Sensational Tips About Cash Flow Statement Income Balance Sheet

A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period.

Cash flow statement income statement balance sheet. The three financial statements are the income statement, the balance sheet, and the cash flow statement. In accounting and finance, the cash flow statement (cfs), or “statement of cash flows,” matters because the financial statement reconciles the shortcomings of the reporting standards established. The three core financial statements are 1) the income statement, 2) the balance sheet, and 3) the cash flow statement.

The cash flow statement shows how well a company manages cash to fund operations and any expansion efforts. These three statements are informative tools that traders can use to analyze a company's financial strength and provide a quick picture of a company's financial health and underlying value. Unless you went to business school—or at least took an accounting or finance course—you’ve probably never given much thought to financial statements such as balance sheets, income statements, or statements of cash flow, right?but now you’ve got some money to invest, you’re looking at a few companies and trying to figure out.

Given an income statement for a company for a given year, how would you estimate operating cash flow. Adjusted income statement, balance sheet and cash flow adjusted income statement (in euro million) fy 2022 fy 2023 % change revenue 19,035 23,199 22% other recurring operating income and expenses (16,724) (20,155) share in profit from joint ventures 97 122 recurring operating income 2,408 3,166 31% % of revenue 12.6%. Please briefly describe an income statement, statement of cash flows, and balance sheet.

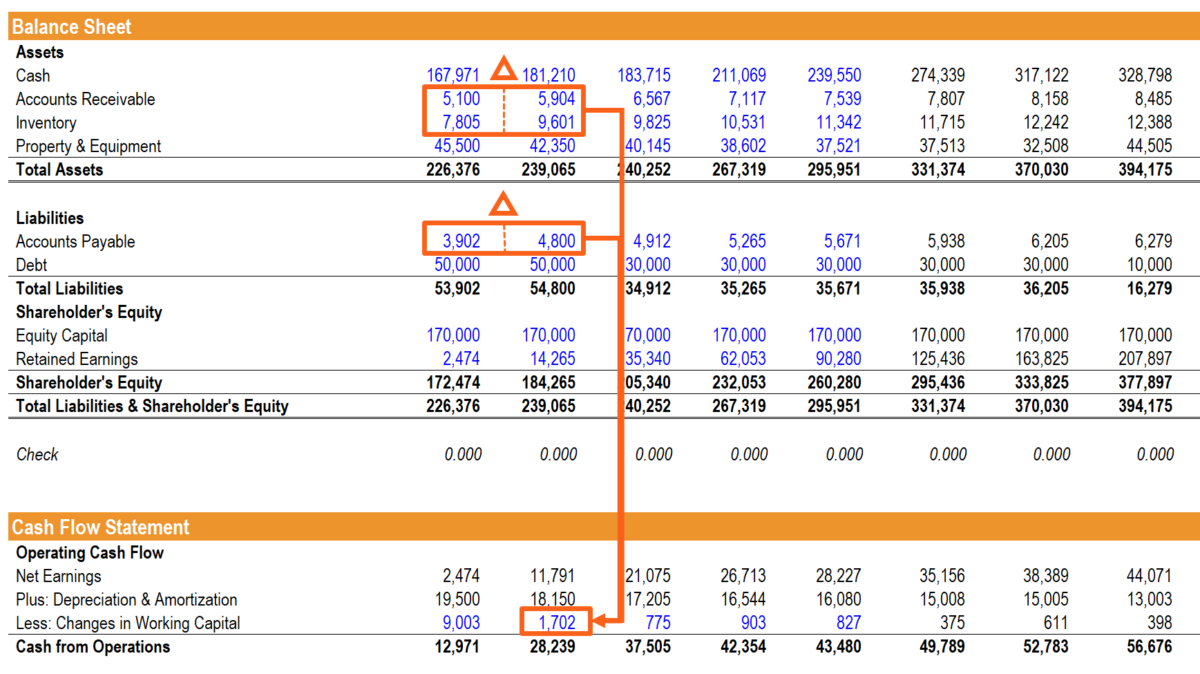

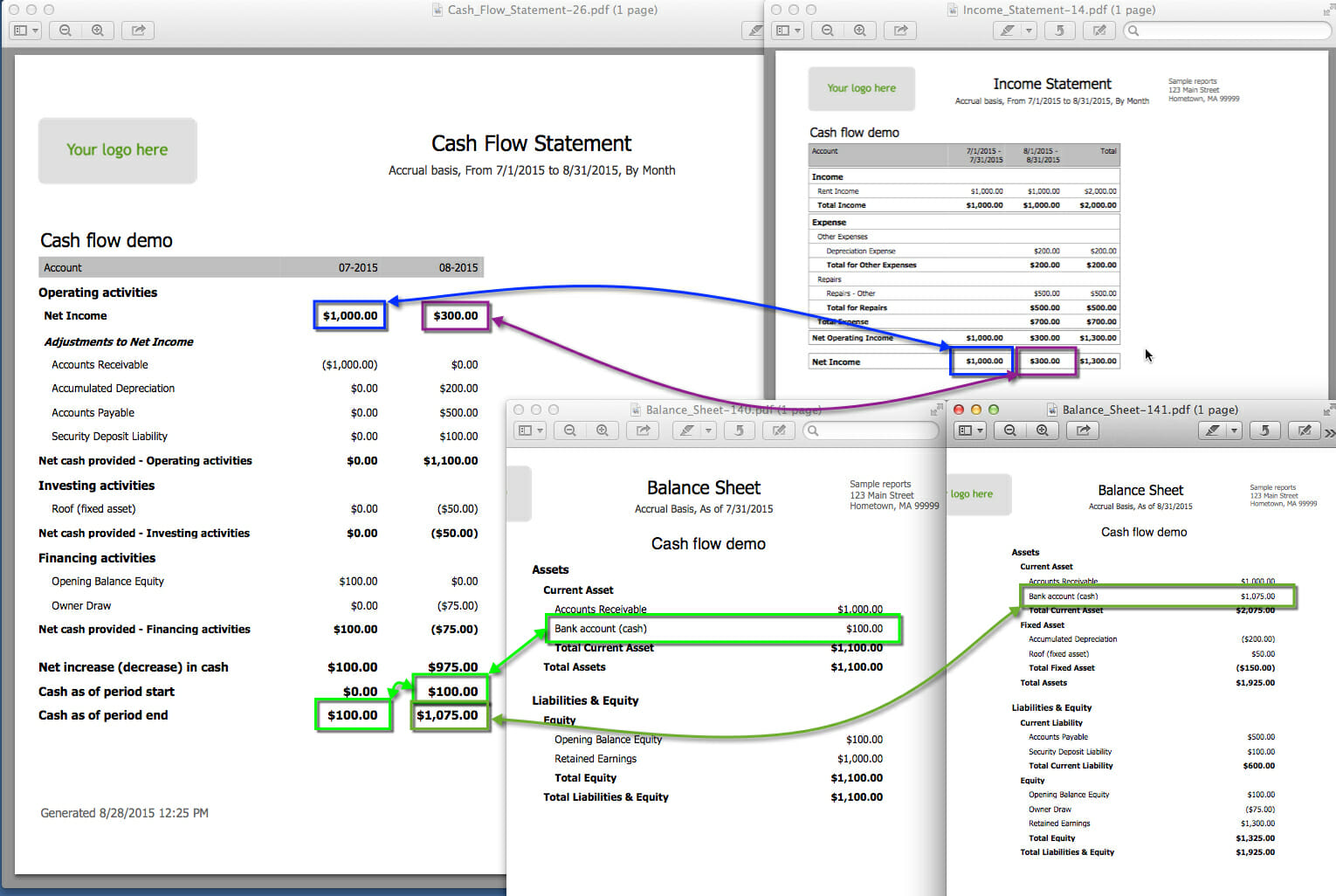

Table of contents what are financial statements? Calculate the cash flows from investing activities The cash flow statement is linked to the income statement by net profit or net loss, which.

Net income from the bottom of the income statement links to the balance sheet and cash flow statement. A balance sheet is one of the three primary financial statements used by businesses to provide a snapshot of their financial position at a specific point in time. Income statements, balance sheets, and cash flow statements are important financial documents for all businesses.

As a reminder, the balance sheet provides a snapshot of the company’s liabilities and assets at a given time. These three financial statements are intricately linked to one another. This article will provide a quick overview of the.

This value can be found on the income statement of the same accounting period. Learn why they matter, how to understand them, and their role in financial decision. Key highlights since the income statement and balance sheet are based on accrual accounting, those financials don’t directly measure what happens to cash over a period.

While income statements are excellent for showing you how much money you’ve spent and earned, they don’t necessarily tell you how much cash you have on hand for a specific period of time. Do dividends go on the balance sheet? Let’s compare the cash flow statement vs balance sheet for a company to.

Balance sheet 📊income statement 📈cash flow statement 💎the guide is completely free. The balance sheet and cash flow statement are two of the three financial statements that companies issue to report their financial performance. Create a cash flow statement from scratch on excel using a balance sheet and income statement.👉 get 25% off financial edge using code kenji25:

On the balance sheet, it feeds into retained earnings and on the cash flow statement, it is the starting point for the cash from operations section. Make adjustments for non cash transactions step 4: Data found in the balance sheet, the income statement, and the cash flow statement is used to calculate important financial ratios that provide insight on the company’s financial.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)