Best Tips About Balance Sheet Profit

Evaluates a company's financial performance over a specific period, such as a month, quarter, or year.

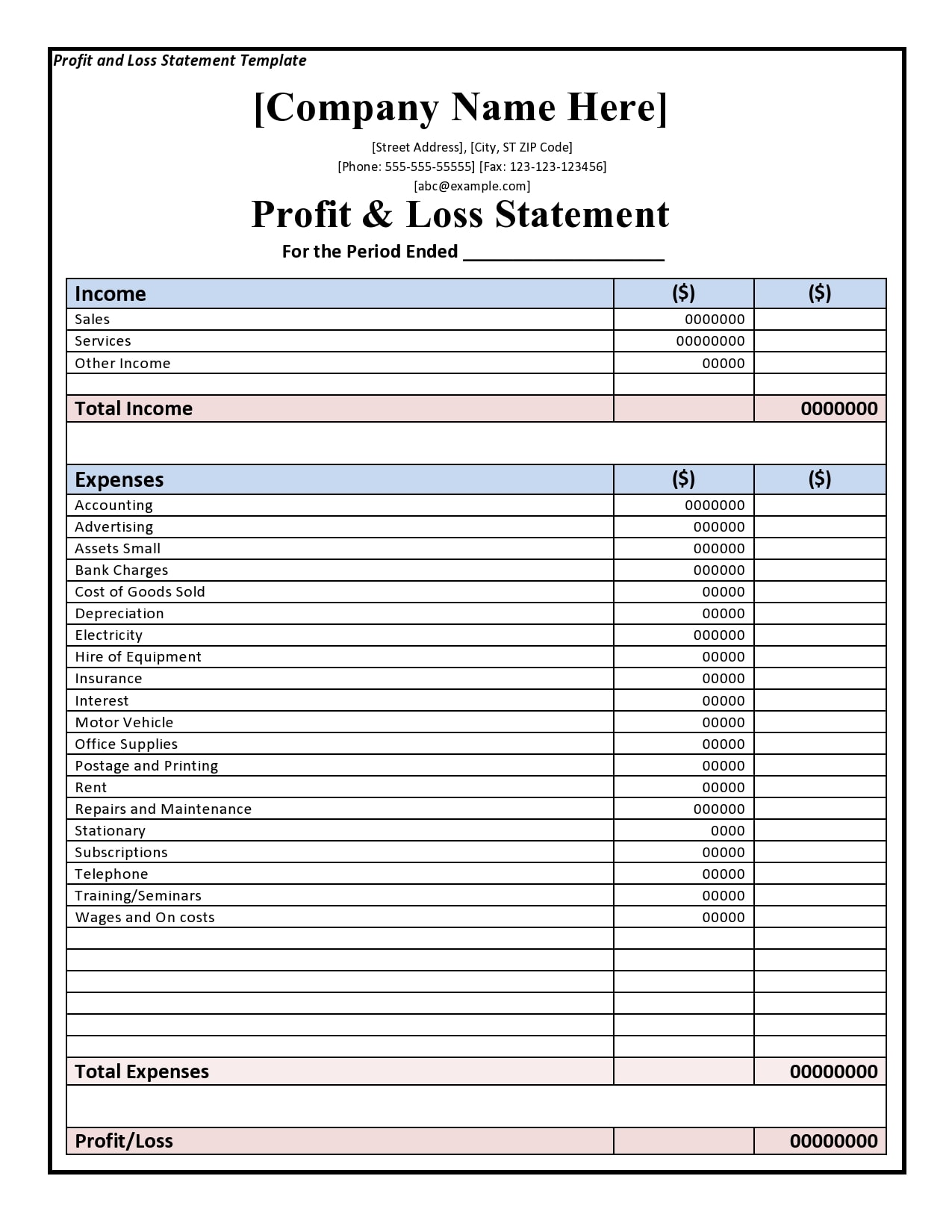

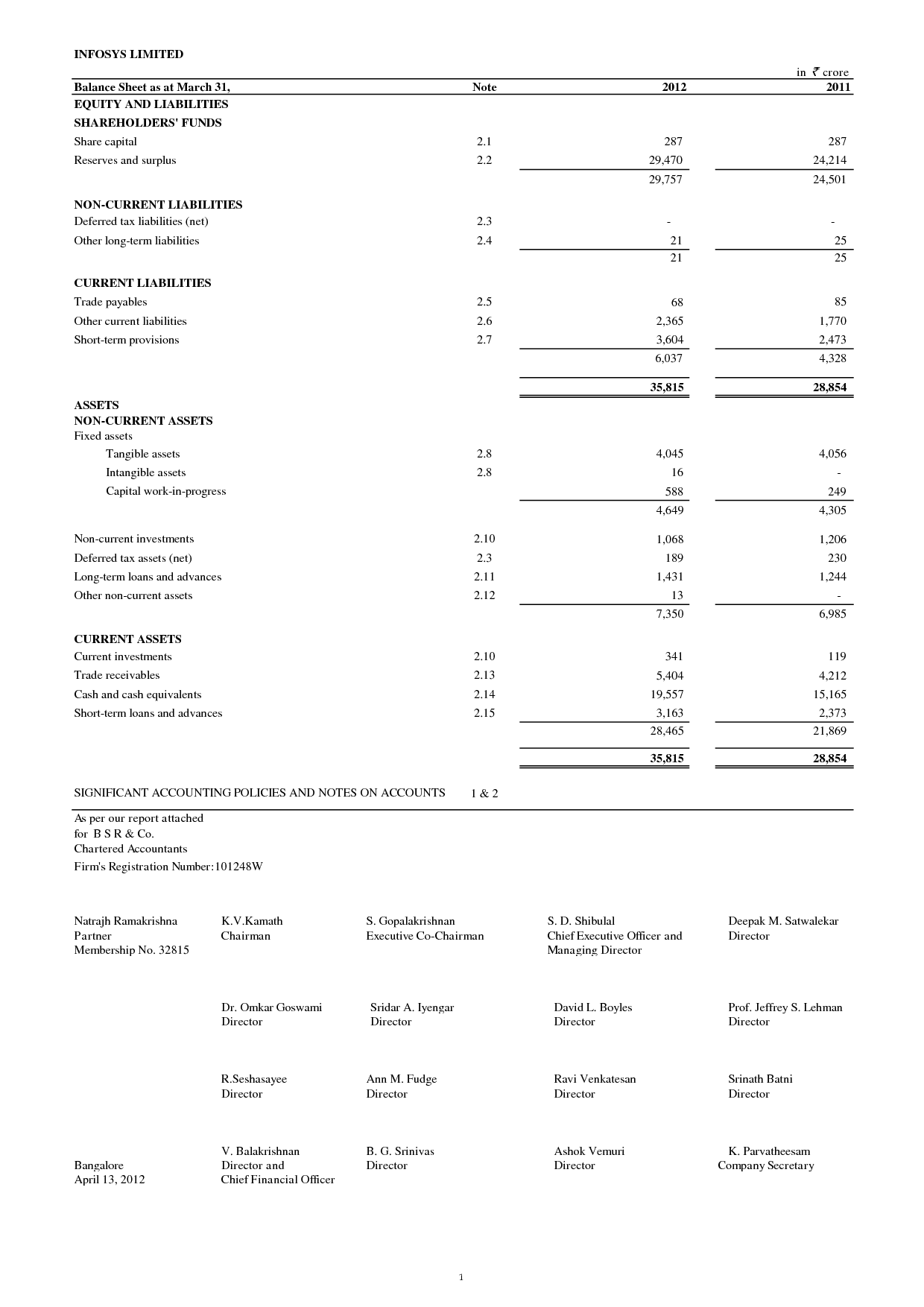

Balance sheet profit. Profit is the result of revenues minus expenses. An income statement, also known as a profit and loss (p&l) statement, summarizes the cumulative impact of revenue, gain, expense, and loss transactions for a given period. The organization’s assets (such as cash, investments, property and.

A balance sheet should always balance. Profit and loss statement (income statement) The european central bank’s (ecb’s) audited financial statements for 2023 show a loss of €1,266 million (2022:

Fed minutes suggest officials are seeking smallest balance sheet possible. A profit and loss (p&l) statement is one of the three types of financial statements prepared by companies. Does the balance sheet always balance?

July 13, 2022 when looking at your financial statements, there are three main types that you will issue on a regular basis: If your operating earnings change from $21,052.44 to $23,443.33, that might not tell you much by itself, because other numbers might have changed as well. Days cash on hand measures liquidity and estimates how many days of organizational expenses could be covered with current.

Days cash on hand measures liquidity and estimates how many days of organizational expenses could be covered with current. It can be understood with a simple accounting equation: Below is a brief explanation of each of these financial indicators:

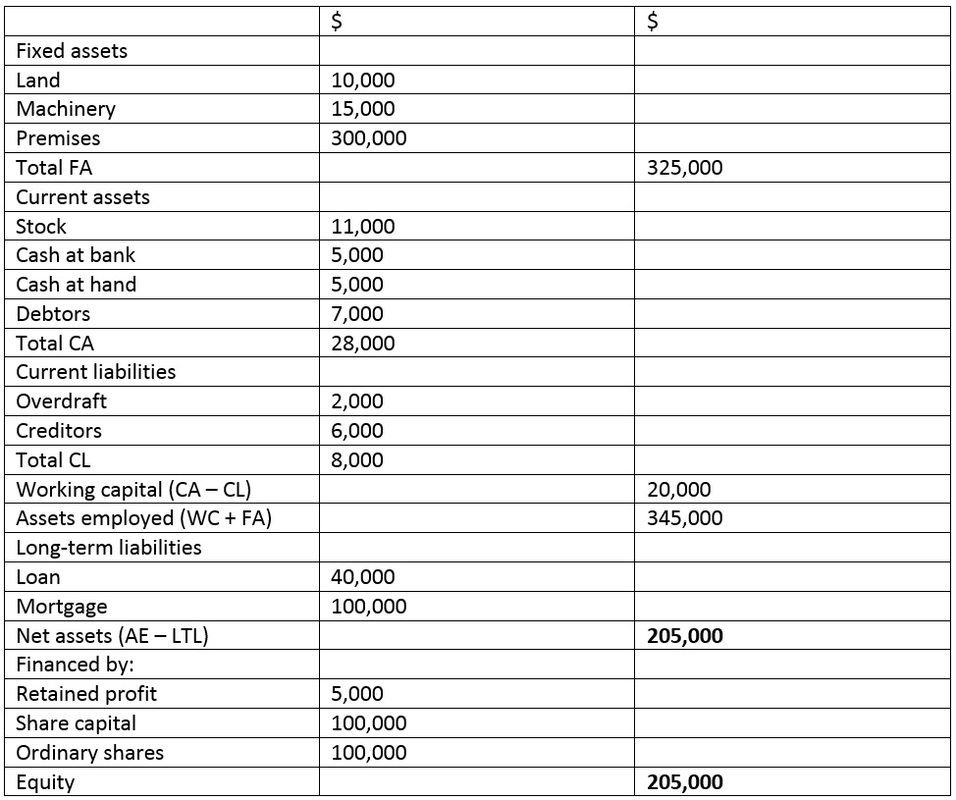

Profit and loss statement vs. Balance sheets provide the basis for. How profits change the balance sheet since all business transactions affect at least two accounts, there will likely be an enormous number of changes to the balance sheet.

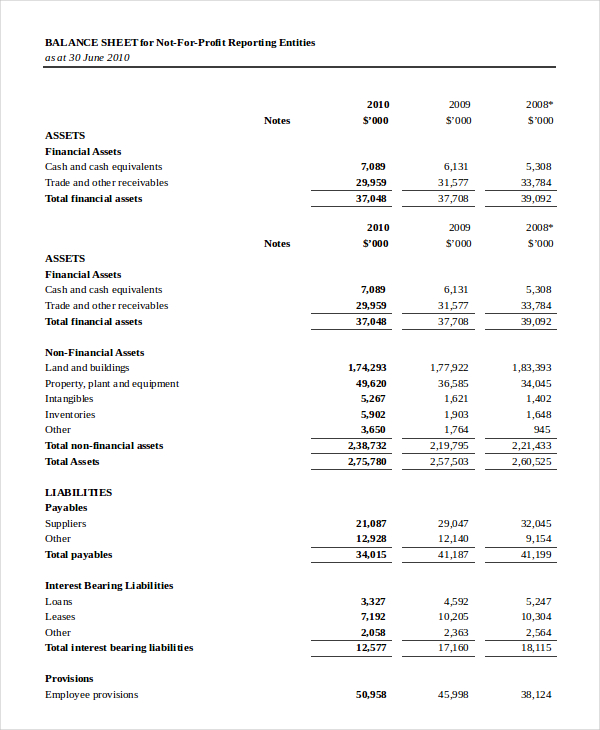

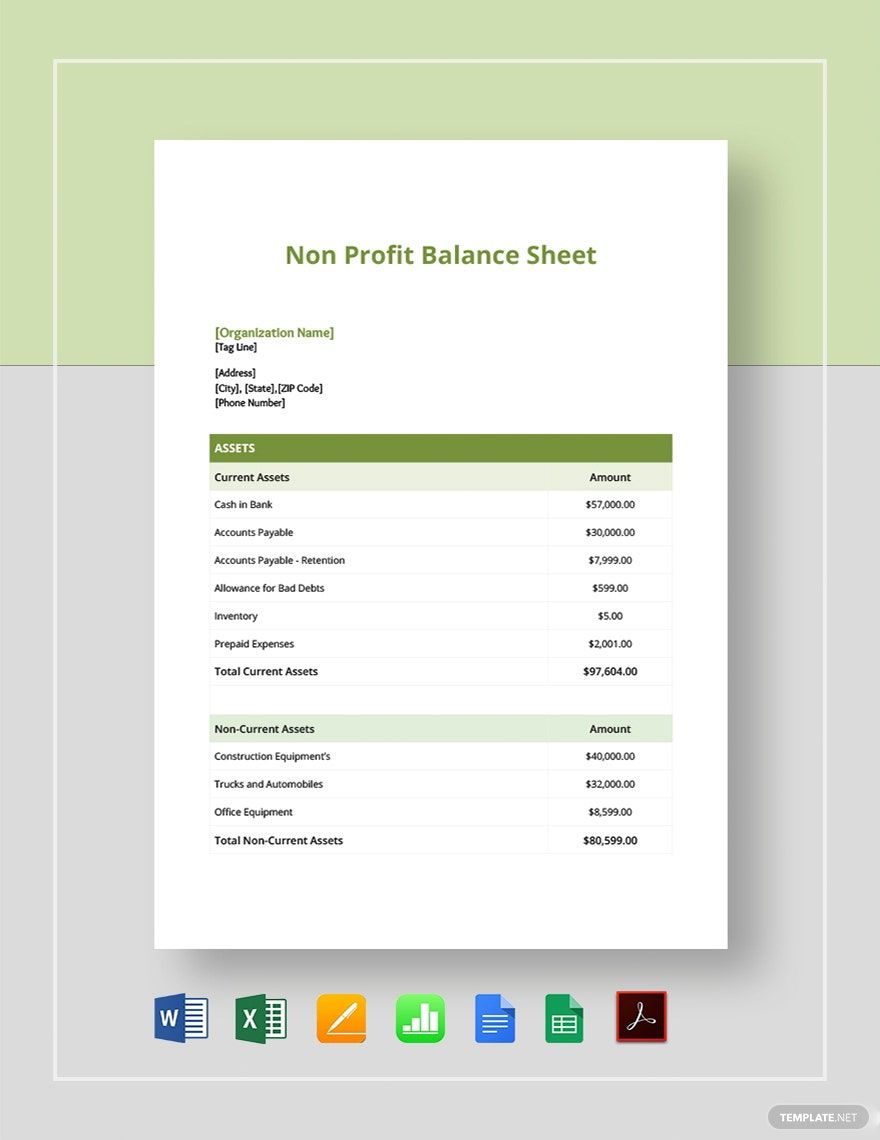

The three financial statements are: Profit and loss (p&l) statement balance sheet; A nonprofit balance sheet is technically known as a statement of financial position.

Policymakers said slower qt could ease shift to ample. The balance sheet, the profit and loss (p&l) statement, and the cash flow statement. The balance sheet has a lot of valuable information.

How to read an income statement. It is allowing up to $95 billion in treasury and mortgage bonds to. The fed more the doubled the size of its holdings starting in march 2020 to a peak of nearly $9 trillion, using bond purchases to stabilize markets and provide stimulus beyond the near zero.

Our balance sheet cheat sheet highlights six key measures that are useful for all types of nonprofits. Assets = liabilities + equity. It outlines three primary areas: