Favorite Info About P And Loss Statement

Knowing how to read a profit and loss statement is key to making informed.

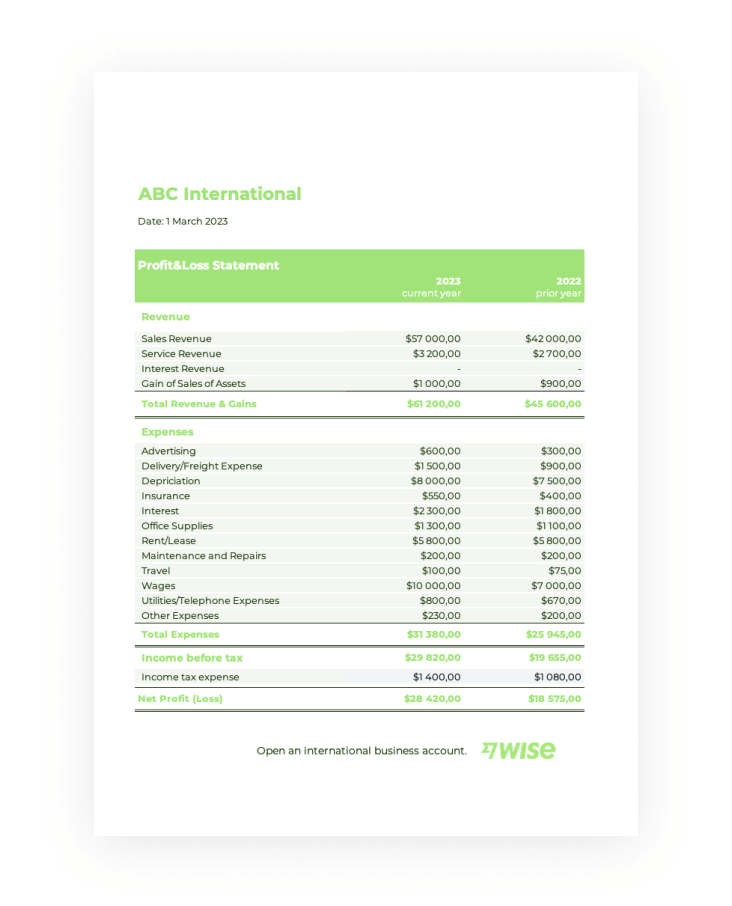

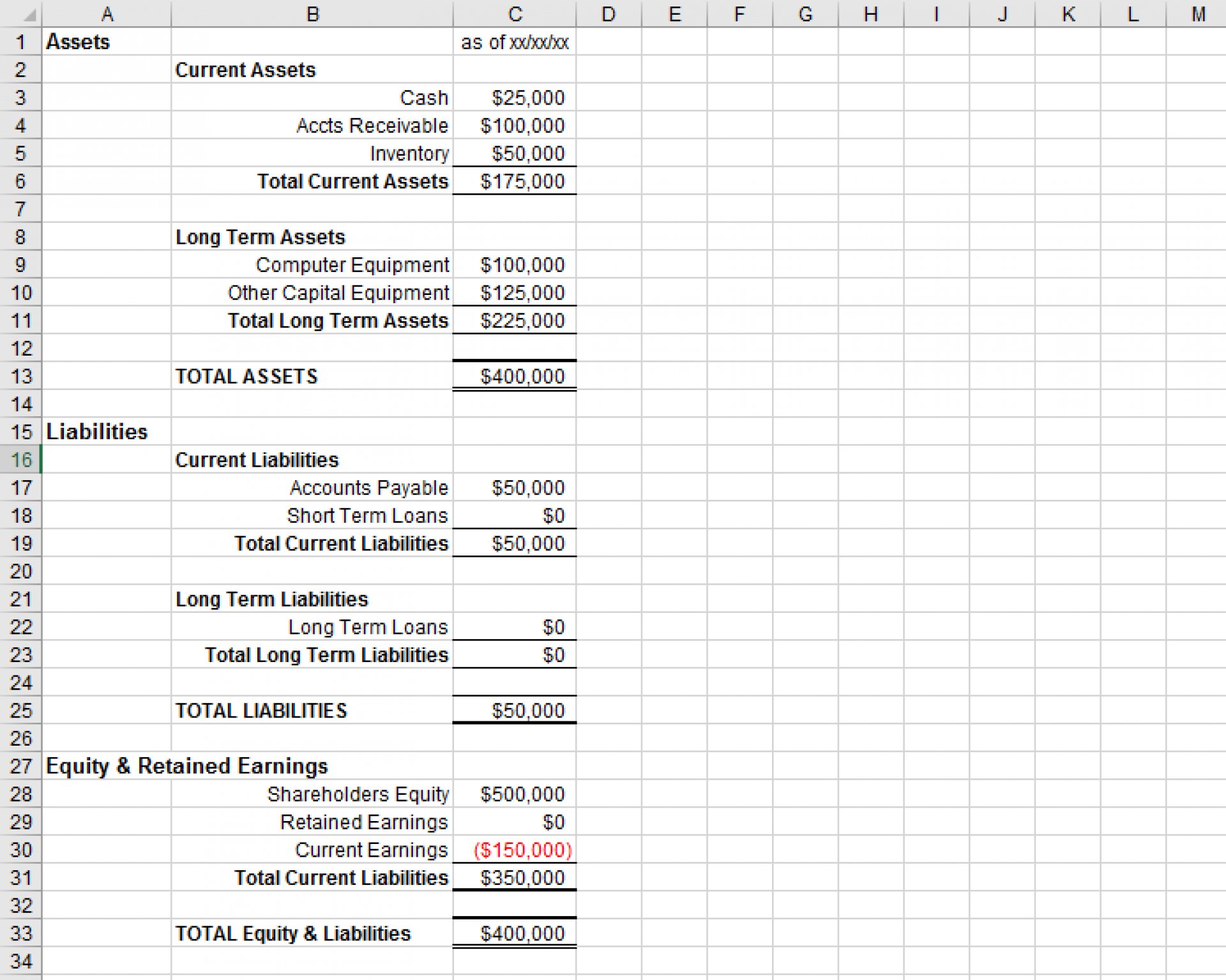

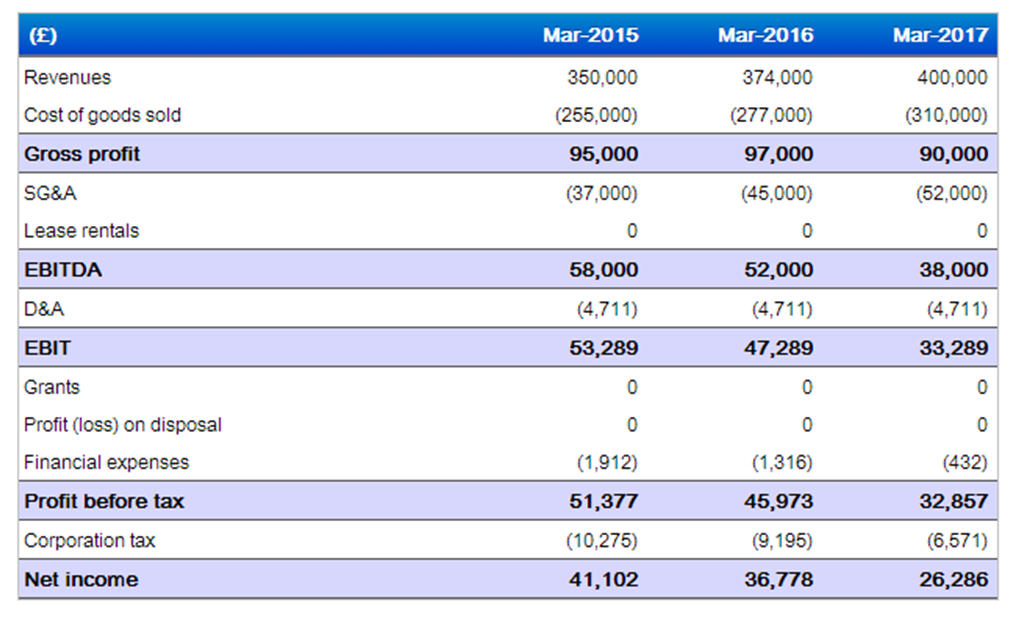

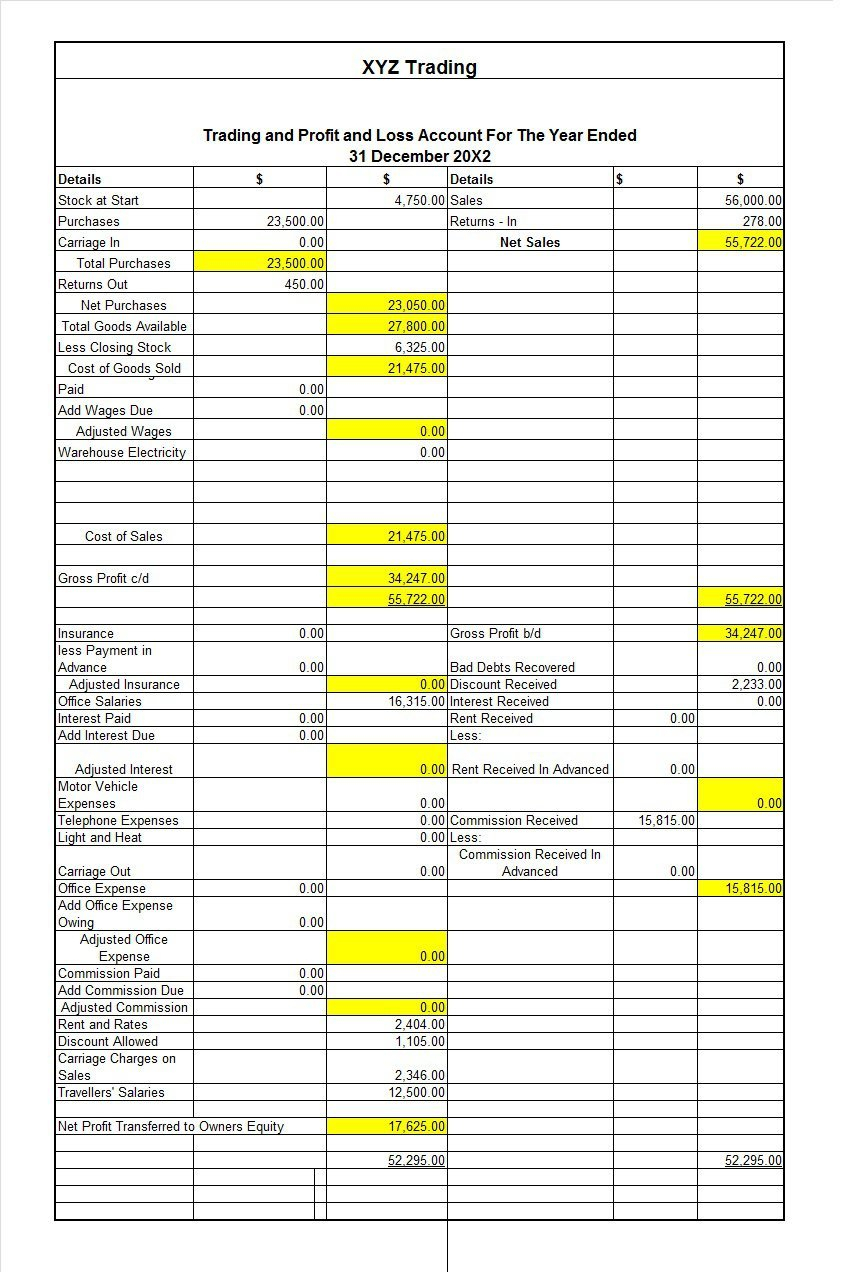

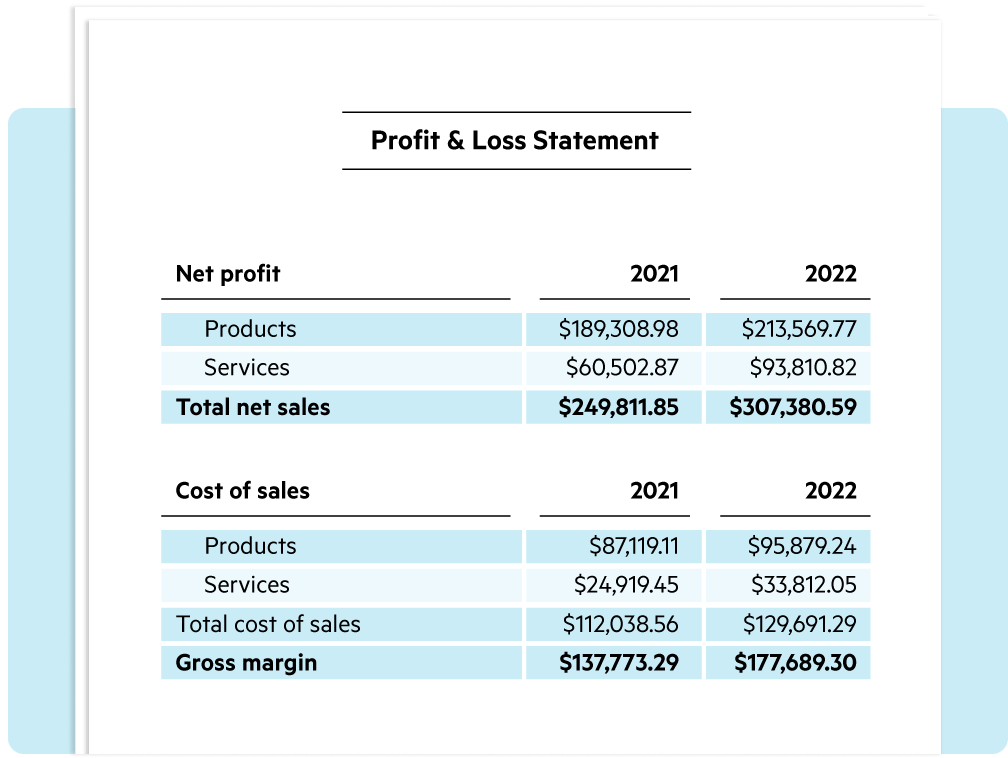

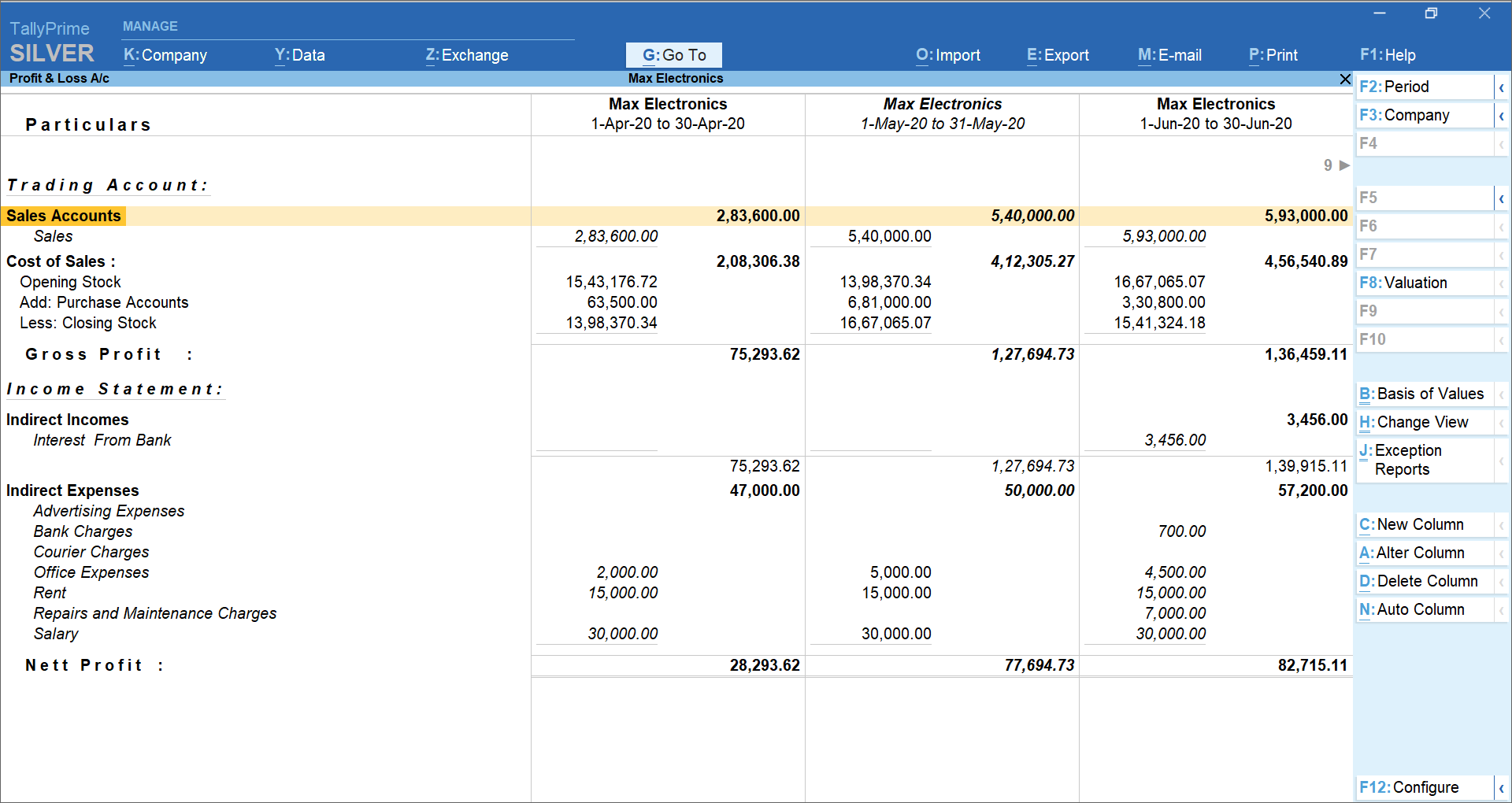

P and loss statement. Key takeaways a p&l statement explains the income and expenses that lead to a company’s profits (or losses). You are free to use this image on your website, templates, etc, please provide us with an attribution link. A profit and loss (p&l) statement, also known as an income statement or statement of earnings, is a vital financial document that provides insights into a company’s financial performance during a specific period.

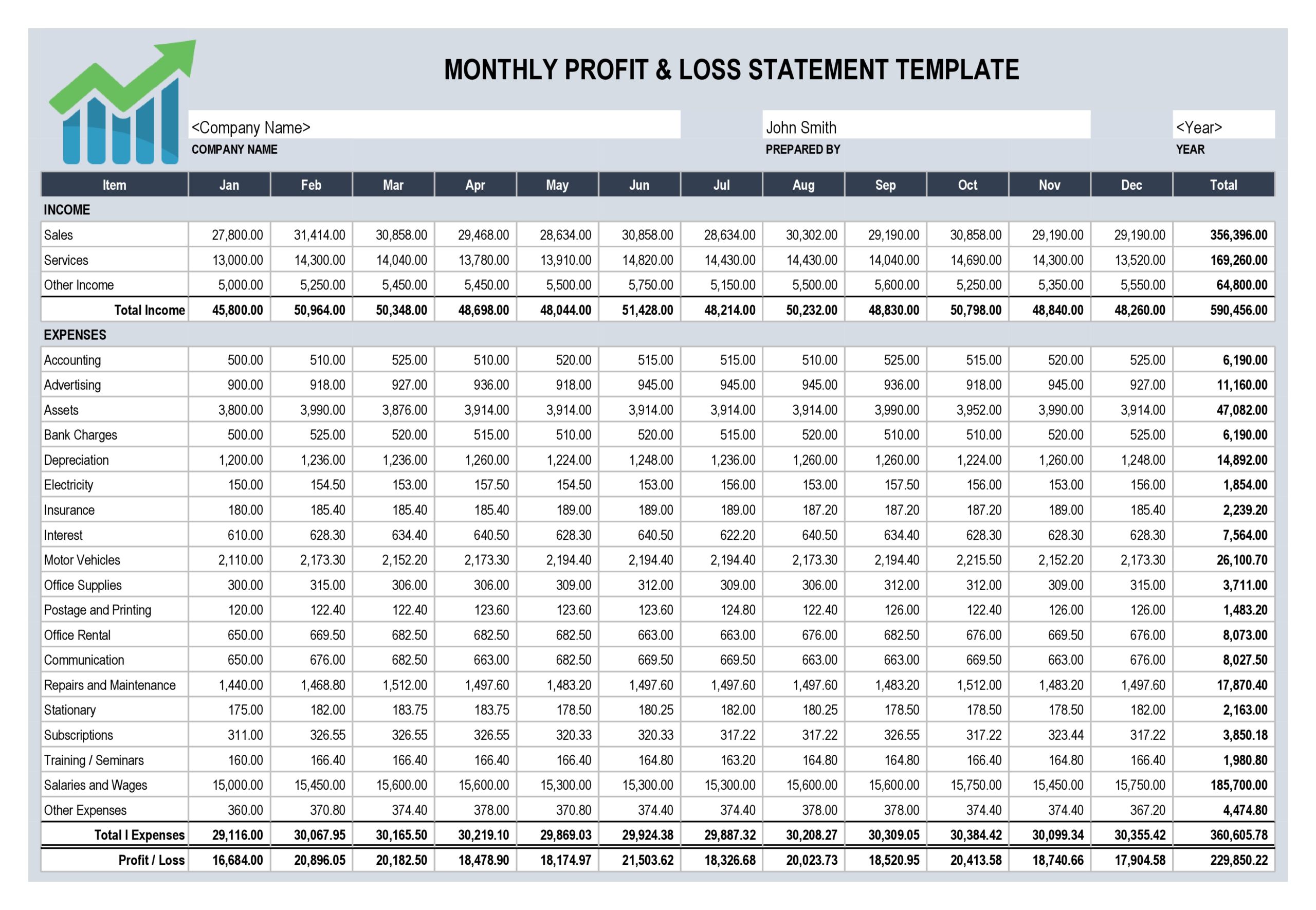

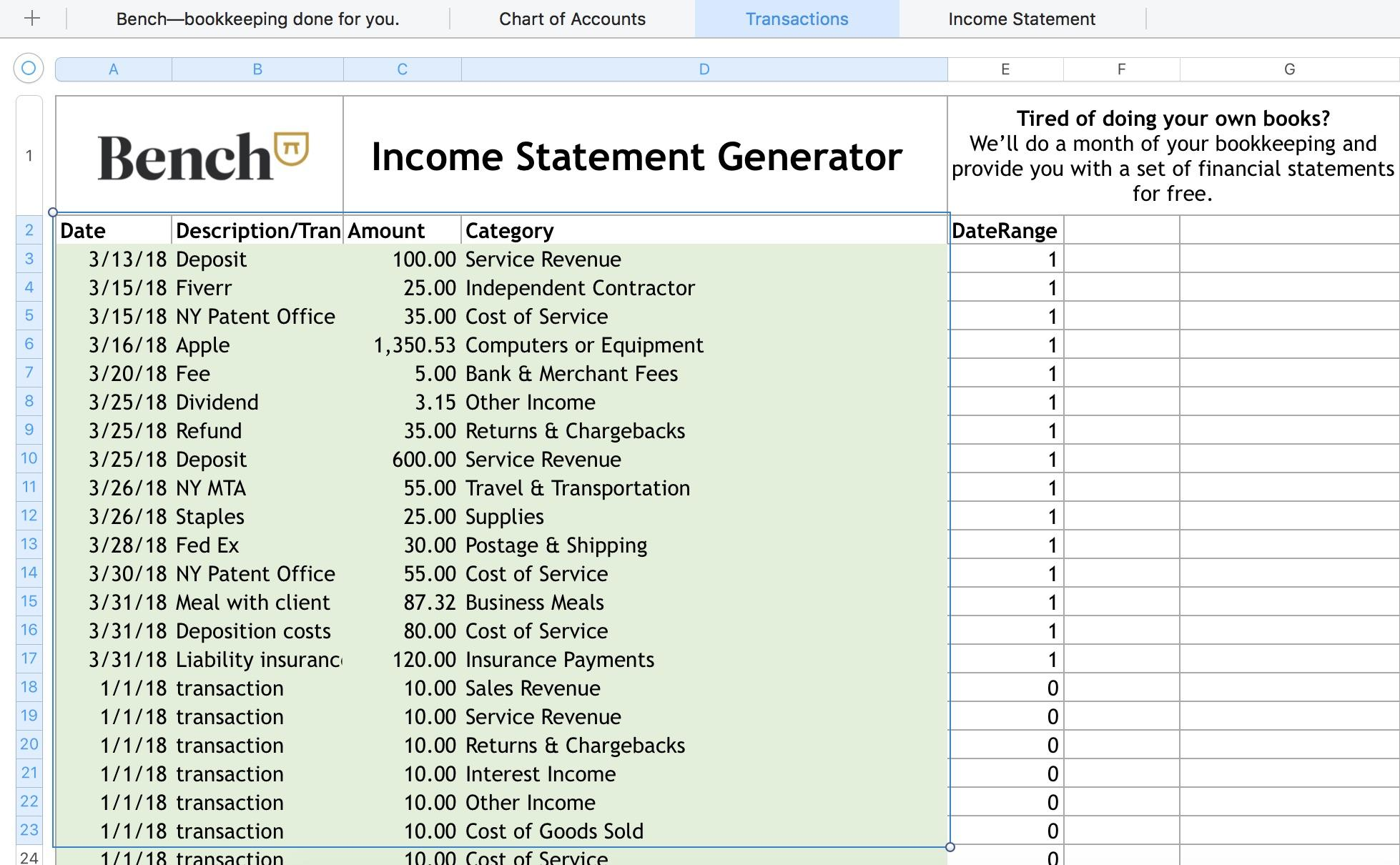

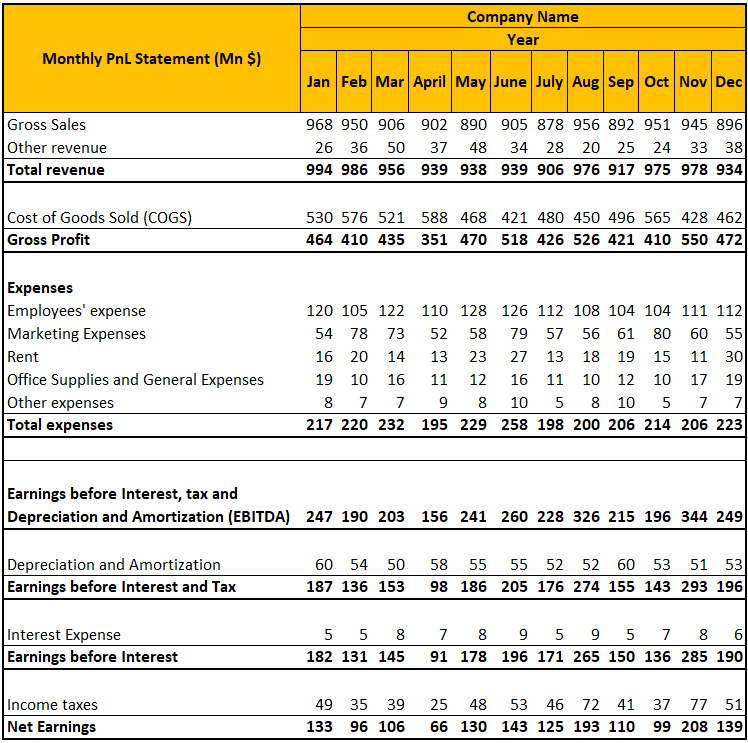

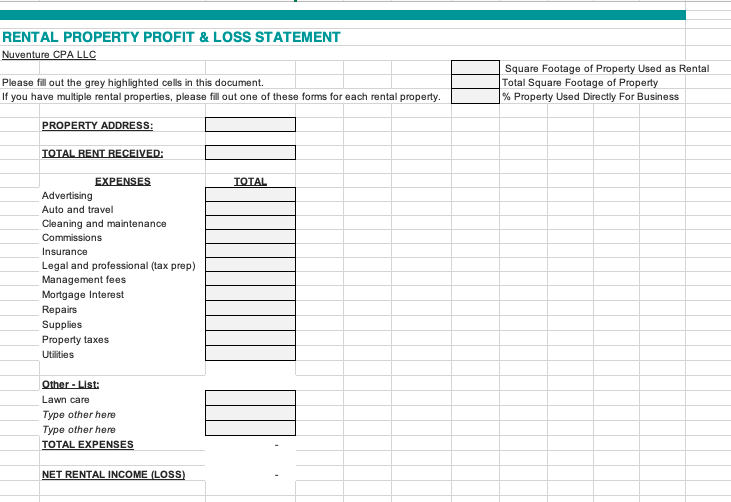

How to read a profit and loss statement The p&l reporting period can be any length of time, but the most common are monthly, quarterly, and annually. The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period.

A profit and loss (p&l) statement is a summary of an organization’s income and expenses over a period of time. This summary provides a net income (or bottom line) for a reporting period. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time.

Your cash flow statement would show your cash. The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services. The holder of those numbers is suing for negligence.

A profit and loss statement, also called an income statement or p&l statement, is a financial document that summarized the revenues, costs, and expenses incurred by a company during a specified period. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. Basic income statements contain the following elements:

A profit and loss statement—also called an income statement or p&l statement—is a financial statement that shows a business’s revenue, expenses, and net income over a specific period of time. The final figure will show the financial performance and show if the business has made a profit or loss. A profit and loss statement contains three basic elements:

A p&l statement is also known as: It’s usually assessed quarterly and at the end of a business’s accounting year. P&l starts with a revenue entry, or top line, and deducts business expenses such as the cost of goods sold, operating expenses, tax charges, and interest expenses.

The outcome is either your final profit or loss. Revenue, expenses, and net income. What is a profit and loss statement?

The result is either your final profit (if things went well) or loss. A traditional cell phone tower. The p&l statement is one of three.

Create the report either annually, quarterly, monthly or even weekly. Your balance sheet would show that you have an equity position of $300. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Rental-Property-Profit-and-Loss-Statement-Template-TemplateLab.com_-scaled.jpg)

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Profit-and-Loss-Statement-Daycare-TemplateLab.com_-790x1085.jpg)