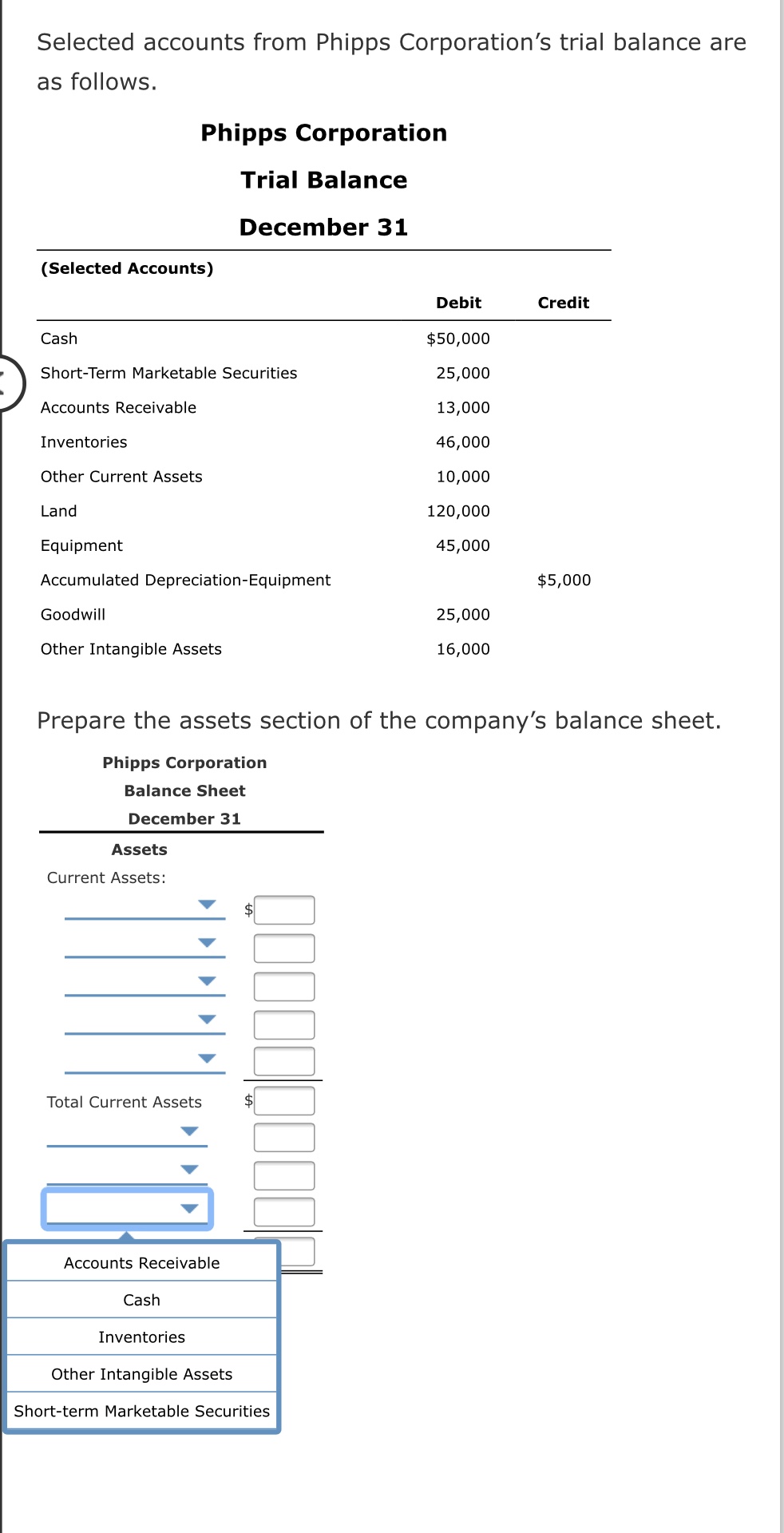

Fine Beautiful Info About Short Term Marketable Securities On Balance Sheet

Money market instruments, futures, options, and hedge fund investments can also be.

Short term marketable securities on balance sheet. Examples marketable securities are predominantly of two types: Marketable securities, also known as marketable equity or marketable financial assets, are financial instruments that can be easily bought or sold in the open market. A marketable security is a financial asset that can be sold or converted to cash within a year.

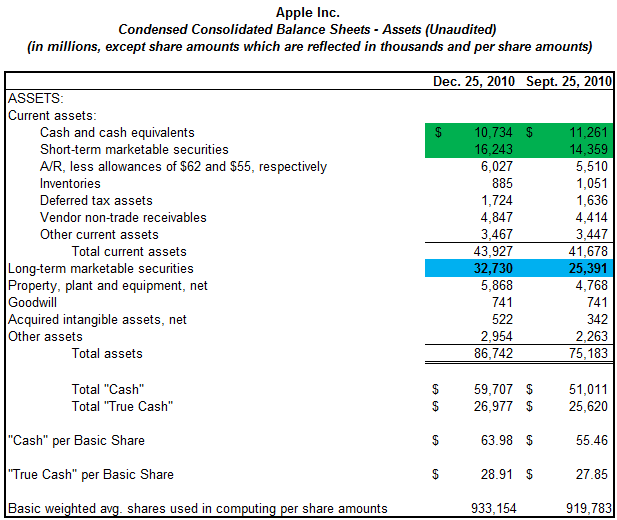

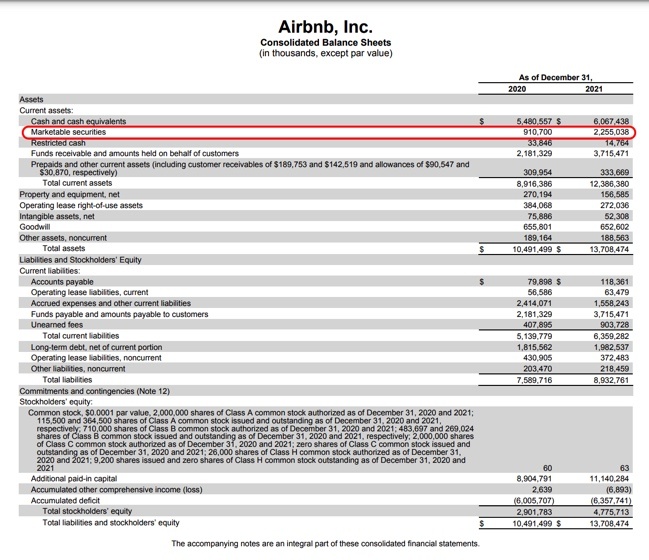

Introduction welcome to our comprehensive guide on marketable securities on the balance sheet. The issuing company creates these instruments for the express purpose of raising funds to further finance business activities and expansion. Marketable securities on the balance sheet can be long term or short term.

Marketable securities are defined as any unrestricted financial instrument that can be bought or sold on a public stock exchange or a public bond exchange. Since these securities regularly trade at high volumes, their value remains relatively constant with minimal fluctuations (i.e. Government security is one of the preferred modes of investment used by many fortune 500 companies.

Marketable securities refers to assets that can be sold within a short period of time, generally through a quoted public market. We do not believe the term marketable securities is required on the face of the balance sheet. E.g., u.s treasury maturity can be as high as 30 years or as low as 28 days.

We have different levels of marketable securities; More on that in a moment. Government securities generally have a long maturity duration.

Shares of common stock of a company listed on a stock exchange Definition marketable securities. Find out more about them and how they impact the balance sheet.

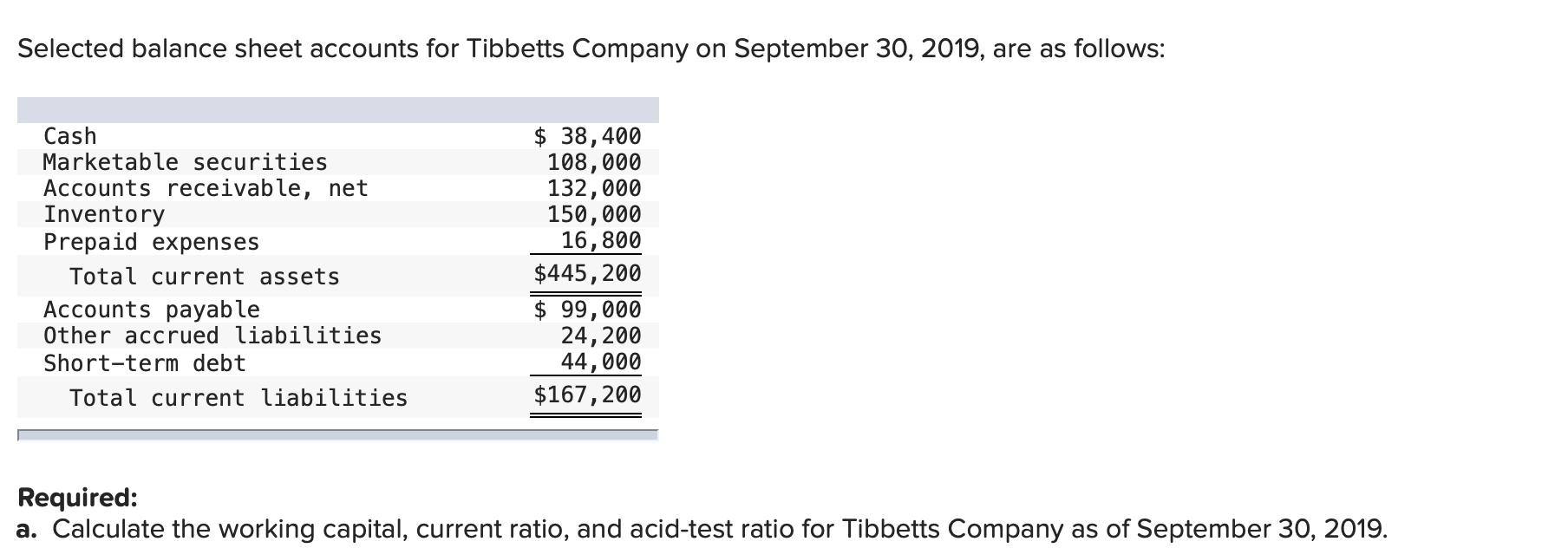

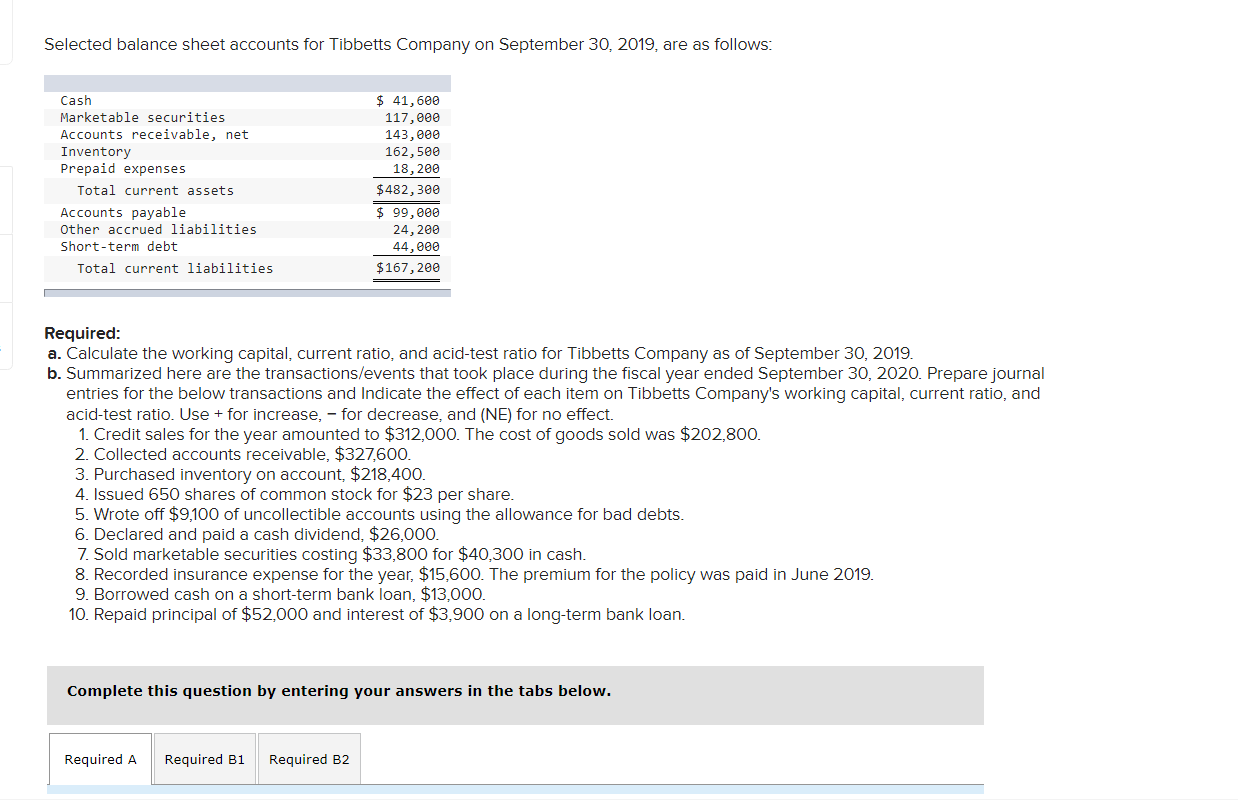

Understanding what they are, how they are classified, and their importance on the balance sheet is essential for anyone involved in. In fact, the defining characteristic of marketable securities is their liquidity — meaning they can be bought and sold quickly. In the world of finance, marketable securities play a vital role for companies and investors alike.

They are financial assets that are expected to be converted into cash within a relatively short period, typically one year or less. See fsp 5.9.4 for information on the presentation of a subsidiary's investment in its parent's stock. Marketable securities on the balance sheet are a mixture of investments ranging from commercial paper, bonds, and money market accounts to stocks.

They are typically securities that can be bought or sold on an exchange. Examples of marketable securities include: An active market should be available to guarantee liquidity for these investments.

Trading securities are recorded in the balance sheet of the investor at their fair value as of the balance sheet date. Common or preferred stock treasury bills Obviously bonds and stocks that are publicly traded fit this bill.