Amazing Info About Income Statement T Accounts

The opposite is true for expenses and losses.

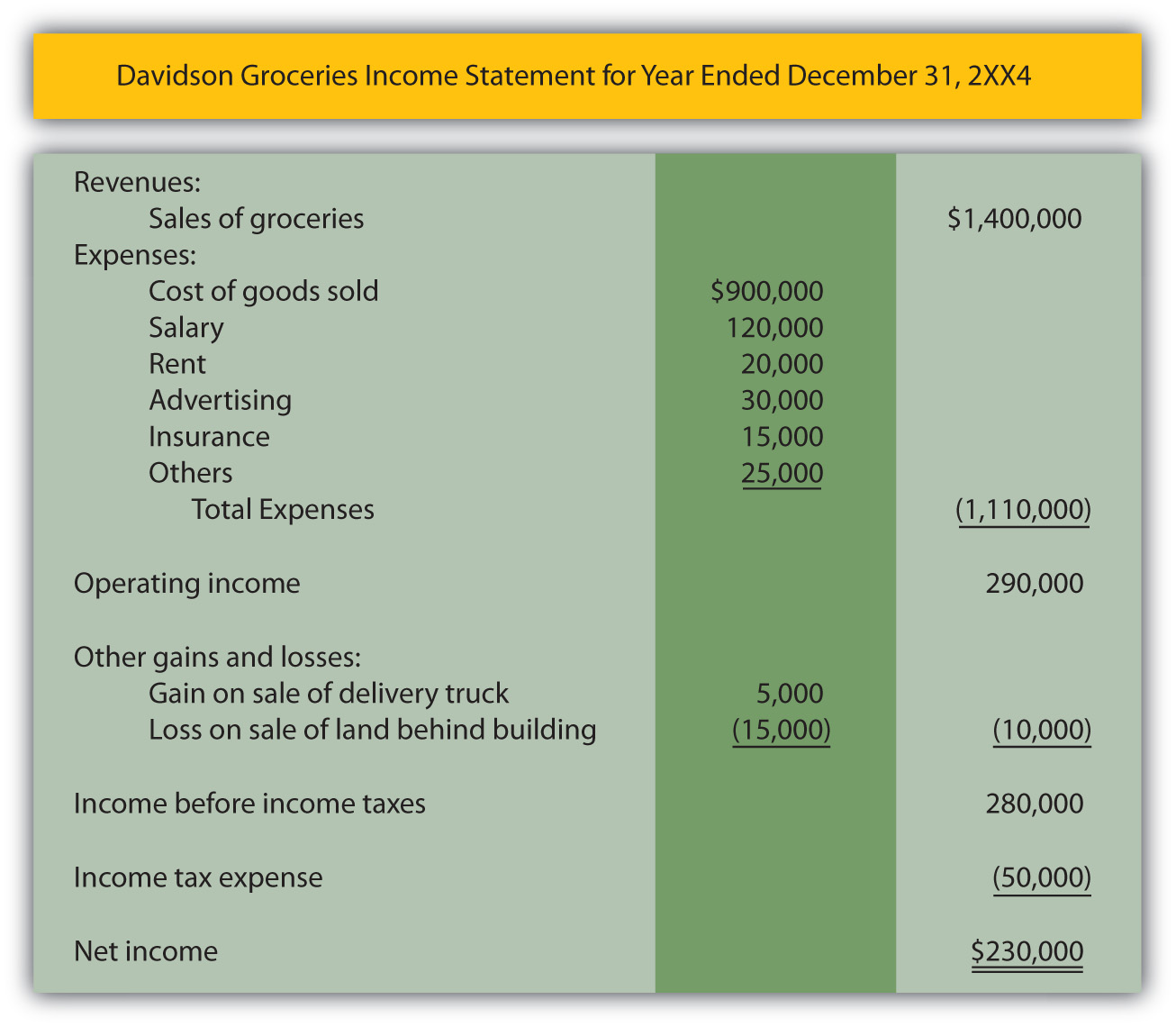

Income statement t accounts. What are income statement accounts? 2.1 describe the income statement, statement of owner’s equity, balance sheet,. The general ledger and t accounts work as intermediaries between primary documents, such as invoices or receipts, and the financial statements used by financial.

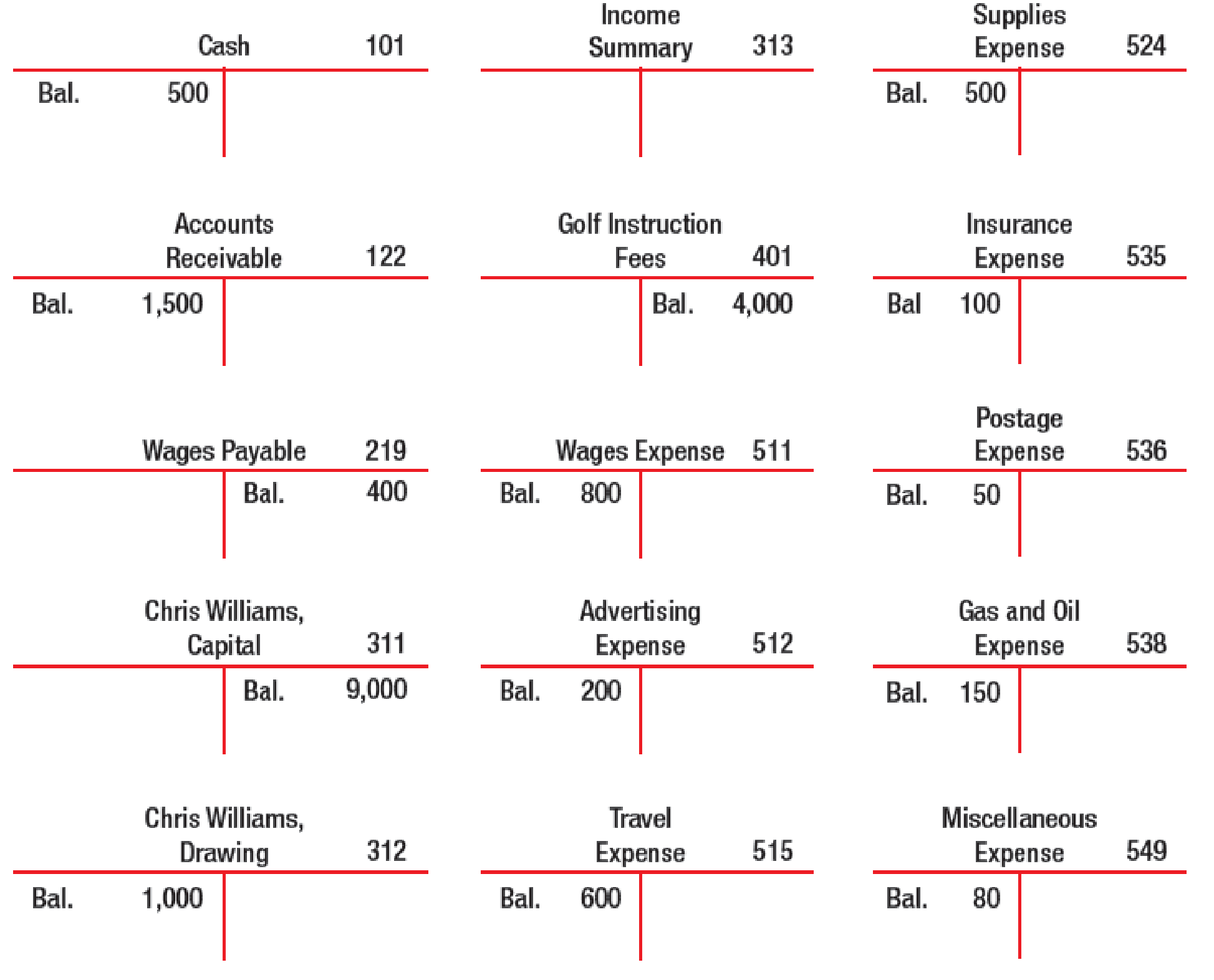

Debits (abbreviated dr.) always go on the left. T accounts the simplest account structure is shaped like the letter t. Revenue, expenses, gains, and losses.

Prepare a trial balance from t accounts. This satisfies the rule that each adjusting. Supplies is a balance sheet account, and supplies expense is an income statement account.

The tax breaks cost the. The account title and account number appear above the t. Prepare an income statement, a statement of owner's equity, and a.

Story by [email protected] (india.com news desk)49m. T accounts are also used for income statement accounts as well, which include revenues, expenses, gains, and losses. Set up t accounts for revenue and expenses.

Impact on the financial statements: You pay taxes when you withdraw the money in retirement. T account template examples.

The first of our examples is for paying rent. Continuing our approach to political content on instagram and threads. Income statement accounts are those accounts in the general ledger that are used in a firm’s profit and loss.

The following steps show how to record. Once again, debits to revenue/gain decrease the account while credits increase the account. The income statement focuses on four key items:

The account title is written above the horizontal part of the t. Putting all the accounts together, we can examine the. We want instagram and threads to be a great experience for everyone.