Lessons I Learned From Info About An Income Statement Would Not Include

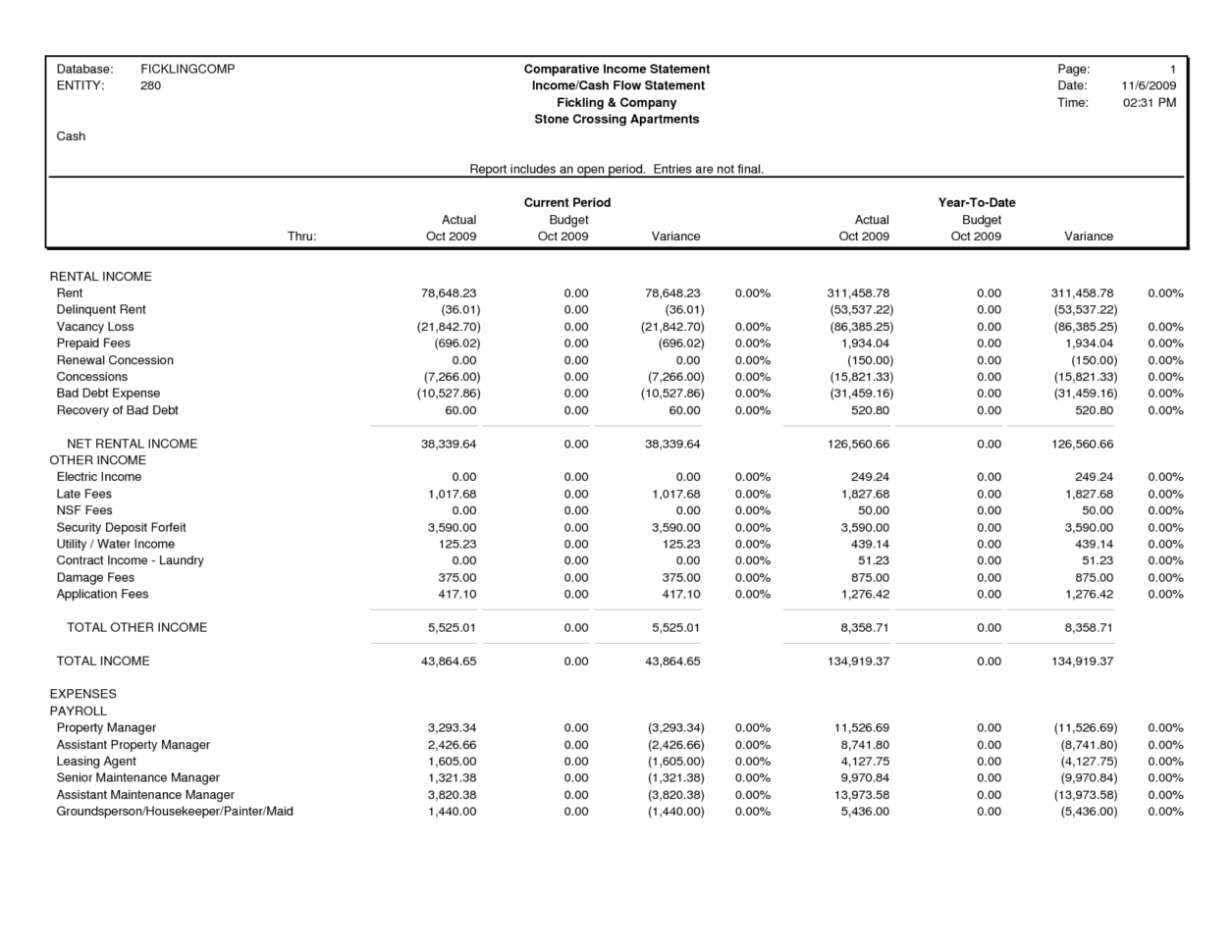

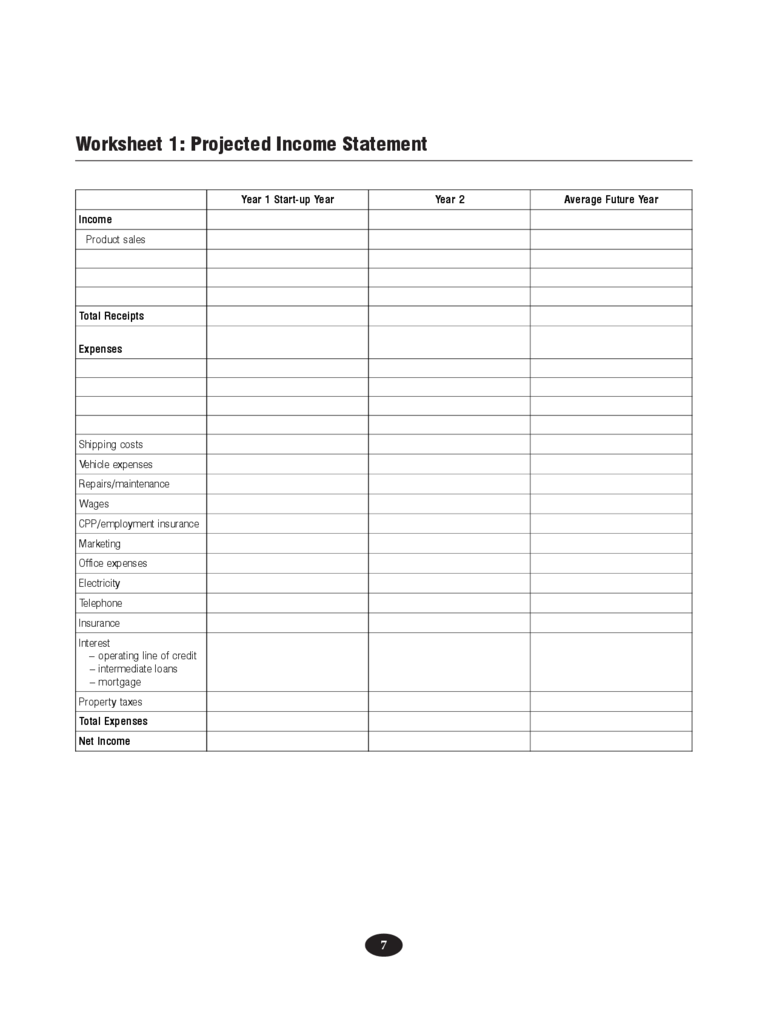

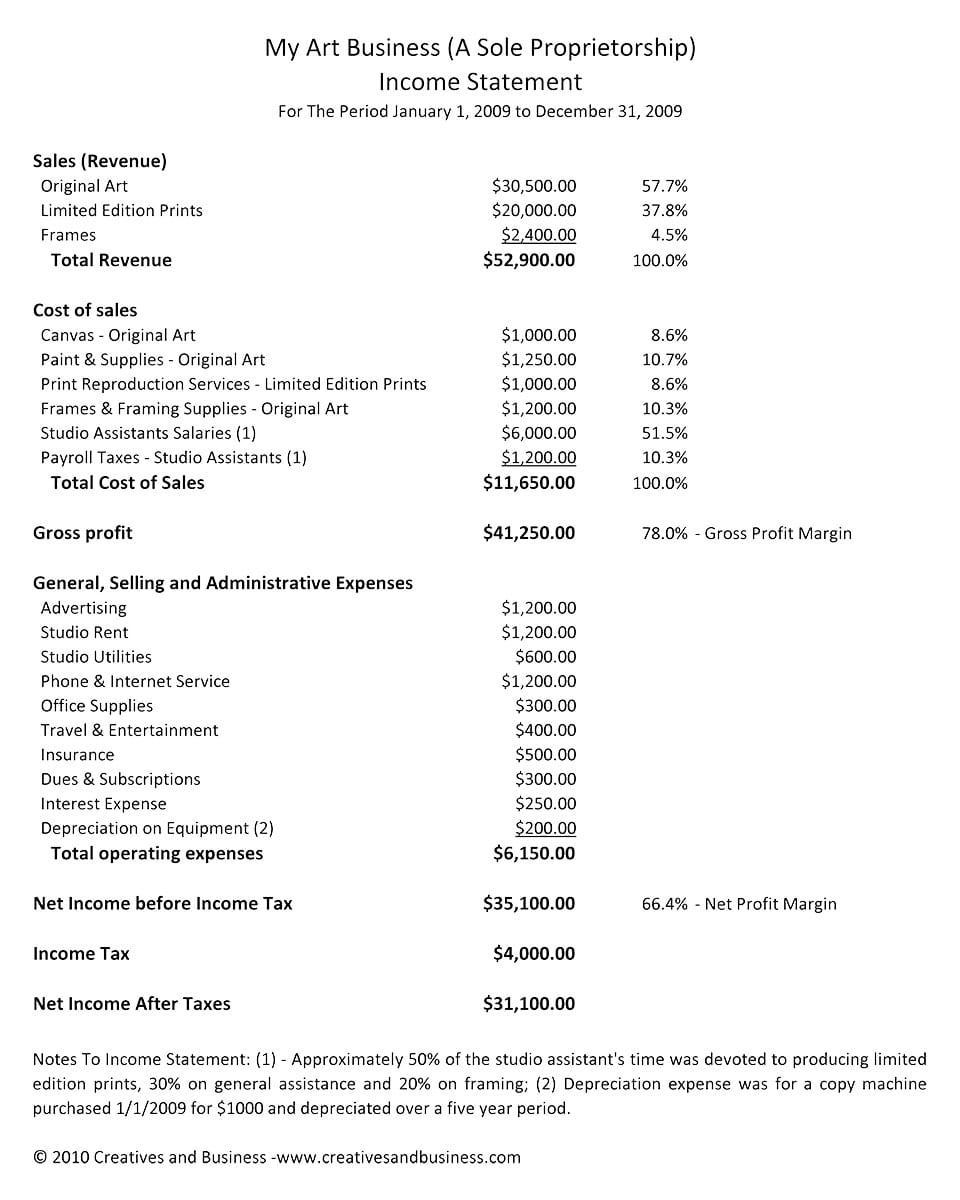

Revenue in year one totaled $300,000 and in year.

An income statement would not include. In this guide we’ll use annual reports as examples, but you can prepare income statements quarterly or monthly as well. Changes to the stage 3 tax. The income statement is also sometimes referred to as.

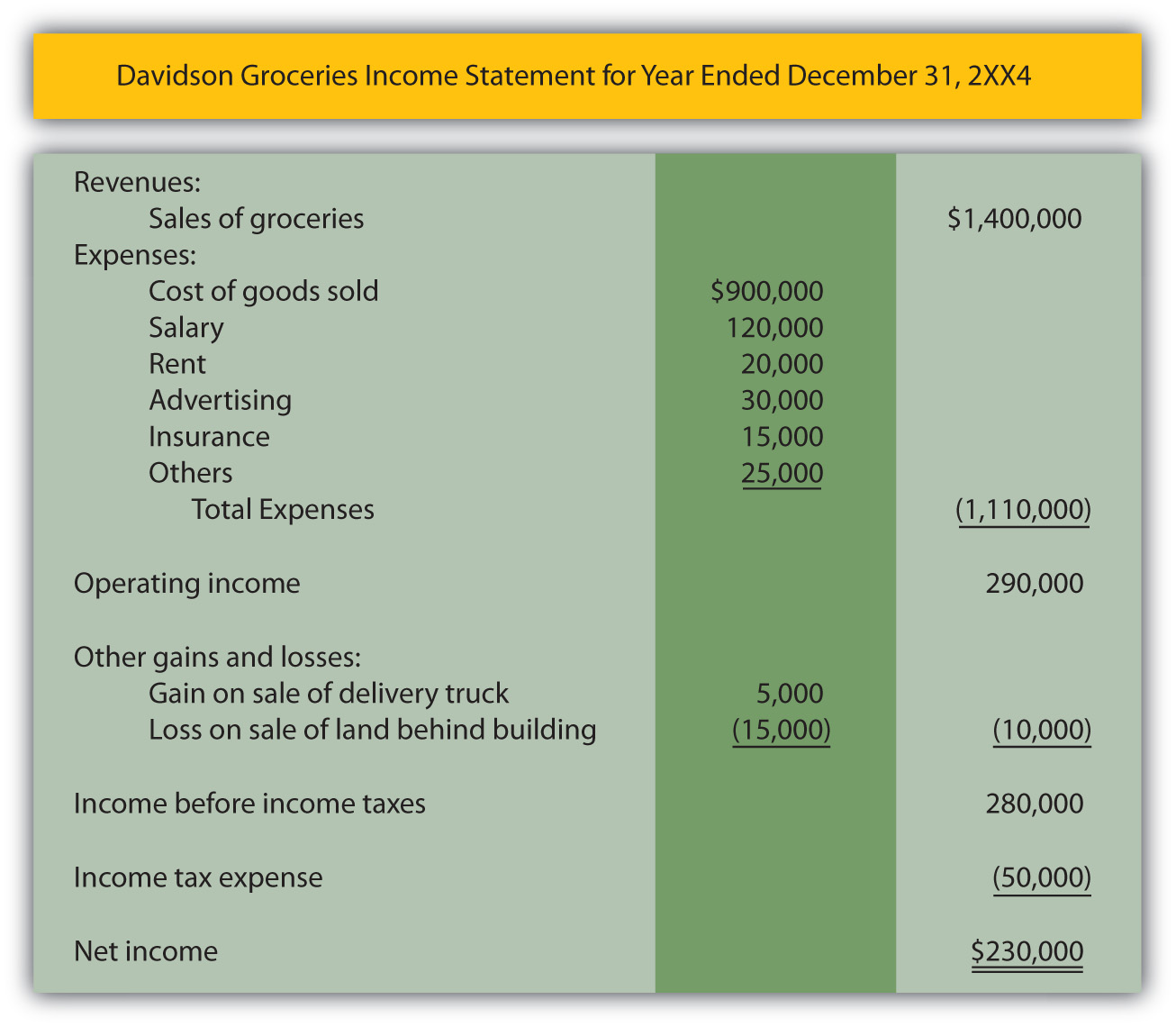

The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time. An income statement is a financial report detailing a company’s income and expenses over a reporting period. Published september 08, 2020.

Expenses in the income statement, expenses are costs incurred by a business to generate revenue. It can also be referred to as a profit and loss (p&l) statement and is typically prepared quarterly or annually. This statement includes information about the money that came into your company during a given period, the expenses your company incurred during that period, and.

An income statement helps business owners decide whether they can generate profit by increasing revenues, by decreasing costs, or both. An income statement, which shows your revenue after expenses and losses, tells a story about the performance of your business over a certain time period, such as monthly, quarterly or annually. If you are an unmarried senior at least 65 years old and your gross income is more than $14,700.

The income statement communicates how much revenue the company generated during a period and what costs it incurred in connection with generating that revenue. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Trump was penalized $355 million plus interest and banned for three years from serving in any top roles at a new york.

Importance of an income statement. An income statement would not include a. Question 24 an income statement would not include oa discontinued operations.

Sales on credit) or cash. Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss transactions. You'll get a detailed solution from a subject matter expert.

The cash flow statement or statement of cash flows measures. Accurately calculating revenue ensures that the income statement reflects genuine business activity, crucial for assessing the business’s performance and making informed strategic decisions. This problem has been solved!

Study with quizlet and memorize flashcards containing terms like what is an income statement?, what are the two qualitative characteristics that need to be considered when creating income statements?, what should an income statement include? It shows you how much money flowed into and out of your business over a certain period of time. An income statement would not include a.

Question 26 generally, the most important category on the statement of cash flows is cash flows from oa operating activities. In the pizza parlor example, the revenue in the income statement represents all the money earned from sales of all food and drink for each year. Comprehensive income is a statement of all income and expenses recognized during a specified period.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-021-eb8d8819386649a898bb94fd7ca3abf8.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)