Smart Tips About View 26as Tds

The website provides access to the.

View 26as tds. How to view form 26as? You are accessing traces from outside india and therefore, you will require a user id with password. How to rectify errors in form 26as?

Users having pan number registered with their home branch can avail the facility of online. Form 26as can be viewed through: A taxpayer can view the tax credit or the tax that has been deducted on his behalf in the form of tds.this information is available in form 26as and can be.

Retail.onlinesbi.sbi/personal can view tax credit in form 26as through bank login : It is also known as tax credit statement or annual tax statement. Form 26as, or the annual statement or tax credit statement, is a consolidated statement issued by the income tax department of india.

Form 26as can be downloaded: Alternatively, the form can be viewed. You may view form 26as by pan no.

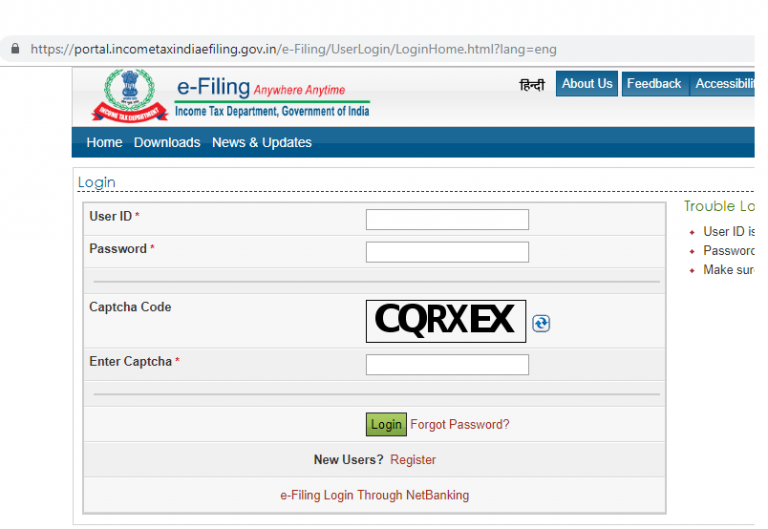

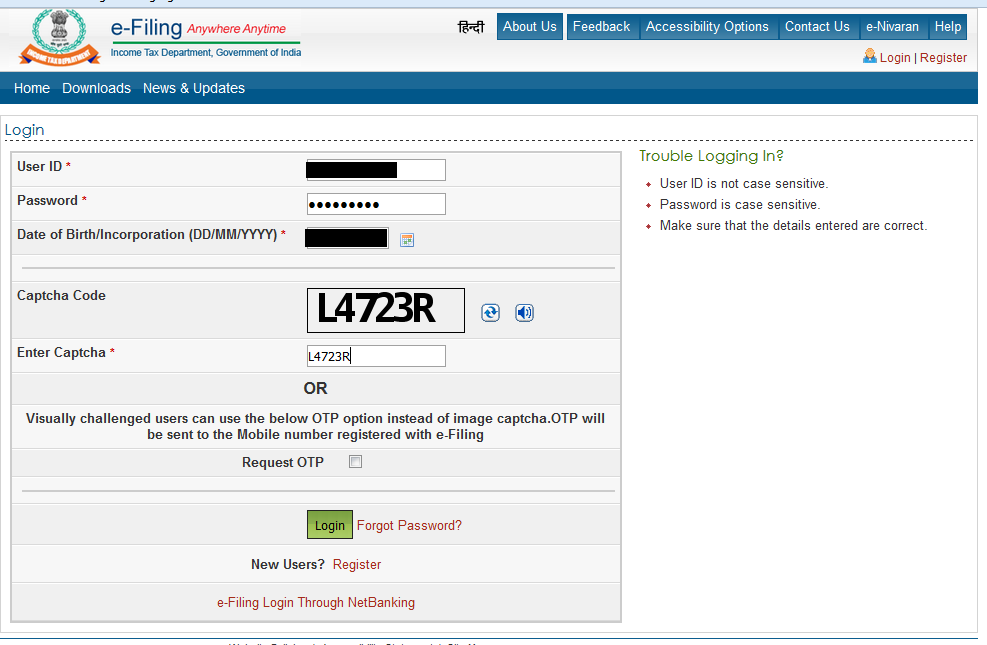

To view form 26as or. However, not all banks provide the facility. A) log on to form 26as with the user id and password.

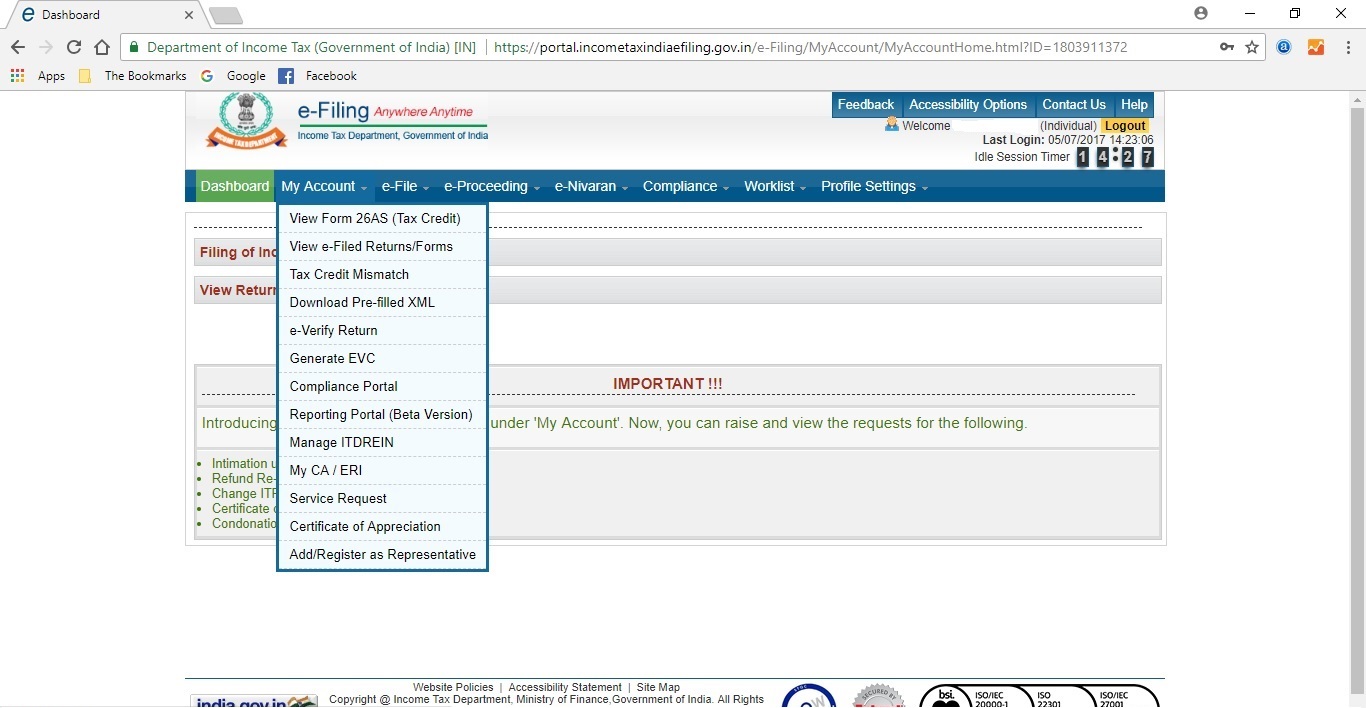

As a taxpayer you can view form 26as in two modes: When filing an income tax return (itr) on. B) click on ‘view form 26as’.

Individuals have the option to view form 26as from the traces portal and can also download it as shown in the previous section. How to view form 26as? On the tds reconciliation analysis and correction enabling system (traces) portal.

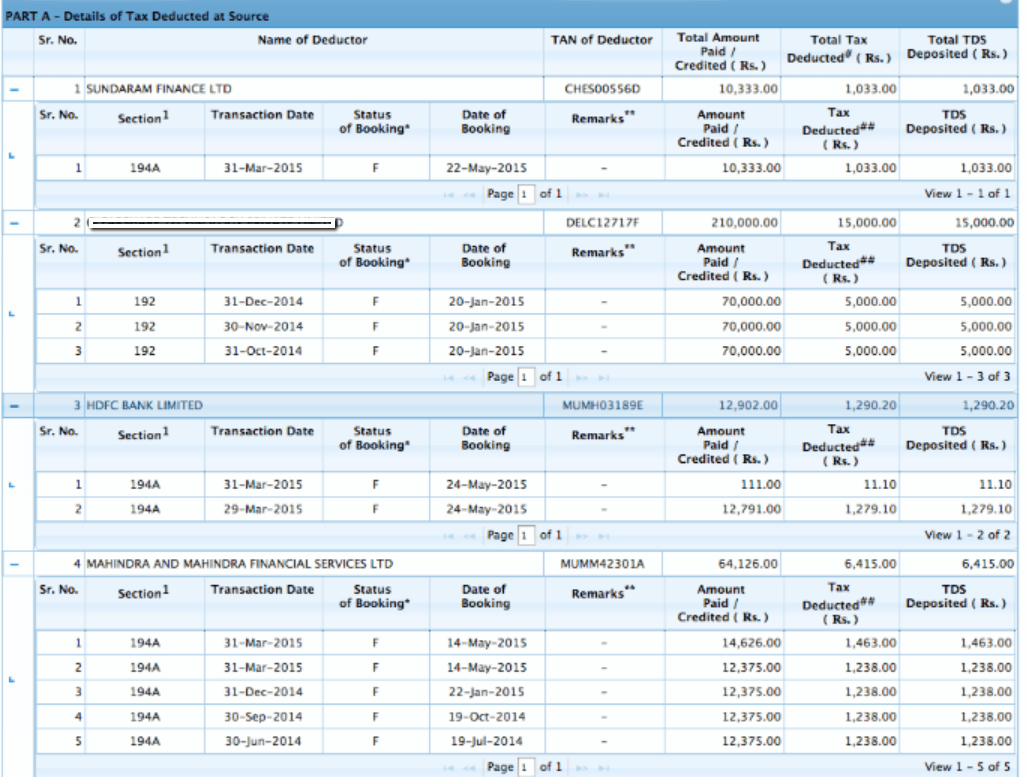

Form 26as with respect to tds: C) go to the option ‘tds certificate’ provided at the top of menu bar. Introduction form 26as is a consolidated tax statement issued to the pan holders.

Select 'view tax credit', choose 'assessment year', 'view type' as 'excel', and click 'view/download'. Only a registered pan holder can view their form 26as on traces. Form 26as serves as a comprehensive tax credit statement, capturing vital details of tax deducted at source (tds) or tax collected at source (tcs) from diverse.

How to view form 26as?