Unbelievable Info About Accrued Revenues Would Appear On The Balance Sheet As

Accrued revenue has a significant impact on a business’s financial statements.

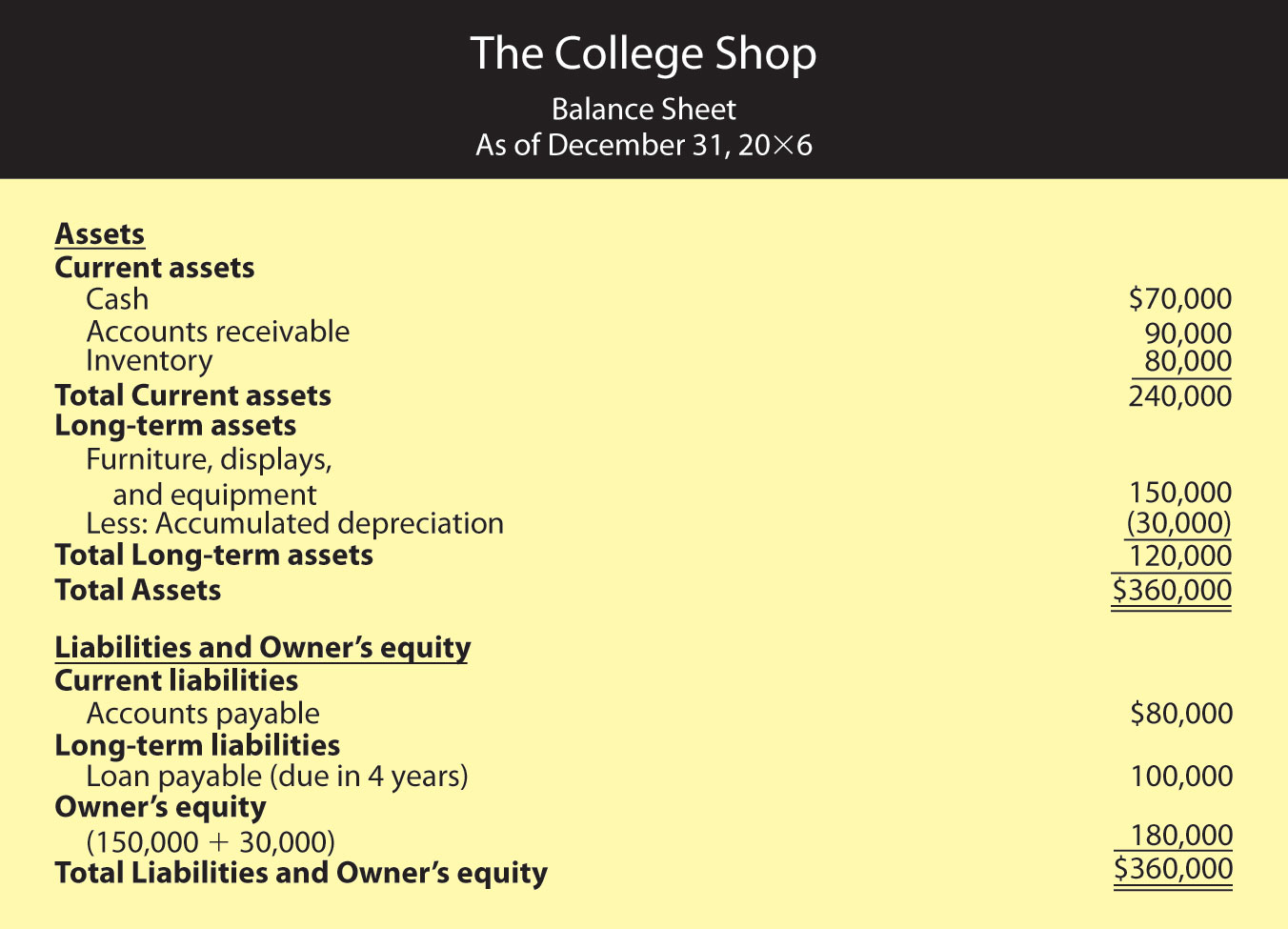

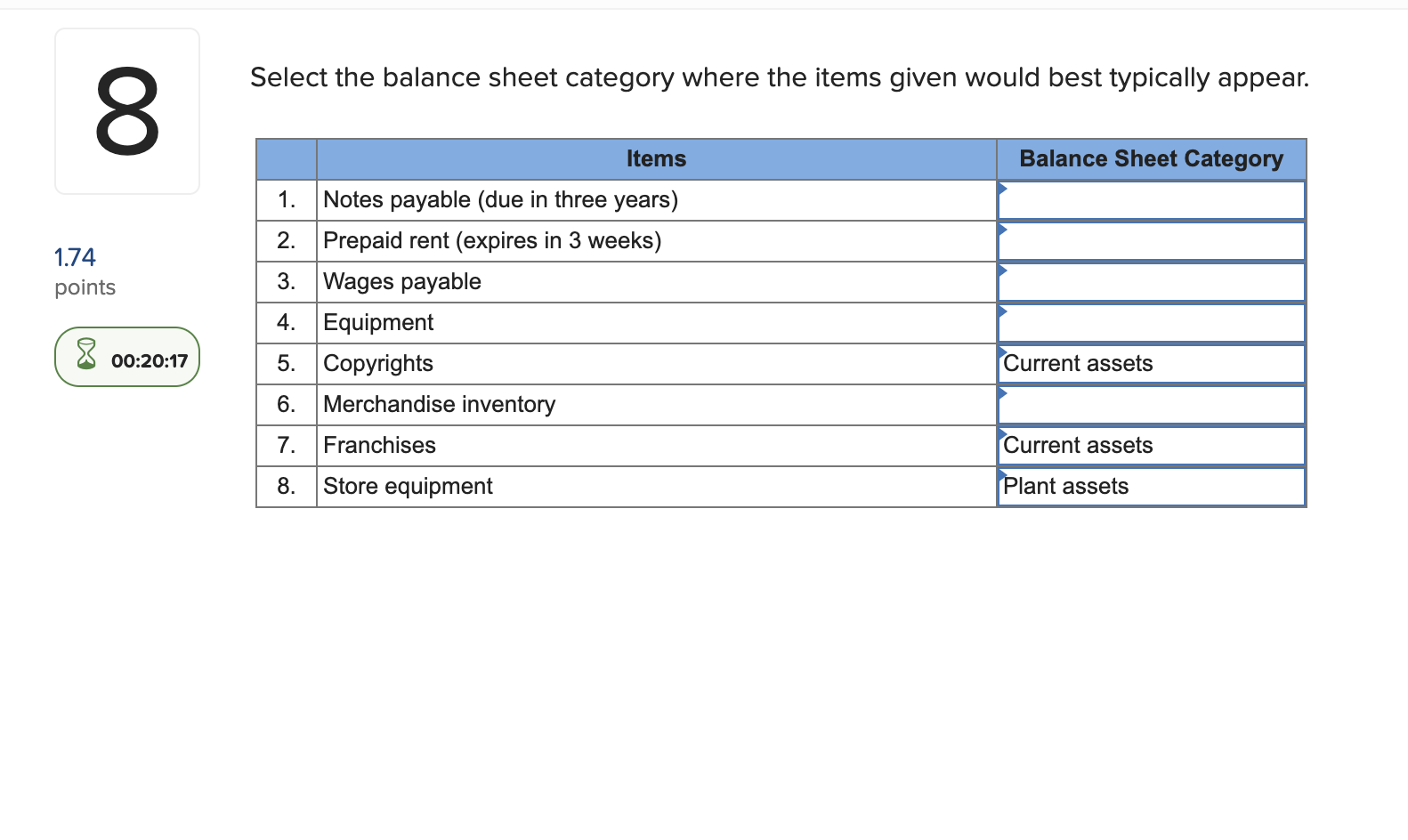

Accrued revenues would appear on the balance sheet as. Since it comes with the customer’s future obligation to pay, an accrued revenue account on the balance sheet will appear when the related revenue is first booked on the income statement. The entry for accrued revenue is typically a credit to the sales account and a debit to an accrued revenue account. These revenues are shown as receivables on the balance sheet to reflect the amount customers owe the company for the items or services they purchased.

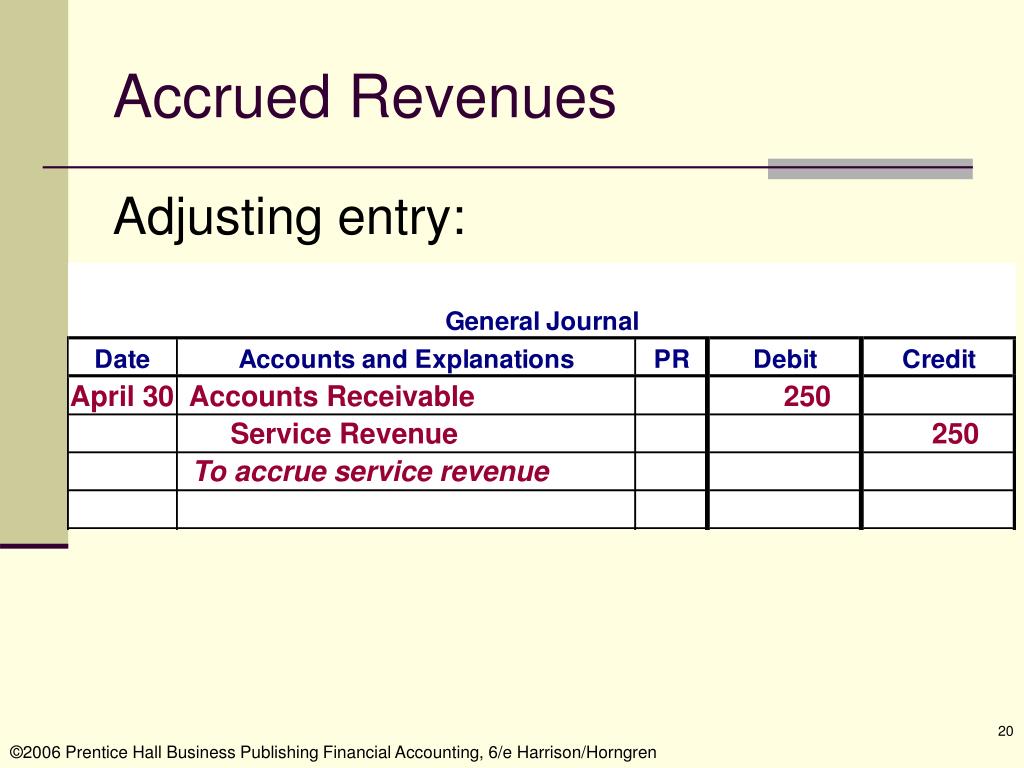

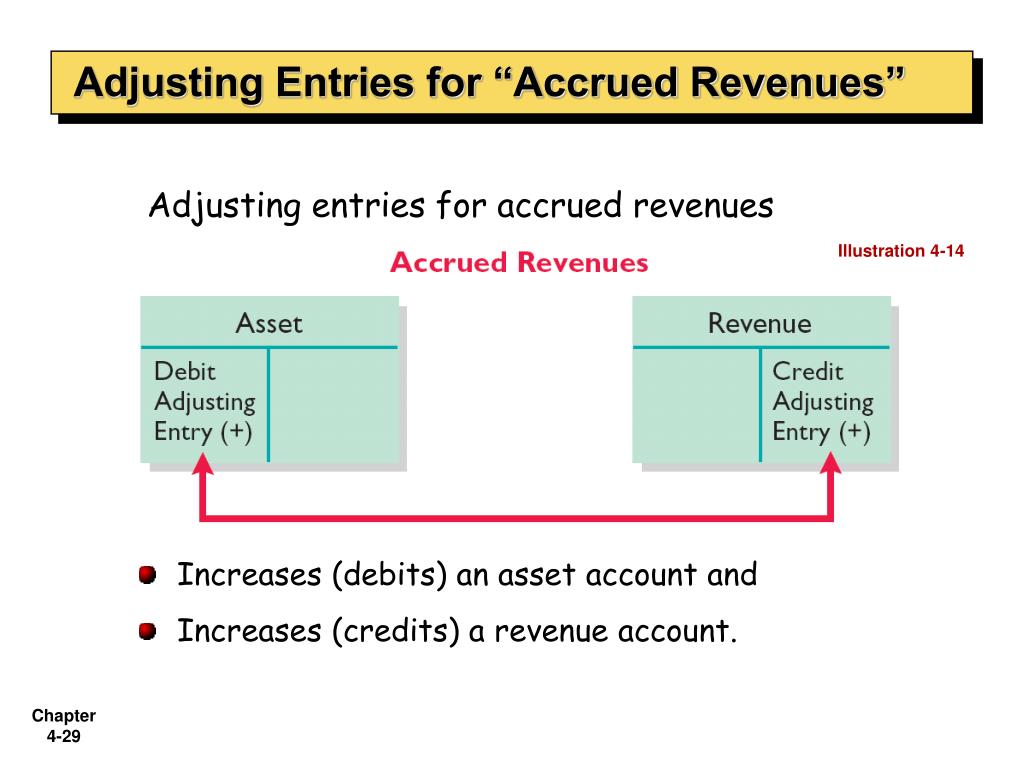

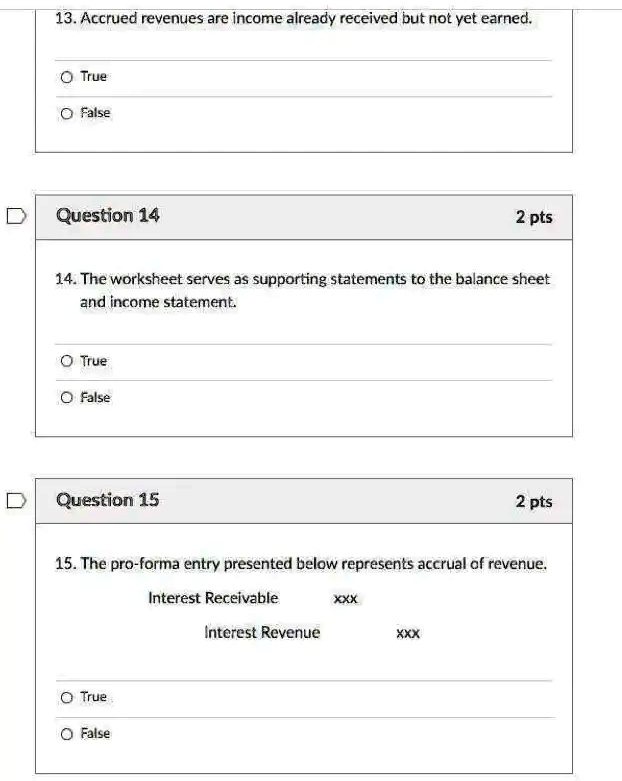

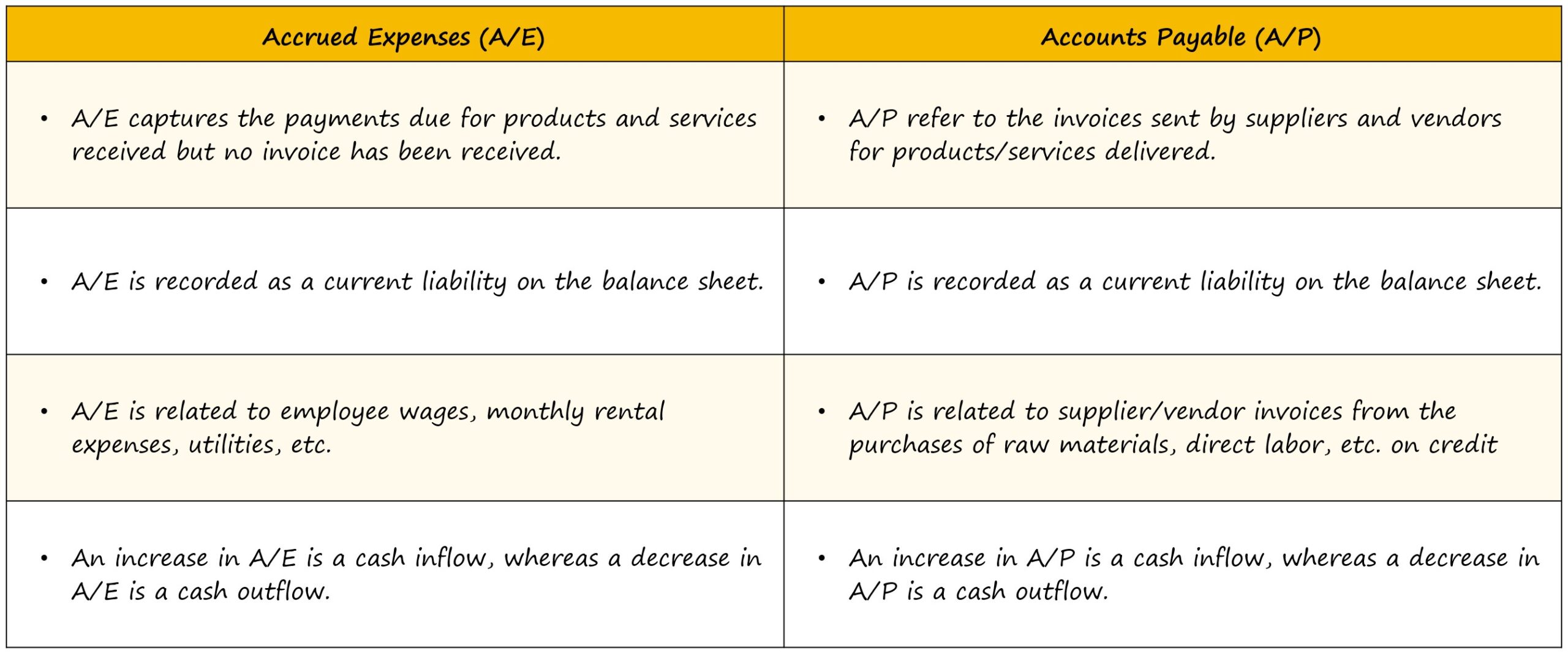

What is the difference between accounts payable and accrued expenses payable? The accrual of revenues will usually involve an accrual adjusting entry that increases a company's revenues and increases its current assets. Accrued revenues would appear on the balance sheet as a.

Accrued revenues are recorded as receivables on the balance sheet to reflect the amount of money that customers owe the business for the goods or services they purchased. While they are recorded as a liability on the balance sheet, accrued expenses also appear on the income statement, since they have already been incurred. Both accrued revenue and accounts receivable are considered assets on the balance sheet, but accounts receivable is listed separately from accrued revenue.

Accrued revenues would appear on the balance sheet as a. What you need to know about adjusting journal entries with cash basis accounting, you'll debit accrued income on the balance sheet under the current assets as an adjusting journal entry. Accruals can appear on the balance sheet in a few different places, depending on whether they are related to assets or liabilities.

For example, for amazon inc. The accounting equation remains in balance. Most retail transactions are fast enough to avoid this mismatch.

For instance, let’s assume a company pays $100,000 in salaries for the whole year. As specified by generally accepted accounting principles (gaap. What are accrued liabilities?

The first one is to close _____; Revenue that has been earned through the provision of goods or services for which no money has been exchanged is known as accrued revenue. Accrued revenue is recognized when the revenue has been earned, but accounts receivable revenue is recognized when an invoice has been sent.

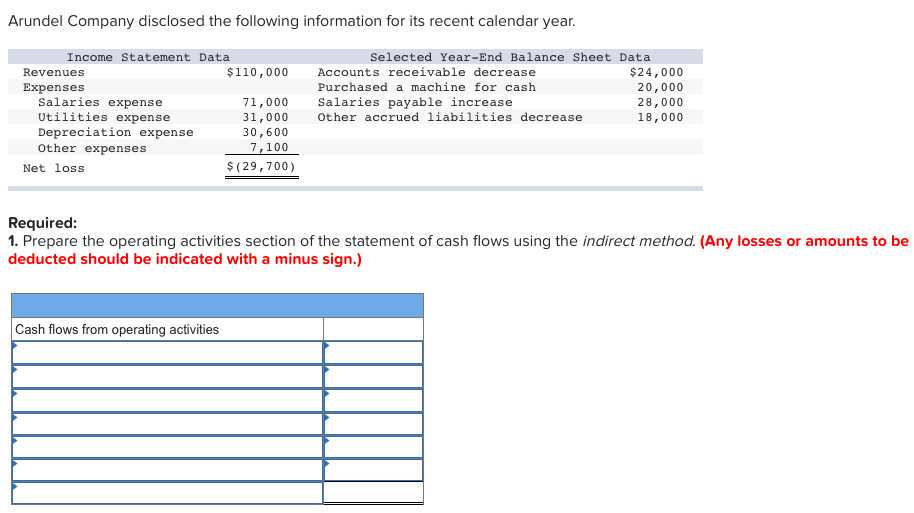

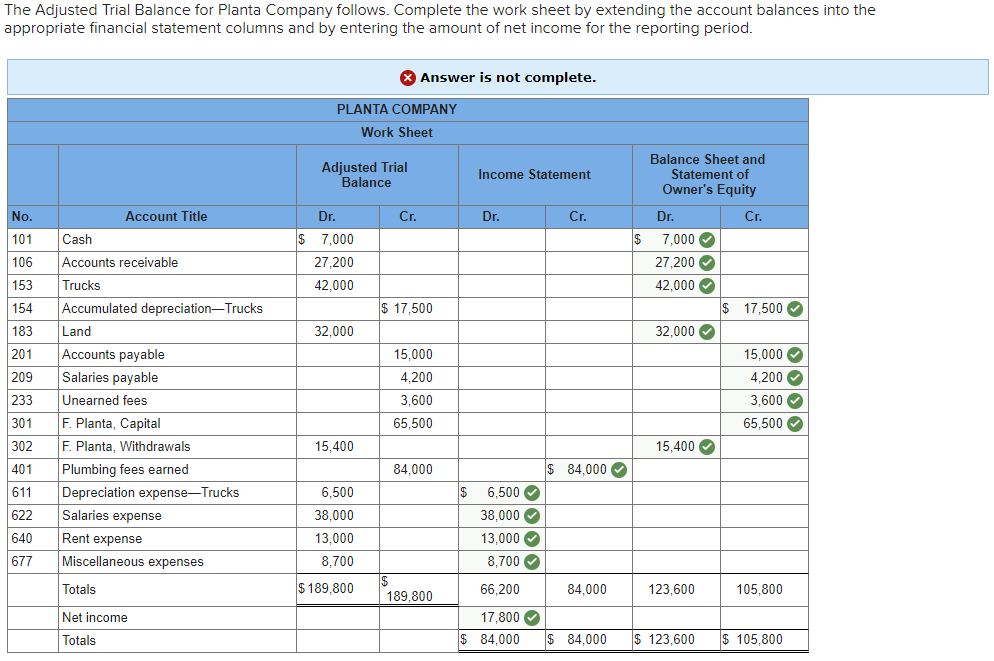

The sum of all debits is always equal to the sum of all credits in each journal entry. On the income statement, you'll record it as earned revenue. When accrued revenue is recorded, accrued revenue is recognized on the income statement as revenue, and an associated accrued revenue account on the company's balance sheet is debited by.

They record the accrued revenue that they are yet to receive with the “accounts receivable, net and other” as customer. The second one is to close _____. For example, if a company has earned revenue but has not yet received payment, that revenue will be recorded as an accrued asset on the balance sheet.

Impact on financial statements. Will the adjusting entry amounts appear in the balance sheet and income statement? Accrued revenue is a part of accrual accounting.

:max_bytes(150000):strip_icc()/ScreenShot2022-03-05at10.15.17AM-b1c05918ed68413fbbaa818d057eda34.png)