Best Info About Treatment Of Dividend Received In Cash Flow Statement

Treatment of dividends on cash flow statement.

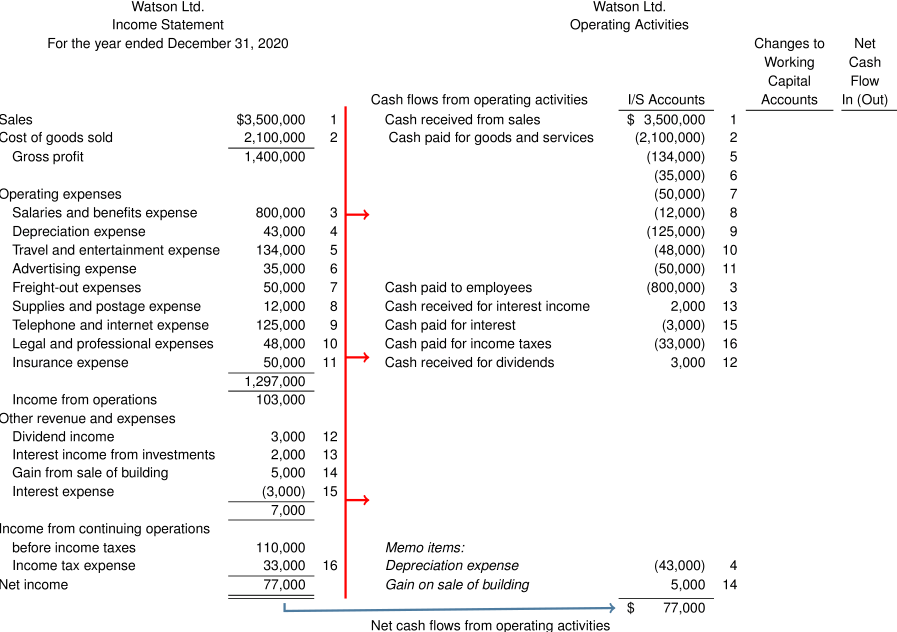

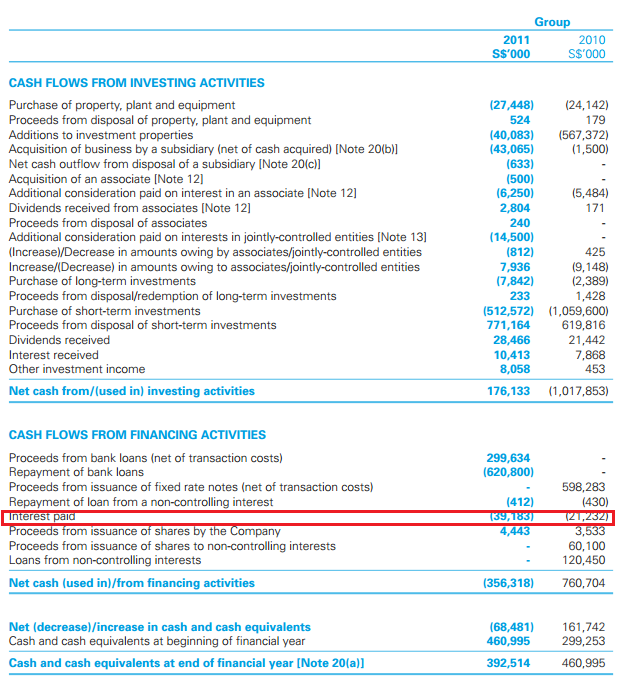

Treatment of dividend received in cash flow statement. Cash flows from financing activities. Paragraph 33 of ias 7 states that interest paid and interest and dividends received are normally classified as operating cash flows by a financial institution. If the company receives dividends from an investment, that is considered dividend income.

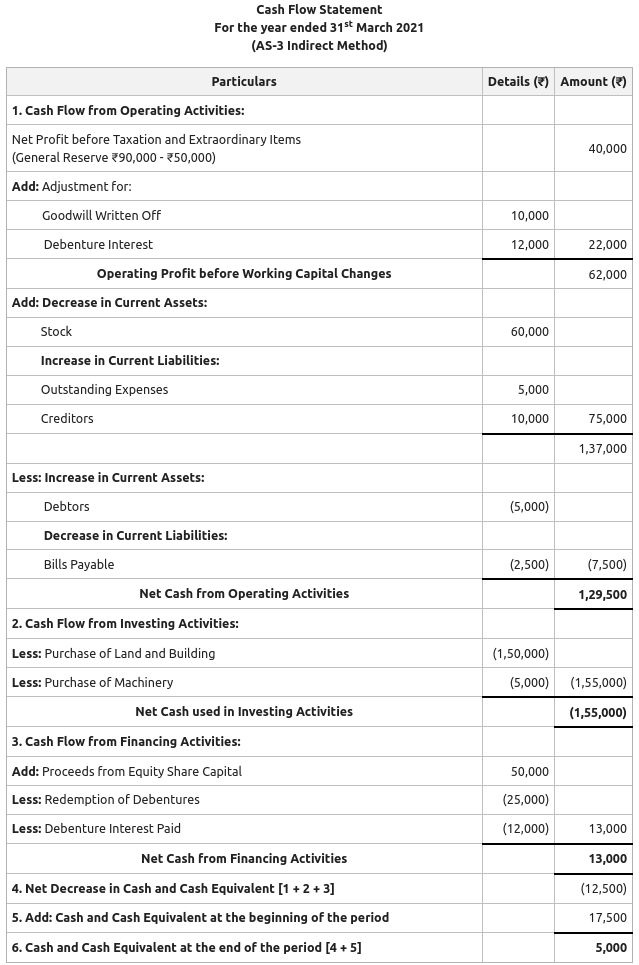

The purpose of the statement of cash flows is to provide a means “to assess the enterprise’s capacity to generate cash and cash equivalents, and to enable users to. Cash flows from interest and dividends received and paid shall each be disclosed separately. Figuring the formula for dividends and cash flow.

According to the definitive international statement on this, international accounting standards (ias) 7, statement of cash. Consolidated statements of cash flows. However, there are two approaches to deal with the treatment of unclaimed dividend:

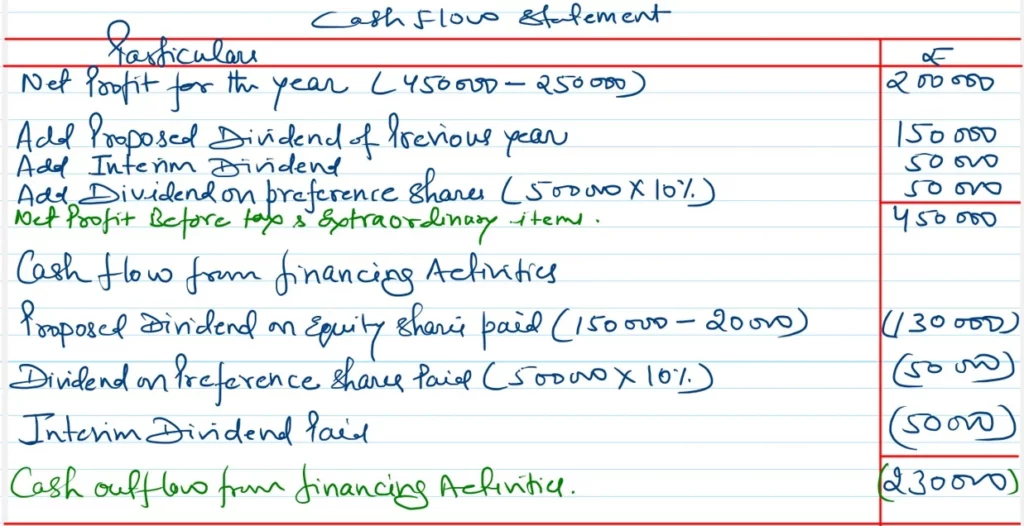

Dividends paid are required to be classified in the financing section of the cash flow statement and interest paid (and expensed), interest received, and dividends received. Paid and interest/dividends received in the statement of cash flows by prescribing a single classification for each of these items. Each shall be classified in a consistent manner from period to period as.

The answer to this is not so straightforward. Proceeds from issue of share capital. The primary purpose of a cash flow statement is to track the movement of cash, which includes not only the actual currency but also cash equivalents such as.

In general, paragraph 7.14 requires a company to present cash flows from dividends both paid and received separately and consistently. To determine how much outward cash flow results from a dividend payment, you have to know the amount of. This paper does not address the.

International accounting standard (ias) 7 statement of cash flows in para 31 requires: Any dividend income should be recorded in the operation section as a cash. Operating or financing cash flows.

Payment of lease liabilities ( 90). The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of. As cash dividends are cash outflows, they are shown as negative numbers in the financing section of the cash flow statement (examined in detail in chapter 8).

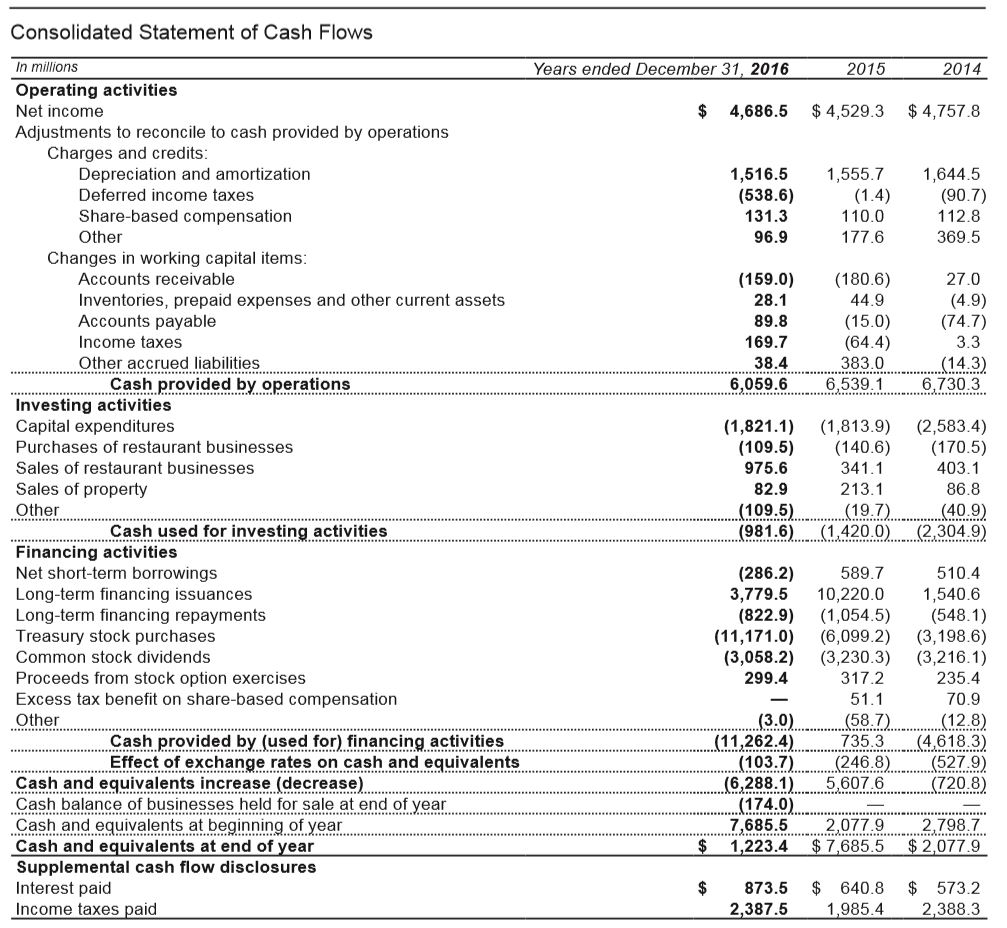

The above consolidated statements of cash flows should be read in conjunction with the accompanying notes. Require companies, other than those for which investing and financing are main business activities, to classify interest and dividends paid as cash flows arising. Classification of certain cash receipts and cash payments, to address eight.

First, since there is no inflow or outflow of cash, there is no need to show it in the cash.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)