Brilliant Tips About Cash Flow From Operating Activities Calculation

Operating cash flow = operating income +.

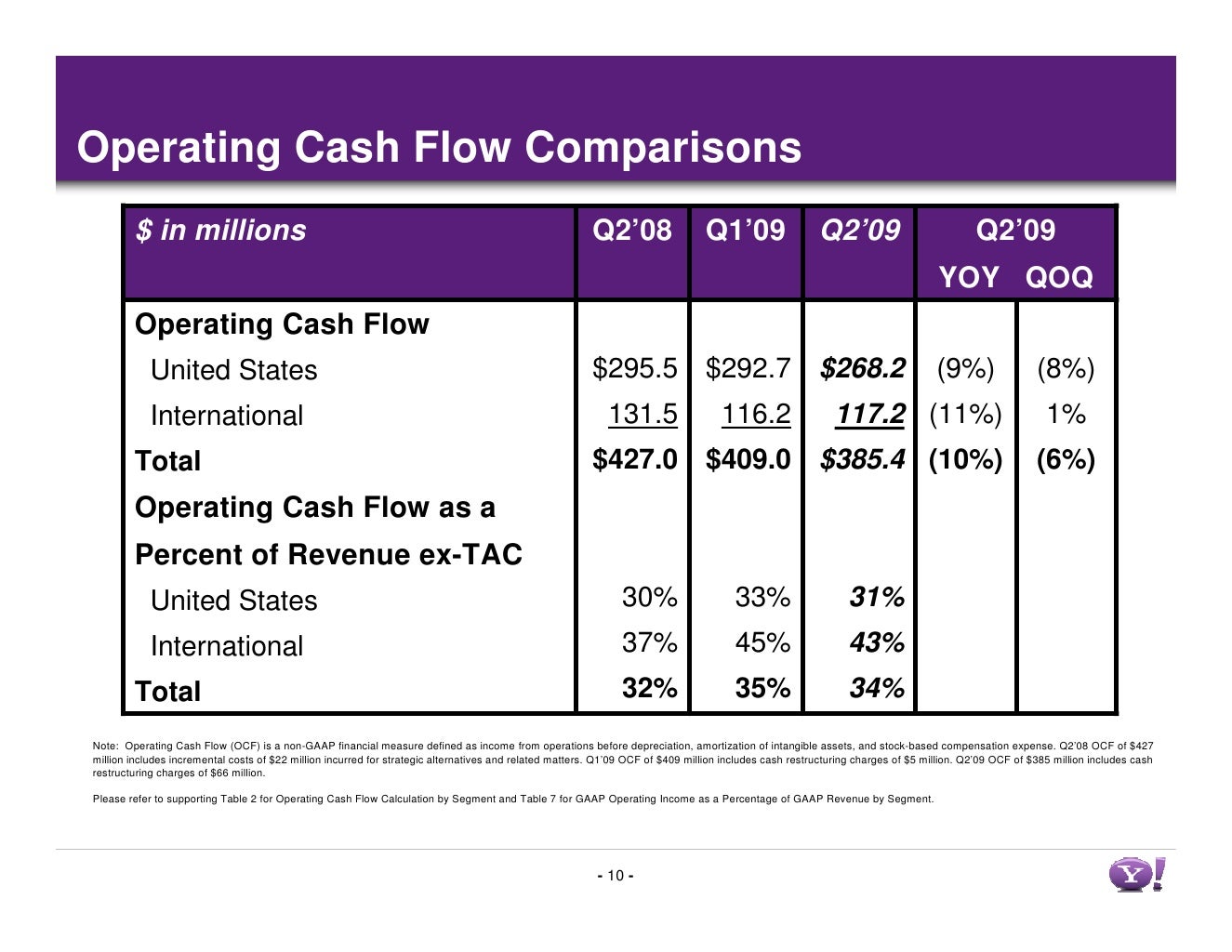

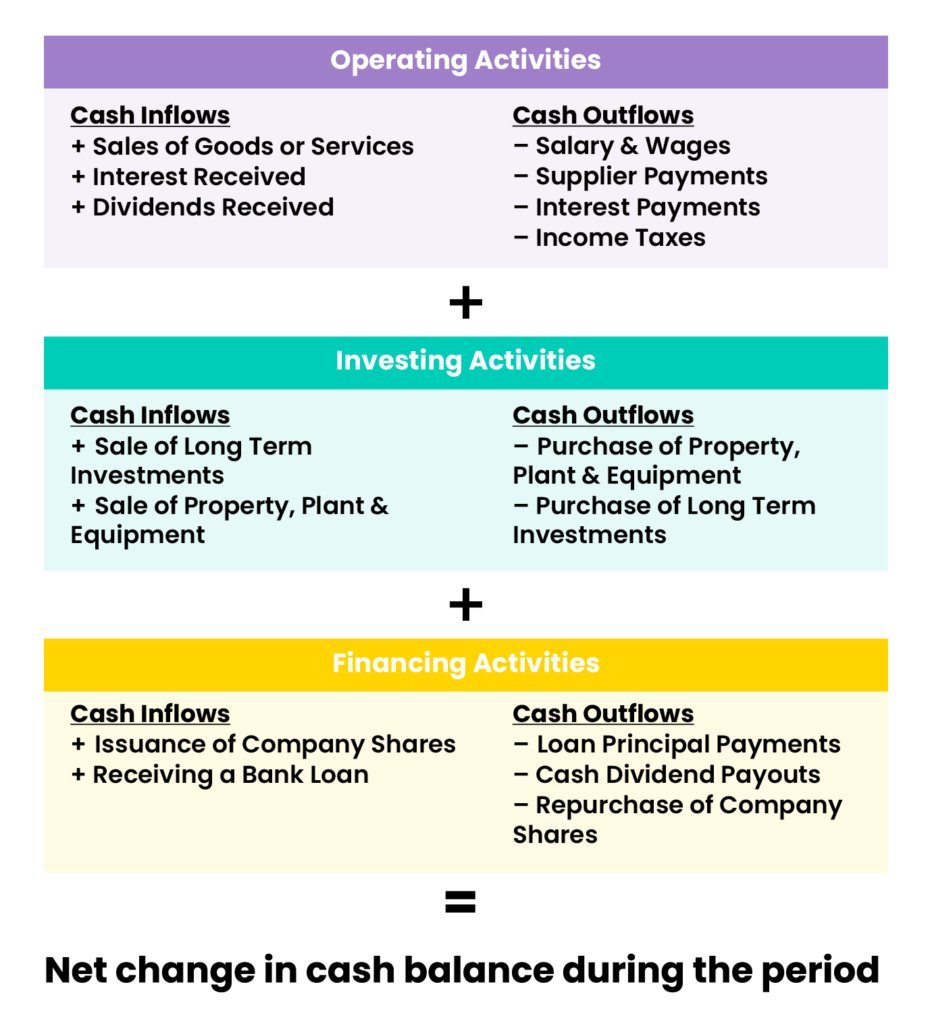

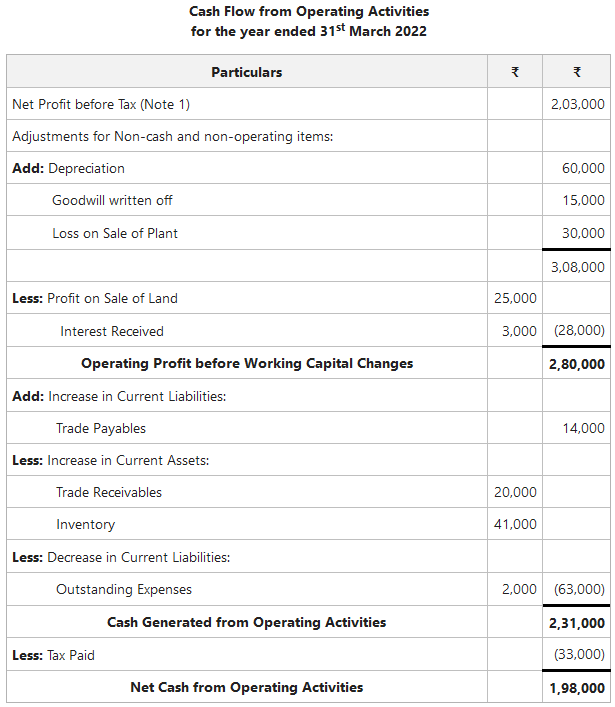

Cash flow from operating activities calculation. Operating cash flow (ocf) refers to the amount of cash a company generates from its operations. The calculated operating cash flow. Cash flow from operating activities is the first of the three parts of a company's cash flow statement.

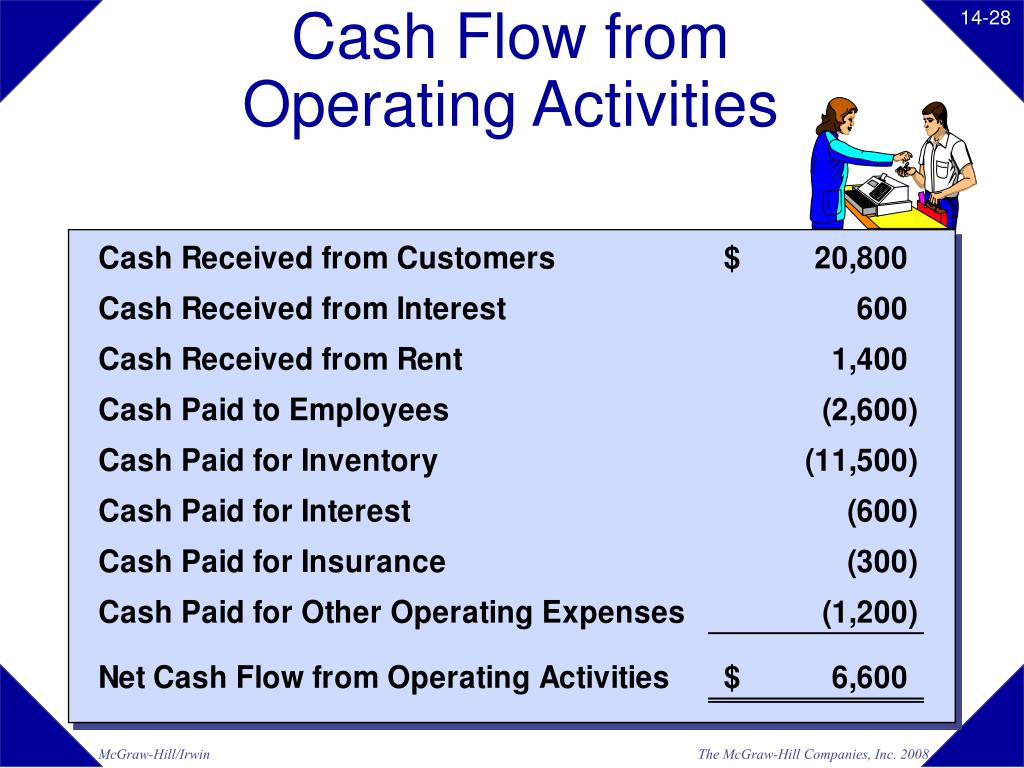

The operating cash flow ratio is calculated by dividing operating cash flow by current liabilities. Essentially, you want to adjust for things like depreciation, increases in accounts receivable, and other non. The direct method of calculating operating cash flow is:

Operating cash flow (ocf), often called cash flow from operations, is an efficiency calculation that measures the cash that a business produces from its. Cash flow from operating activities is the incoming and outgoing money related to daily operation. While the exact formula will be different for every company (depending on the items they have on their income statement and balance sheet), there is a generic cash flow from operations formula that can be used:

Click the ‘calculate’ button, and the calculator will execute the ocf calculation based on the provided data. It represents the amount of cash a company spends or. Common cash flow calculations include the tax paid, which is an operating activity cash out flow, the payment to buy property plant and equipment (ppe) which is an investing.

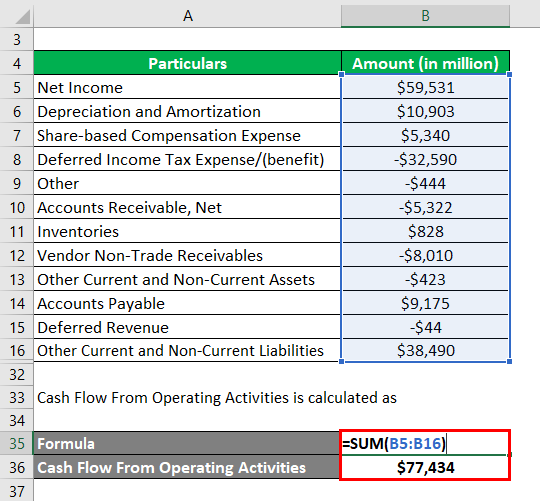

Cash flow from operating activities (cfo) → the starting line item is net income. Cash flow from operations = net income + depreciation + amortisation + adjustments to net income + changes in accounts receivable + changes in accounts. Total revenue is the full amount of.

Its examples include sales revenue, production. The sum of the three cash flow. Calculation of net cfo:

Updated september 13, 2020 what is cash flow from operating activities?

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)

:max_bytes(150000):strip_icc()/terms_c_cash-flow-from-operating-activities_FINAL-e4025a9df8de40059fc1b585394c4b8b.jpg)

/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)