Impressive Info About Contributed Capital Balance Sheet

Capital contribution is the process that shareholders or business owner invests cash or asset into the company.

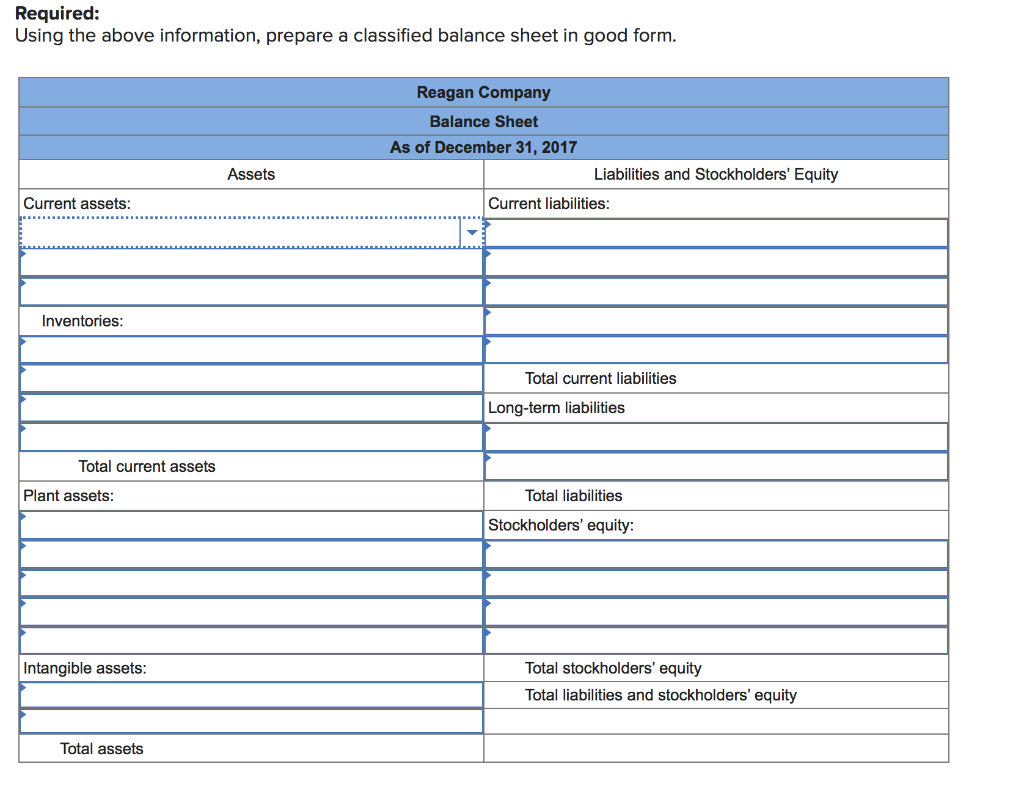

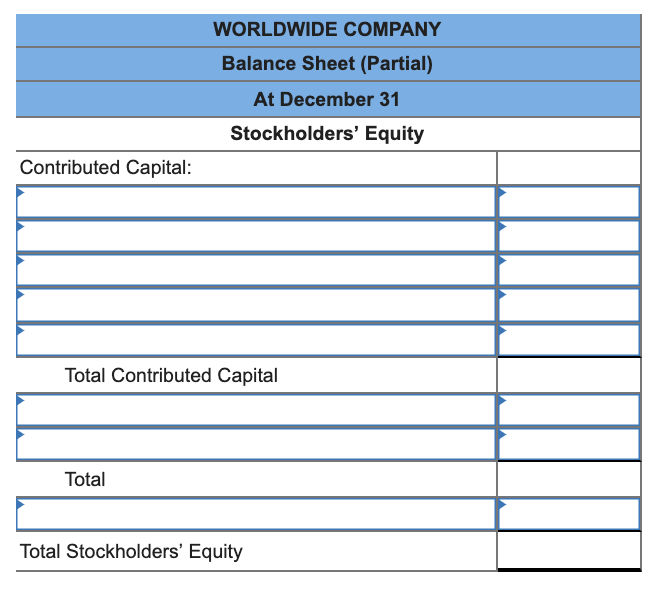

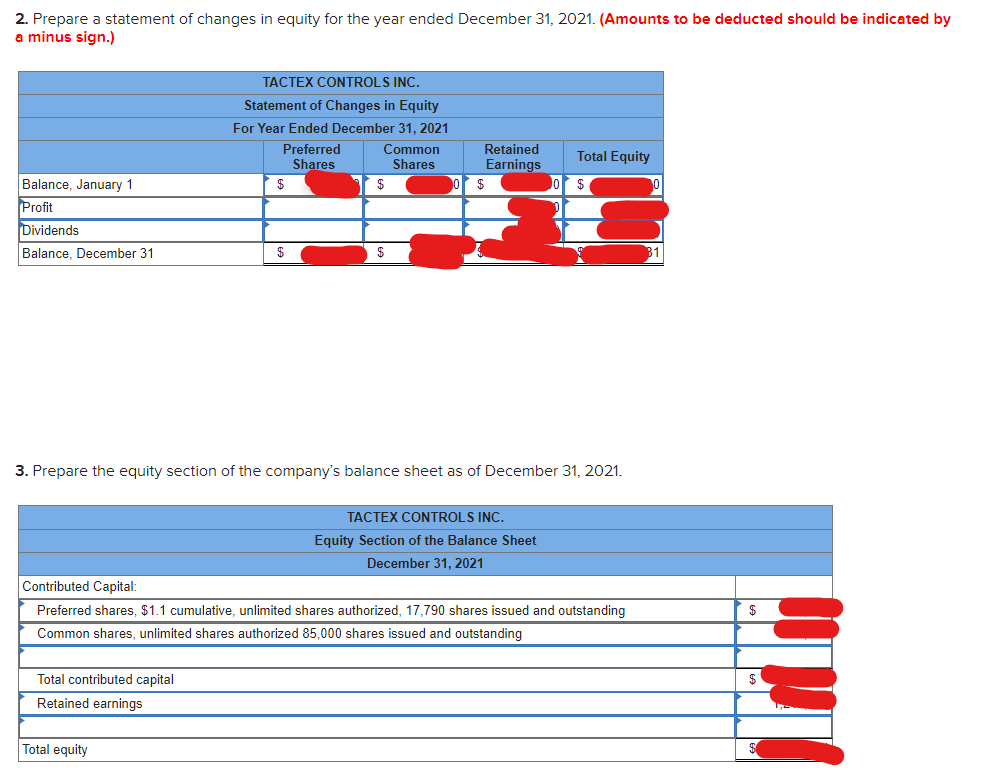

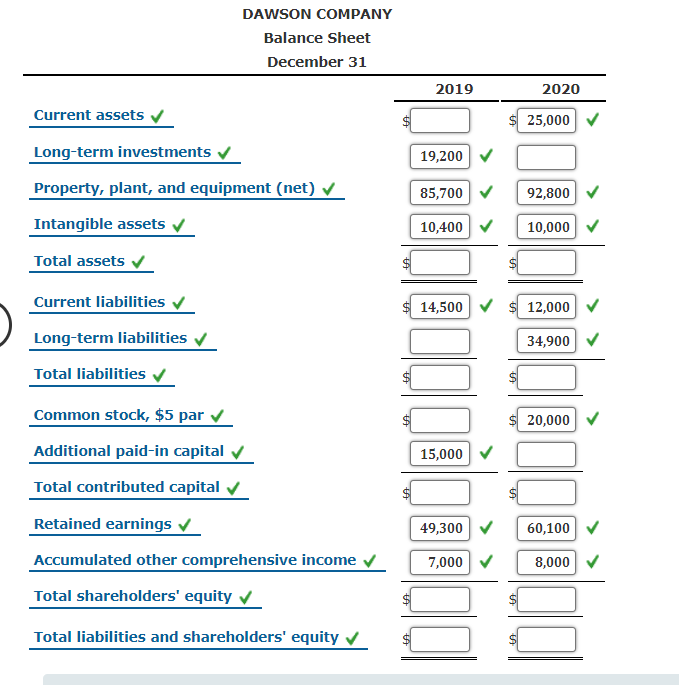

Contributed capital balance sheet. On a company's balance sheet, contributed capital is an entry that reflects the amount of a company's stock that is shareholders have purchased. Contributed capital is the total value of a firm's equity purchased directly from the corporation by investors. It is the fixed value of filed stakes.

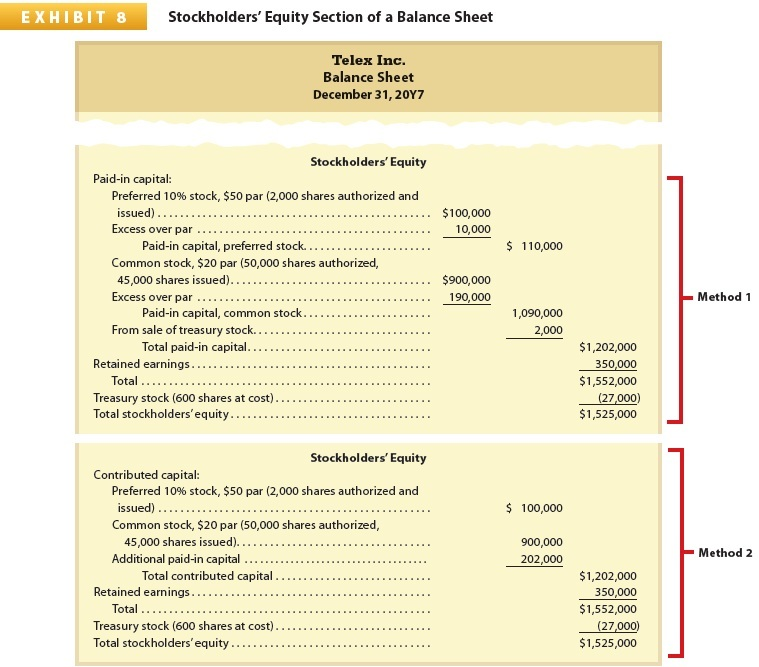

Contributed capital is reported on the equity section of the balance sheet and usually split into two different accounts: So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. As fixed assets age, they begin to lose their value.

In financial accounting, contributed capital is documented on the balance sheet under shareholders’ equity. Contributed capital is an element of the total amount of equity recorded by an organization. It is vital for a new company issuing stock.

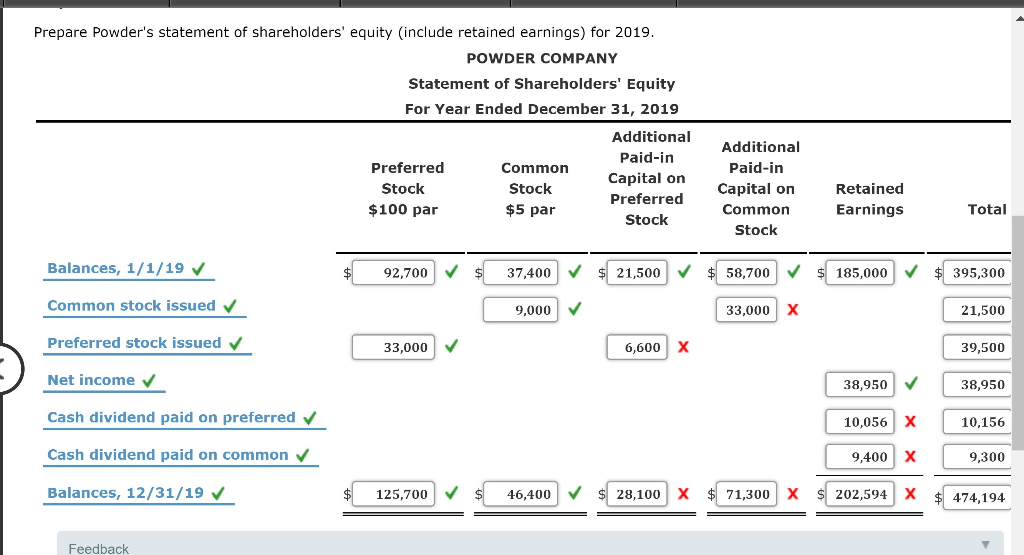

On the balance sheet, the contributed capital contains two separate accounts:. Contributed capital is the amount of money shareholders have invested in the company in exchange for ownership rights. Contributed capital is one of two types of owner’s equity recorded on a balance sheet, the other is retained earnings.

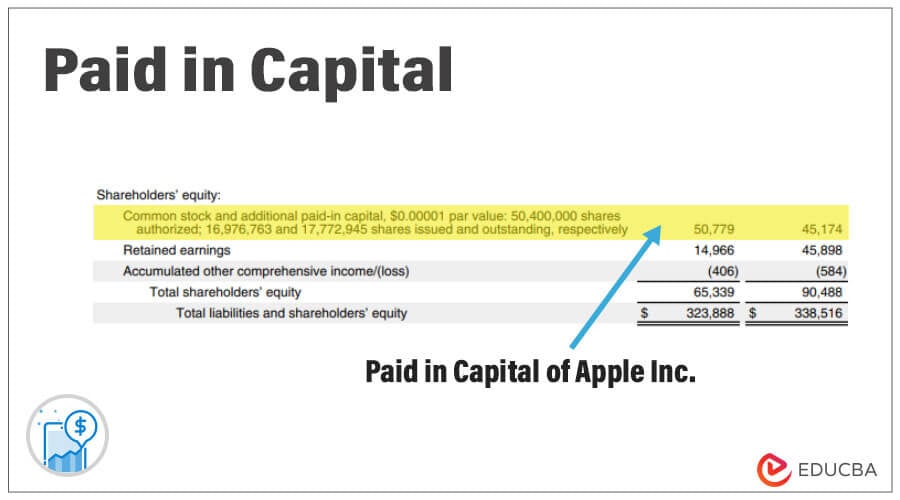

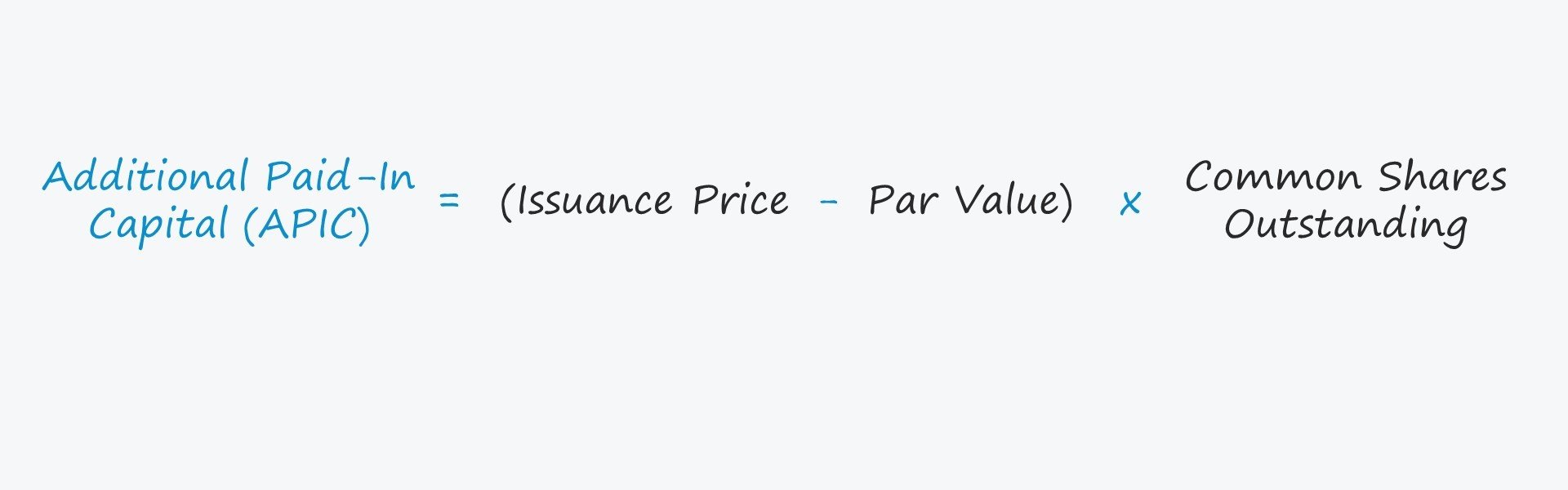

In other words, contributed capital includes the par value—or nominal value—of the stock, found in the common. The formula for contributed capital:. The common stock of firms is known to show up on its balance sheet as preferred and common stock.

It can be a separate account within the stockholders' equity section. On the stockholders’ equity section of the balance sheet, the reporting for contributed capital includes two separate accounts: It reflects the total value of shares that have.

The company needs cash to start the operation as it may not be. Contributed capital is reported on the balance sheet under the shareholders’ equity section. Its presence on the balance sheet strengthens the company’s financial position and enables it to pursue growth initiatives, ultimately contributing to its stability,.

According to the last reported balance sheet, fastenal had liabilities of us$661.3m due within 12 months, and liabilities of us$452.8m due beyond 12 months.

:max_bytes(150000):strip_icc()/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)