Sensational Tips About The Balance Sheet Model Of Firm

Last updated on wed, 18 jan 2023 | capital structure.

The balance sheet model of the firm. The balance sheet is one of the three core financial statements that are used to. (for a complete guide to working capital, read our “working capital 101” article.). In a leveraged buyout (lbo) transaction, a firm will take on significant leverage to finance the acquisition.

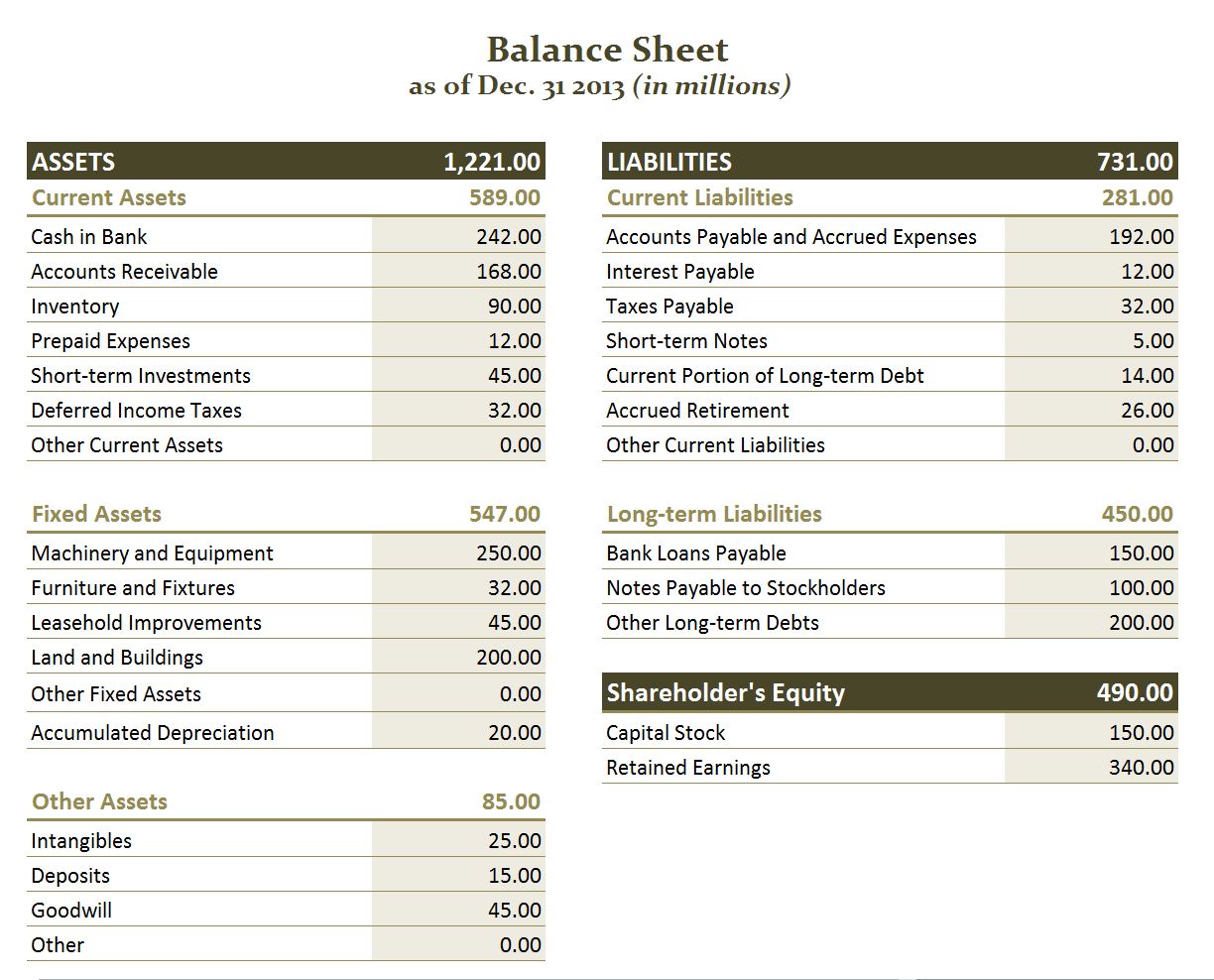

With this information, a company can quickly assess whether it has borrowed a large amount of money, whether the assets are not liquid enough, or whether it has enough current cash to fulfill current demands. Assets of $148,900 equal the sum of liabilities and owners’ equity ($70,150 + $78,750). This draws a distinction between firm’s scr capital models and a stochastic full balance sheet model that may be used for risk appetite purposes.

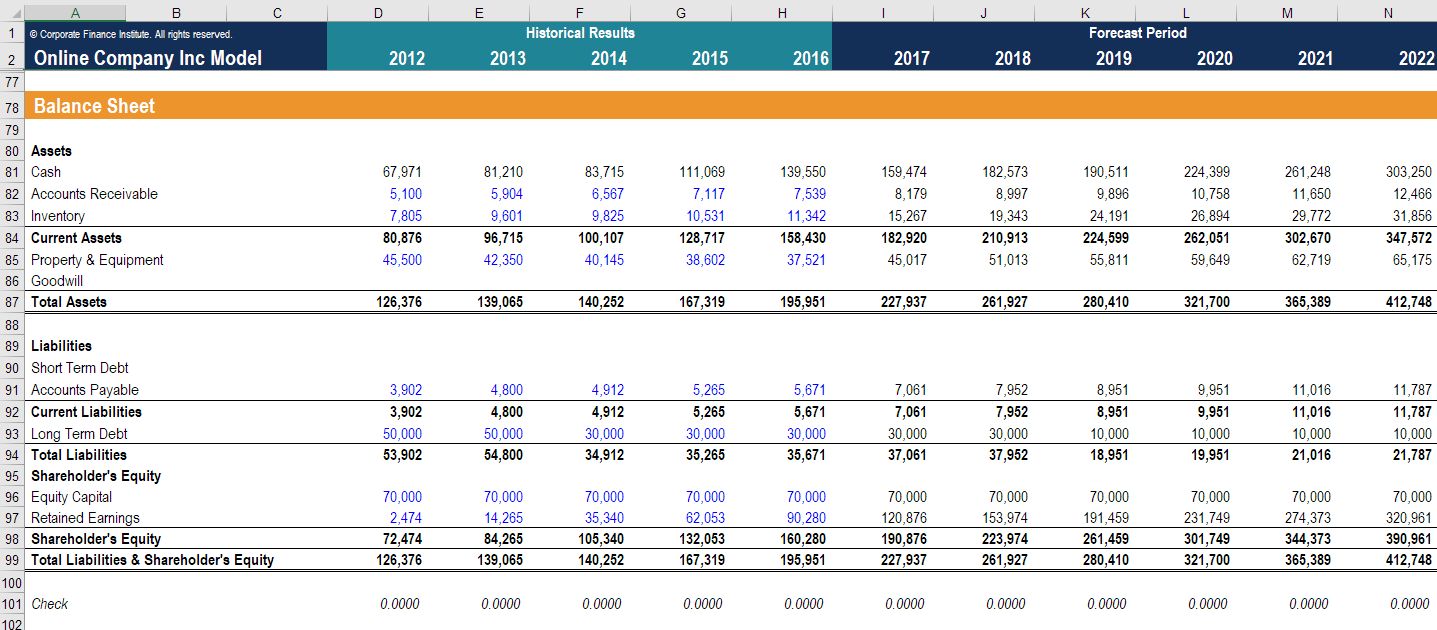

To learn more, check out cfi’s m&a financial modeling course. The three main categories of. The screenshot below shows how two companies are combined and recapitalized to produce an entirely new balance sheet.

03 july 2019 bill curry article metrics save pdf cite rights & permissions abstract this paper describes the use of a stochastic model of the full regulatory balance sheet of an insurer under the solvency ii regime. Furthermore, the impact of firms’ balance sheet variables on bankruptcy risk can be modelled in a dynamic panel data model, where it is also possible to condition on macroeconomic. Balance sheets examine risk.

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. One of the fundamental tenets of accounting is that this relationship between assets, liabilities, and owners’ equity must always be in balance (hence the name “balance sheet”): Which of the following groups correctly lists these three areas?

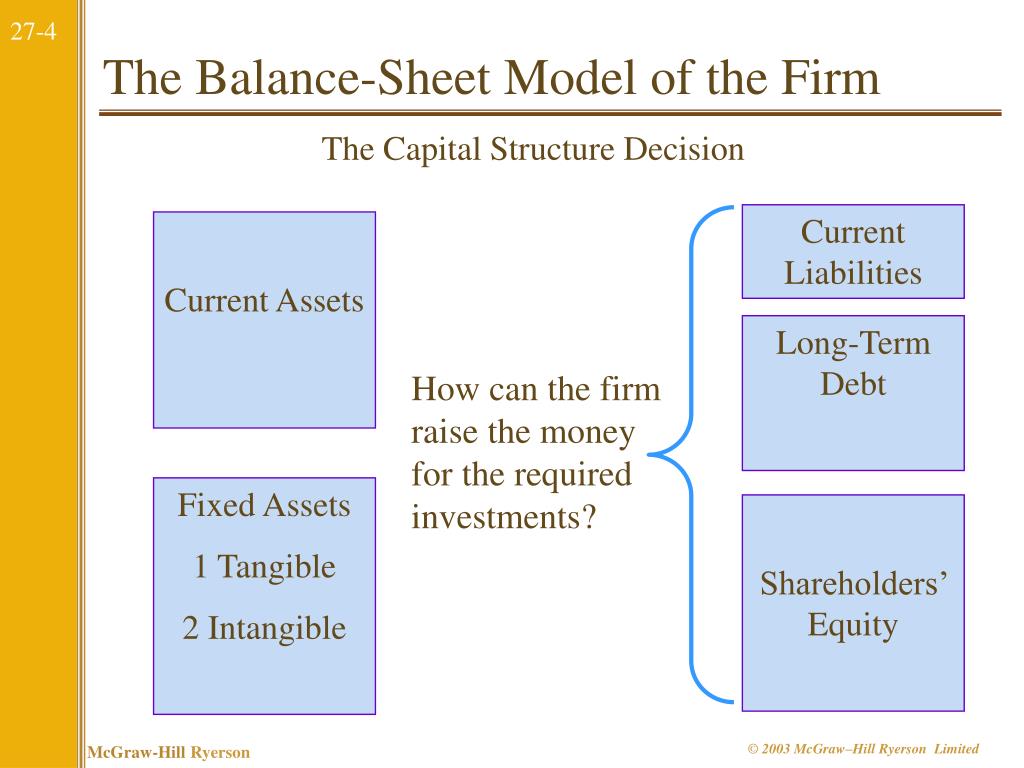

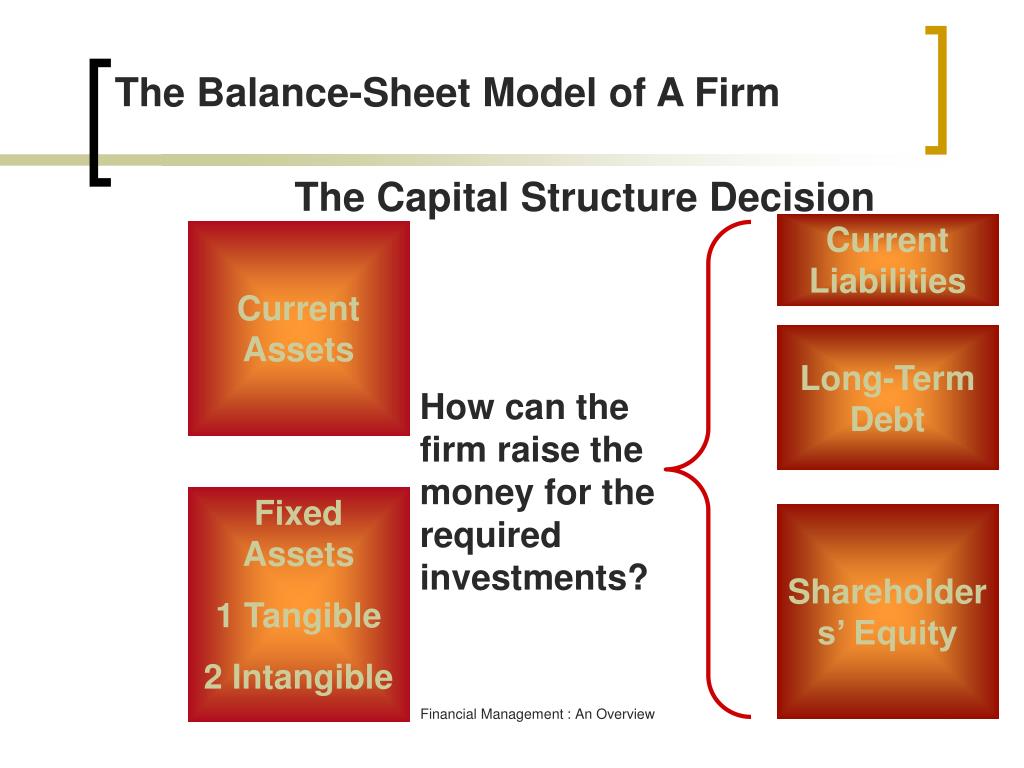

Which of the following groups correctly lists these three areas? Using the balance sheet model of the firm, corporate finance may be thought of as the analysis of three primary subject areas. The balance sheet as of december 31, 2018, for delicious desserts, inc., a fictitious bakery, is illustrated in table 14.1.

It can also be referred to as a statement of net worth or a statement of financial position. Balance sheet model and example of balance sheet A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity.

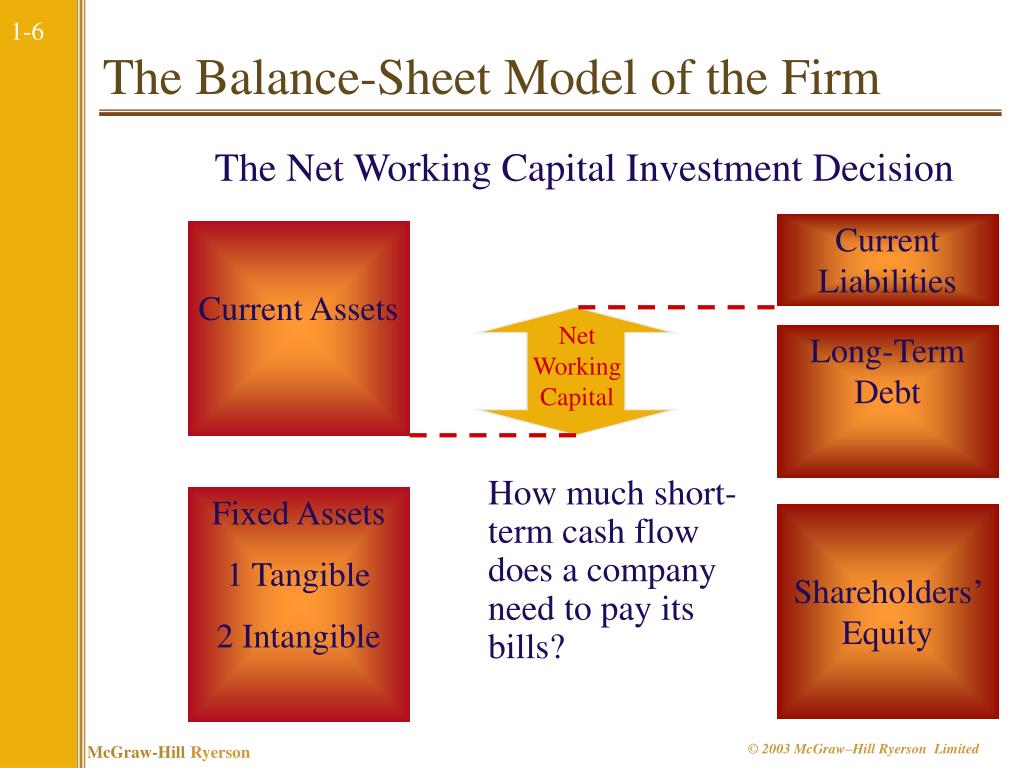

Assets = liabilities + owners’ equity 3.1 balance sheet model of a firm business firms require money to run their operations. 1.3.6 in addition to allowing for changes in scr and rm, there may be other important areas of difference between a firm’s scr model and a stochastic full balance sheet model.

Conceptually, working capital is a measure of a company’s short. The investors get a reasonable return on their investment, and the firms get the badly needed capital. Using the balance sheet model of the firm, corporate finance may be thought of the analysis of three primary subject areas.

This money, or capital, is provided by the investors. The purpose of the model is to enable firms to understand the key We start the balance sheet forecast by forecasting working capital items.

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)