Beautiful Tips About At December 31 The Unadjusted Trial Balance Of H&r

![[Solved] The unadjusted trial balance as of December 31, 2021, for the](https://media.cheggcdn.com/media/b23/b235e62a-d319-4d64-84e9-64d073112728/phpSWooe1.png)

Next year, those customers are expected.

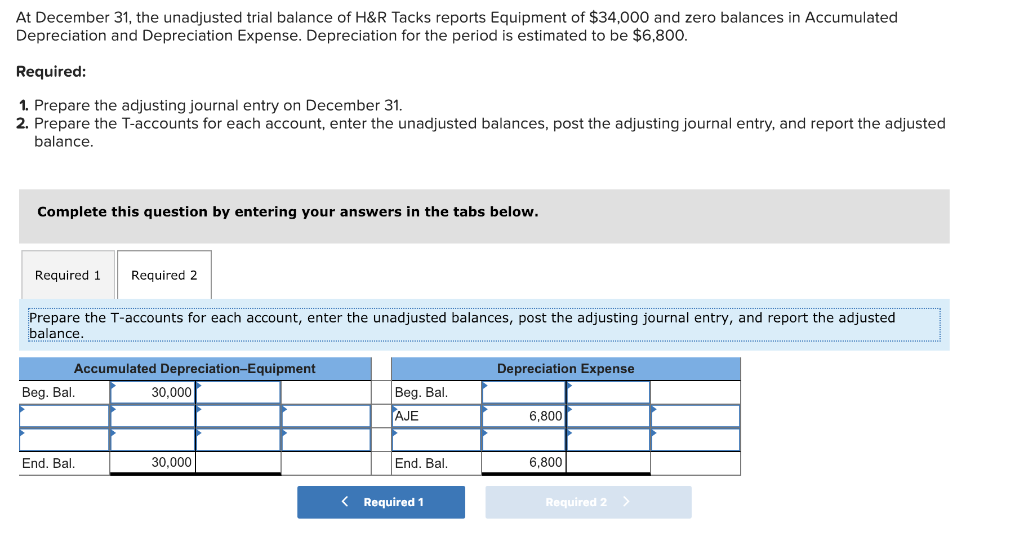

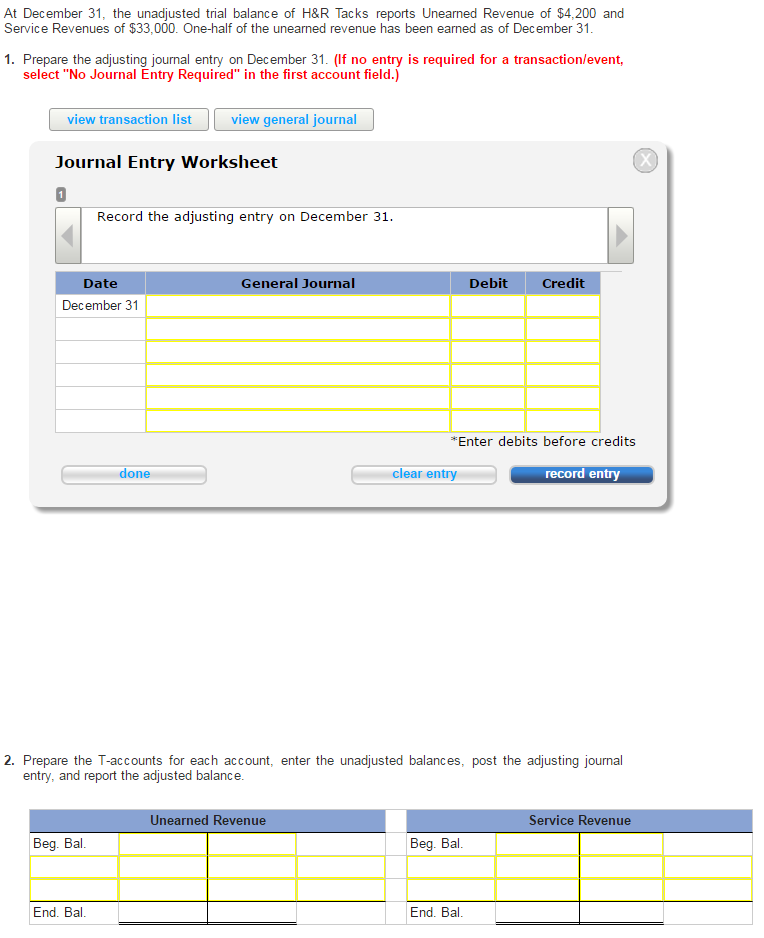

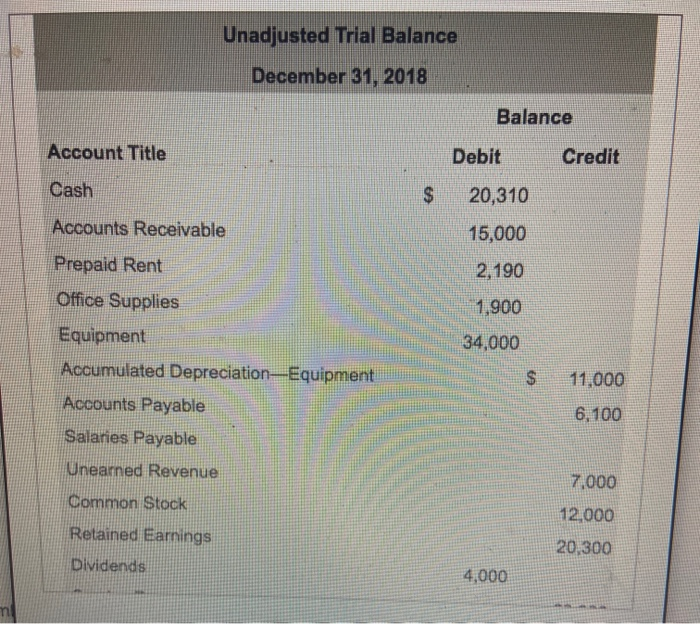

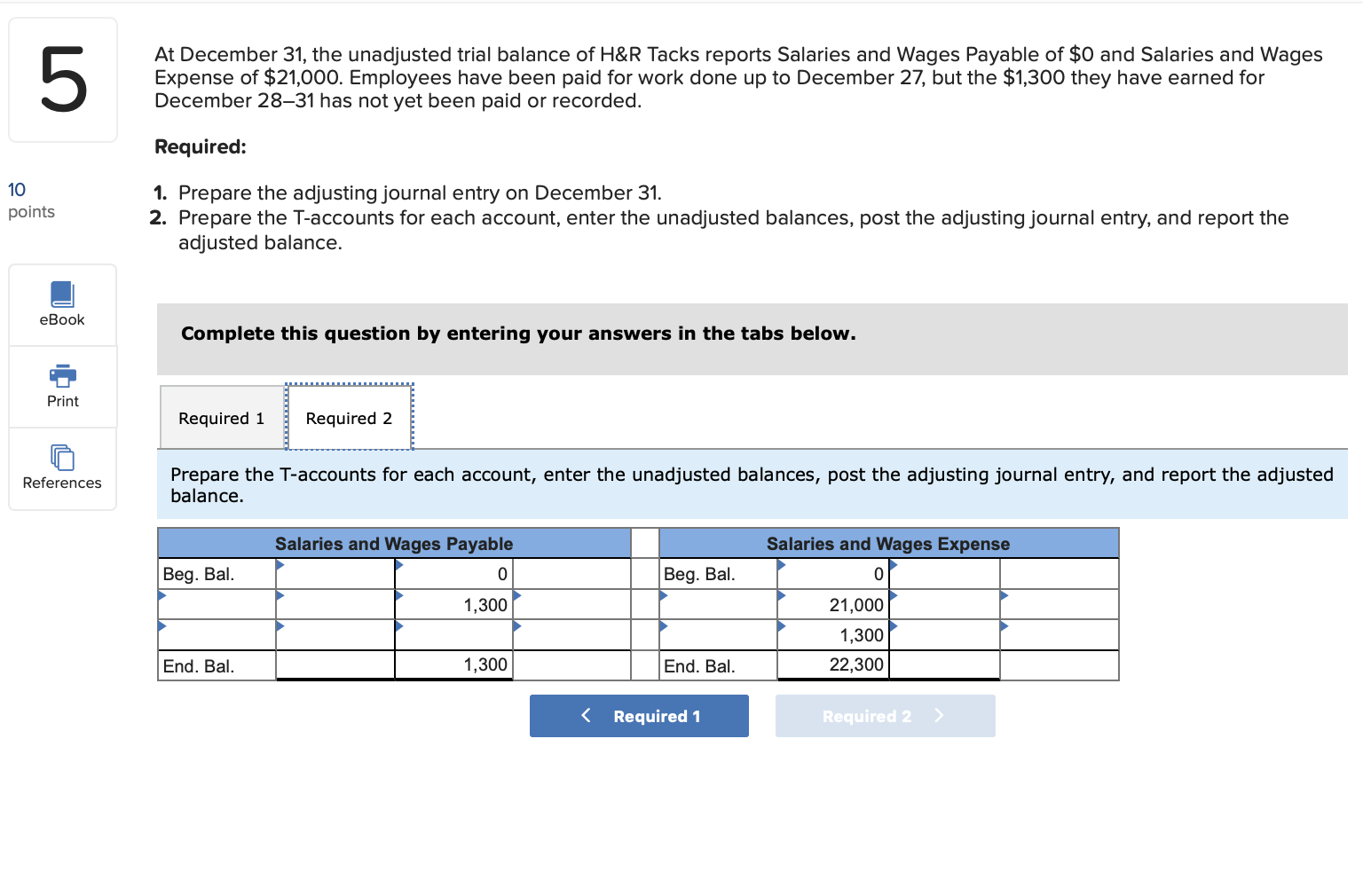

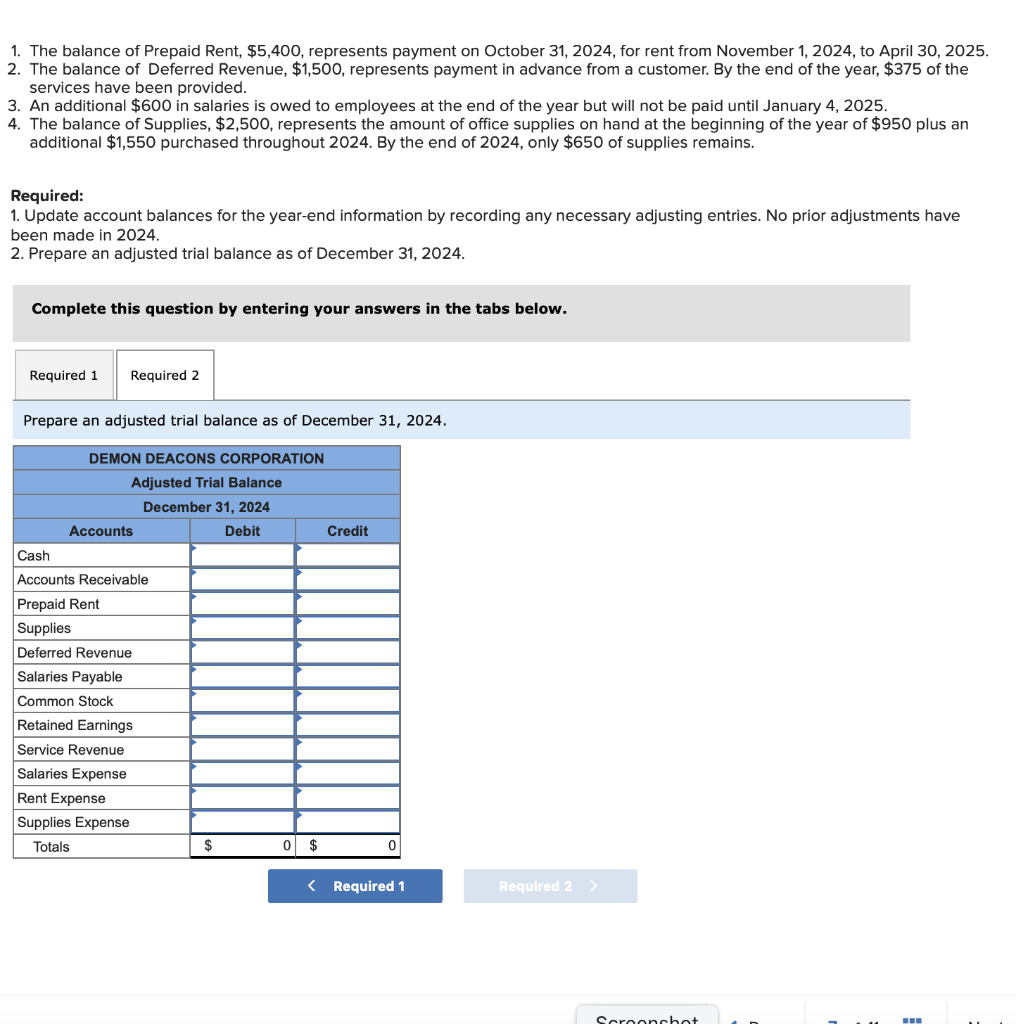

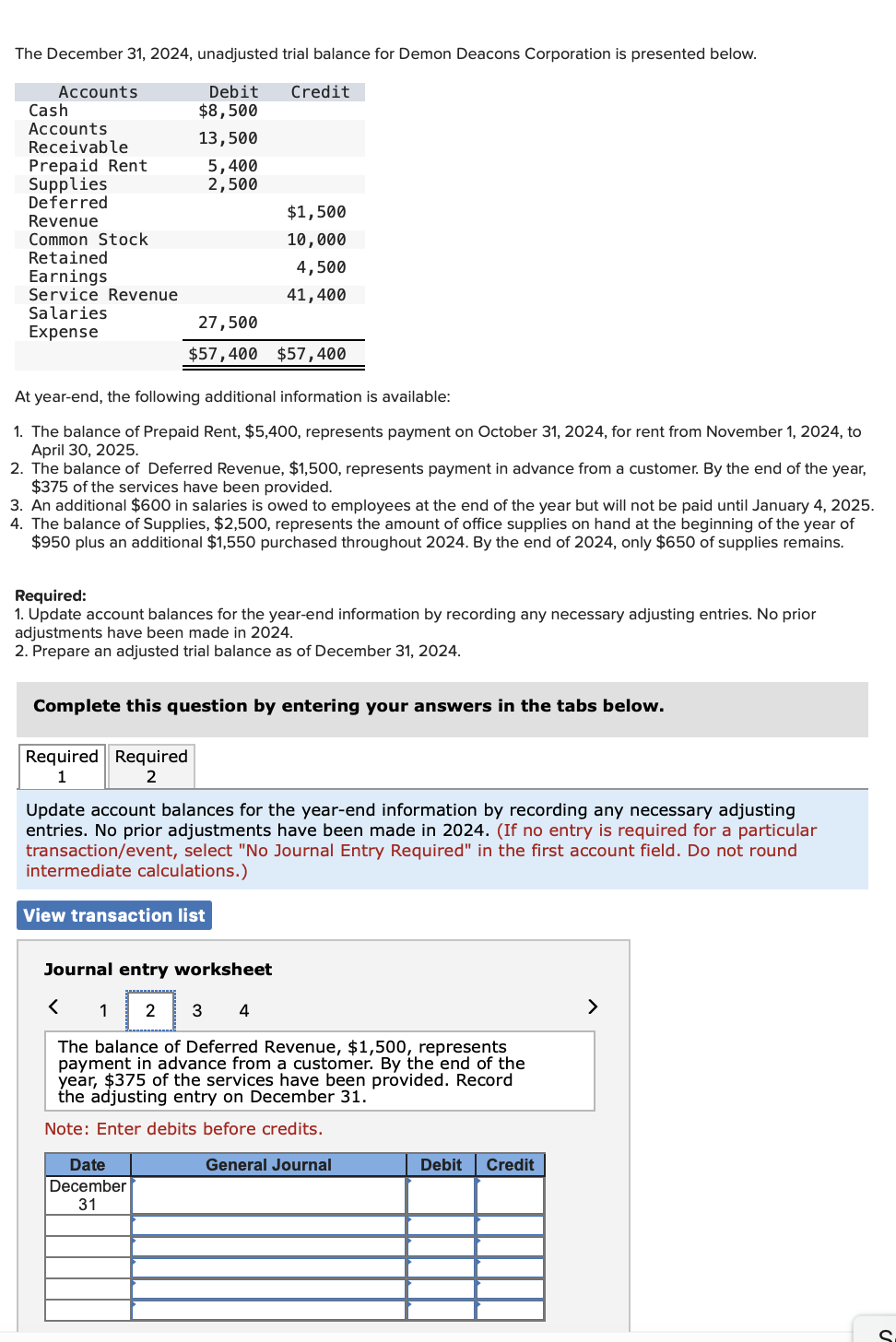

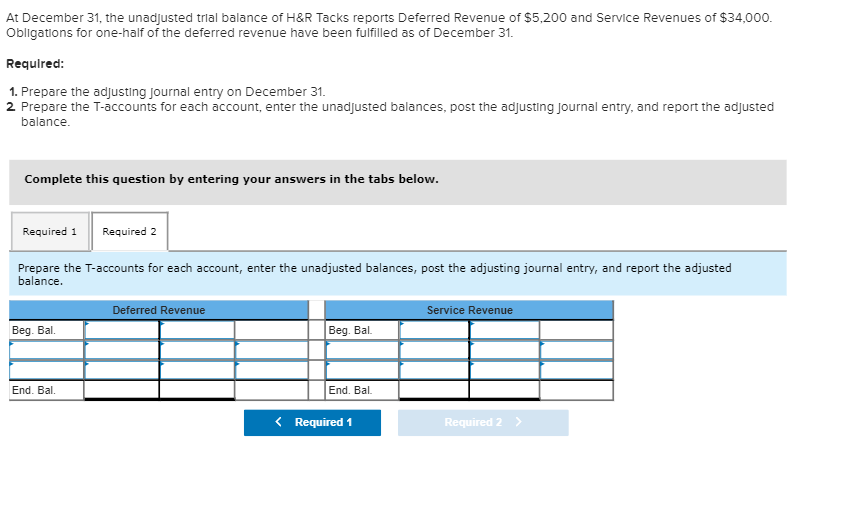

At december 31 the unadjusted trial balance of h&r. On december 31, supplies costing $7,400 are on hand. Solutions expert solution adjusting entry t account ekkarill92 answered 1 year ago next > < previous related solutions at december 31, the unadjusted trial balance of h&r. At december 31, the unadjusted trial balance of h&r tacks reports deferred revenue of $5,200 and service revenues of $34,000.

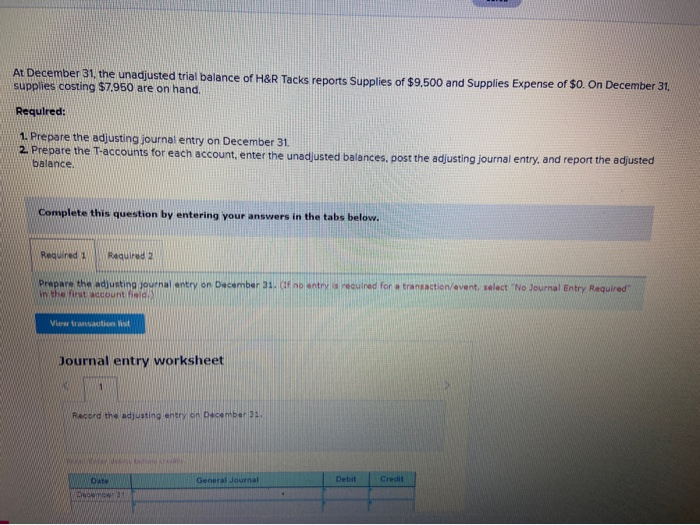

At december 31, the unadjusted trial balance of h&r tacks reports supplies of $8,400 and supplies expense of $0. You said no adjustments have been made, and it's december 31st. At december 31, the unadjusted trial balance of h&r tacks reports salaries and wages payable of $0 and salaries and wages expense of $20,000.

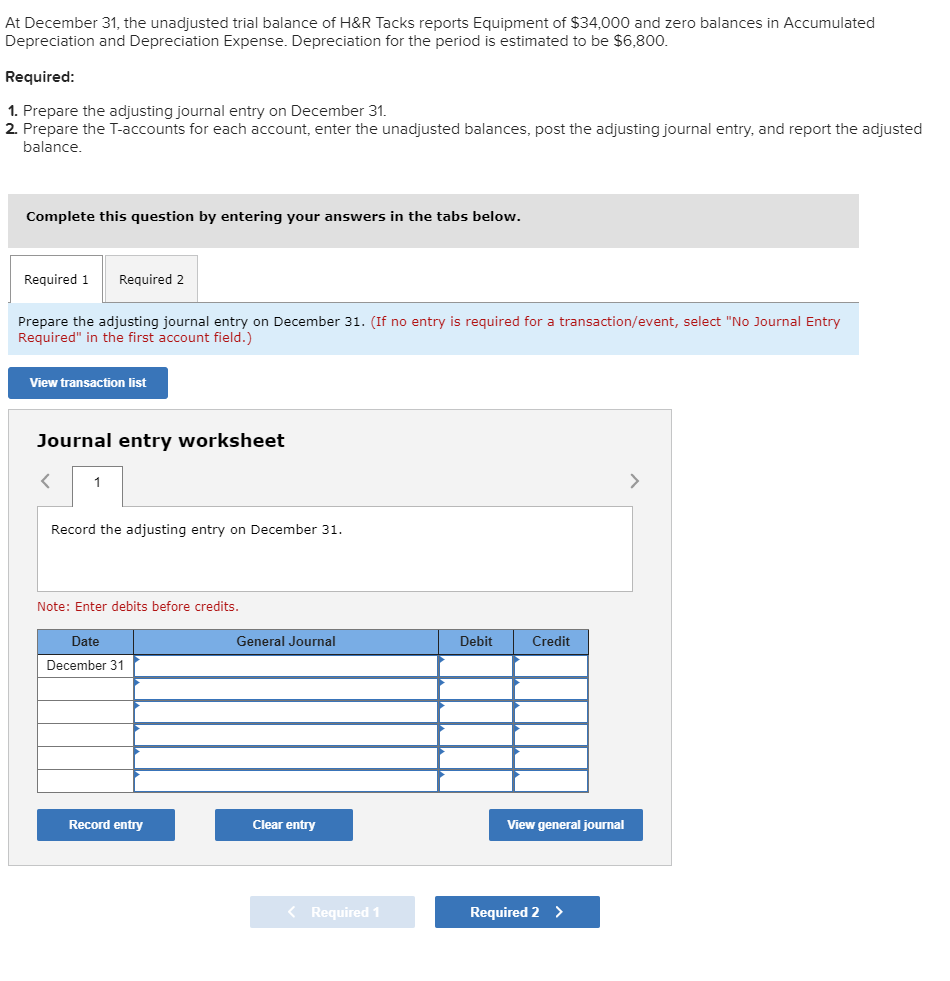

At december 31, the unadjusted trial balance of h&r tacks reports supplies of $8,500 and supplies expense of $0. The insurance was purchased on july 1 and. At december 31, the unadjusted trial balance of h&r tacks reports equipment of 31,500 and zero balances in accumulated depreciation and depreciation expense, depreciation.

At december 31, the unadjusted trial balance of h&r tacks reports interest payable of $0 and interest expense of $0. Interest incurred and owed in december totals $460. Accounting questions and answers.

At december 31, the unadjusted trial balance of h&r tacks reports supplies of $8,400 and supplies expense of $0. At december 31, the unadjusted trial balance of h&r tacks reports prepaid insurance of $6,000 and insurance expense of $0. On december 31, supplies costing $7,450 are on.

At december 31, the unadjusted trial balance of h&r tacks reports prepaid insurance of $5,040 and insurance expense of $0. The insurance was purchased on july 1 and. On december 31, supplies costing $7,400 are on hand.

At december 31, the unadjusted trial balance of h&r tacks reports prepaid insurance of $6,960 and insurance expense of $0. At december 31, the unadjusted trial balance of h&r tacks reports deferred revenue of $4,400 andservice revenues of $33,200. At december 31, the unadjusted trial balance of h&r tacks reports prepaid insurance of $5,040 and insurance expense of $0.

At december 31, the unadjusted trial balance of h&r tacks reports software of $34,500 and and zero balances in accumulated amortization and amortization expense. In this example, we're going to practise adjusting entries and our company provided 2000 services to customers. On december 31, supplies costing $7,200 are on hand.

The adjusting entry from july 1 to december 31 is 6 months old, so we get 5 free video unlocks on our app. At december 31, the unadjusted trial balance of h&r tacks reports software of $18,500 and and zero balances in accumulated amortization and amortization expense. The insurance was purchased on july 1 and.

![[Solved] As of December 31, 2018, XYZ Company's un SolutionInn](https://s3.amazonaws.com/si.experts.images/questions/2020/10/5f7aff98adb6a_1601896346800.jpg)

![[Solved] Consider the unadjusted trial balance of SolutionInn](https://s3.amazonaws.com/si.question.images/images/question_images/1560/3/4/5/7055d00fc69236981560328702178.jpg)