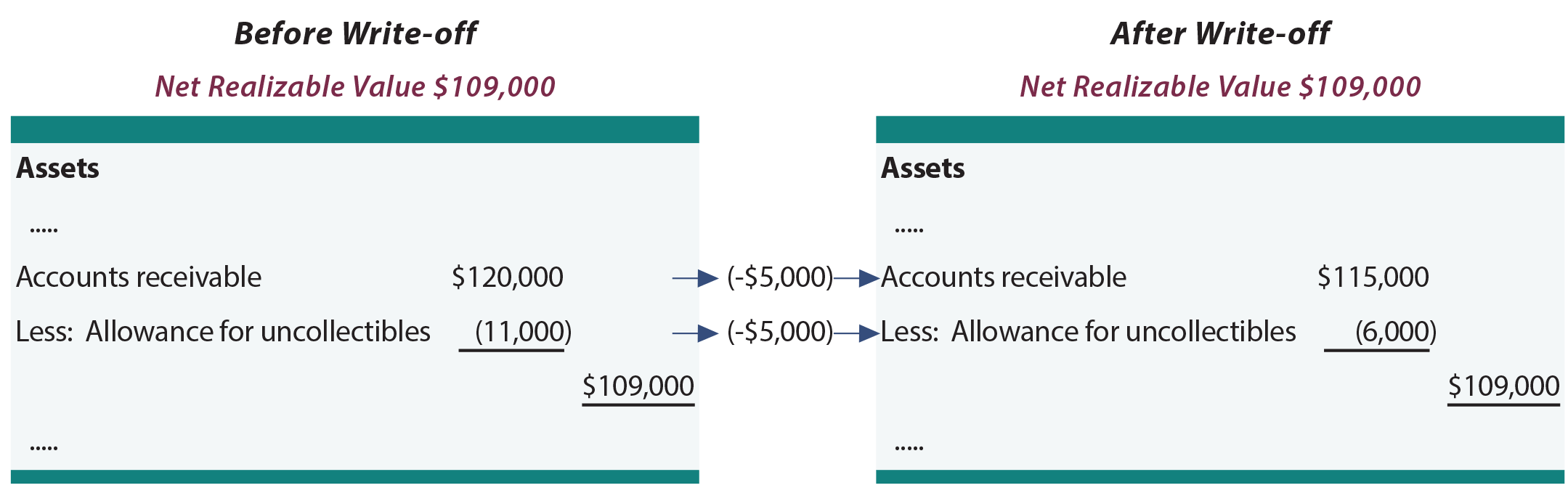

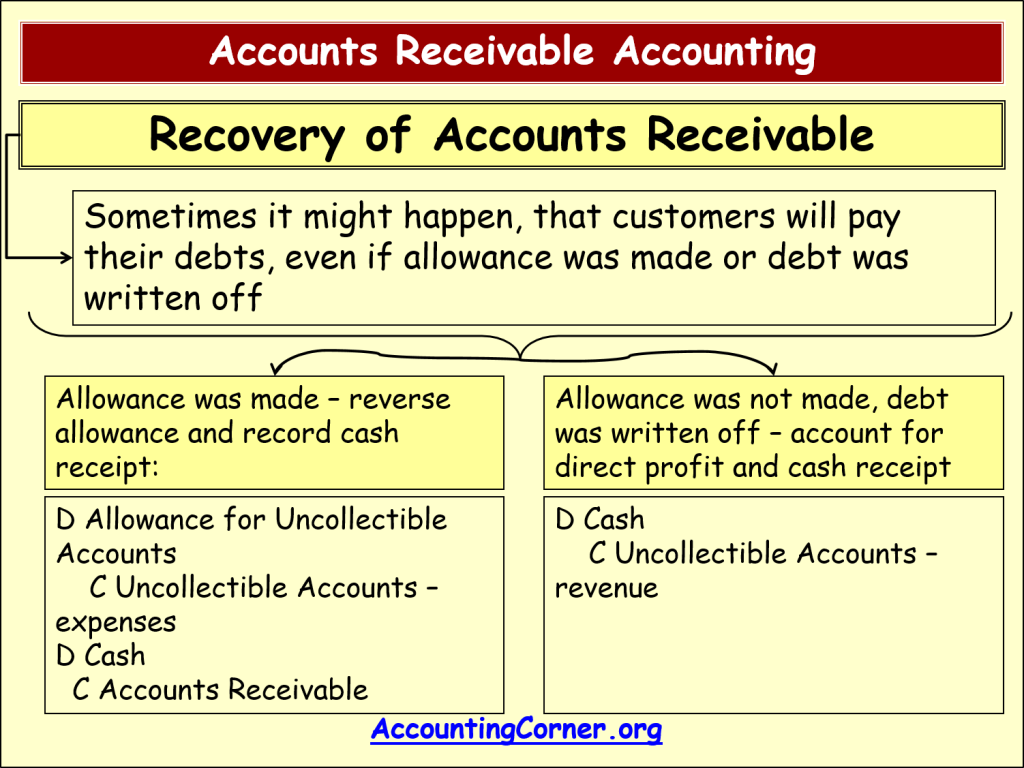

Cash collected on accounts receivable can positively impact the balance sheet, improving liquidity and reducing outstanding debts. When you debit cash or bank. Because the afda is a contra account to accounts receivable, and both have been reduced by identical amounts, there is no effect on the net accounts receivable (nrv).

Because the afda is a contra account to accounts receivable, and both have been reduced by identical amounts, there is no effect on the net accounts. When future collection of receivables cannot be reasonably assumed, recognizing this potential nonpayment is. Its a/r balance decreases, while its cash balance increases.