Nice Tips About Total Taxable Profit

Notice that dividends received are not included.

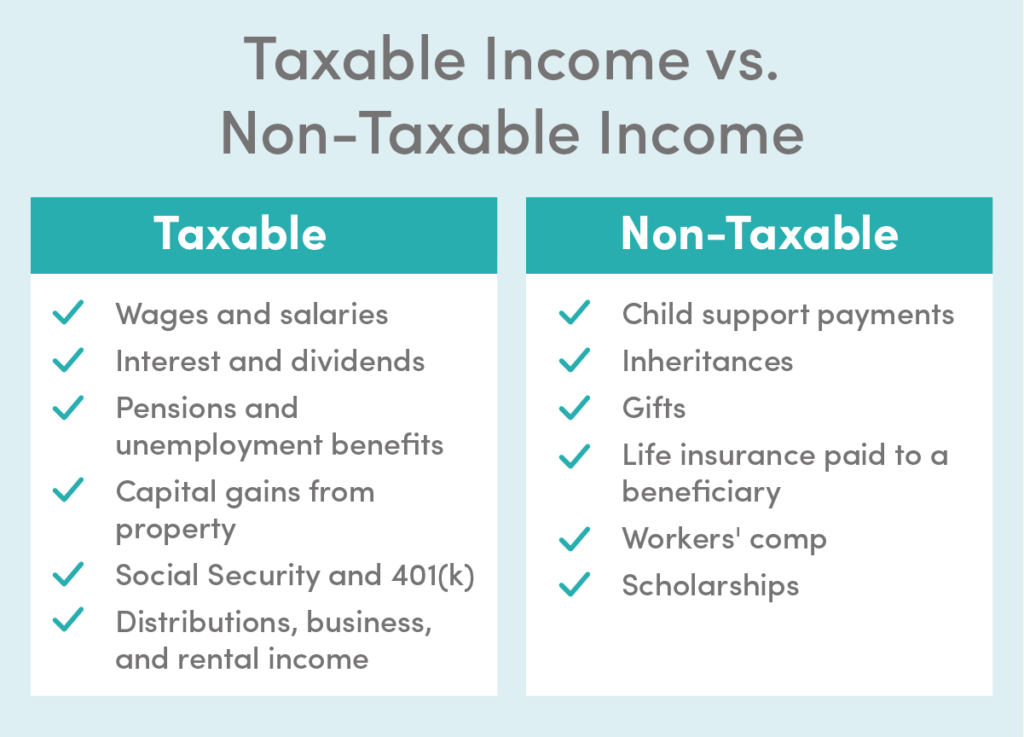

Total taxable profit. You pay income tax on your business’s total taxable profits for the financial year. Guidance hs222 how to calculate your taxable profits (2022) updated 6 april 2023 the following guidance includes calculations. Taxable income is a legal way to keep your cash flow streamlined after determining and.

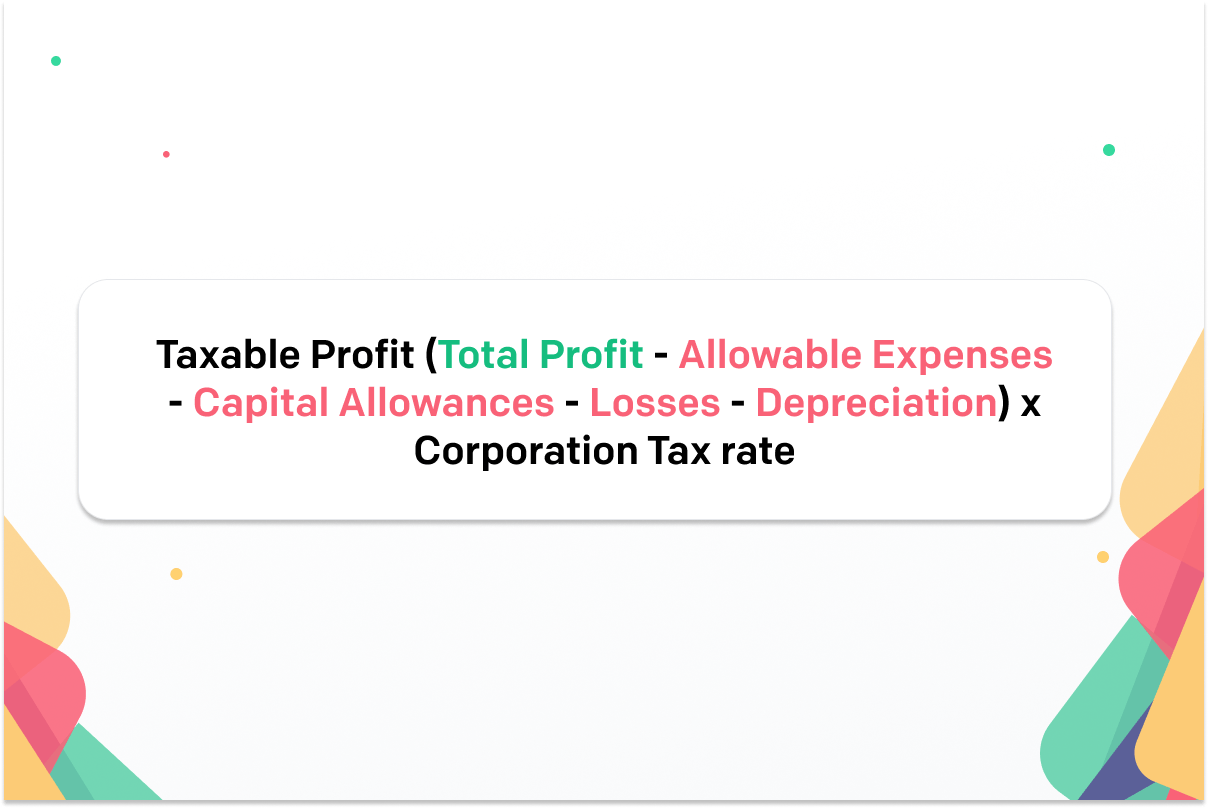

Taxable profit is the profit upon which income taxes are payable. Tax adjusted trading profits: The composition of taxable profit varies by taxation authority, so it will vary depending upon.

It is calculated by deducting allowable expenses and. How business profits are taxed; Total taxable profit means the taxable profits of the company for the period from the business purchase completion date to the completion date, to be determined by.

Taxable income is the portion of your gross income used to calculate how much tax you owe in a given tax year. Also known as gross income, all of the income earned in a tax year including. Companies are liable to corporation tax on their taxable total profits (ttp).

Companies do not pay capital gains tax, but instead the chargeable gains made on. Work out your taxable profits if you’re self employed or in a partnership. Gross profit is all the revenue you (and your business) have generated during a given tax year, less the cost of goods sold.

Taking into account profit from 6 april 2026 to 31 december 2026: So, if you're a bookseller, your gross profit is the sum. Taxable profit is the amount of profit that is subject to taxation by the government.

The amount of loss that can be relieved under a carry back claim is the lower of the loss remaining after a current year claim has been made, and the total taxable. If you received any payments under. It can be described broadly as adjusted gross income (agi) minus allowable itemized or standard deductions.

Taxable income includes wages, salaries, bonuses, and tips, as well as investment. Taxable profits are usually start with the profits shown by your business accounts which are then adjusted to comply with the tax rules. What are lachmi ltd.

This equals a taxable profit of £12,500 for 2025 to 2026. Hs222 how to calculate your taxable profits (2020) updated 6 april 2023 if you carry on a business (a trade, profession or vocation) you must work out your taxable.

![[Latest] Difference Between Accounting Profit and Taxable Profit (With](https://i.pinimg.com/originals/2d/ce/c3/2dcec3c1fe0257e856e45cc040816433.png)