Looking Good Tips About Difference Between Mfrs 139 And 9

Financial guarantee contracts are defined in mfrs 139.9.

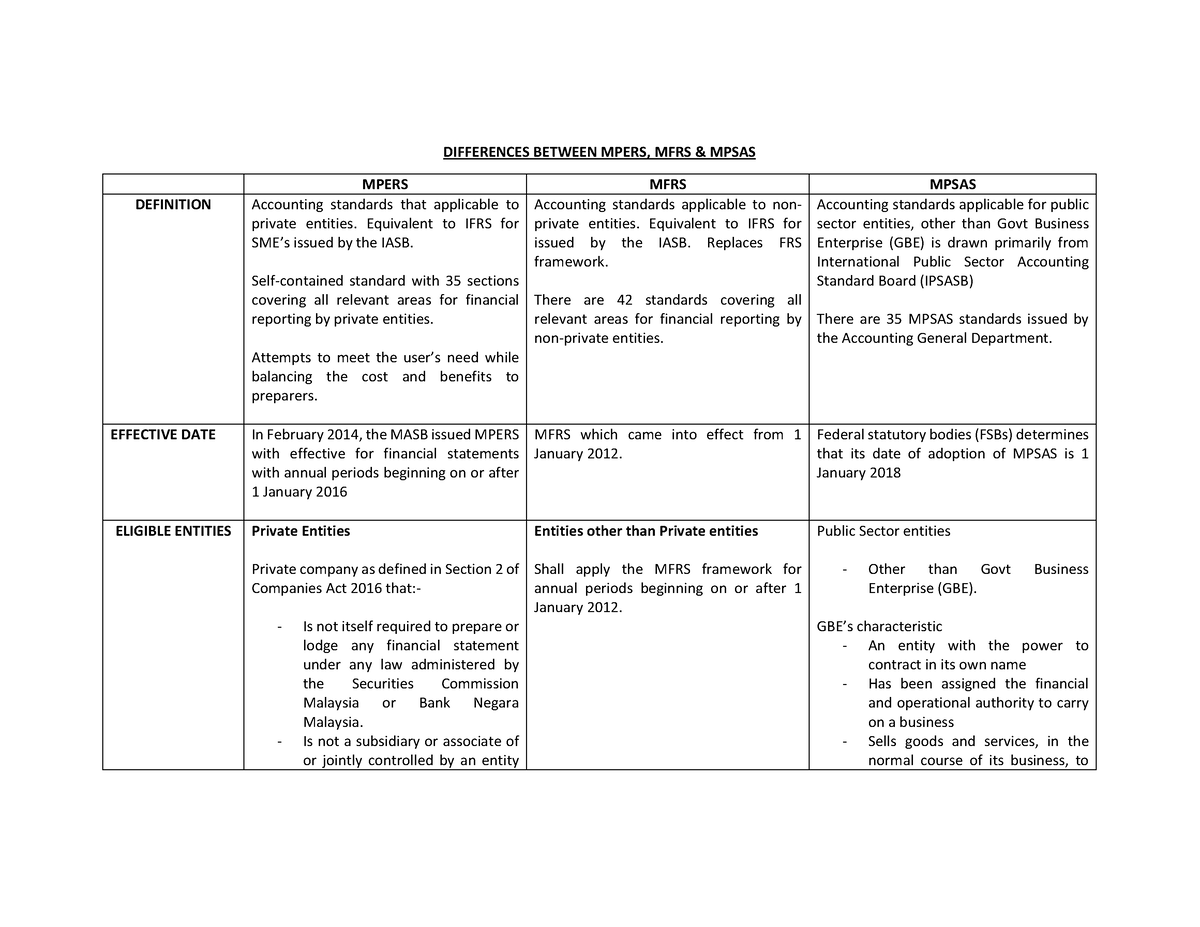

Difference between mfrs 139 and mfrs 9. These new guidelines replace the. G 8.2 the licensed person should take into account of. An overview of the key differences between malaysian private entities reporting standard (mpers), international financial reporting standards (ifrs) for.

The guidelines are issued to explain the changes and provide guidance on the tax treatment for banks or development fis that adopt mfrs 9. Here's what you need to know and practical application guidance from pwc. Under the expected credit losses model, an entity is required to recognise loss.

It required banks to make provisions in. Mfrs 139 adoption facilitates the management and investors by providing better information environment that could enhance company’s intellectual capital. Measurement (mfrs 139) to the opening impairment allowances determined in accordance with mfrs 9.

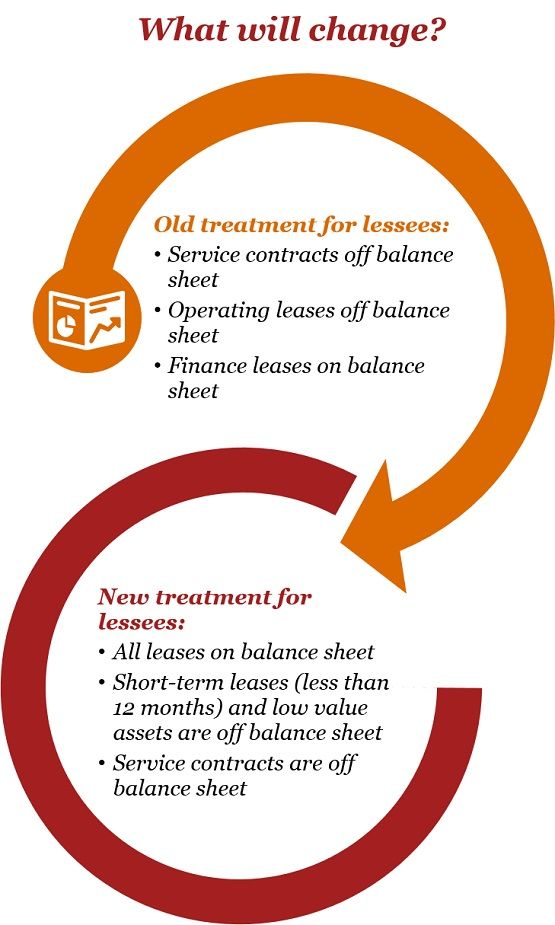

Recognition and measurement from 1 january 2018 and introduced changes in four areas. Mfrs 9 replaced the existing mfrs 139 financial instruments: These contracts are within the scope of mfrs 139, in accordance with mfrs 139.2(e) and 103b.

Introduction on year 2005, mfrs 139 was introduced to prescribe unified rules for reporting of the financial instruments so. We’ll bring you up to speed on topical issues, provide. Private entities now have a choice of continuing with the existing private entity reporting standards (pers) framework, or apply the malaysian financial.

Mfrs 9, which came into effect on jan 1 last year, changes the way banks book provisions on financial assets like loans and bonds. Ias 39/mfrs 139(*) requires the hedge. Mfrs news is your monthly update on all things relating to malaysian financial reporting standards.

9 or mfrs 139 to hedging relationships that are directly affected by interest rate reform and entities that provide disclosures applying the requirements in mfrs 7. Mfrs 9 replaces the current mfrs 139 and. Mfrs 9 replaces the ‘incurred losses model’ in mfrs 139 with the ‘expected credit losses model’.

This standard applies to all entities with a.