Peerless Info About Non Operating Items On The Income Statement

:max_bytes(150000):strip_icc()/dotdash_Final_Operating_Income_Aug_2020-01-e3ccd90db6224fc8b0bea6dac86e478f.jpg)

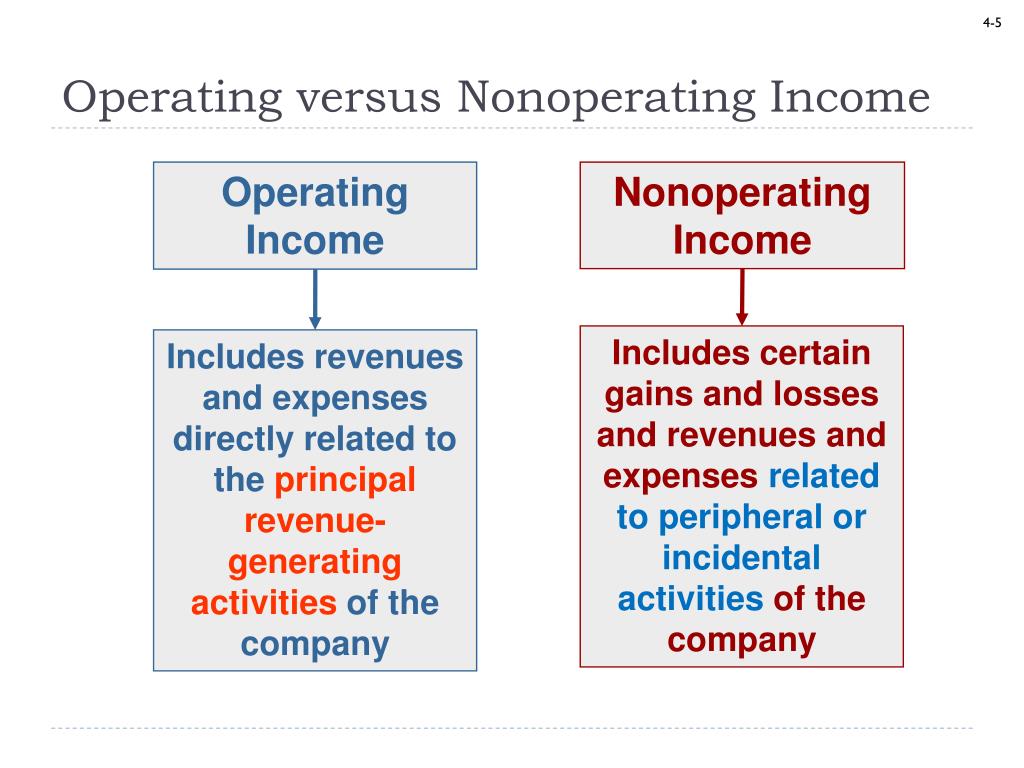

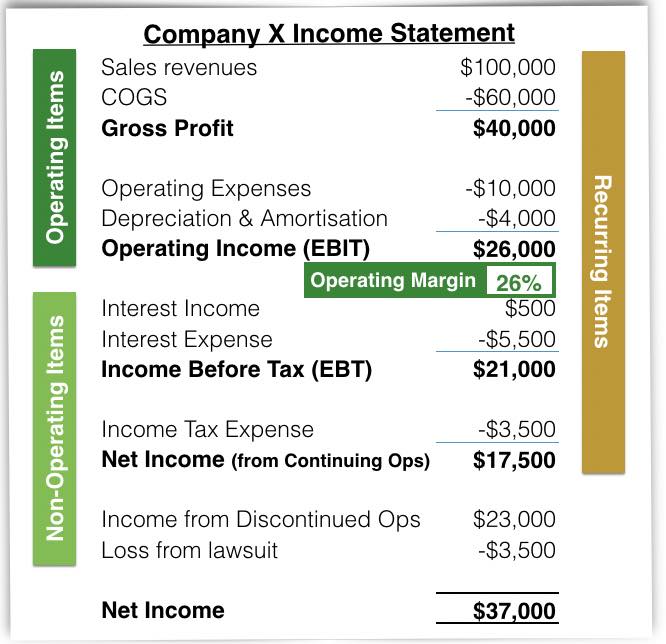

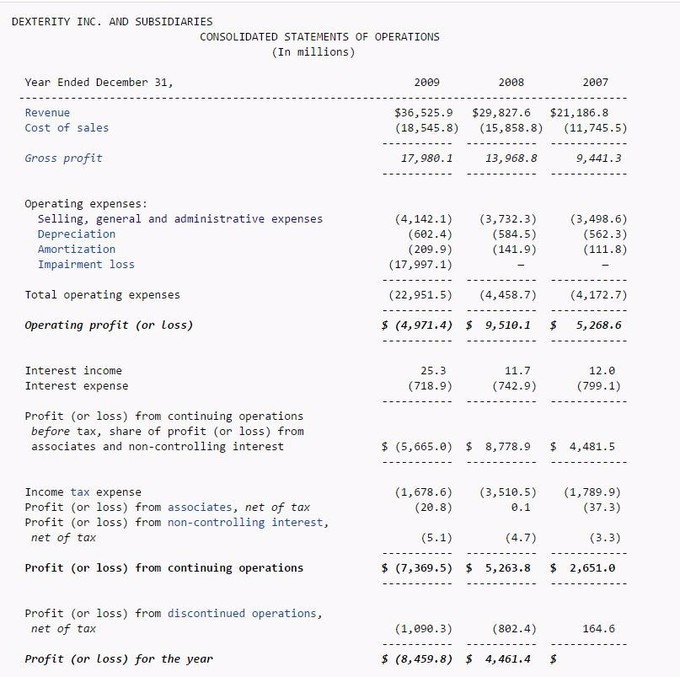

Thus, it is the income stream on the entity’s income statement driven by activities that do not fall under the core business operations of the entity.

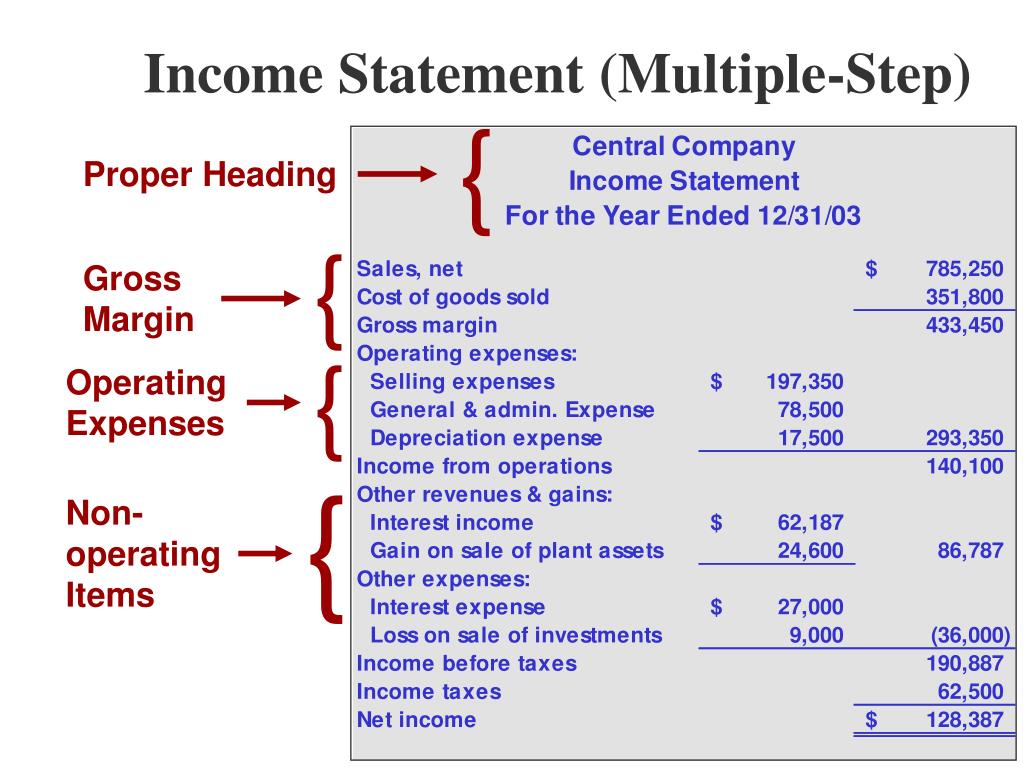

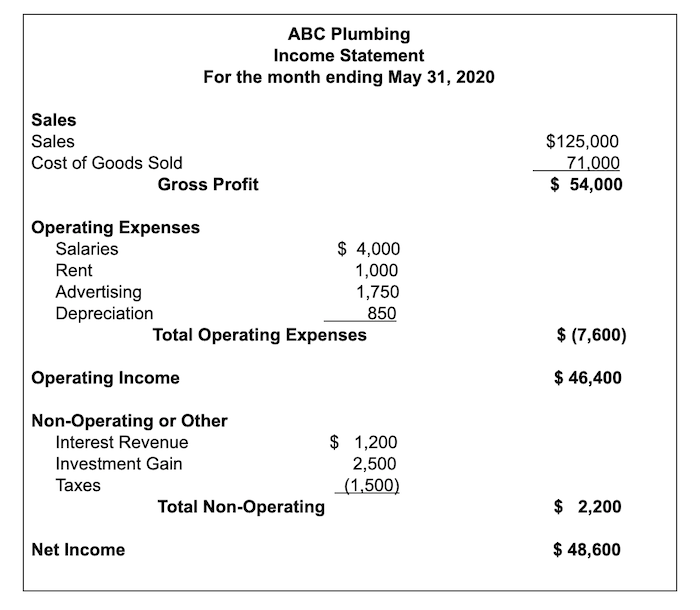

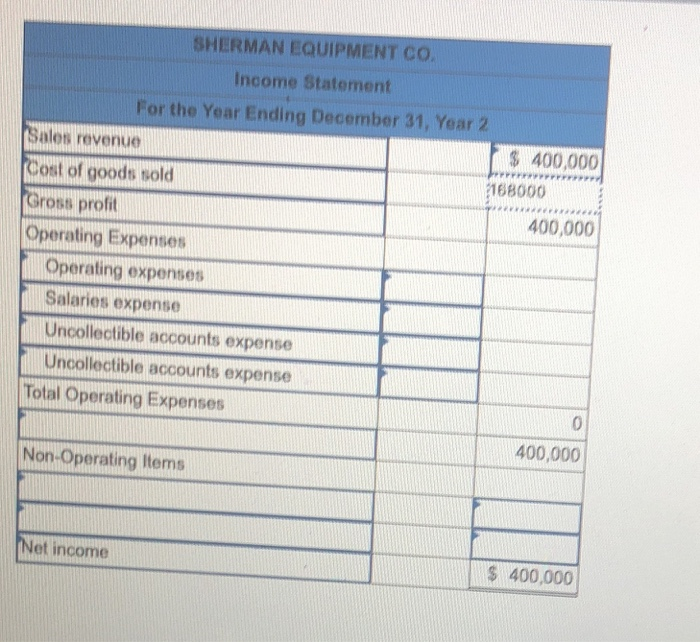

Non operating items on the income statement. Sales on credit) or cash. The components of the income statement include: Commonly referred to as the profit and loss statement, or s tatement of comprehensive income , it focuses on revenues, expenses, gains, and losses.

Sales, general, and administrative expenses; The correct answer is c. Under us gaap, operating activities generally involve producing and delivering goods, providing services, and include all transactions and other events that are not defined as investing or financing activities.

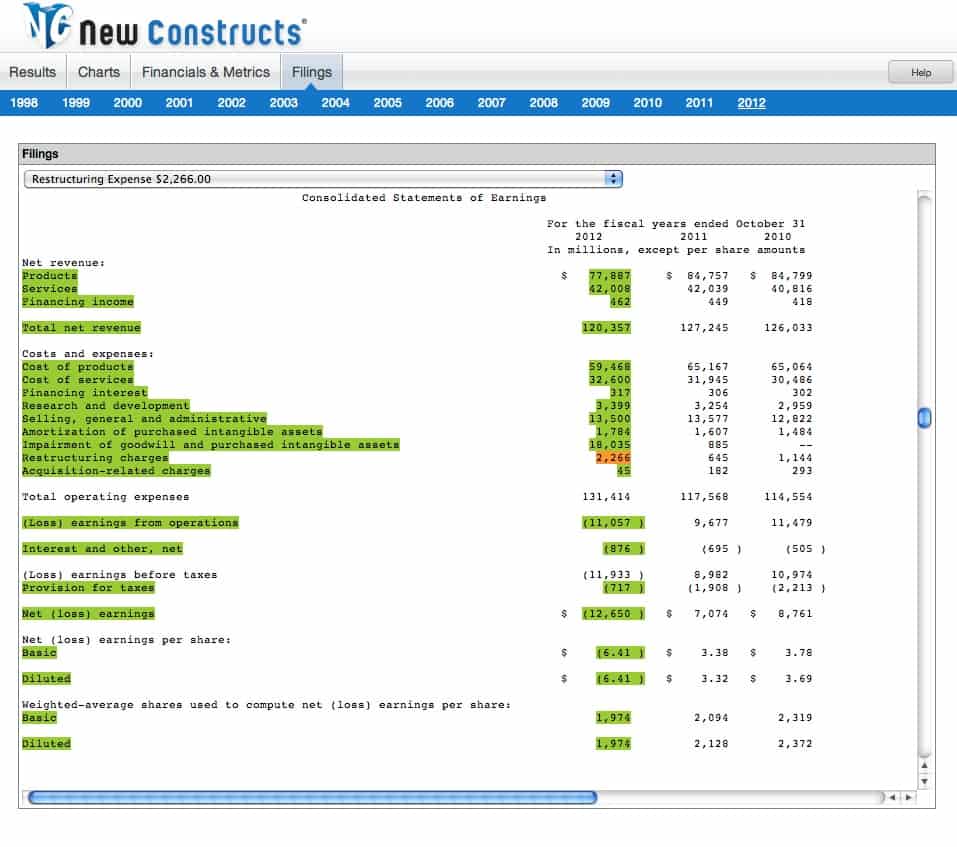

The concept is used by outside analysts, who strip away the effects of these items in order to determine the profitability (if any) of a company's core operations. The income statement presents revenue, expenses, and net income. Sinra inc income statement for the year ended december 31, 2020

There are two types of income statement: [e] treatment and analysis of nonrecurring items (including discontinued operations, unusual or infrequent items ). It can include dividend income, profits or.

On the income statement, operating income is recorded. Investment income, gains or losses from foreign exchange, as well as sales of assets, writedown of assets, interest income are all examples of. Revenue, expenses, gains, and losses.

.png)

:max_bytes(150000):strip_icc()/non-operating-income-final-d3154875b2944bd8b6592741aa791f1c.png)

![Is Operating the Same as EBITDA? [2023 UPDATE]](https://www.mosaic.tech/_next/image?url=https:%2F%2Fmosaiccms.wpengine.com%2Fwp-content%2Fuploads%2F2022%2F12%2FAdobe-Income-Statement.png&w=3840&q=75)