Unbelievable Info About Order Of Current Liabilities On Balance Sheet

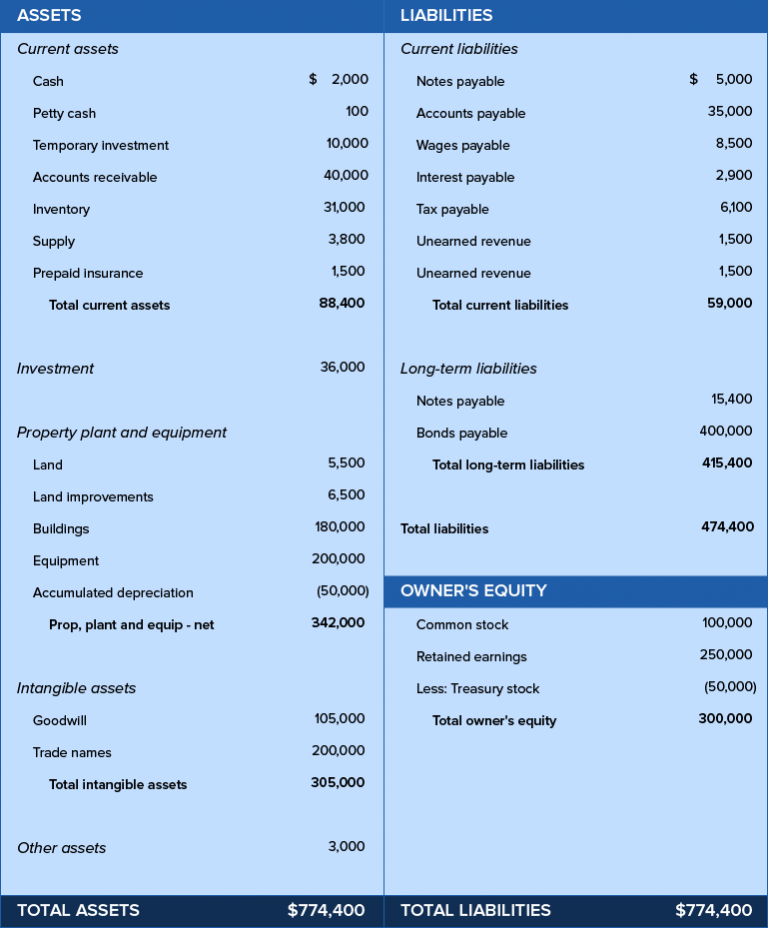

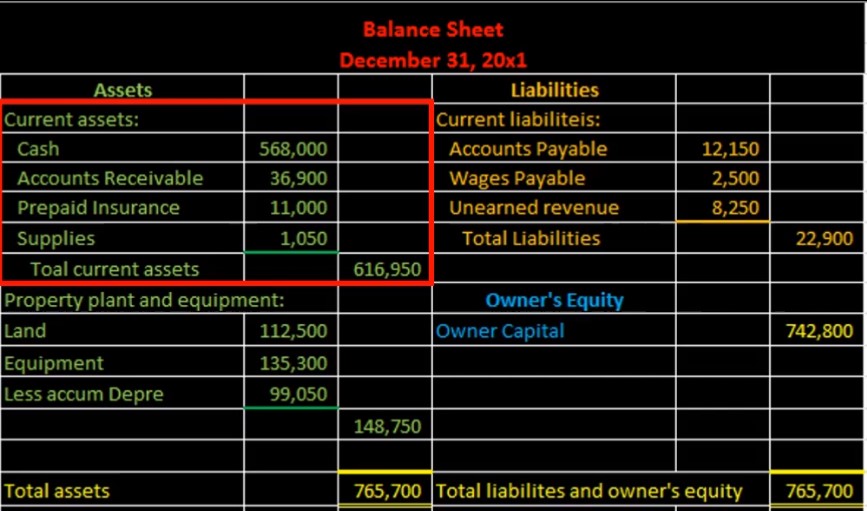

Those liabilities coming due sooner—current liabilities—are listed first on the balance sheet, followed by long.

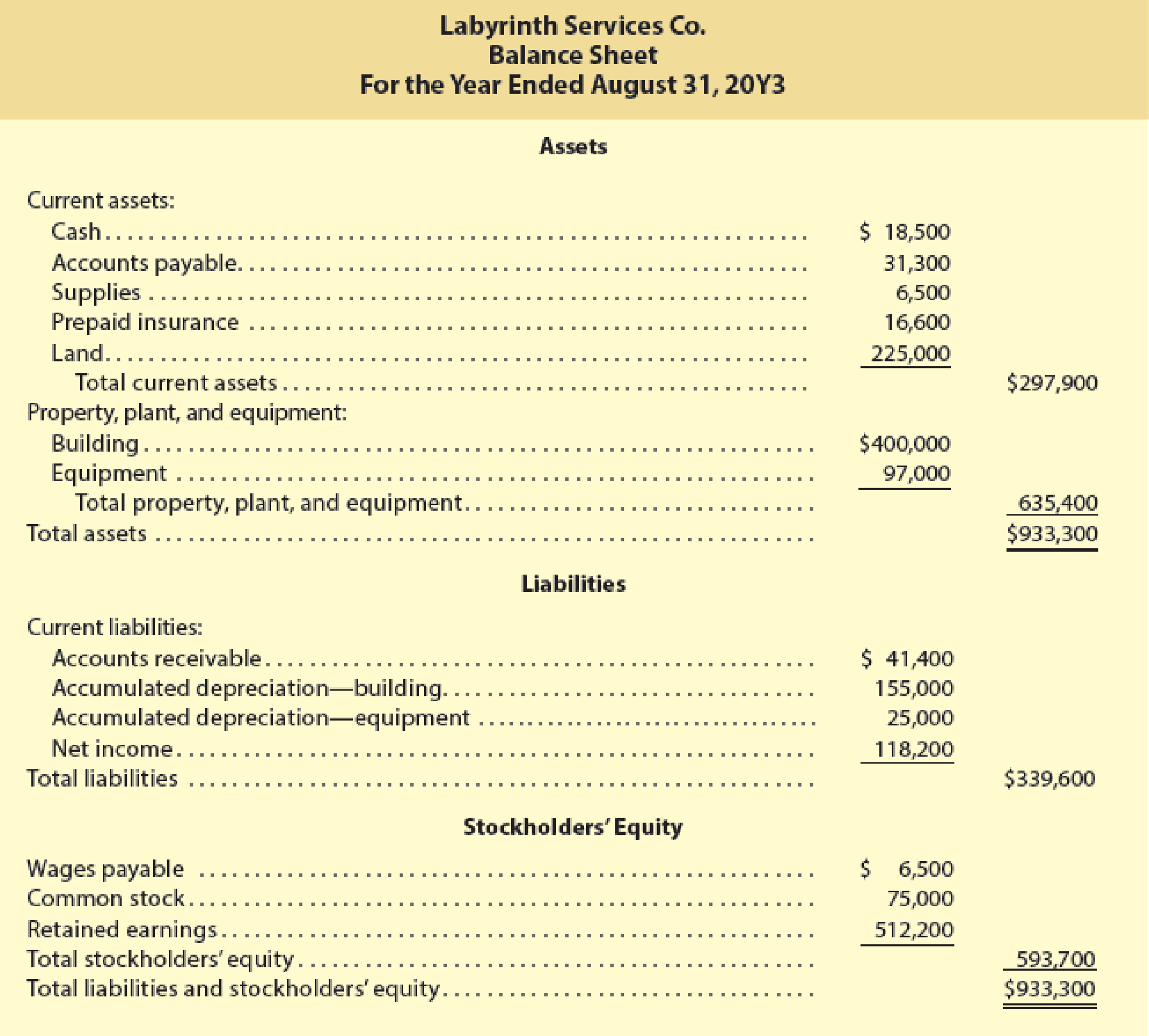

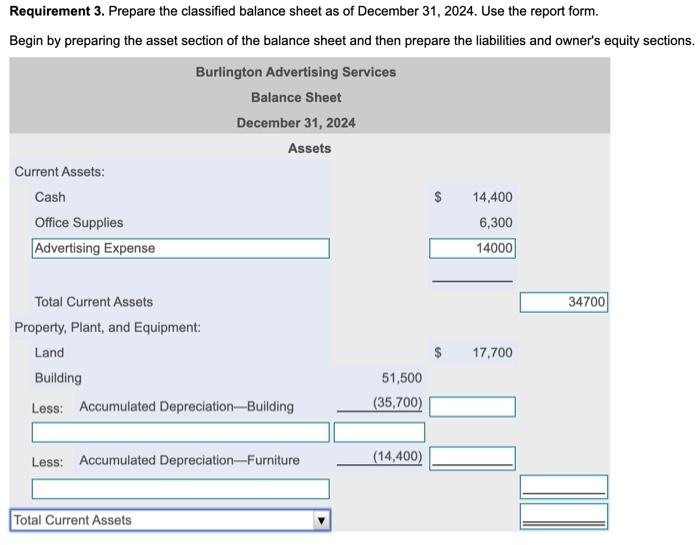

Order of current liabilities on balance sheet. Noncurrent liabilities on the balance sheet. A balance sheet provides a snapshot of a company’s financial performance at a given point in time. The liabilities and assets are listed in the 1st and 3rd column of the balance sheet respectively whereas, the amounts associated with them are listed in the 2nd and 4th.

A liability occurs when a company has undergone a transaction that has. This method of presentation lists the accounts based on how long it takes for the account to. What is a balance sheet?

Current liabilities are financial obligations of a business entity that are due and payable within a year. Current liabilities on the balance sheet refer to the debts or obligations that a company owes and is required to settle within one fiscal year or its normal operating cycle,. A balance sheet summarizes your firm’s current financial worth by showing the value of what it owns (assets) minus what it owes (liabilities).

The order of liquidity is a way of presenting asset accounts on the balance sheet. A major difference between current assets and current liabilities is that more current assets mean high working capital which in turn means high liquidity for the business. This financial statement is used.

Current liabilities are typically settled using current assets. Order for listing liabilities it is logical for a company's liabilities to be organized in the chart of accounts in the same way as they are presented on the balance sheet: Order of liquidity is the presentation of various assets in the balance sheet in the order of time taken by each to get converted into cash, whereby cash is considered as the most.

These debts are the opposite of. The current liabilities section of a balance sheet shows the debts a company owes that must be paid within one year. Just as assets are categorized as current or noncurrent, liabilities are categorized as current liabilities or noncurrent liabilities.

An issue may arise if you are not. Order of liquidity. The obligations are usually to be paid within one year.

This result suggests that the riskiness of current liabilities agrees with the balance sheet order, and the separate classification of current liabilities from noncurrent liabilities is. Liabilities can include: Bills that are due within one year or within a normal operating cycle.

:max_bytes(150000):strip_icc()/Clipboard01-1095385694ff4af0bc51b6410f68b5fe.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)