Real Tips About Treatment Of Opening Stock In Trial Balance

Tally solutions | updated on:

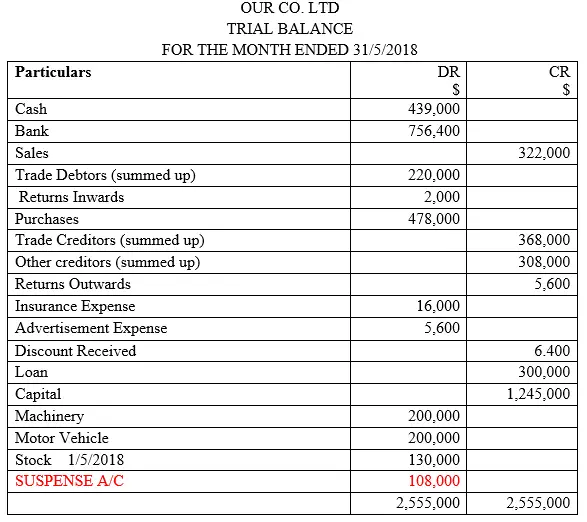

Treatment of opening stock in trial balance. The closing stock normally will not be a part fot he trial balance as there is. December 13, 2021 rules to prepare the trial balance steps to prepare trial balance specimen of trial balance example of trial. Because the closing stock a/c appears but both the purchases a/c and the trading a/c do not appear in the trial balance, we may assume that the closing stock has been recorded by crediting an account that was used to ascertain the cost of goods sold like the cost of goods sold a/c.

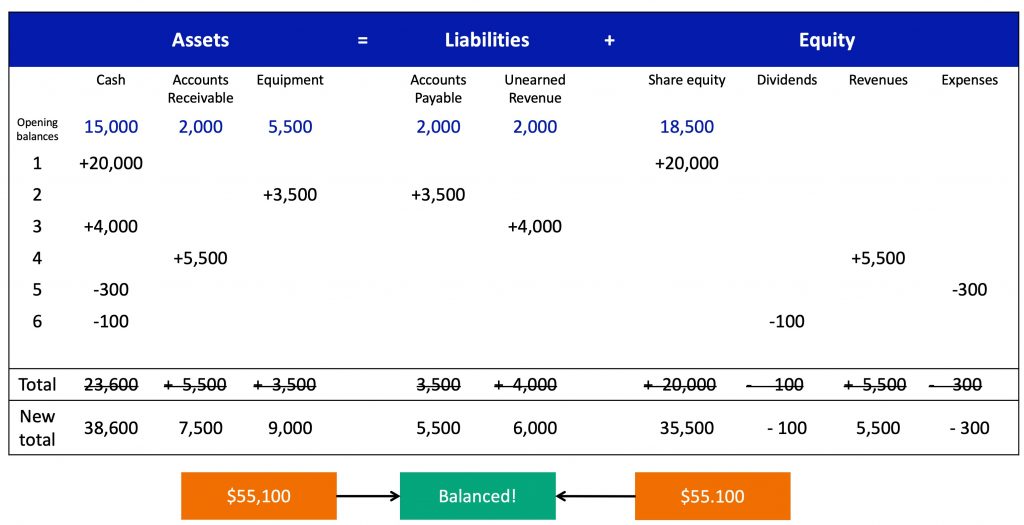

In this video you will learn the adjustment of closing stock in trial balance. To get the numbers in these. The figures in the trial balance will usually be the amounts paid in the period, and they need adjusting for outstanding amounts and amounts paid which relate to other periods to.

When closing stock is shown inside the trial balance. Preparing an unadjusted trial balance is the fourth step in the accounting cycle. Why is closing stock not appearing in trial balance?

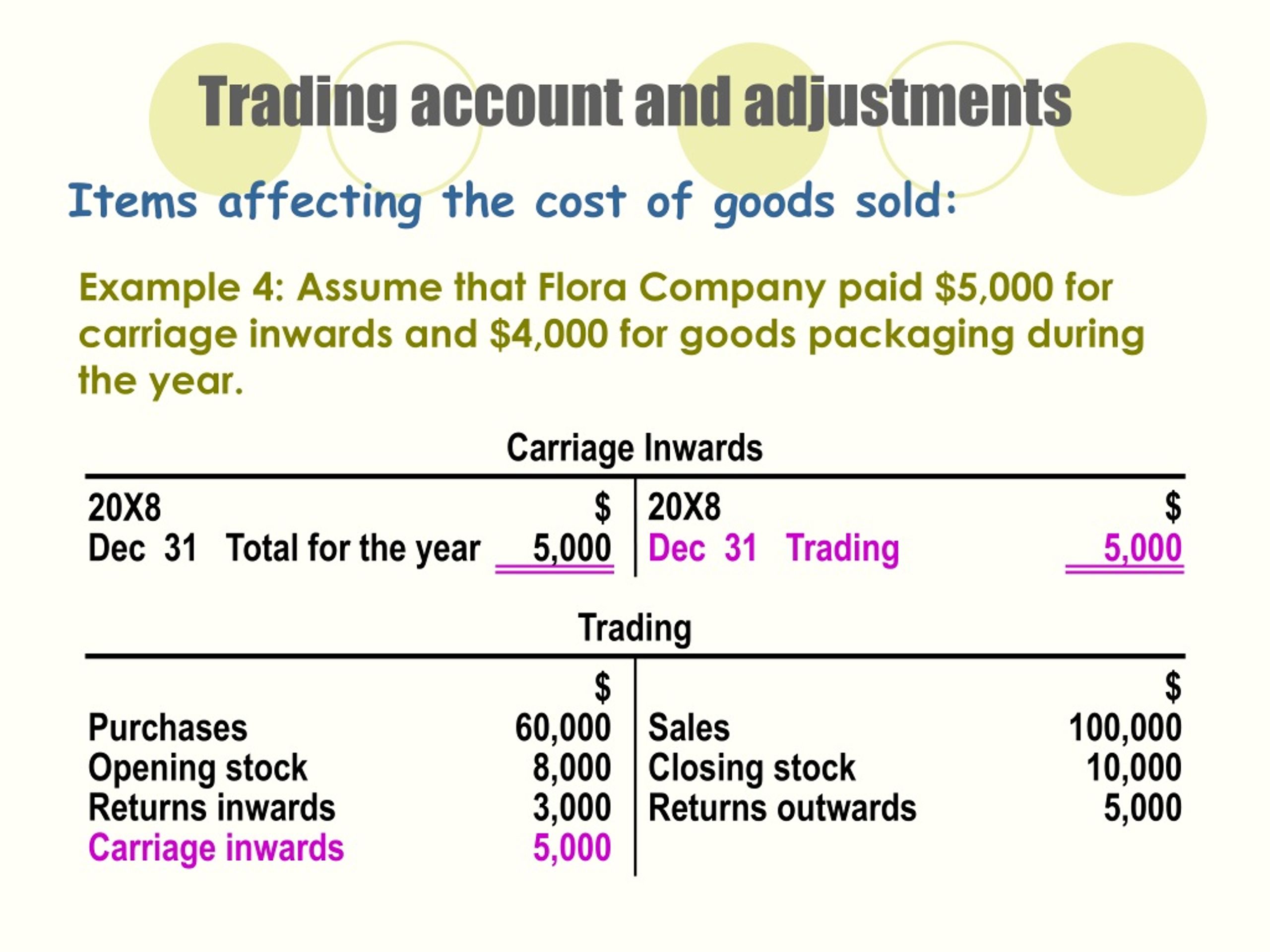

If both purchase and the closing stock is shown in the trial balance, there will be a mismatch of 1,500 mt (1,500 mt x 375) = $ 562,500 because the effect has. If not cost of goods. The next step is to record information in the adjusted trial balance columns.

As the closing stock is an item outside the trial balance, we need to treat it twice. Closing stock is the balance of unsold goods that are remaining from the purchases made during an accounting period. From this information, the company will begin constructing each of.

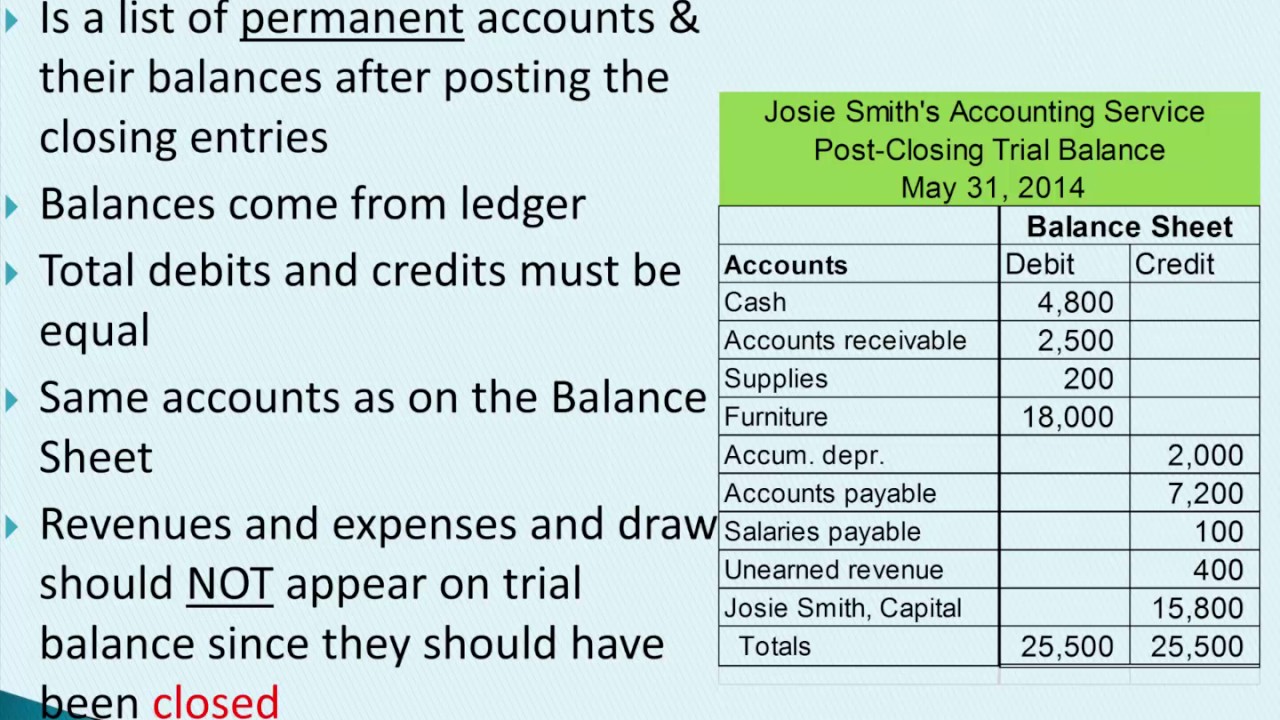

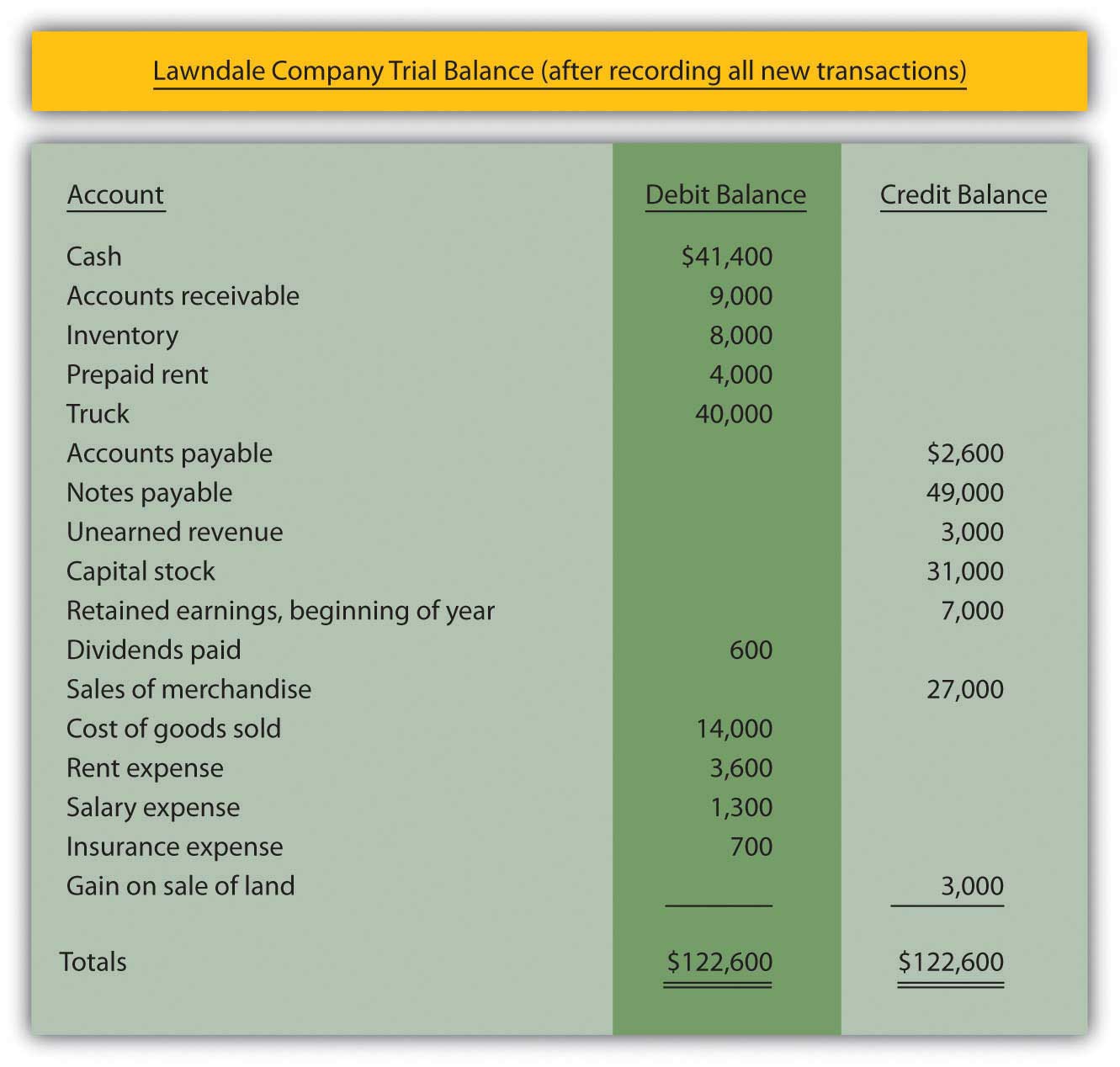

Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. If the amount of the closing stock is already known and is recorded in the books, it is shown in the trial balance itself and it means that both the opening as well as closing stocks. Whatever stock of goods is remaining at the end of an accounting year is known as ‘closing stock’.

To prepare the financial statements, a company will look at the adjusted trial balance for account information. Accounting treatment the unsold stock has the following aspects: A trial balance is a list of all accounts in the general ledger that have nonzero balances.

Opening inventory is brought forward from the previous period’s ledger account and charged to the income statement as follows:. The opening stock (last year’s unsold purchases) will appear on the opening trial balance on the debit side and will be classified as current assets. Firstly, the unsold stock is left out of the opening stock and purchases that have already been.

Thus, it will appear in the trading account and also in the balance sheet. Trial balanceclass xi accountstreatment of opening and closing stock adjusted purchasecost of goods sold This statement comprises two columns:.

The adjustments total of $2,415 balances in the debit and credit columns. Extended tb in order to.