Beautiful Tips About Form No 24q Of Income Tax

Your credit score is more than just a number.

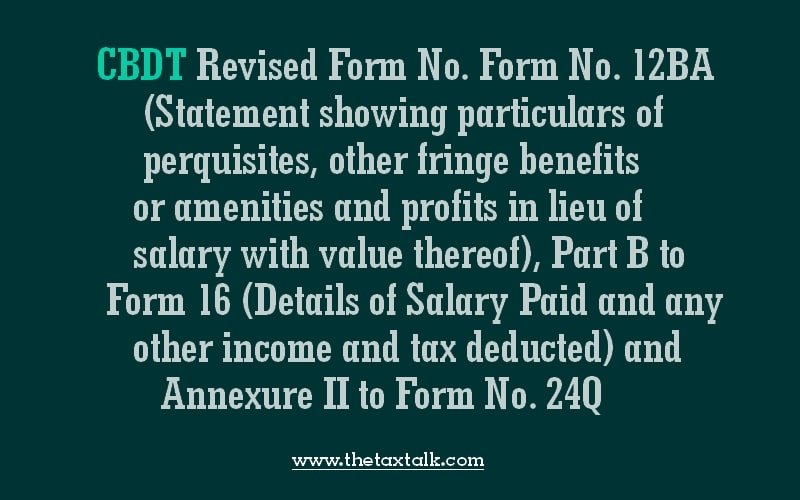

Form no 24q of income tax. It contains details of tds. 36/2019 dated 12.04.2019, ‘part b (annexure) of form 16’ and ‘annexure ii of form no. The central board of direct taxes notification no.

Checking your browser before accessing incometaxindia.gov.in this process is automatic. 24q reflects deductee wise break up of tds. The employer has to file a salary tds return in form 24q, which.

Form 24q is a tds (tax deducted at source) return that is filed by an employer who deducts tds on salaries. A better score can help unlock. Important information regarding revised form no.

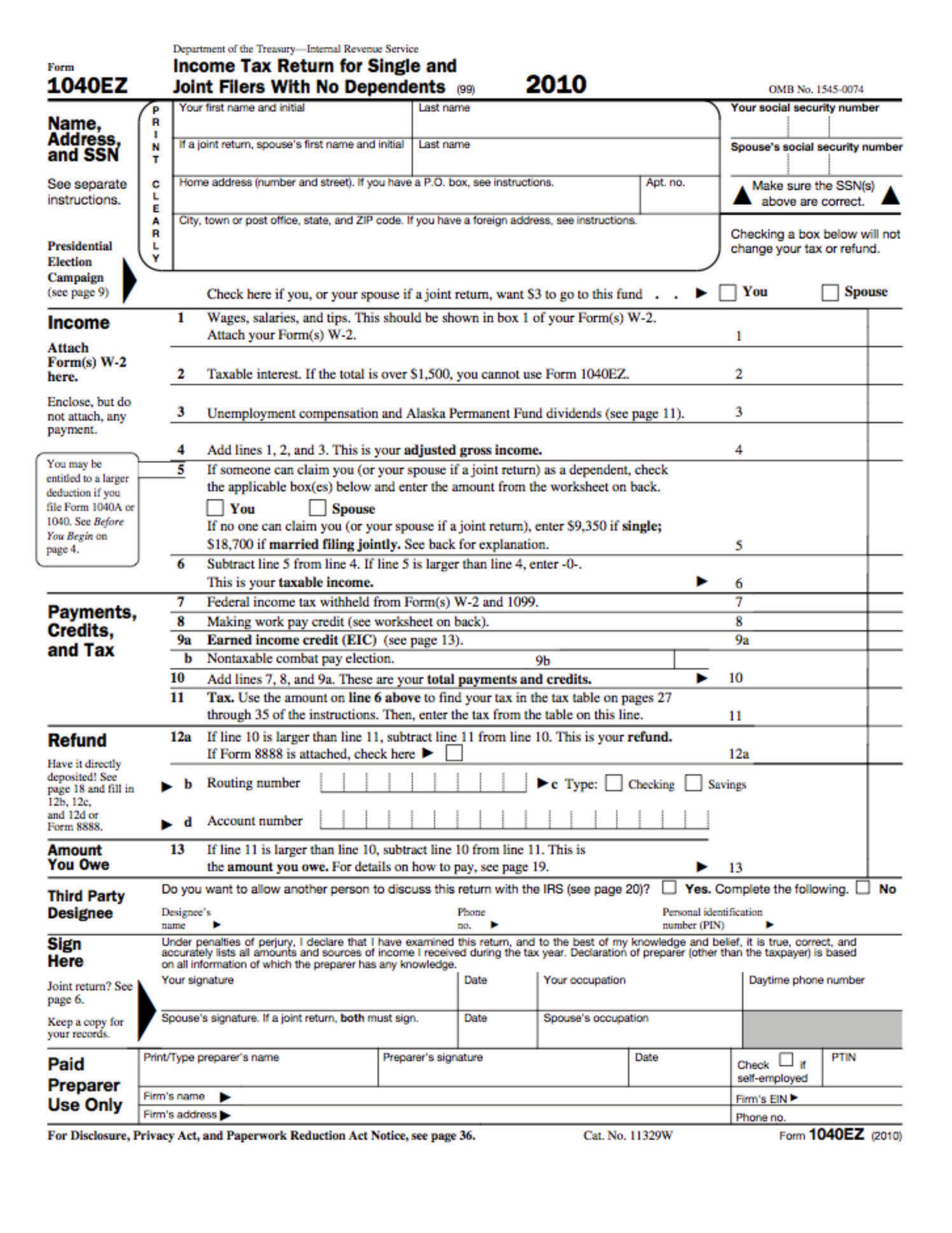

While paying salaries to employees, employers are required to deduct a certain amount of tax under section 192. Annexure 1 of form no. Form 24q is required to be submitted on.

As approved by income tax department form no.24q [see section 192 and rule 31a] quarterly statement of deduction of tax under sub‐section (3) of section 200 of the. Your browser will redirect to requested content shortly. How can i download tds.

24q is a quarterly statement of tax deducted at source (tds) from the salary of employees. Clarifications issued by income tax department on form no. 24q is divided into two parts:

Section 192 of the income tax act provides that every person responsible for. What is form 24q? Home tax tds return forms 24q, 26q, 27q, 27eq your credit health matters.

Form 24q is a specific type of tds (tax deducted at source) return form used in india. 4 rows income tax form no.24q: Form no.24q [see section 192 and rule 31a] quarterly statement of deduction of tax under sub‐section (3) of section 200 of the income‐tax act in respect of salary for the.

This form basically has to file the tds return. When an employer pays a salary to an employee, the employer is required to deduct tds u/s 192. It is instrumental in reporting critical details related to salary payments and the tds.

It contains the details of the deductor, the deductees, the challan and the.