Outstanding Info About Accounting For Vat On The Balance Sheet How To Use A

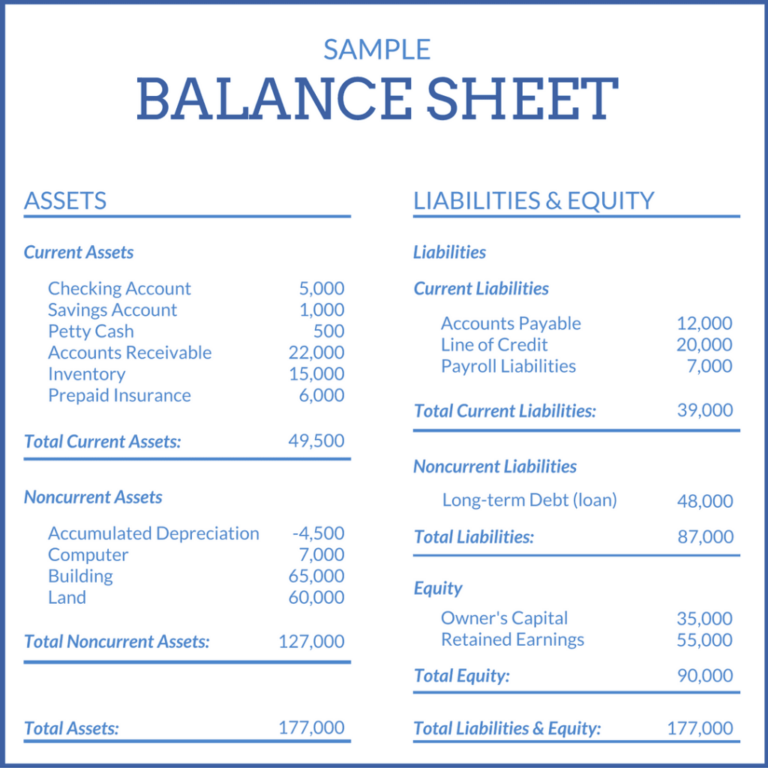

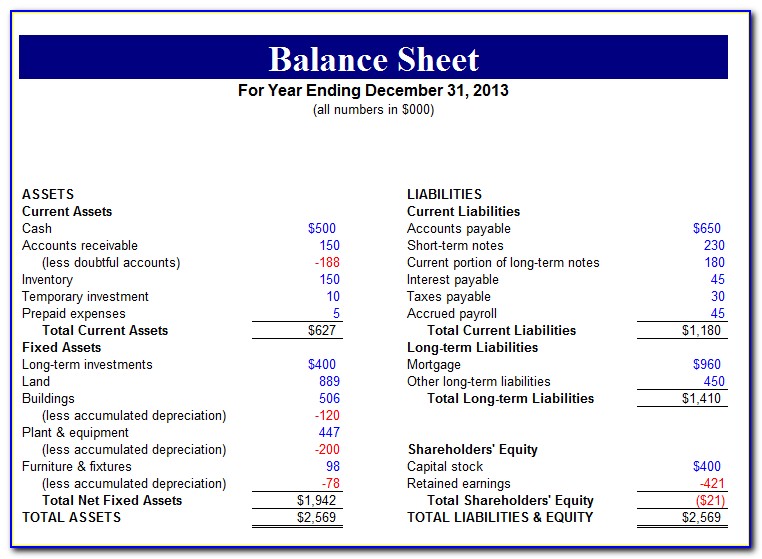

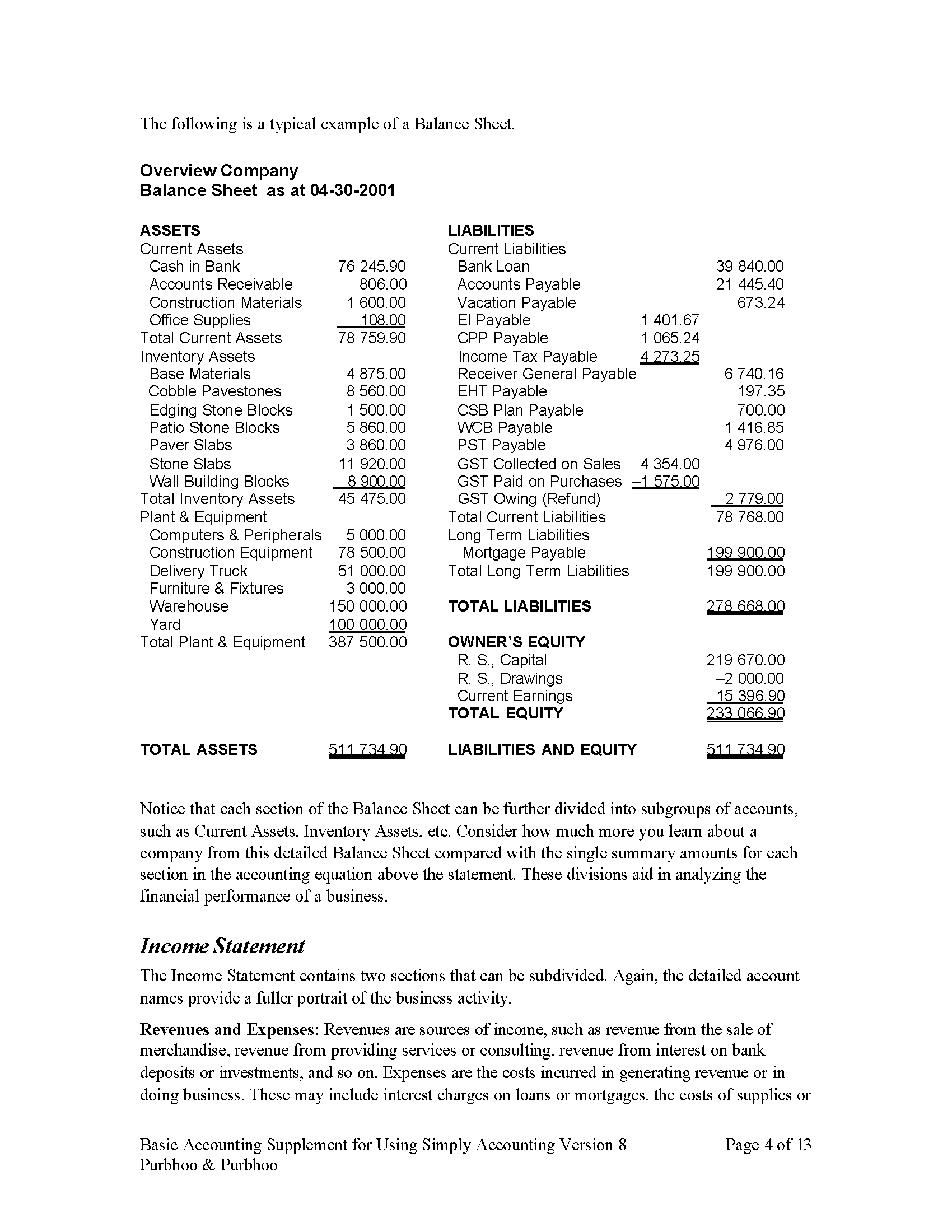

It’s a snapshot of a company’s financial position, as broken down into assets, liabilities,.

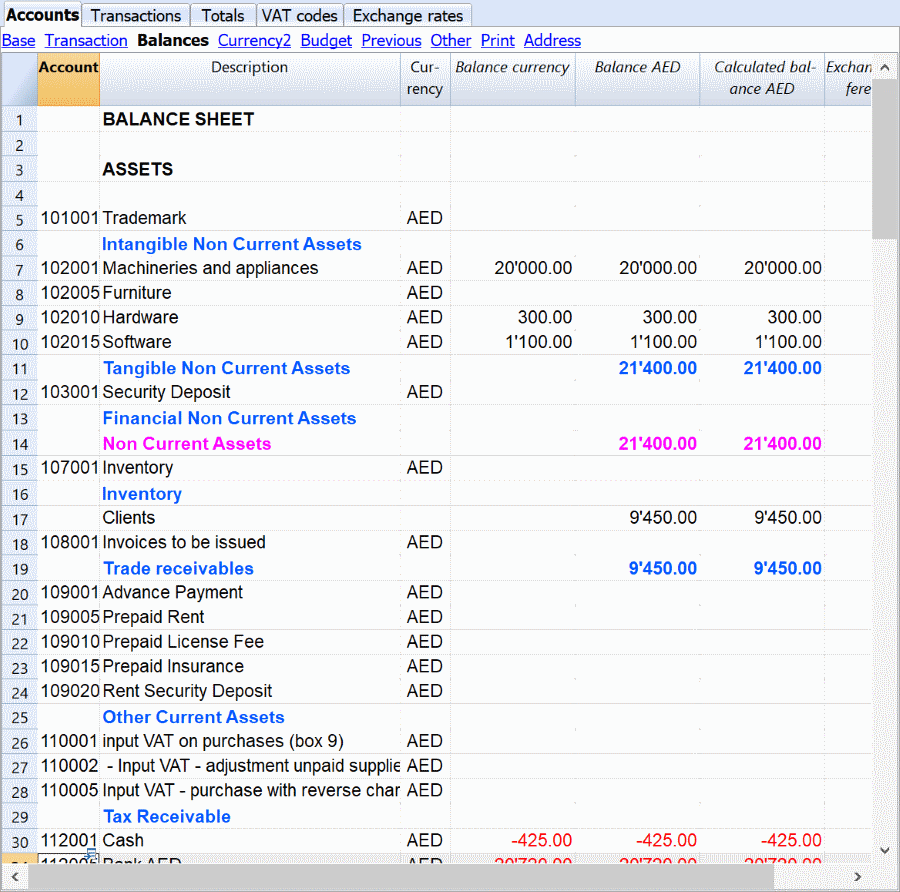

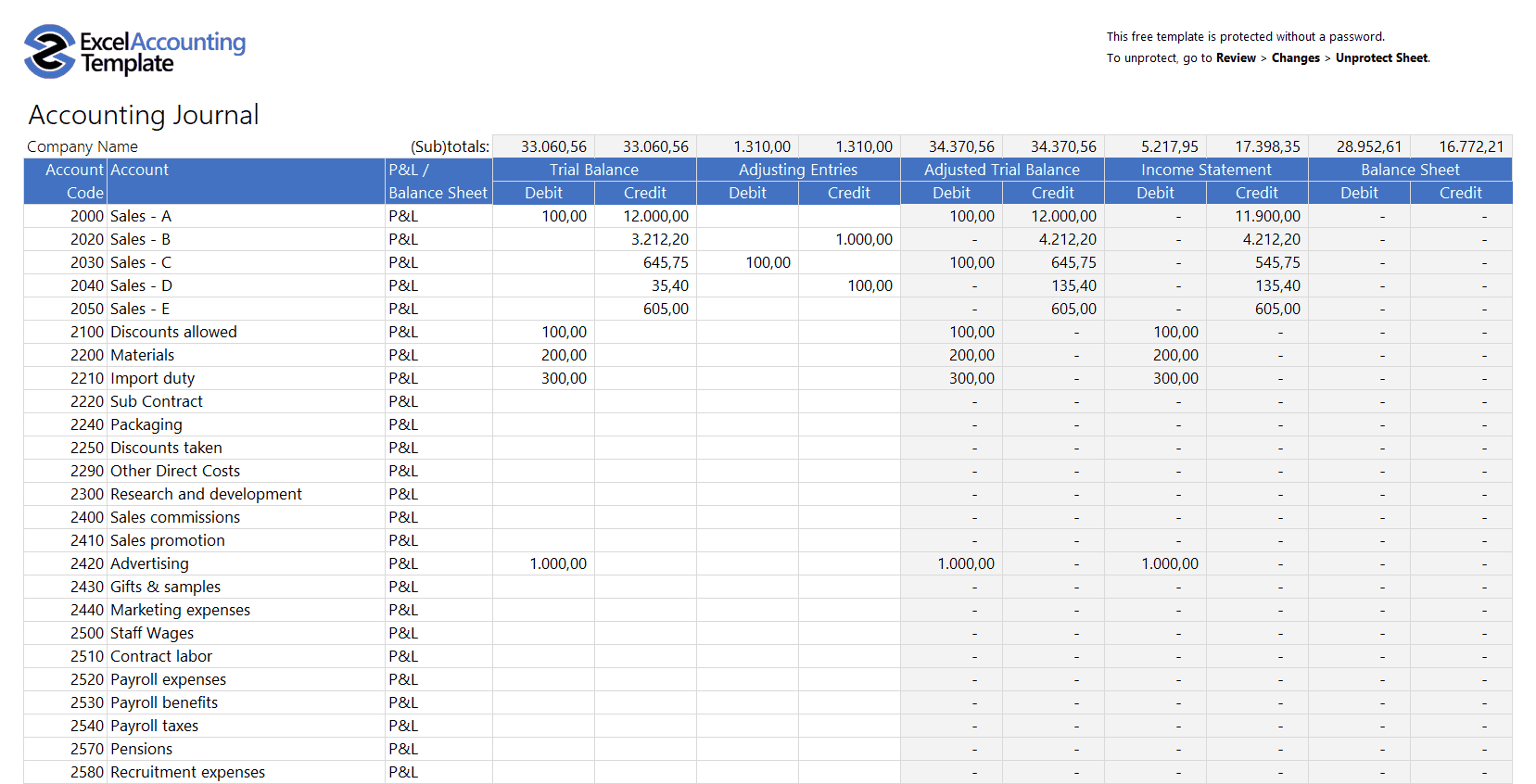

Accounting for vat on the balance sheet how to use a balance sheet. The input vat credits are recorded as an asset on the company's balance sheet, and they are typically offset against the output vat liability when calculating the. Assets = liabilities + equity. When the company makes a payment to the tax authority, it will impact the vat payable and cash balance.

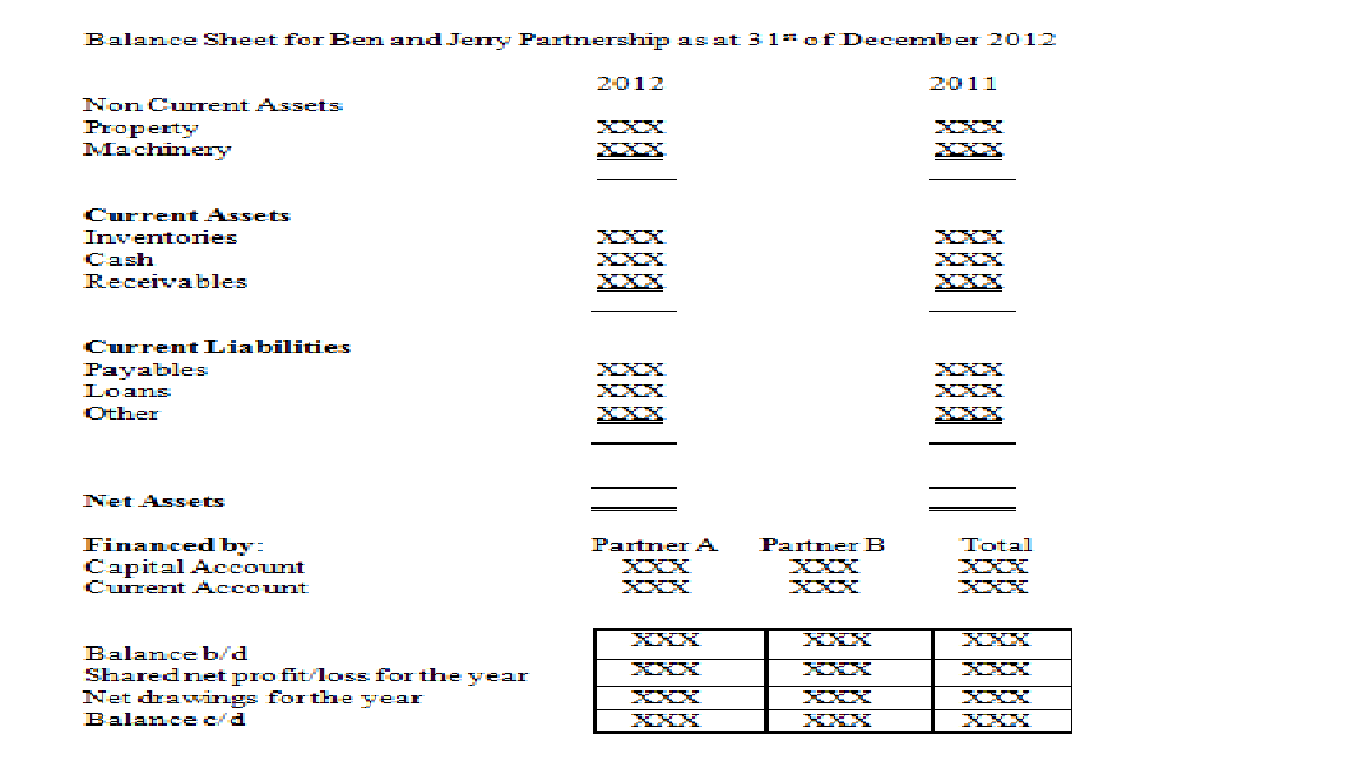

That’s because your business has to pay for all the things it owns (assets) by. The balancing cash payments to and from hmrc, are carried to a vat account. Including rates, returns, paying, accounting schemes, charging and reclaiming, imports and exports and overseas.

At the moment the vat input apears in creditors as a plus figure. Stock record showing separately the particulars of goods stored in cold storage, warehouse, godown or any other place taken on rent;) annual accounts including trading profit & loss. Guidance, notices and forms for vat.

Vat account to be clearly stated regarding total output tax, total input tax and net tax payable or excess tax credit which to be refunded or. Vat would be recorded on the balance sheet under vat control accounts to track how much vat has been collected and paid, and while this could have a balance sheet. A balance sheet provides a summary of a business at a given point in time.

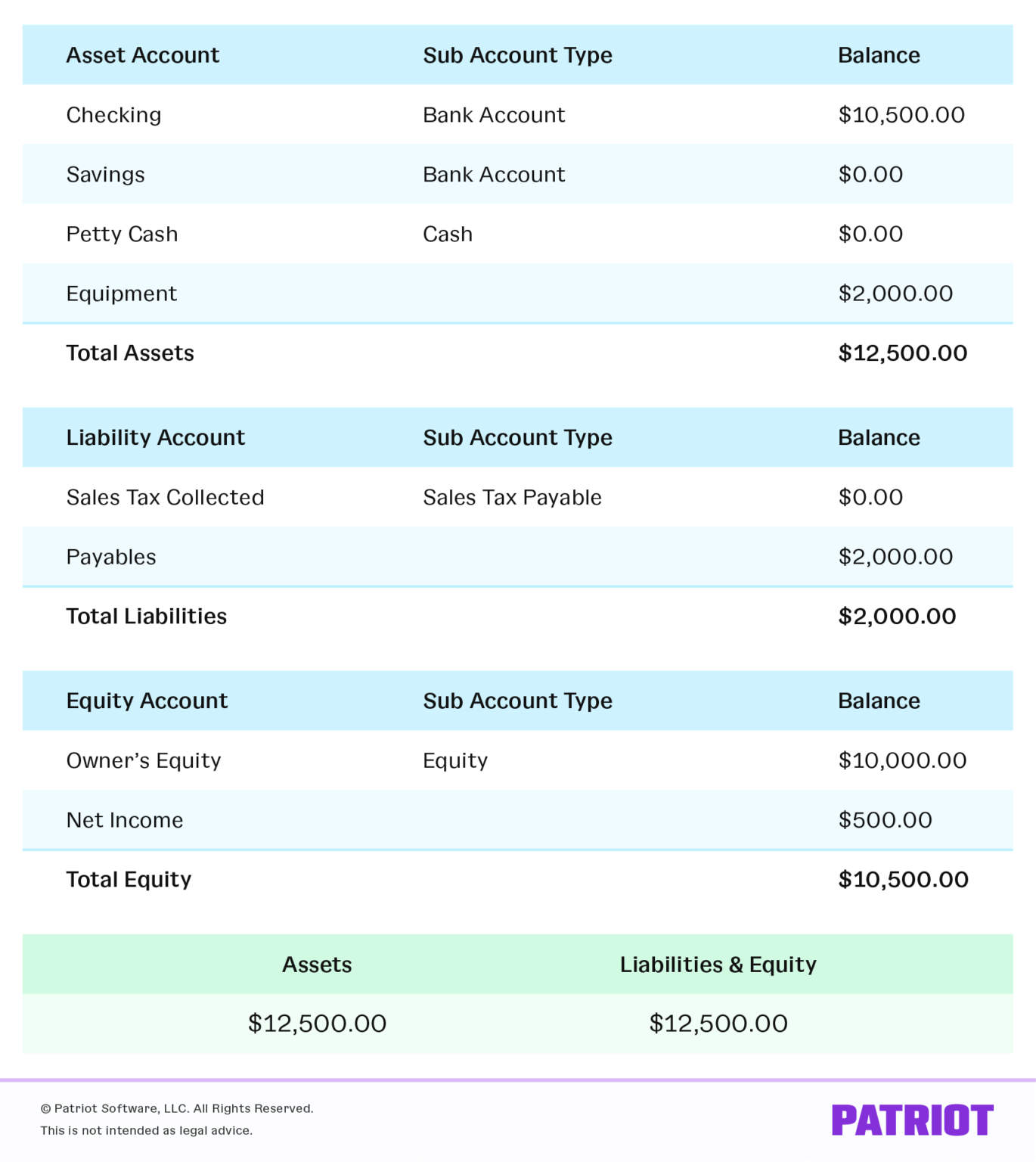

Use the basic accounting equation to make a balance sheets. The balance sheet is just a more detailed version of the fundamental accounting equation—also known as the balance sheet formula—which includes. It can also be referred to as a statement of net worth.

The vat control account records all the vat on both sales (outputs) and purchases (inputs) so that the balance on the account shows the amount that should be paid to (or claimed. The statement must always balance, hence the name. This is assets = liabilities + owner's equity.

A good check as to whether your accounts balance is right. Have you checked the paye and vat liabilities against gov.uk? Tax & filing tax reports resolve vat report discrepancies resolve vat report discrepancies this article is for small businesses who use xero overview if there are.

Should this amount be in debtors. Vat stands for value added tax and for those entities that are registered into the scheme they add a percentage (now at 20%) to each sale, in exchange for the capacity to claim. Thus, a balance sheet has three sections:

Vat payable is the liability on the balance sheet.

![Making Sense of Your Balance Sheet [Infographic] Learn accounting](https://i.pinimg.com/originals/f7/0d/ec/f70dec3a63cbcc1511efabd76241ea3c.jpg)