Divine Info About Format Of Cashflow

Long term profit and cash flow strength support proposed dividend of chf1.20, a 9% annual increase;

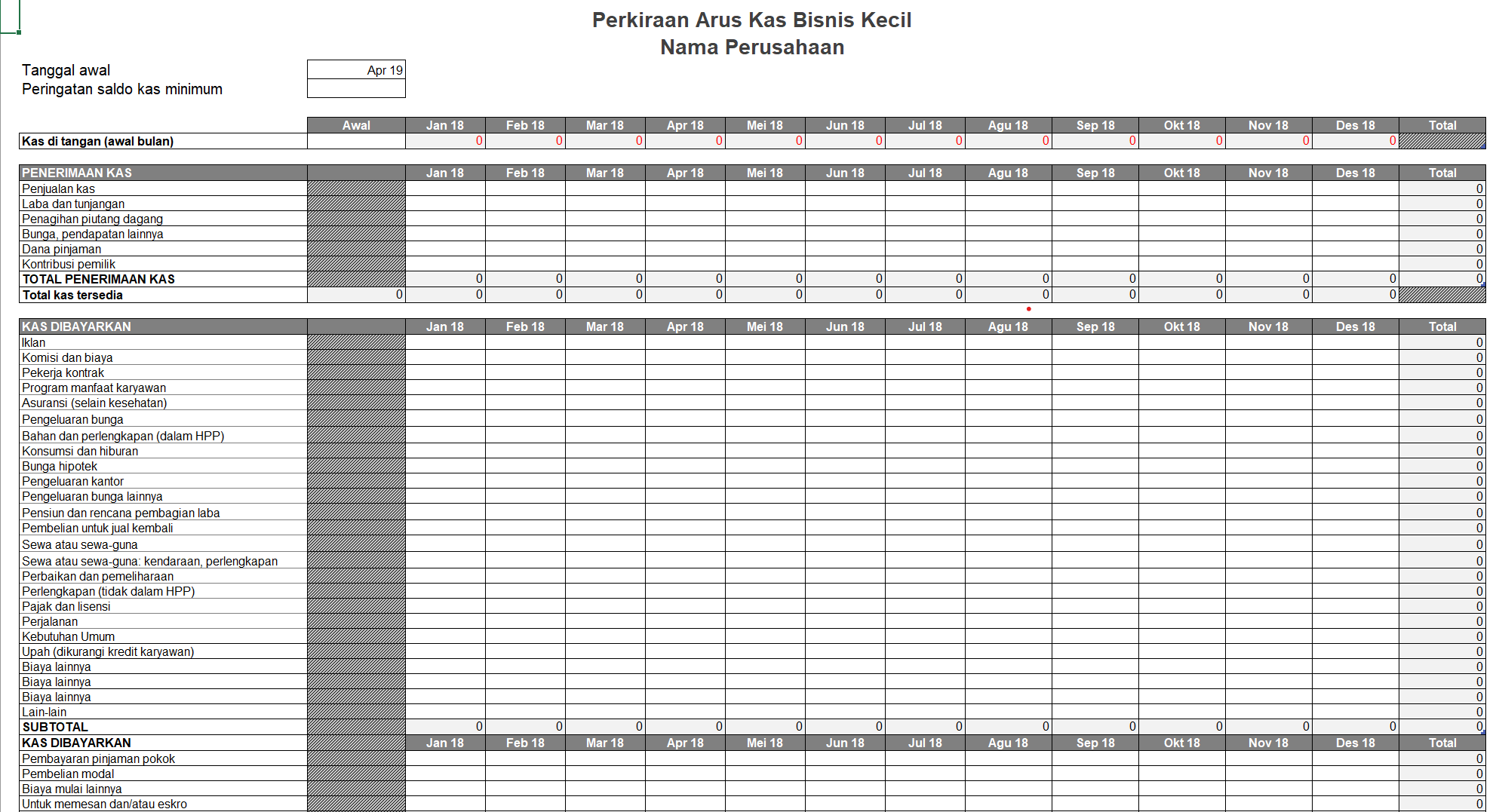

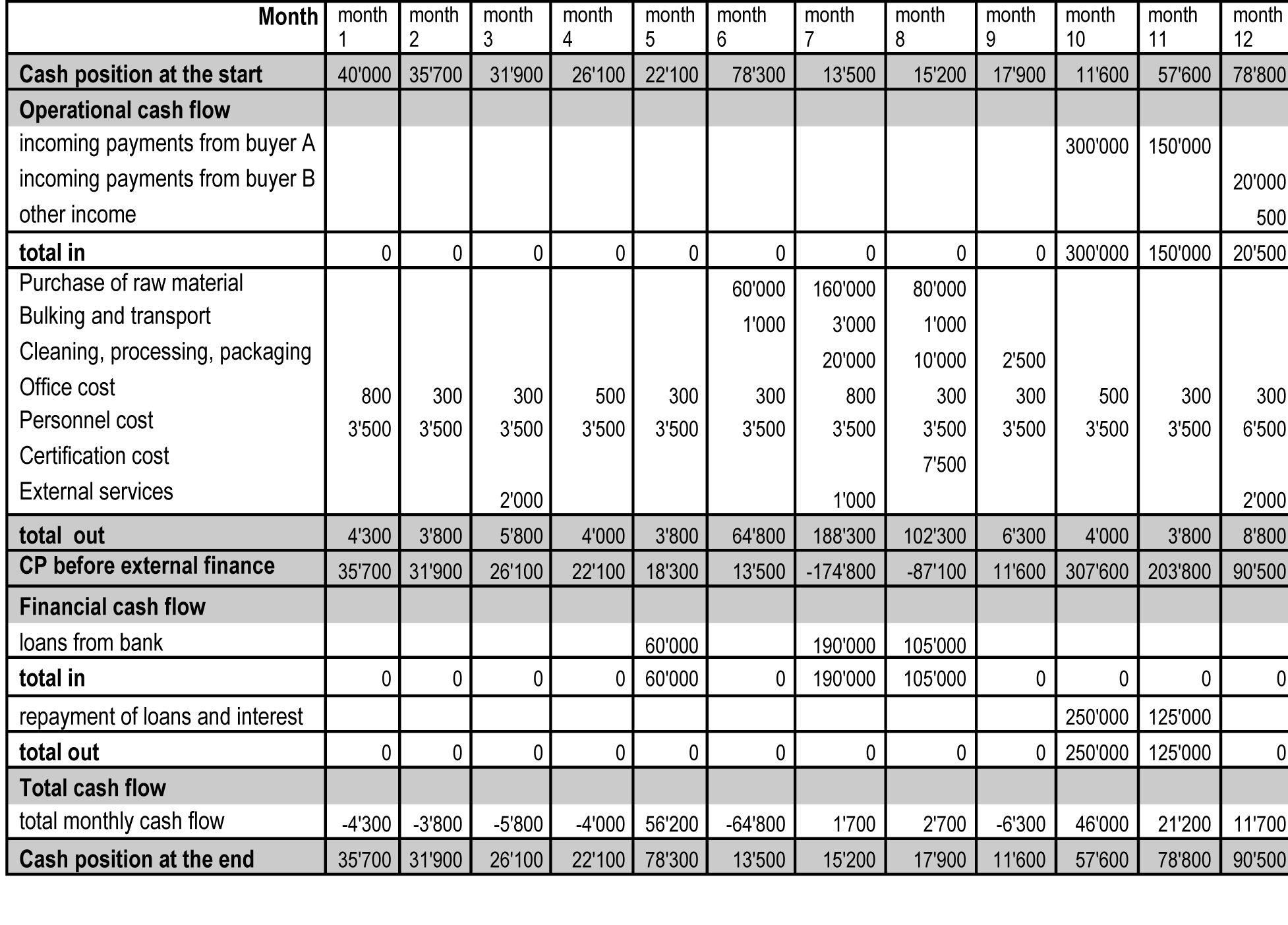

Format of cashflow. Cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities. The cash flow statement is required for a complete set of financial statements. Ifrs 10 consolidated financial statements (issued may 2011), ifrs 11 joint arrangements (issued may 2011), investment entities (amendments to ifrs 10, ifrs 12 and ias 27) (issued october 2012), ifrs 16 leases (issued january 2016) and ifrs 17 insurance contracts (issued may 2017).

Using this information, an investor might decide that a company with uneven cash flow is too risky to. This financial statement provides a detailed overview of a business' cash transactions and reports how a company handles its accounting. It is also pivotal for businesses to understand the different formats of the cash flow statement.

Commenting on the results, temenos ceo andreas andreades said: Cash flow (cf) is the increase or decrease in the amount of money a business, institution, or individual has. For example, cash flow statements can reveal what phase a business is in:

Cash flows from operating activities, investing activities, and financing activities. Any cash flows from current assets and current liabilities Cash flow statement format is prepared by taking operating, investing, and financing activities into consideration.

A new york judge on friday ordered trump to pay $453.5 million in penalties and interest over what he said was more than a decade of fraud. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid). The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company.

The cfs measures how well a company. Operating activities cash flows from operating activities include transactions from the operations of the business. In finance, the term is used to describe the amount of cash (currency) that is generated or consumed in a given time period.

One is the direct method and the other indirect method. A typical cash flow statement comprises three sections: The template is divided into sections for operations, investing, and financing activities.

The cash flow statement format is divided into three main sections: Net change in cash = cash from operations + cash from investing + cash from financing In other words, it lists where the cash inflows came from, usually customers, and where the cash outflows went, typically employees, vendors, etc.

Cash flow statement: The scf reports the cash inflows and cash outflows that occurred during the same time interval as the income statement. Fundamental principle in ias 7 all entities that prepare financial statements in conformity with ifrss are required to present a statement of cash flows.

Cash flow statement format (direct method) okay, so before anything else, here's the format of the cash flow statement itself (see further below for explanations): All the transactions and information related to these three activities are summed up to prepare cash flow statement format. Download a statement of cash flows template for microsoft excel® | updated 9/30/2021.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)