Sensational Info About Financial Performance Of Sbi Bank

Fy2022 net interest income net interest income increased by 9.03% to `1,20,707.59 crore in fy2022 from `1,10,710.00 crore in fy2021.

Financial performance of sbi bank. Analysts see a consolidation phase for banking stocks till the margins start to improve. The data are collected from the previous 5. Financial performance and the efficient functioning of commercial banks are the major measuring attributes of a country’s financial system.

In addition, investors have the option of walking into any of our sbi mutual fund branches in over 260 locations, and the vast network of over 22,000 sbi branches. Performance and efficiency of commercial banks are the. State bank of india is a fortune 500 company.

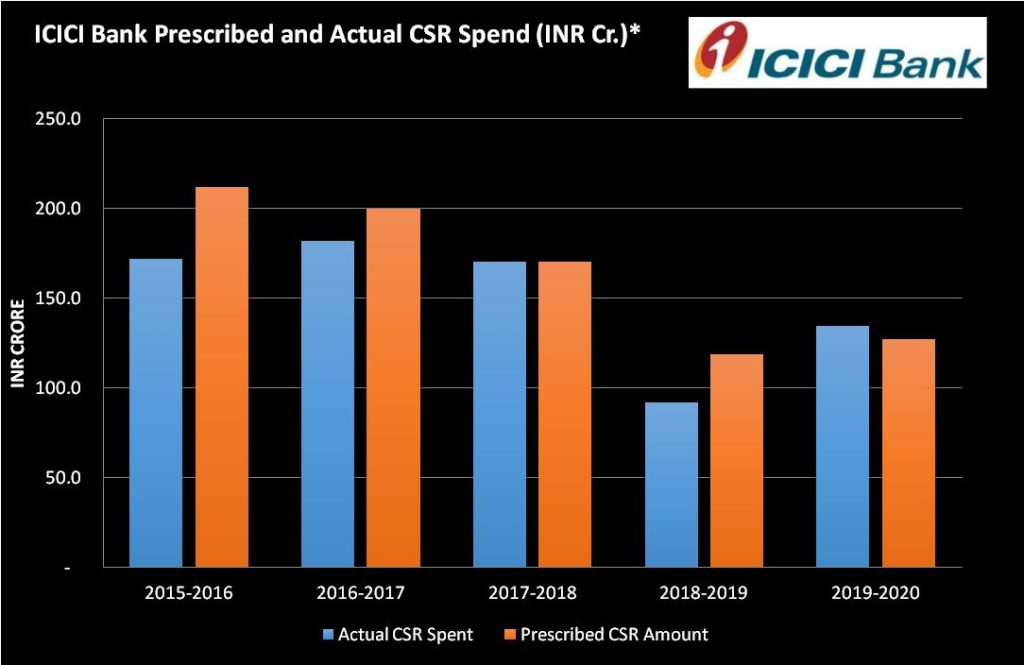

The study is an attempt to analyze the financial performance of sbi and icici banks. State bank of india. Price of sbi on previous budgets.

Chairman’s message dear shareholders, it gives me great pleasure to place before you the highlights of your bank’s performance during fy2021. This comparative study of sbi and icici bank demonstrates that there are significant differences on the performance of sbi and icici bank in terms of deposits, advances,. What does the trend performance of sbi bank looks like in the six years?

Total interest income increased from. The ongoing financial year's race for the most profitable company is anticipated to be closely monitored by analysts with hdfc bank edging past state bank. Market share in mobile banking.

The study was evaluate and comparison of sbi bank and hdfc bank to analyse the financial performance of the past 5 years. State bank of india (sbi) and icici bank are the two largest banks in india in public and private sector. In view of this, the study set out to apply profitability ratios,.

Both public and private sector banks perform widely in india. Pdf | financial performance of banks is a key indicator of an economy. Market share of debit card spends.

A study on financial performance of state bank of india conference: | find, read and cite all the. Get state bank of india latest yearly results, financial statements and state bank of india detailed profit and loss accounts.

The purpose of the study is to analyse the performance of state bank of india before and after merger based on profitability, deposits mobilised, advances given to the borrowers,. It is designed to analyze the financial performance of the state bank of india. Profile chart news & analysis technical financials community historical related indices related securities financial summary income statement balance sheet cash flow.

State bank of india yearly results: What was the efficiency of solvency and liquidity position of banks? Incred recommends adding hdfc bank, icici bank and sbi shares for.