Simple Tips About Audit Of Company Accounts

Audited financial statements public companies are obligated by law to ensure that their financial statements are audited by a registered certified public accountant (cpa).

Audit of company accounts. Generally, an audit includes verifying information in your accounts on a sample test basis and also your company documents such as the confirmation statement filed with companies house if it is still valid. Services agency president erin o'gorman appears at a hearing of the house of commons standing committee on public accounts on. Internal audits are performed by the employees of a company or organization.

Typically, those that own a company, the shareholders, are not those that manage it. An audit cycle is the accounting process that auditors employ in the review of a company's financial statements and related information. There are three main types of audits:

The purpose of the independent audit is to provide assurance that company management has presented financial statements that are free from material error. An accounting audit is the process of examining a company's entire financial situation, with an emphasis on ensuring compliance with relevant reporting standards, and promoting adequate cash handling policies and internal controls. Auditors build up a detailed understanding of the business so that they can highlight and assess the key areas in the financial statements most at risk of material misstatement;

Planning for the audit planning is crucial, and additional time needs to be taken to adequately prepare for an audit. A company has to close its accounts every financial year and prepare the financial statements prepared as per the books of accounts depicting true and fair view of the affairs of the company. An accounting audit is an examination of the organization’s financial information which is conducted by an independent auditor with the aim to ensure that the information is represented fairly and accurately and.

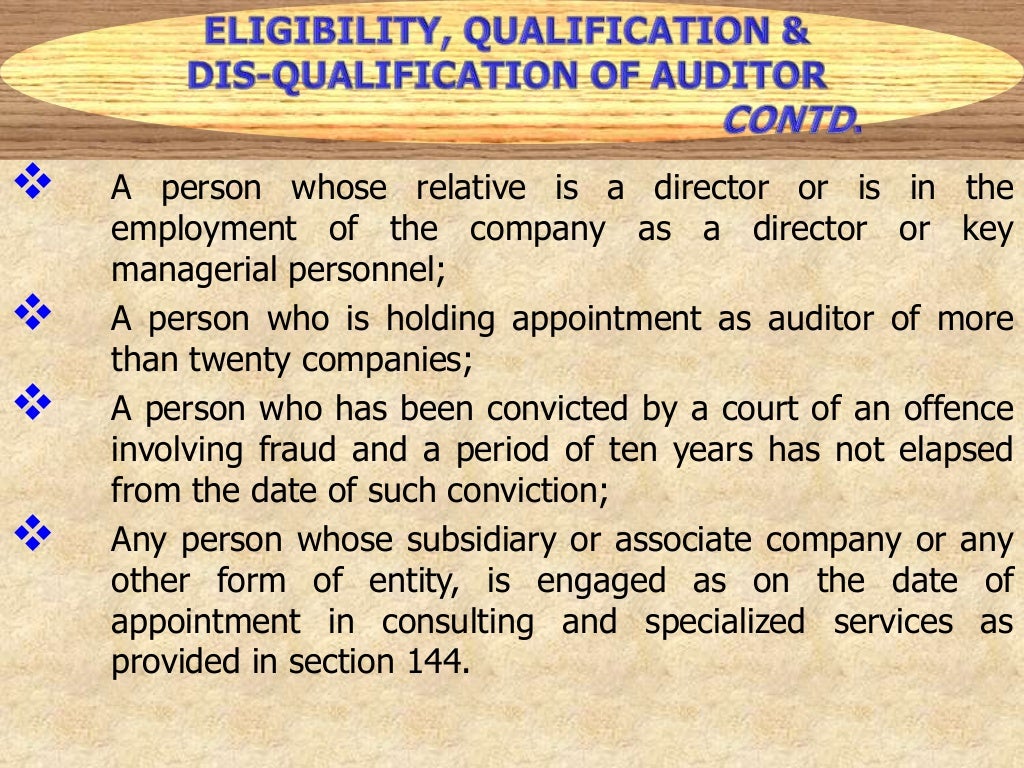

We focus on partners in our study because this position best accounts for auditors’ incentives and audit quality compared to other positions that a. The firm, which has been revolution beauty’s auditor since 2019, has been replaced in the role by mha with immediate effect. It may be a few months or a few weeks, depending on the complexity of financial records.

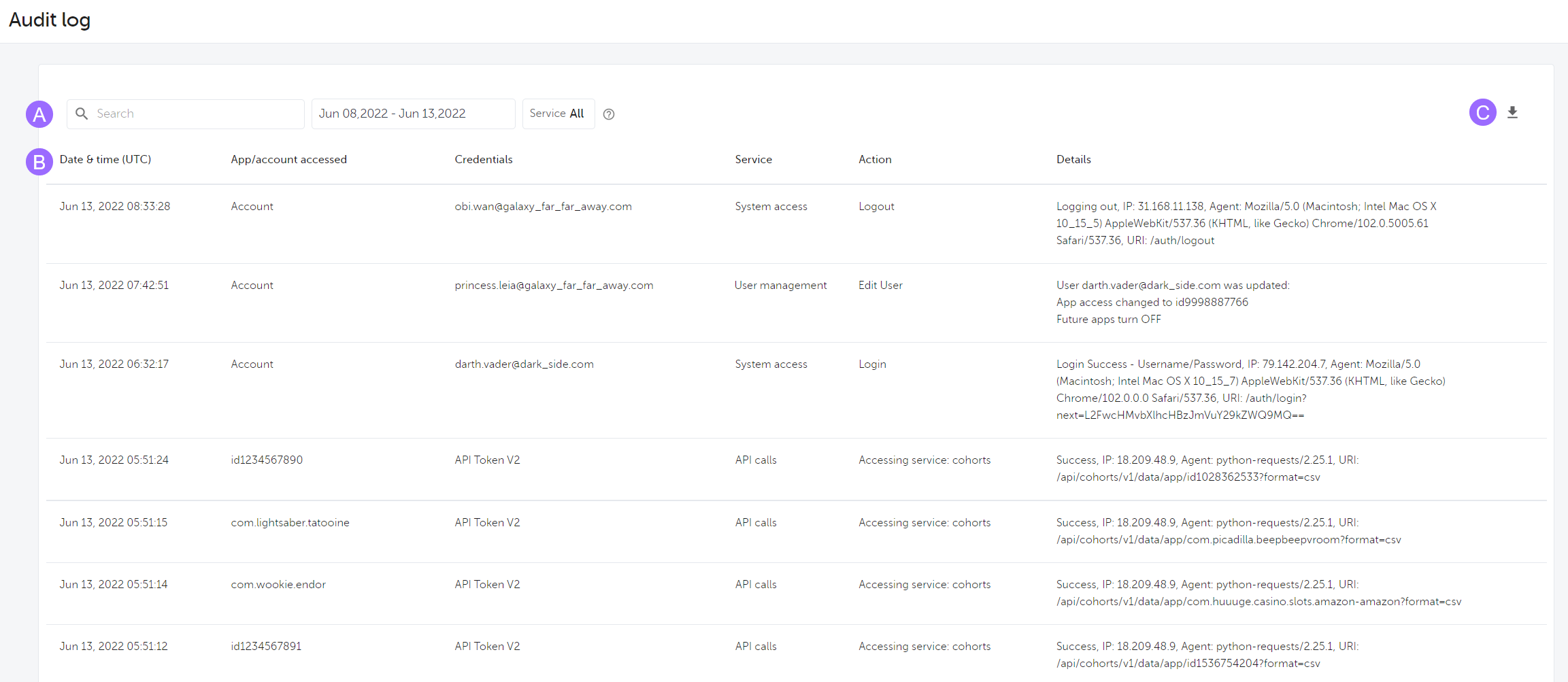

Auditing of book of accounts means verification of accounts by an independent professional to ensure that the accounting has been carried as per the relevant regulatory requirements and to check the veracity of transactions and make an opinion whether the books of accounts shows a true and fair view of financial. An audit trail tracks accounting data to its source for verification. Once preliminary assessments have been made, you will need to create a plan to carry out the audit.

If you are a small. An accounting audit is a systematic examination and verification of a company’s financial records, transactions, and processes by an independent, qualified auditor. The financials shall then be audited by the statutory auditor appointed for this purpose and laid before the members for approval.

The audit report is a document containing the auditor’s opinion on whether a company’s financial statements comply with accounting standards and are free from material misstatements. Assign team members to each task, if applicable. Revolution beauty has announced that bdo llp has resigned by mutual agreement with the company as its auditor.

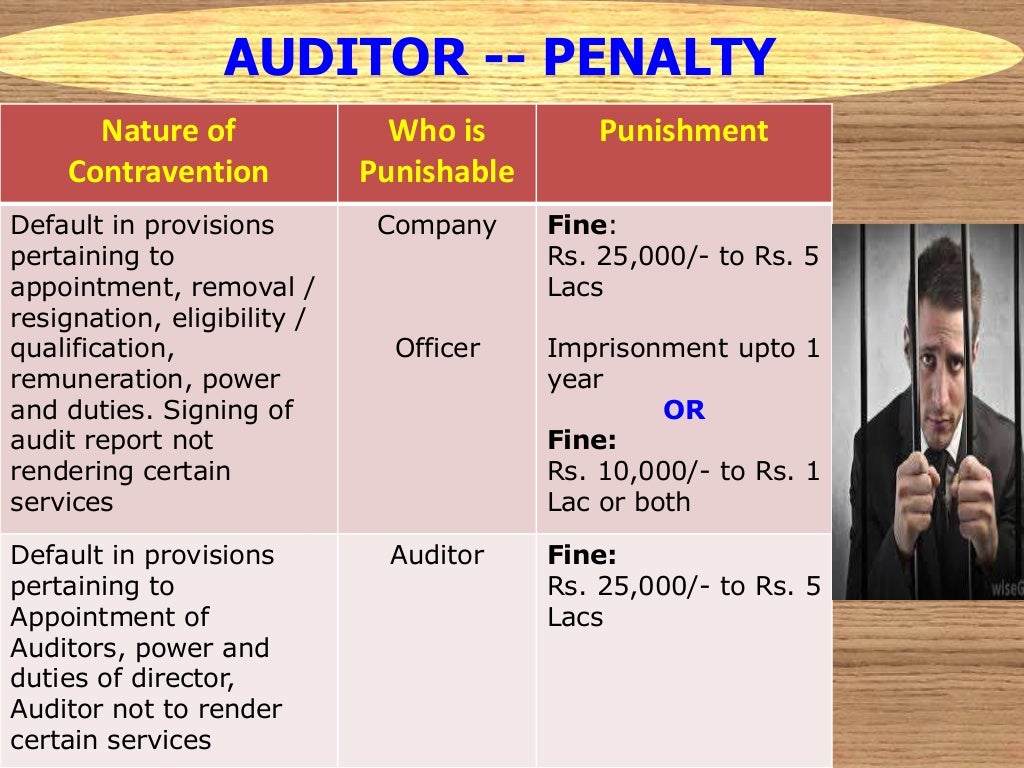

The audit of the accounts of a firm is not compulsory, whereas the audit of accounts of a company is mandatory. All the audits look at are the accounting books and financial statements for public companies and businesses, most of which have to go through the auditing of accounts once every year, mandated by law. The public company accounting oversight board (pcaob) today announced settled disciplinary orders sanctioning four audit firms for violating pcaob rules and standards related to communications that firms are required to make to audit committees.

Lay out all of the different actions that need to be taken, including areas that you think may be of the most interest. An audit cycle includes the steps that an auditor takes to. In accounting, there are three main types of audits: