Great Info About Balance Sheet Centrelink

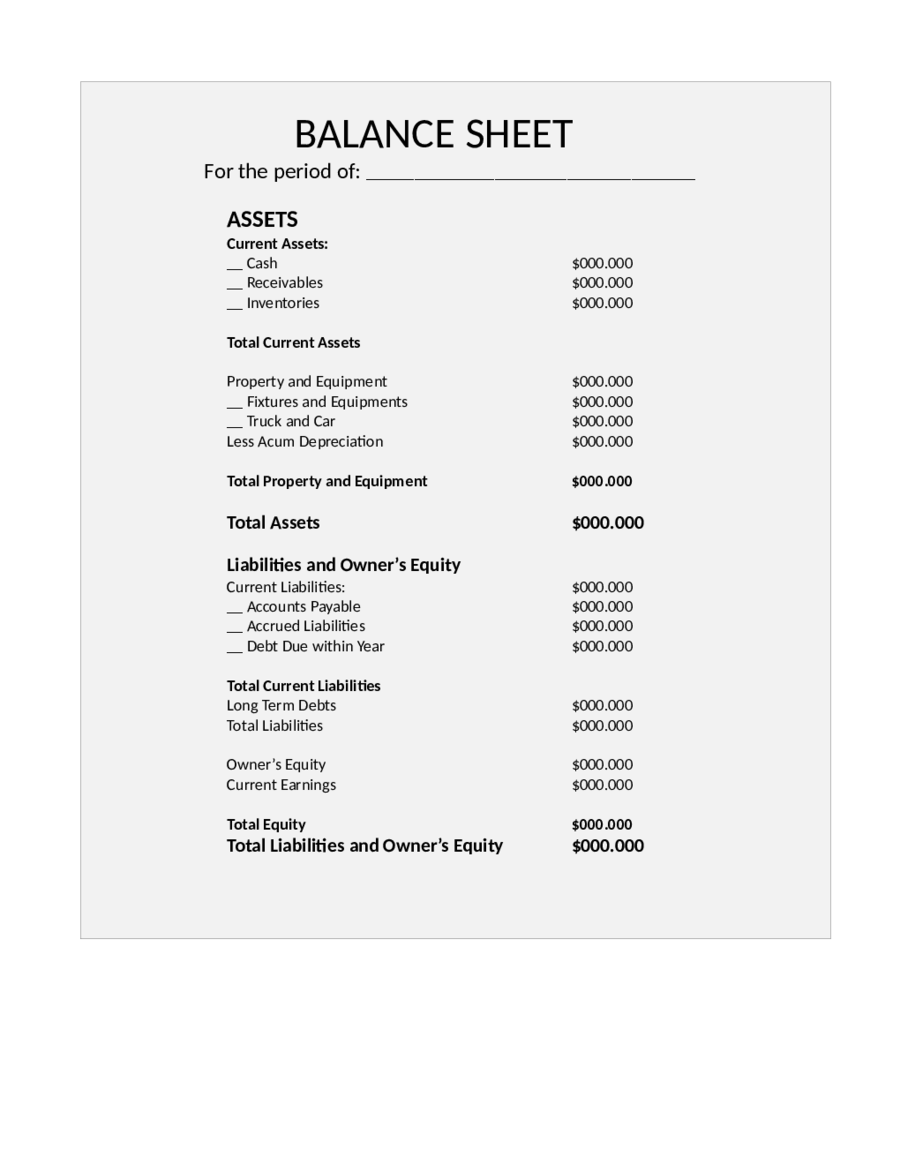

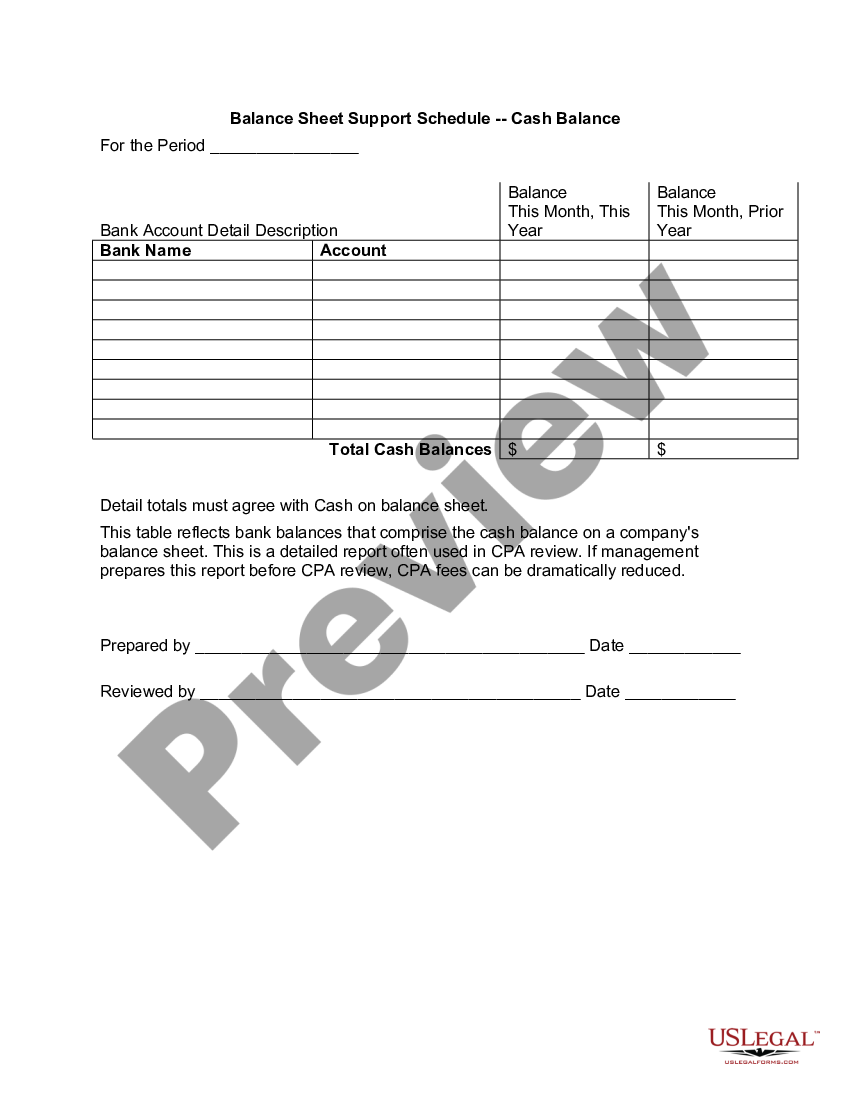

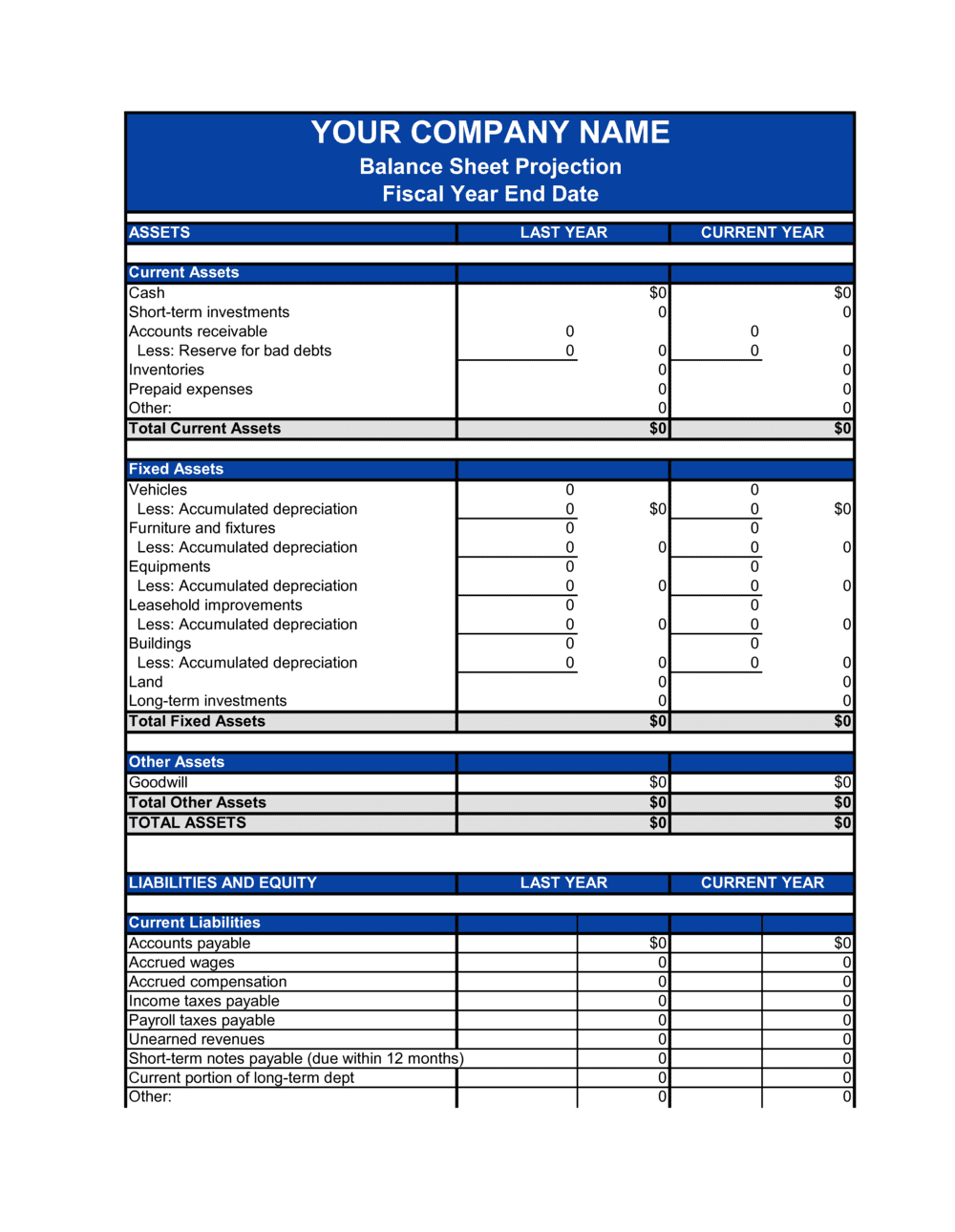

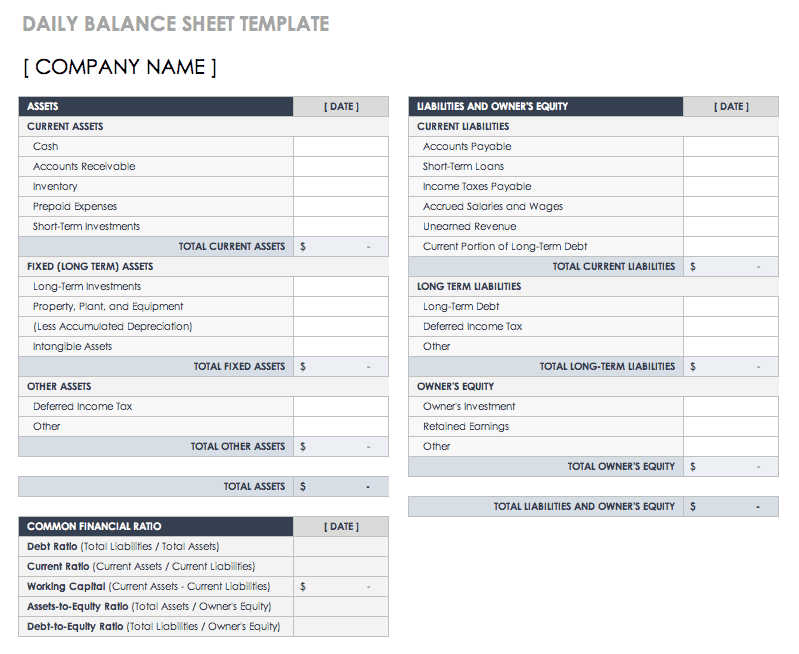

If you do not have a balance sheet, you can provide a list of the type and amount of each asset or liability of the business.

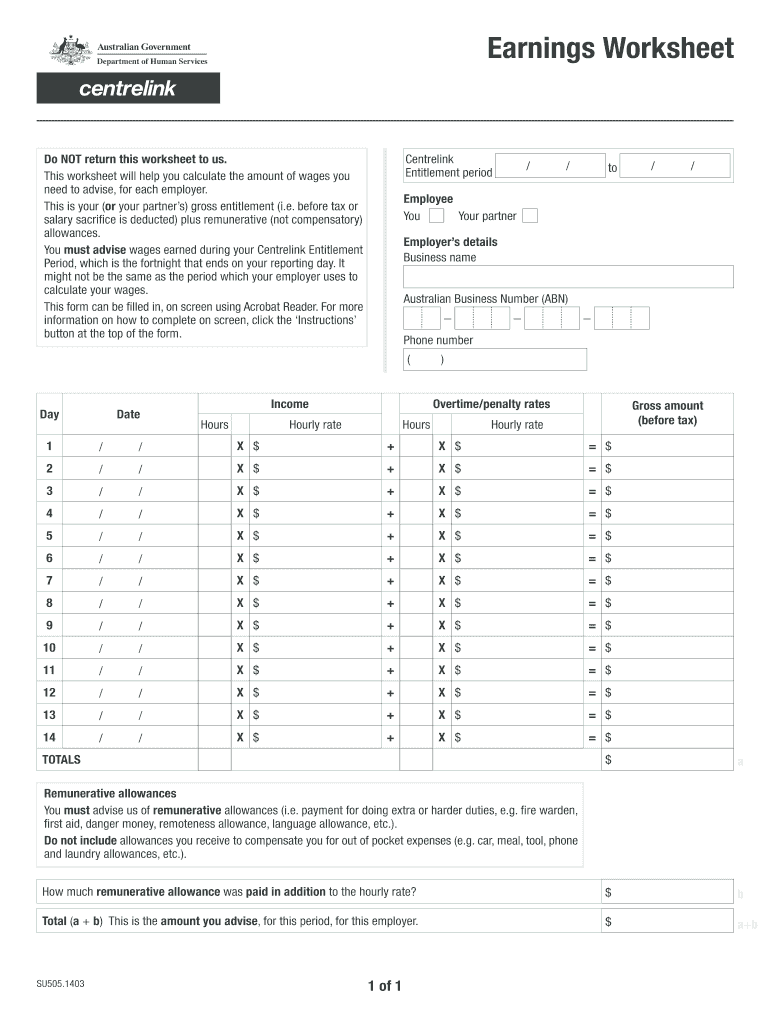

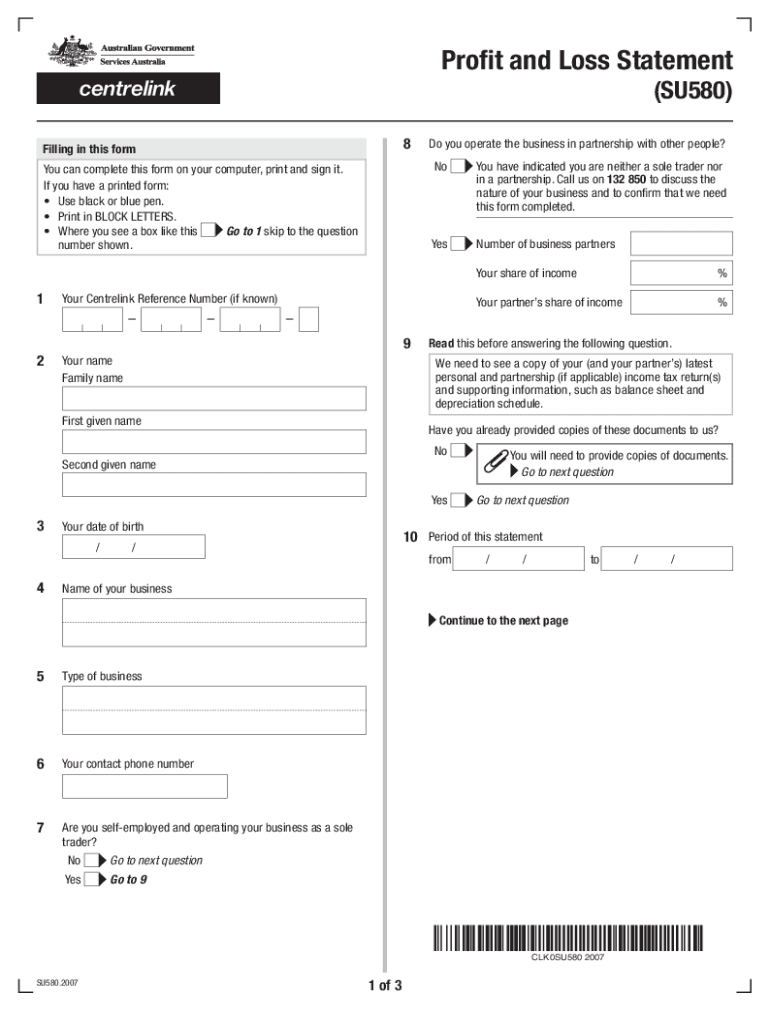

Balance sheet centrelink. If you use estimated costs, you need to label them clearly. If you are applying for the jobseeker payment, you’ll be asked to provide a number of documents, including a. Livestock trading account if the business is a primary production business.

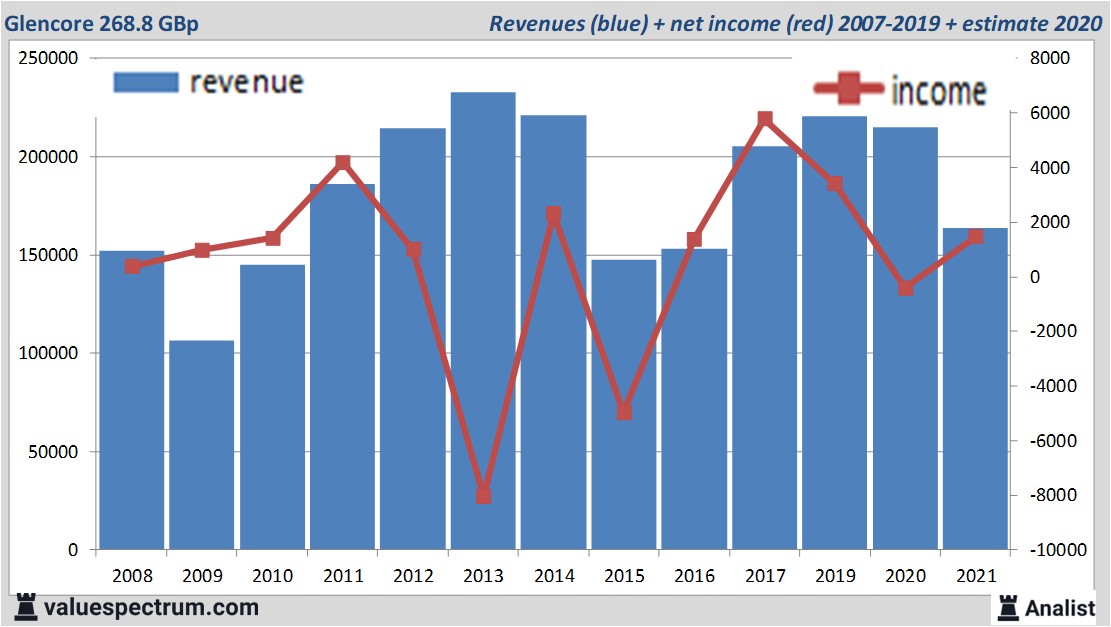

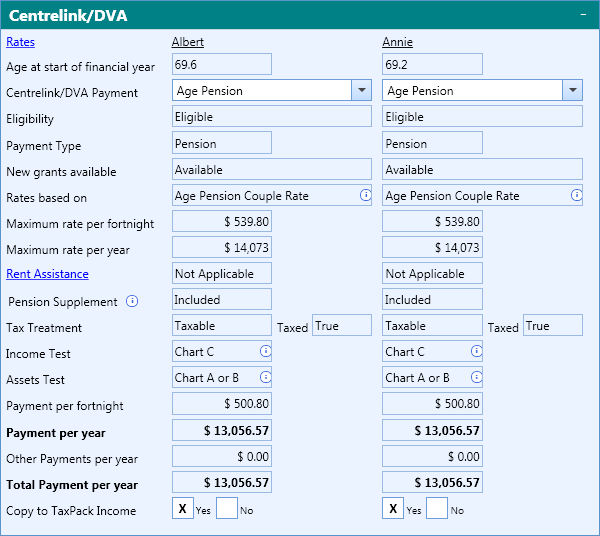

It is made up of the following three sections: When the income of a business changes or is anticipated to change, the recipient should notify centrelink. If you do not have a mygov or centrelink online account, it is easy to create one.

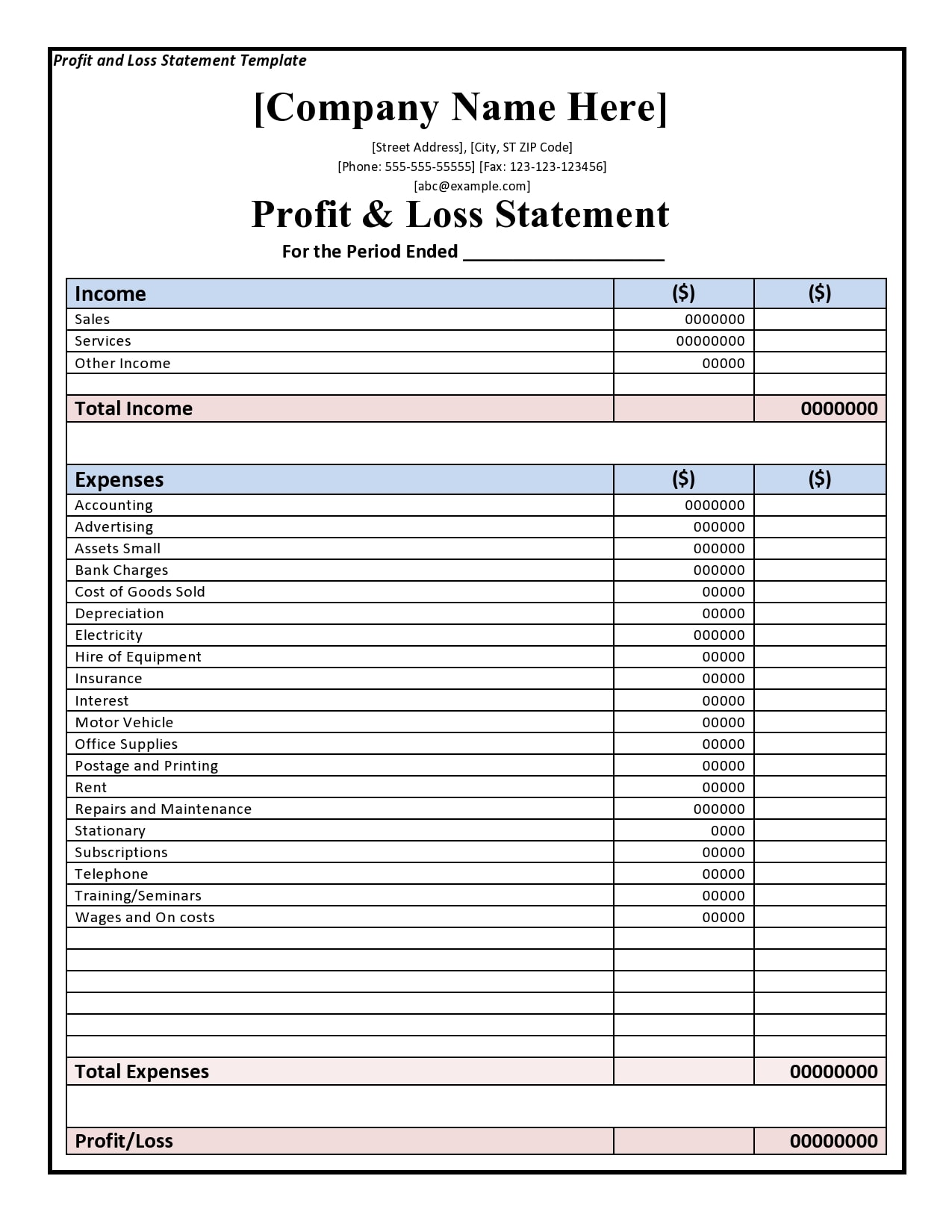

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Complete this form and the relevant claim form if you want to claim any of the following payments: Complete your profit and loss statement.

The employment diary is no longer available in your centrelink online account. You also need to clearly state on your profit and loss statement whether your figures are gst inclusive or exclusive. Centrelink & jobseeker initial application for uber drivers.

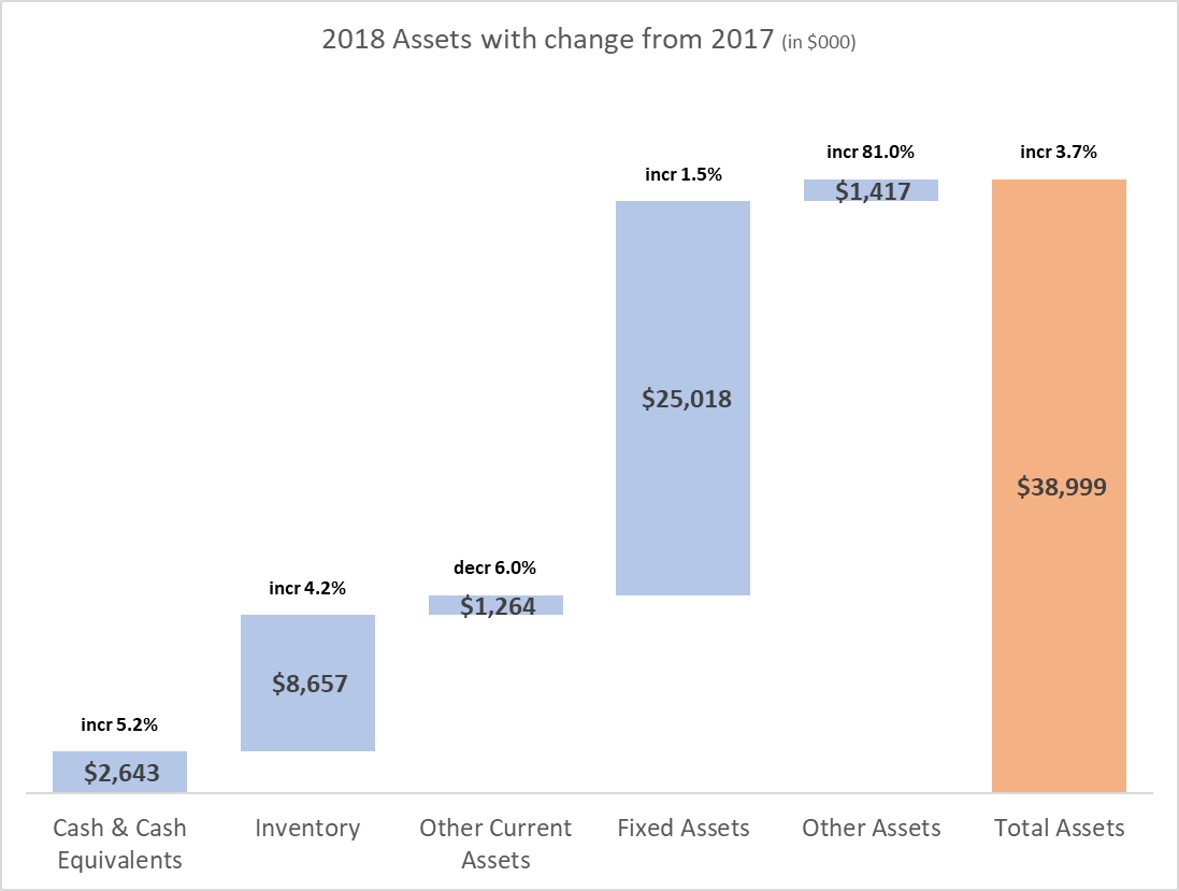

Start using xero for free. Download and complete the earnings worksheet. Monthly, quarterly, and annual balance sheets provide insight into gradual.

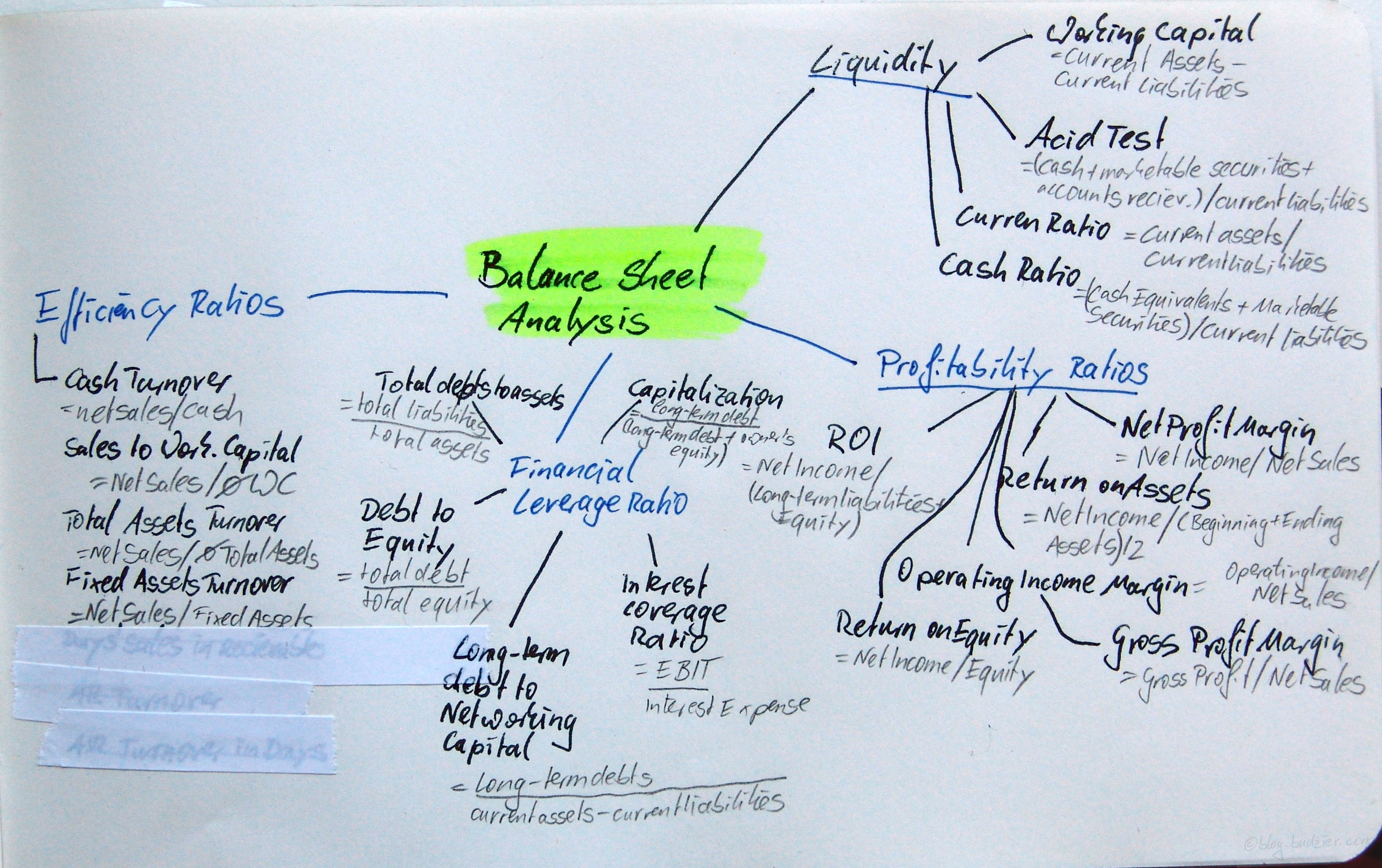

Use our template to set up a balance sheet and understand your business's financial health. Download and complete the income and assets form. Based on the financials you mentioned she would need to provide a statement/balance sheet for the managed portfolio as centrelink will want to know the.

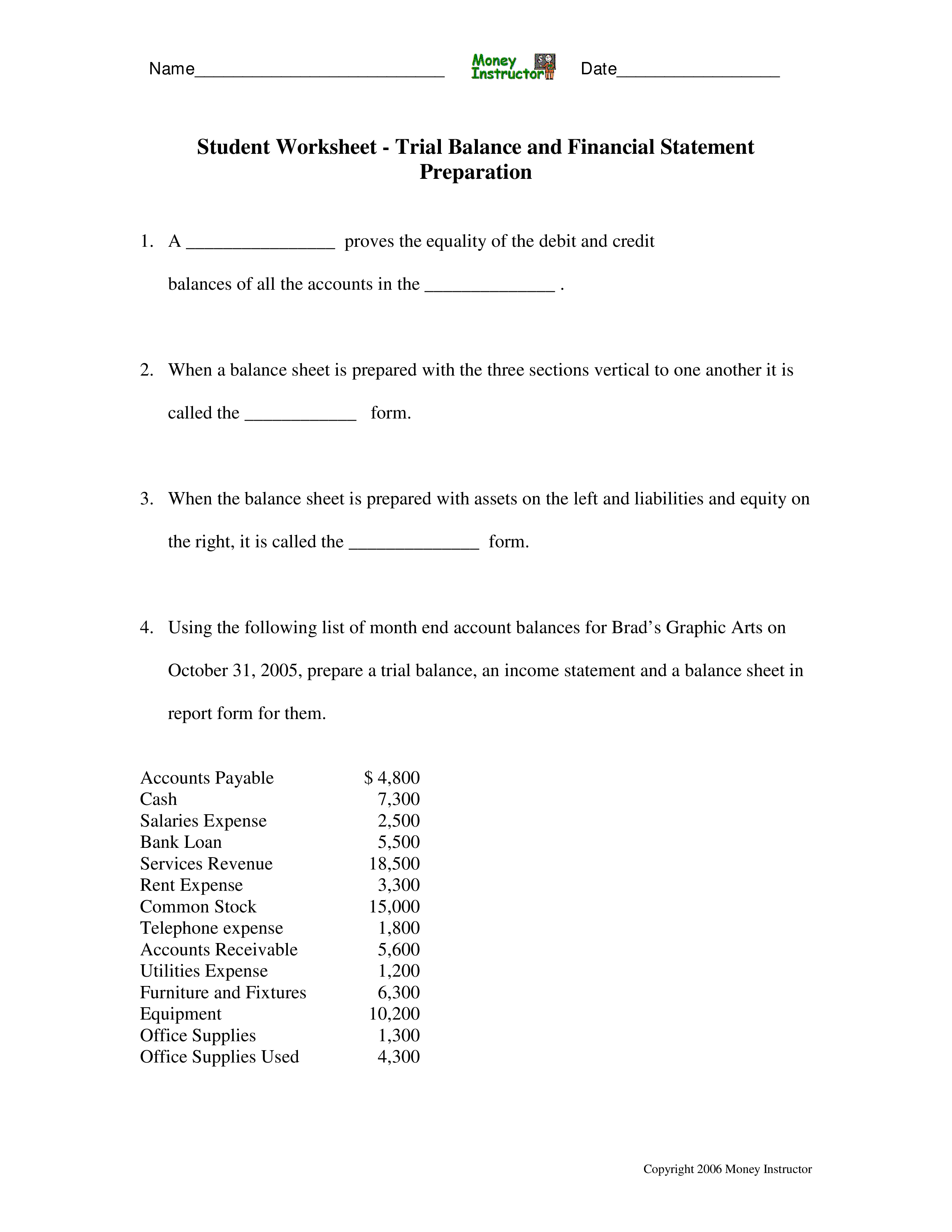

In light of the assets changes taking place on 1 january 2017, will centrelink independently verify every current pensioner’s financials (balance in bank accounts,. I will show you how they are meant to be formatted. It records all your business’ assets and debts;

Information you need to know about reporting employment and using the earnings worksheet form (su505(i)) information you need to know about your claim for carer. Centrelink are going to want to see a balance sheet, and they are not too hard to make.

Therefore, it shows the ‘net worth’ of your business at any given time. I filled out all my basic stuff like income and expenses (petrol, phone plan, etc) on my p&l so i asked centrelink what i should do about the balance sheet it apparently needs. Access xero features for 30 days, then decide which plan best suits your business.

For each year, you need to fill in actual or forecasted figures against each of the below items. Their need for income support will be reassessed and. Balance sheet depicts a company’s financial health.