Fun Info About Capital Injection Balance Sheet

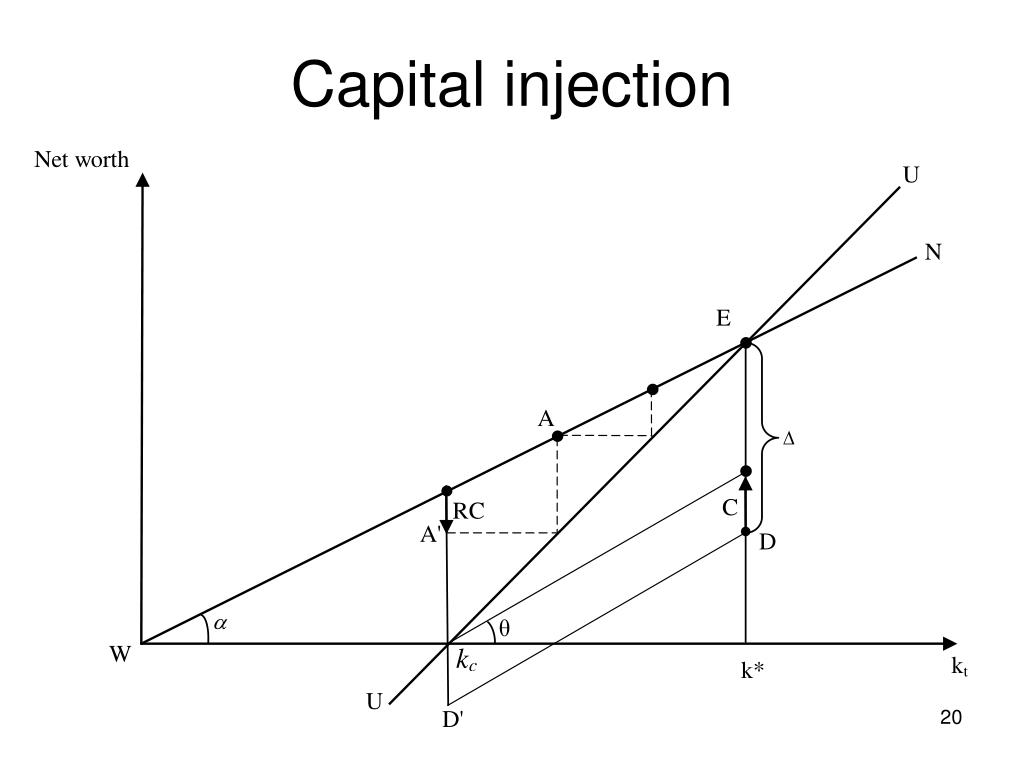

A capital injection involves the infusion of capital, often in the form of cash, equity, or debt, into a project, company, or investment.

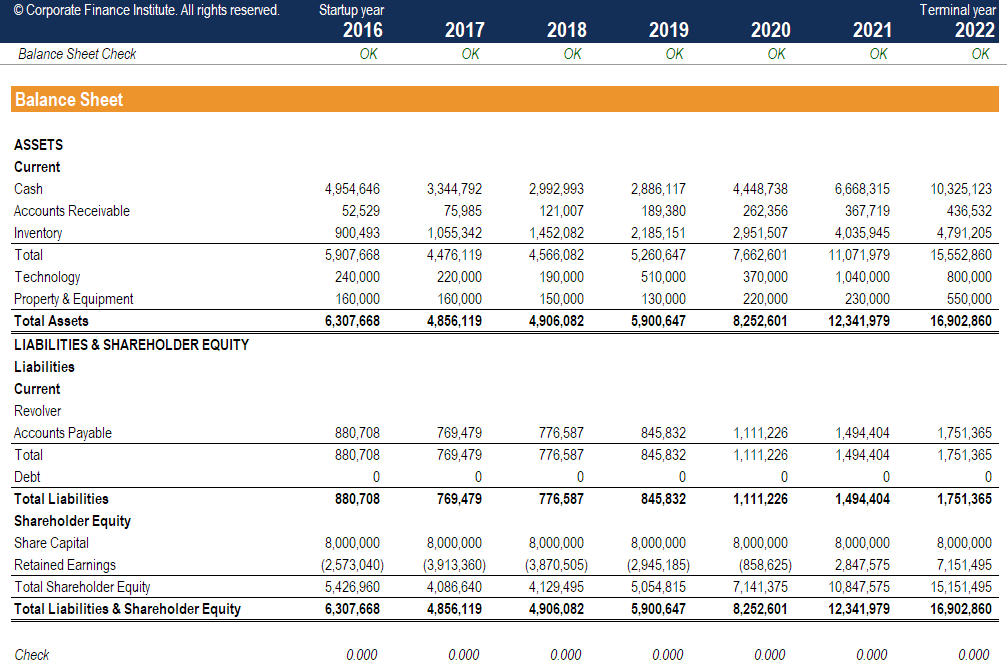

Capital injection balance sheet. The runoff of the bond portfolio has brought the total size of the fed’s balance sheet down by more than $1 trillion as of november, from a record peak of near. Capital introduction bookkeeping entries explained. The assets are highly likely to include cash, fixed assets, and so on.

The recording of capital contribution will impact both assets and equity section of balance sheet. A capital injection is a financial sector term that refers to an infusion of cash into a company or financial institution. Oftentimes, the word injection implies that the company or organization receiving funding may be in financial distress.

On the balance sheet, it represents the accounting equation in which assets are equal to liability plus equity. A capital injection is an investment of capital into a project, company, or investment, typically in the form of cash, equity, or debt. Updated june 24, 2022.

A balance sheet is a financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time. In year 2 the business makes has net income of 500 and retains this within. As fixed assets age, they begin to lose their value.

As the car is newly purchased, we can use the. Capital injection is an investment of capital into a company or institution, typically in the form of cash, equity, or debt. Companies receiving the capital injections usually give up equity to the injectors, and sometimes they even give.

Contributed capital may also refer to a company's balance sheet item listed under stockholders' equity, often shown alongside the balance sheet entry for additional. Lately, we’ve had a lot of questions around how startups record equity on the balance sheet. There are 2 ways that startups record equity on the.

Any withdrawal or advance of money to private limited companies by shareholders are recorded separately in the balance sheet account called amount due. Fubon insurance is perceived to have adequate balance sheet strength, operating performance, business profile, and enterprise risk management, along with support from. The company needs assets to operate the business to make a profit.

The french government’s latest €10.5bn ($13.4bn) capital injection offered to six banks is aimed more directly at bolstering the banks’ balance sheets. Axa enters its new strategic plan in a position of strength. Injection of capital if a director of the business was to inject a sum of money into an established company (i.e.

So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. When a company is first created, if its only asset is the cash invested by the shareholders, the balance sheet is balanced with cash on the left and share capital on the right side. We have transformed the group and delivered consistent execution of our “driving progress 2023” plan,.

This comes from either the government or private. The word injection connotes that the. Capital will maintain on balance sheet unless owner decides to withdraw or change the capital structure.

:max_bytes(150000):strip_icc()/syringe3-56912ef43df78cafda818c14.jpg)