Lessons I Learned From Info About Interest Received In Profit And Loss Account

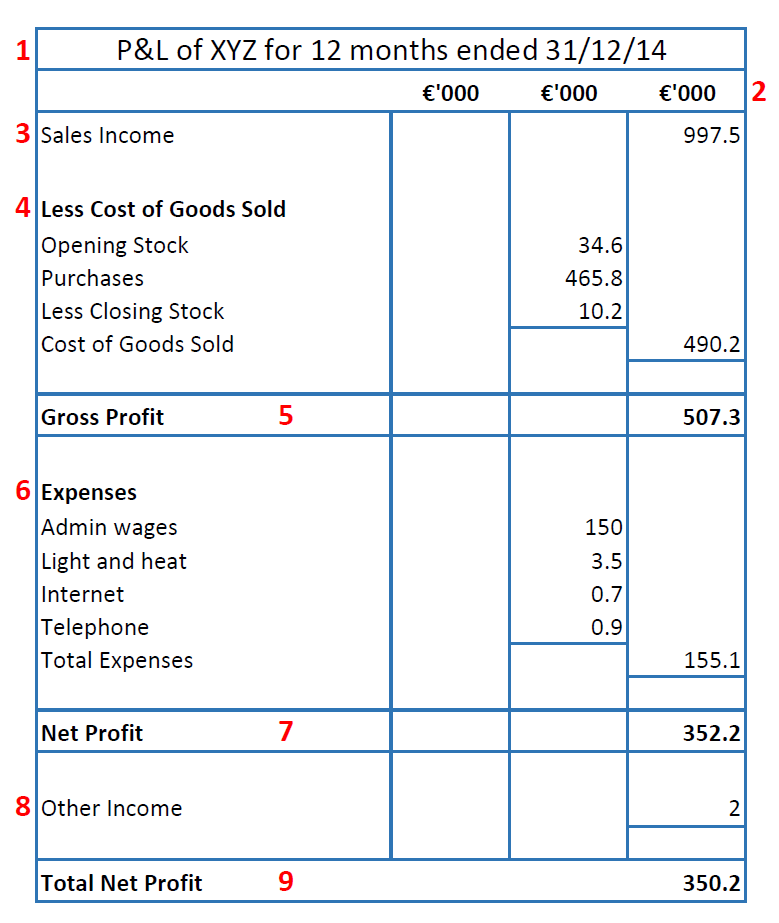

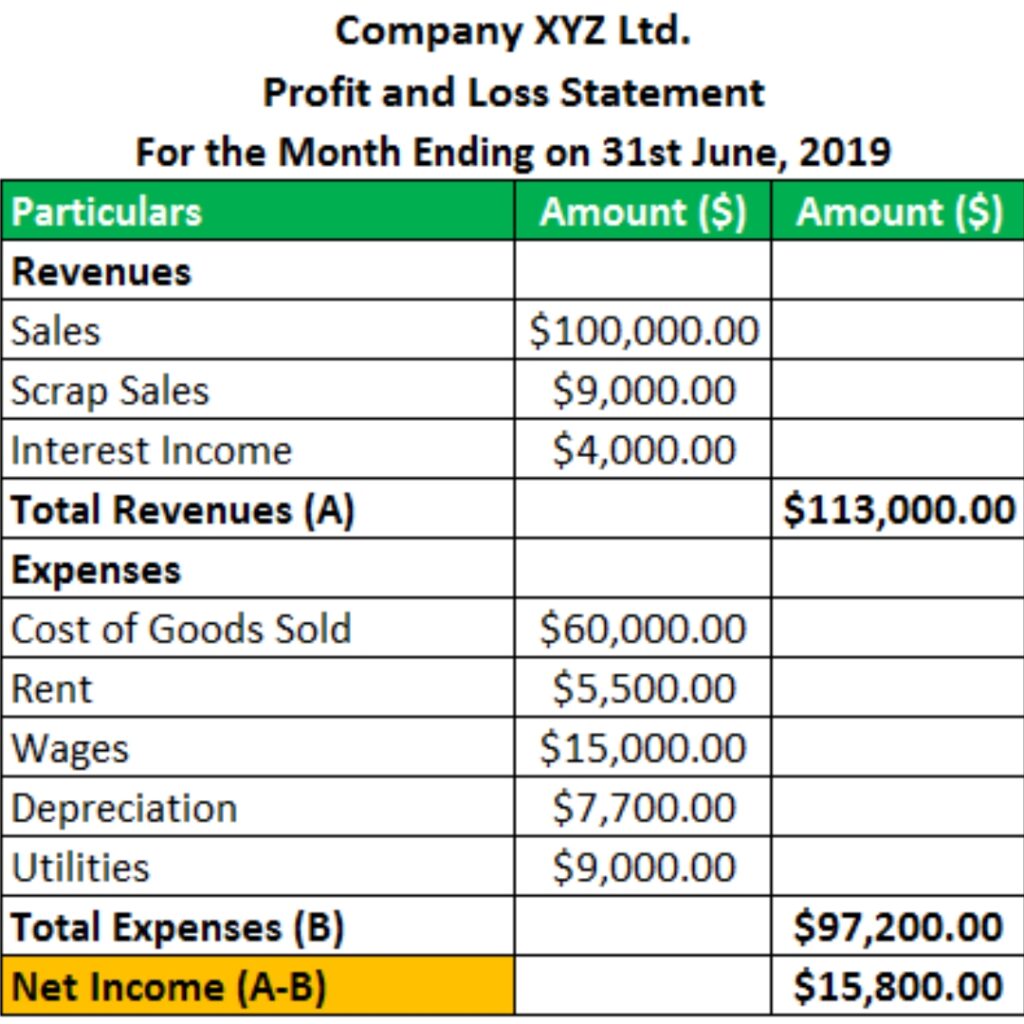

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time.

Interest received in profit and loss account. Interest receivable is the amount of interest that has been earned, but which has not yet been received in cash. The interest of ₹50000 is outstanding. A profit and loss statement is also called an income statement, a statement of profit, or a profit and loss report.

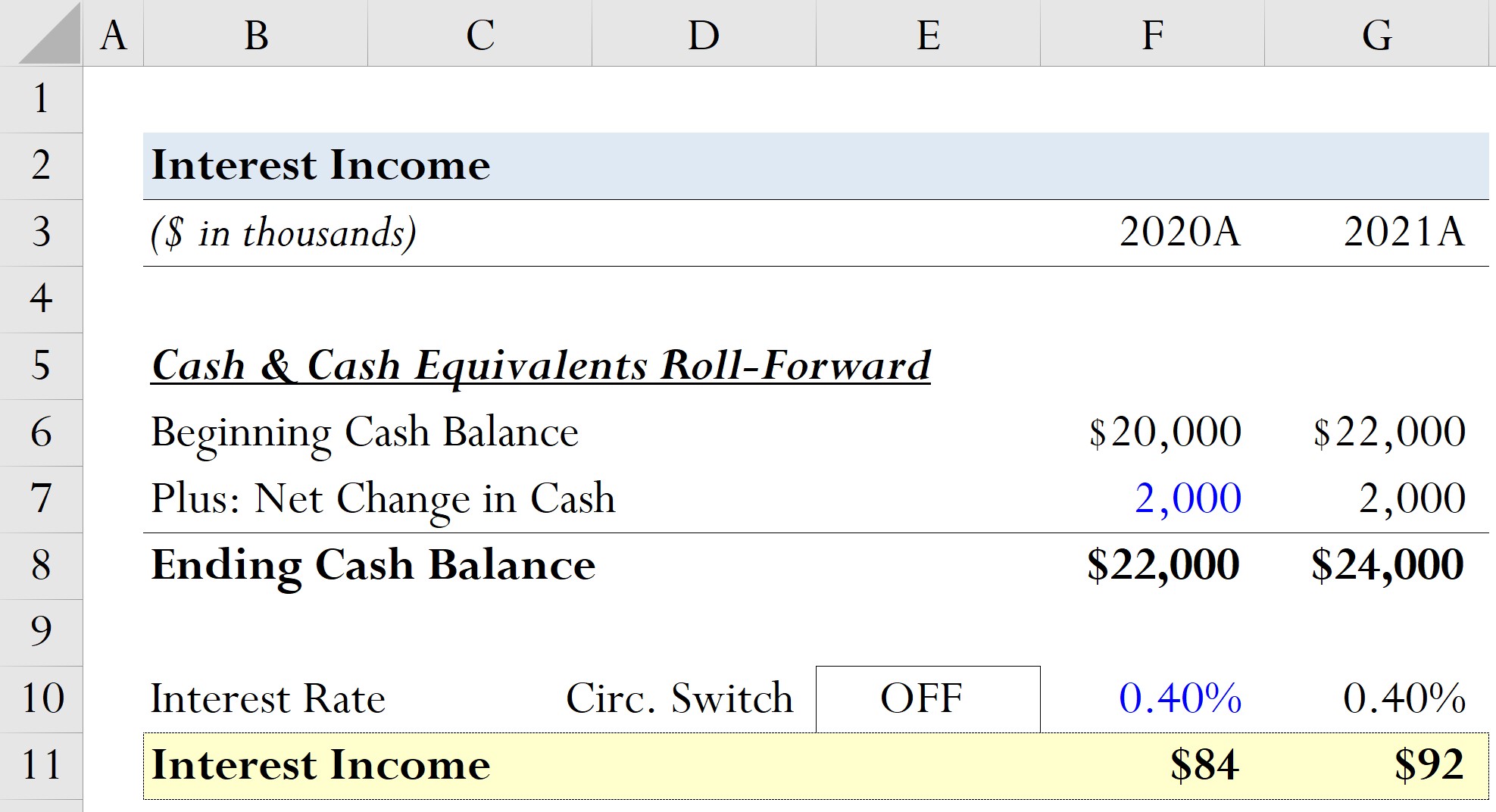

Create the report either annually, quarterly, monthly or even weekly. Interest income is money earned by an individual or company for lending their funds, either by putting them into a deposit account in a bank or by purchasing certificates of deposits. November 17, 2023 what is interest receivable?

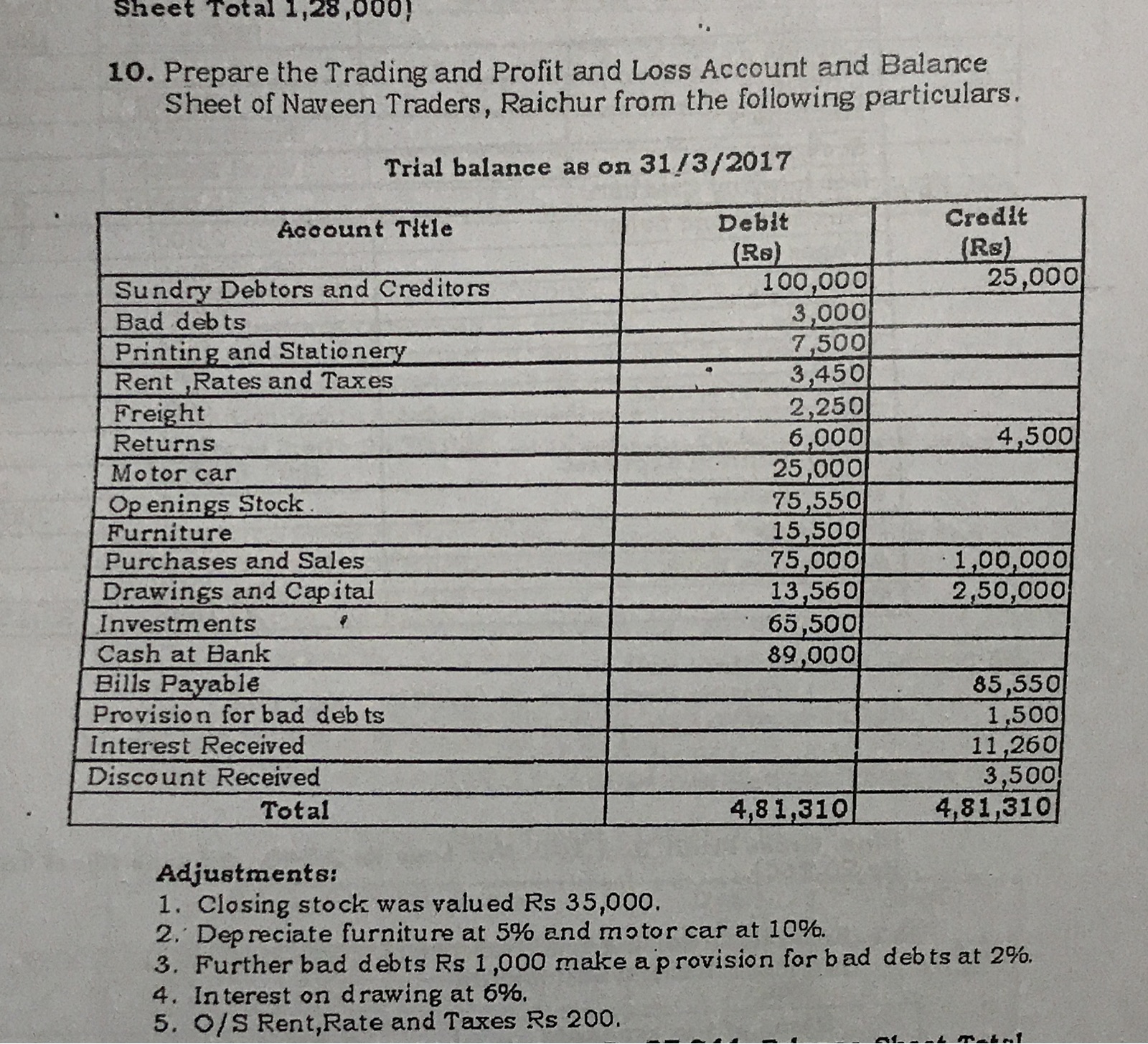

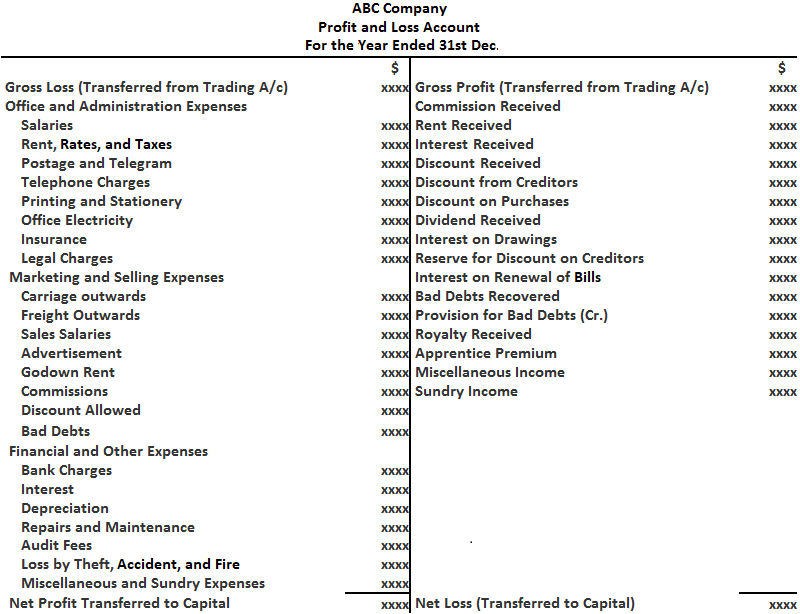

The result is either your final profit (if. It is prepared to determine the net profit or net loss of a trader. A profit and loss (p&l) statement summarizes the revenues.

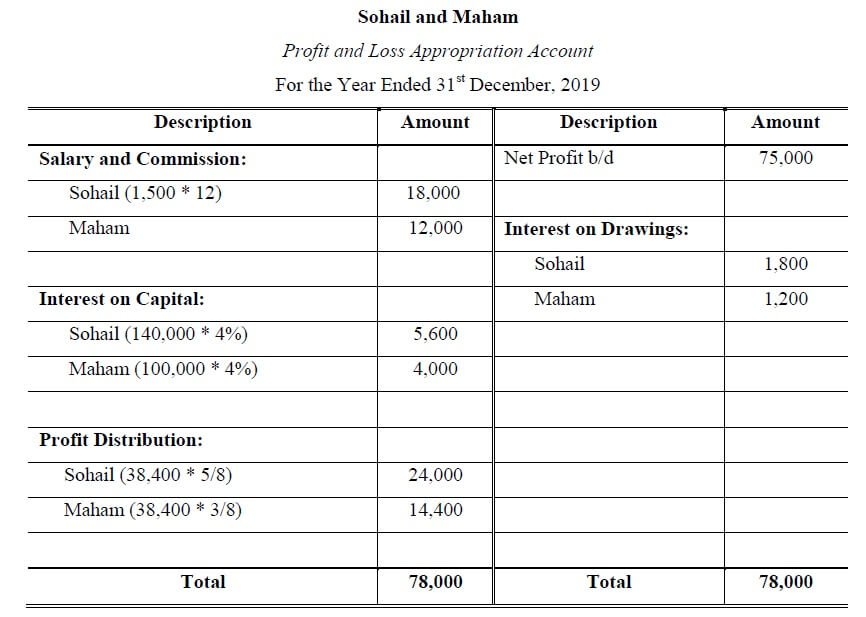

Profit and loss accounting is when companies prepare the profit and loss statements to figure out their financial performance for a fiscal quarter or year. It could be for a week, a quarter or a financial year. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period.

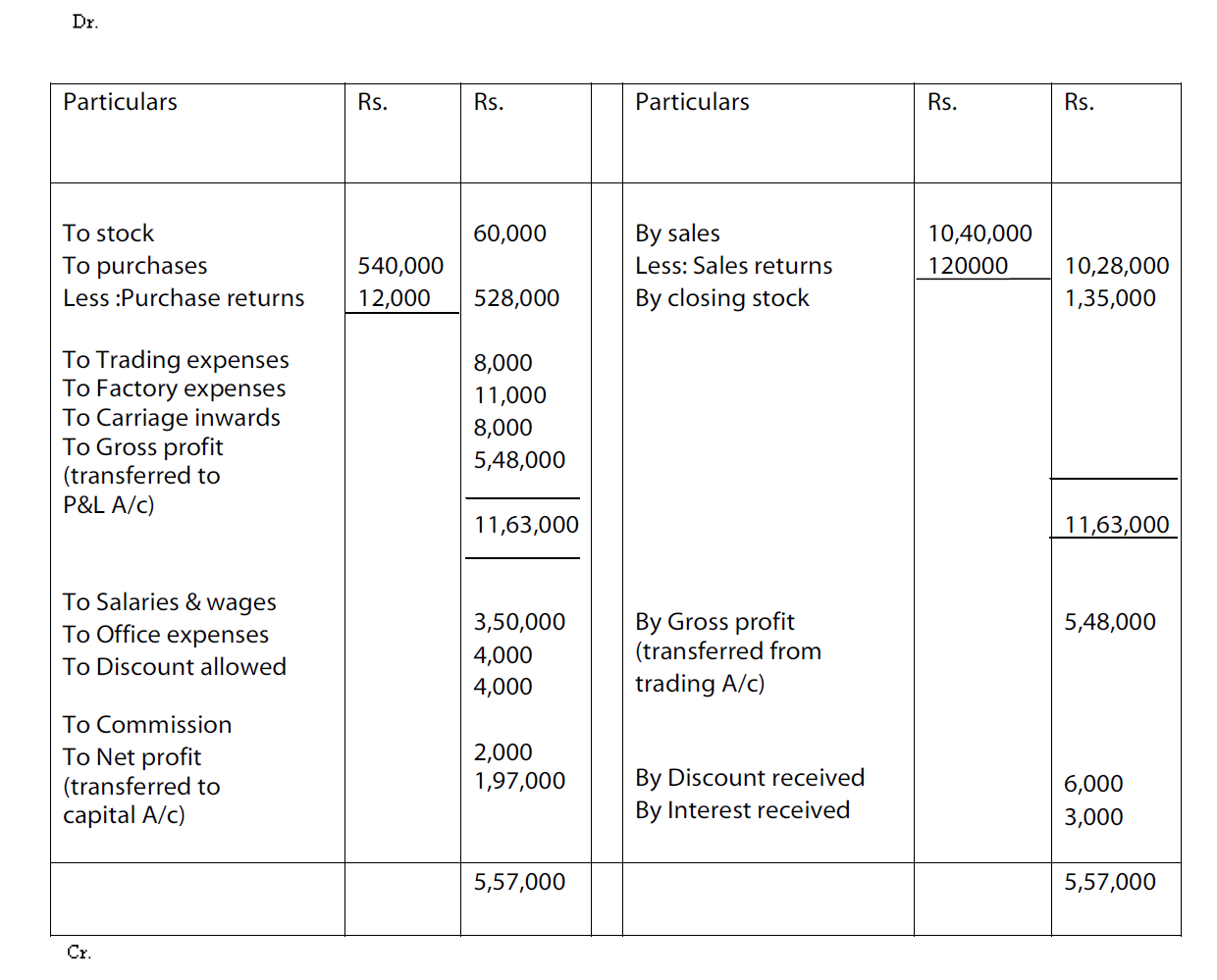

Amount of commission earned but not received is ₹5000. Only indirect expenses are shown in this account. In case of accrued interest meaning in accounting the interest expense on profit and loss statement is increased by the amount of the interest that is yet to paid by the company.

It captures how money flows in and out of your business. A profit and loss account (or statement or sheet) is, on a simple level, used to show you how much your company is making or how much it is losing. All the indirect expenses and incomes, including the gross profit/loss, are reported in the profit & loss statement to arrive at the net profit or loss.

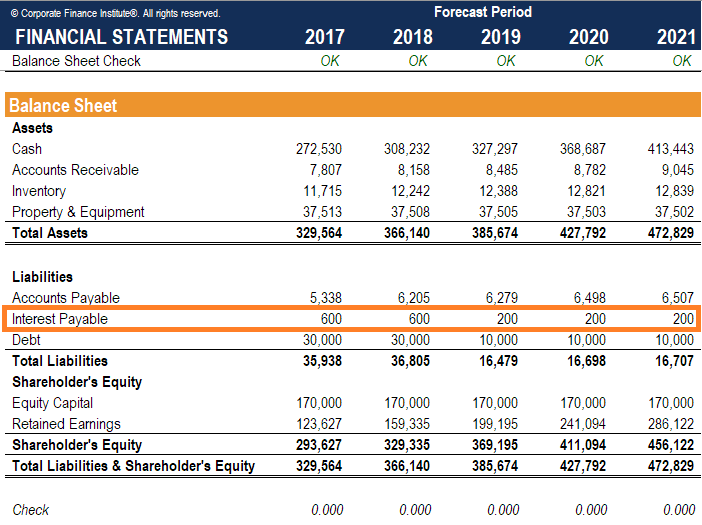

A balance sheet provides both investors and creditors with a snapshot as to how effectively a company's management uses its resources. A profit and loss (p&l) account shows the annual net profit or net loss of a business. Account for interest.

The income statement helps owners and managers make informed decisions about pricing, cost control, and resource allocation. Profit and loss account is made to ascertain annual profit or loss of business. The judge's ruling orders former president donald trump and his company to pay $354 million in fines, plus almost $100 million in interest, and restricts trump's business activities in the state.

The trading and profit and loss accounts are discussed in more detail below. What is a profit and loss statement? The profit & loss statement is a crucial financial statement summarising the costs, revenues and expenses incurred by a business during a specific period, usually a quarter or year.

Interest expense = average balance of debt obligation x interest rate ebit and ebt interest is deducted from earnings before interest and taxes (ebit) to arrive at earnings before tax (ebt). If you have any business debt, you’ll need to account for your interest payments as part of the profit and loss statement. To determine the company’s actual net profit or loss.