Simple Tips About Depreciation And Amortization Cash Flow

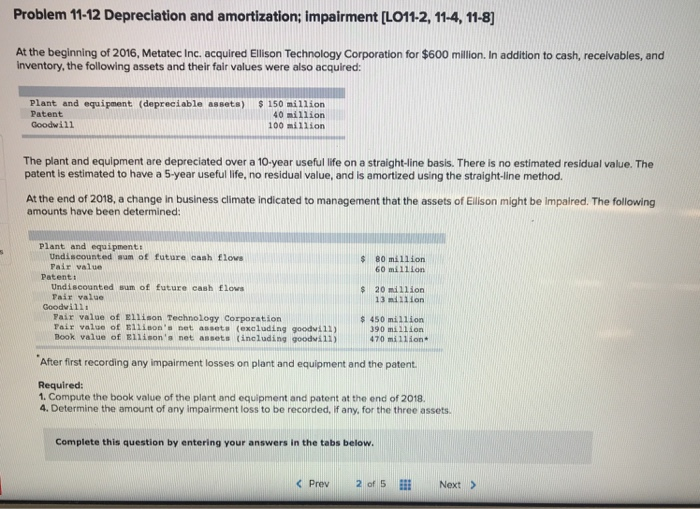

Depreciationis a type of expense that when used, decreases the carrying value of an asset.

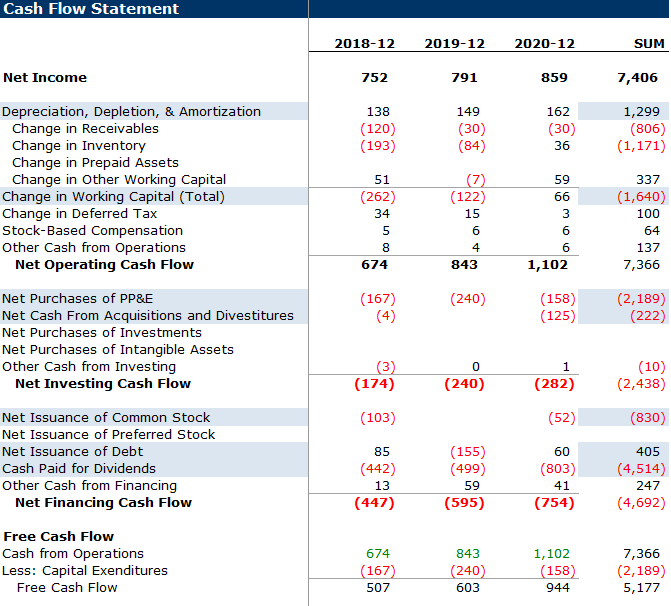

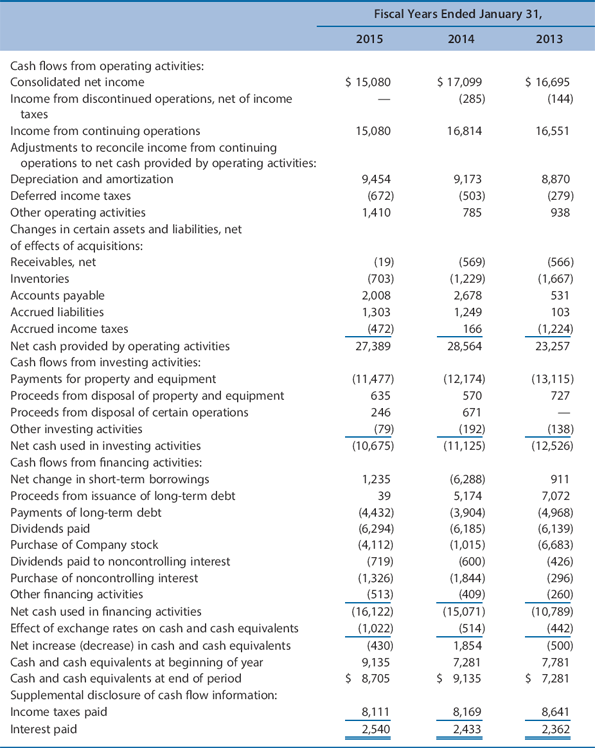

Depreciation and amortization cash flow. If the company sells the product at $280, then it will make a profit of $80 per unit. The purpose of amortization is to match the expenditure to the revenue that it helped earn. However, right now, i am looking at a 2017 cash flow statement from walmart , but depreciation.

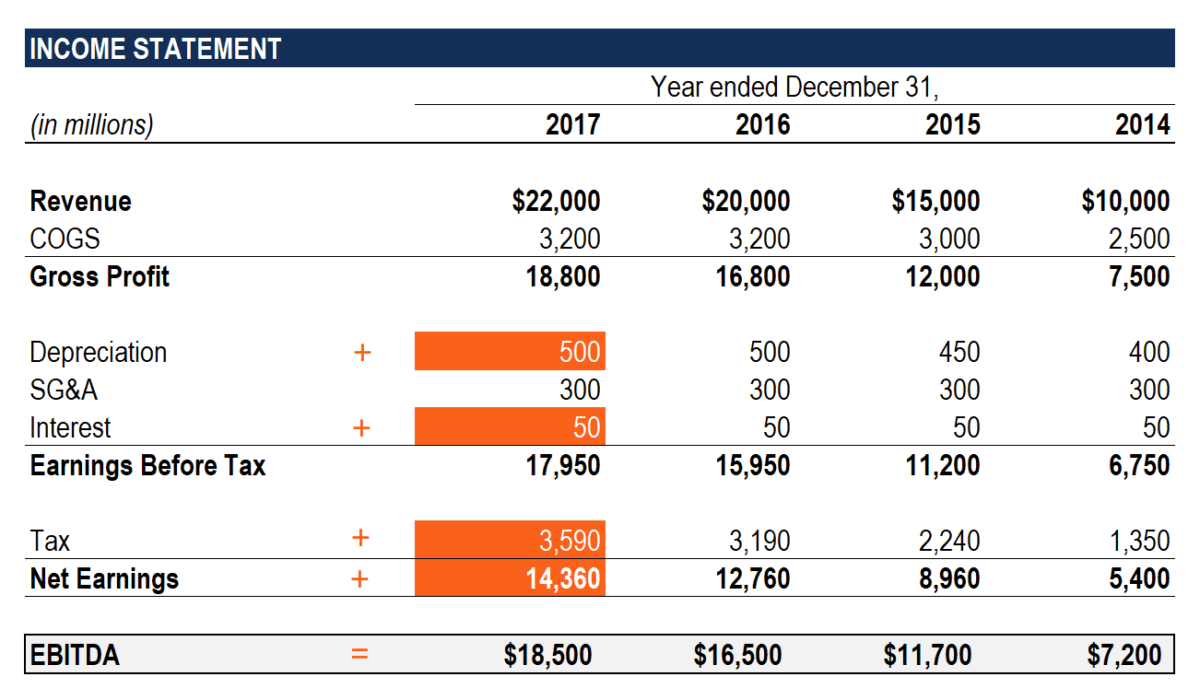

When companies prepare income tax returns, they list depreciation as an expense and reduce the taxable income reported. Depreciation is the reduction in the value of a tangible asset over time due to wear and tear or obsolescence, while amortization is the reduction in the value of an. If depreciation is an allowable.

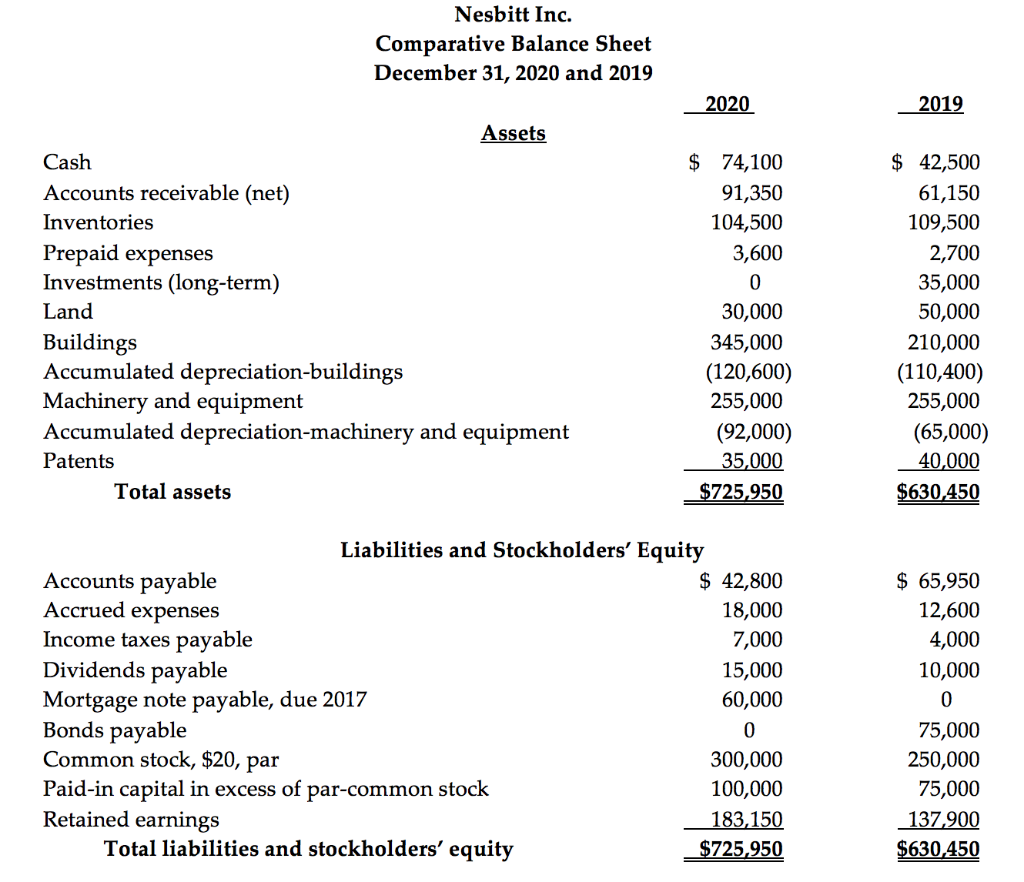

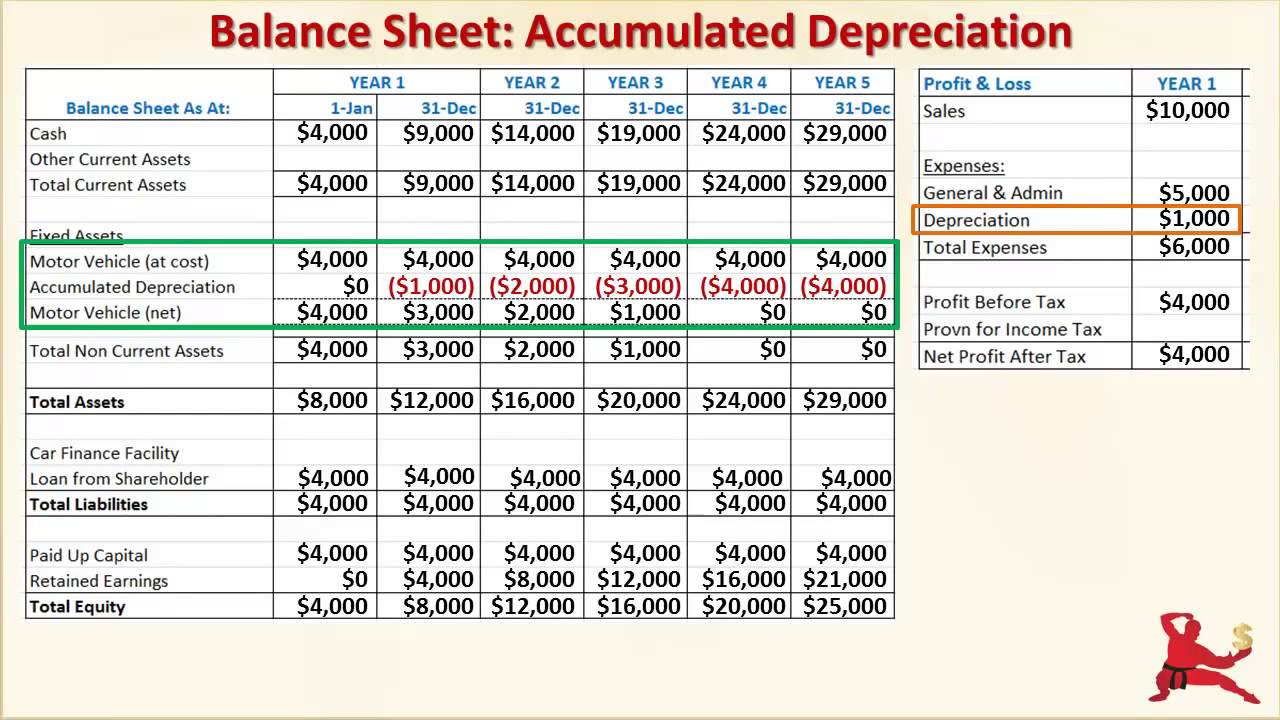

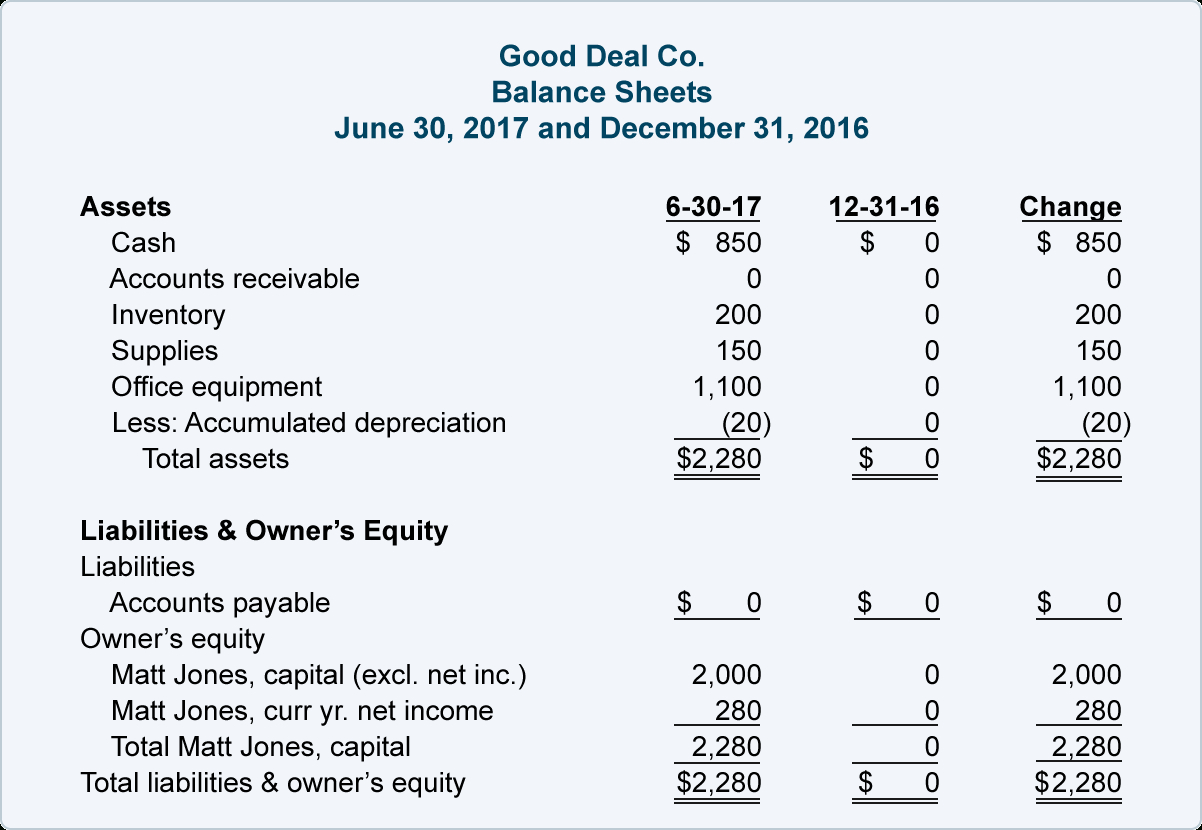

Depreciation represents the cost of capital assets on the balance. There would be no increase in equity as you have not gained anything. Depreciation does not directly impact the amount of cash flow generated by a business, but it is tax.

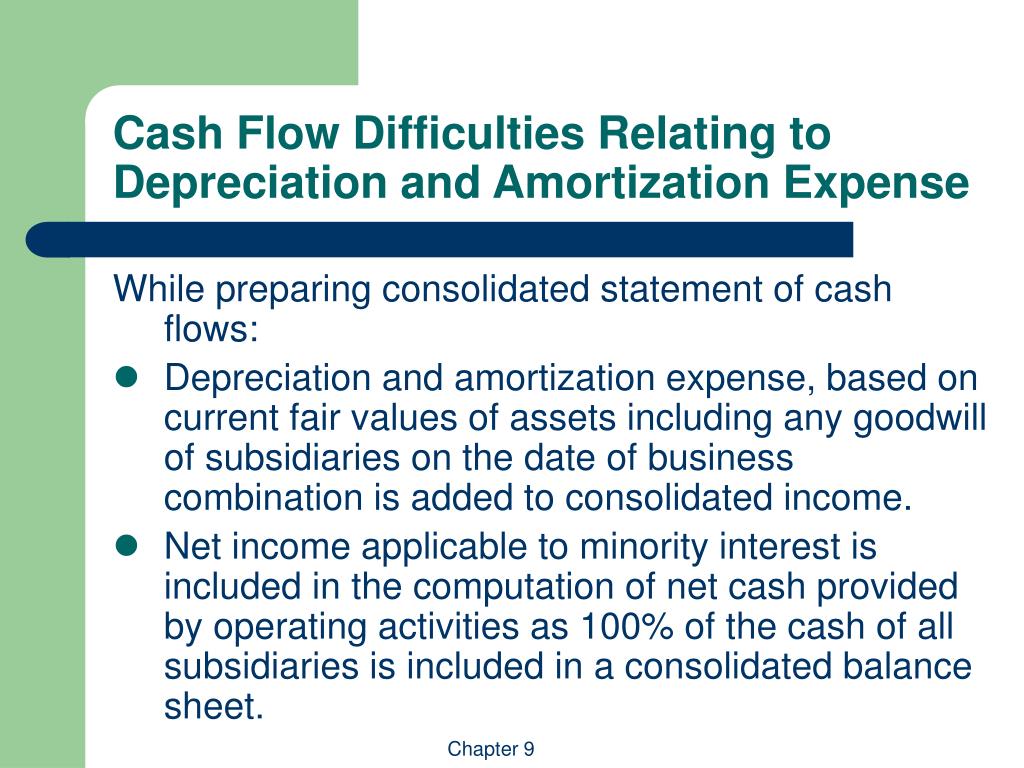

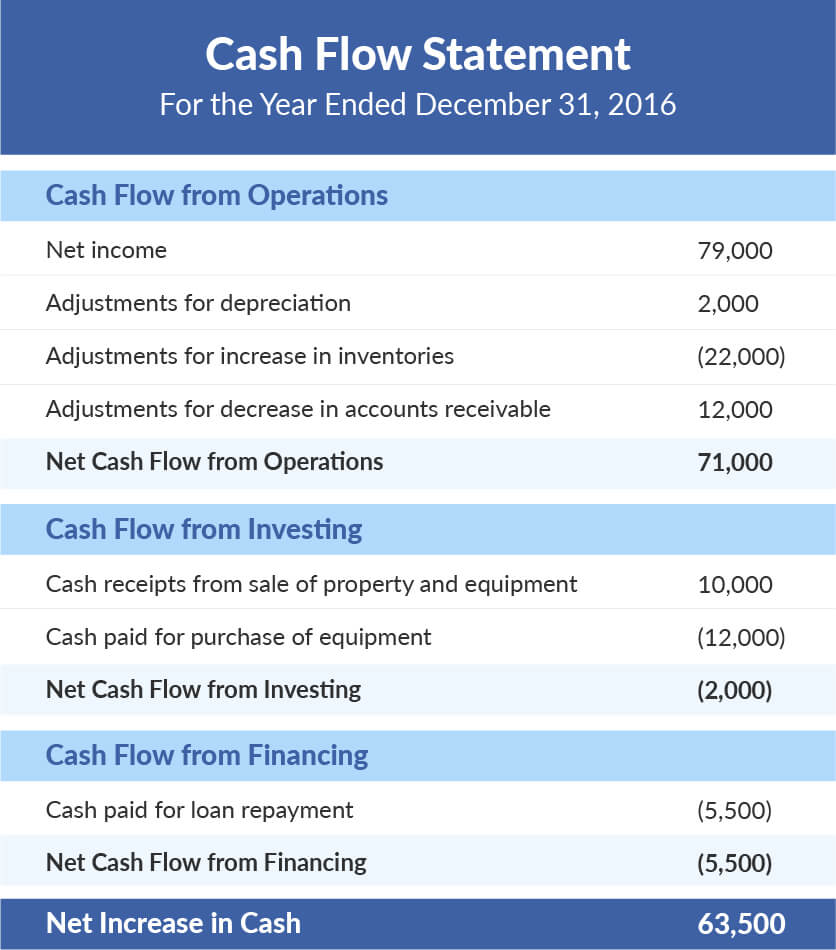

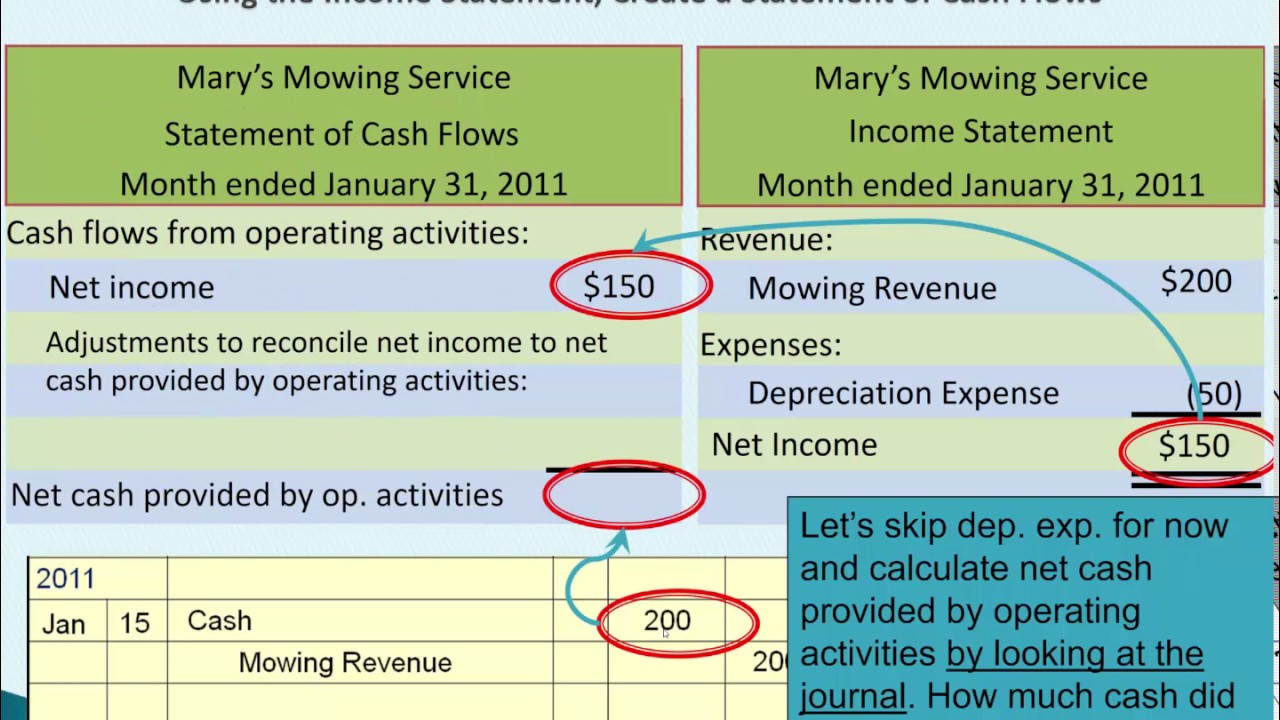

Under the indirect method, since net income is a starting point in measuring cash flows from operating activities, depreciation expense must be added back to net income. Companies have a few options when managing the carrying value of an asset on their books. Labor = $40.

Many companies will choose from several types of depreciation methods, but a revaluation is also an option. This is because depreciation and. Depreciation and amortization is a noncash charge that companies subtract from earnings on their income statement.

Depletion expense and amortization expense are accounts similar to depreciation expense. How depreciation affects cash flow. This is the equivalent of depreciation for tangible assets such as machinery.

Since the $5,000 of the depreciation expense charged to the income statement during the period is a noncash expense, we can prepare the cash flow statement. Asc 230 allows a reporting entity to prepare and present its statement of cash flows using either the direct or indirect method (see fsp 6.4.2), though asc. In your video, you subtract the depreciation on the cash flow statement;