Smart Info About Trial Balance Retained Earnings

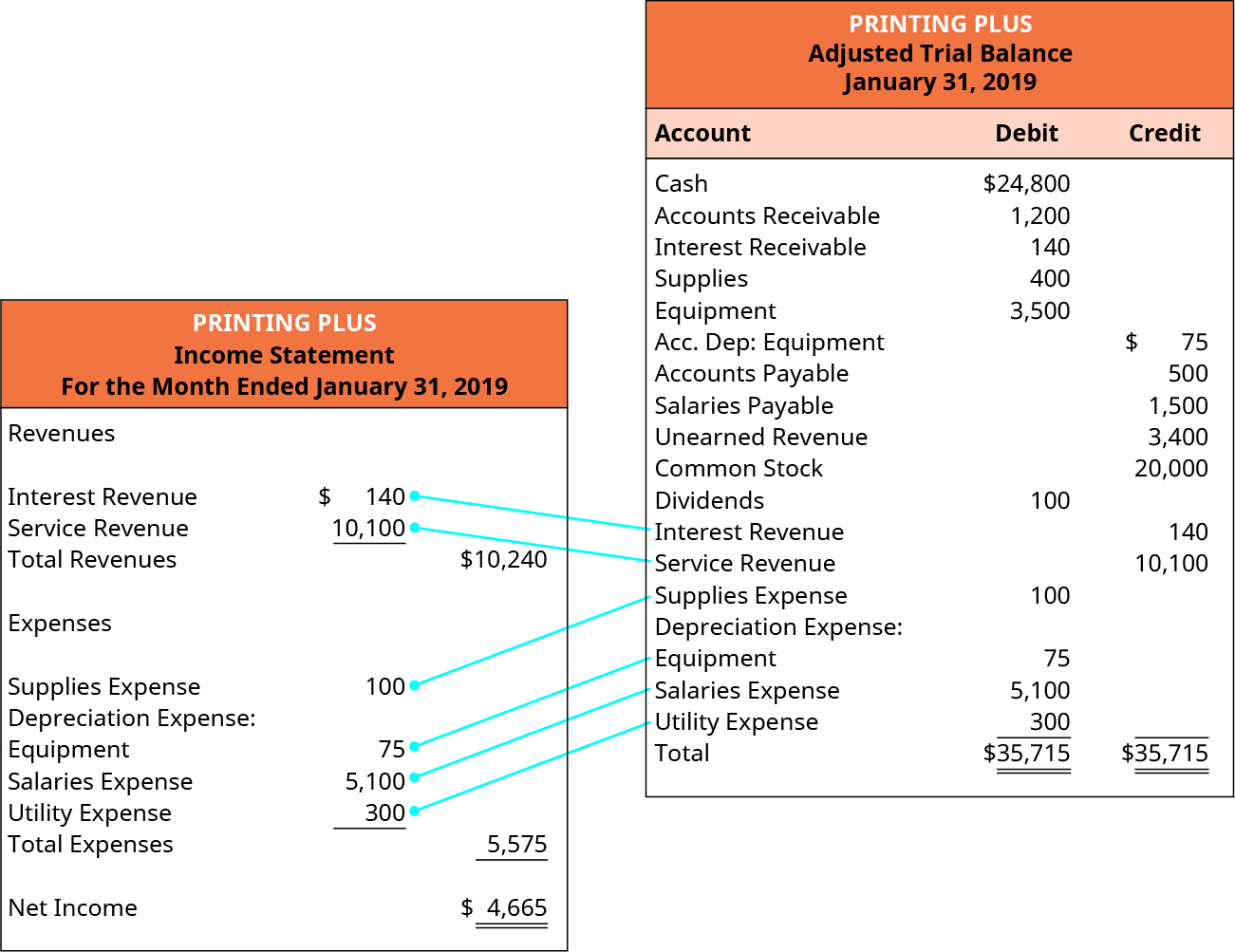

A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle.

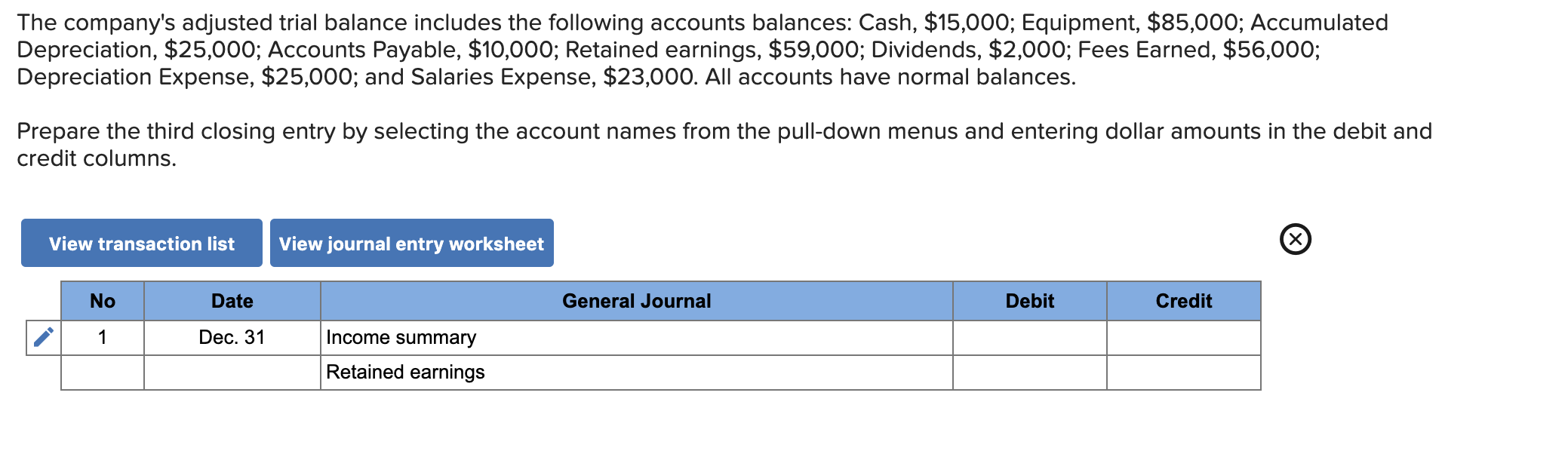

Trial balance retained earnings. Find your beginning retained earnings balance. Notice how the retained earnings balance is $6,100? The statement of retained earnings is prepared before.

In the trial balance, the accumulated past profits that. To get a better understanding of what retained. In accrual accounting, we record the revenue as it is earned.

Unlike previous trial balances, the retained earnings figure is included, which was obtained through the closing process. Errors that result in an unbalanced trial balance are usually the result of a one sided entry in the bookkeeping records or an incorrect addition. At this point, the accounting cycle is complete, and.

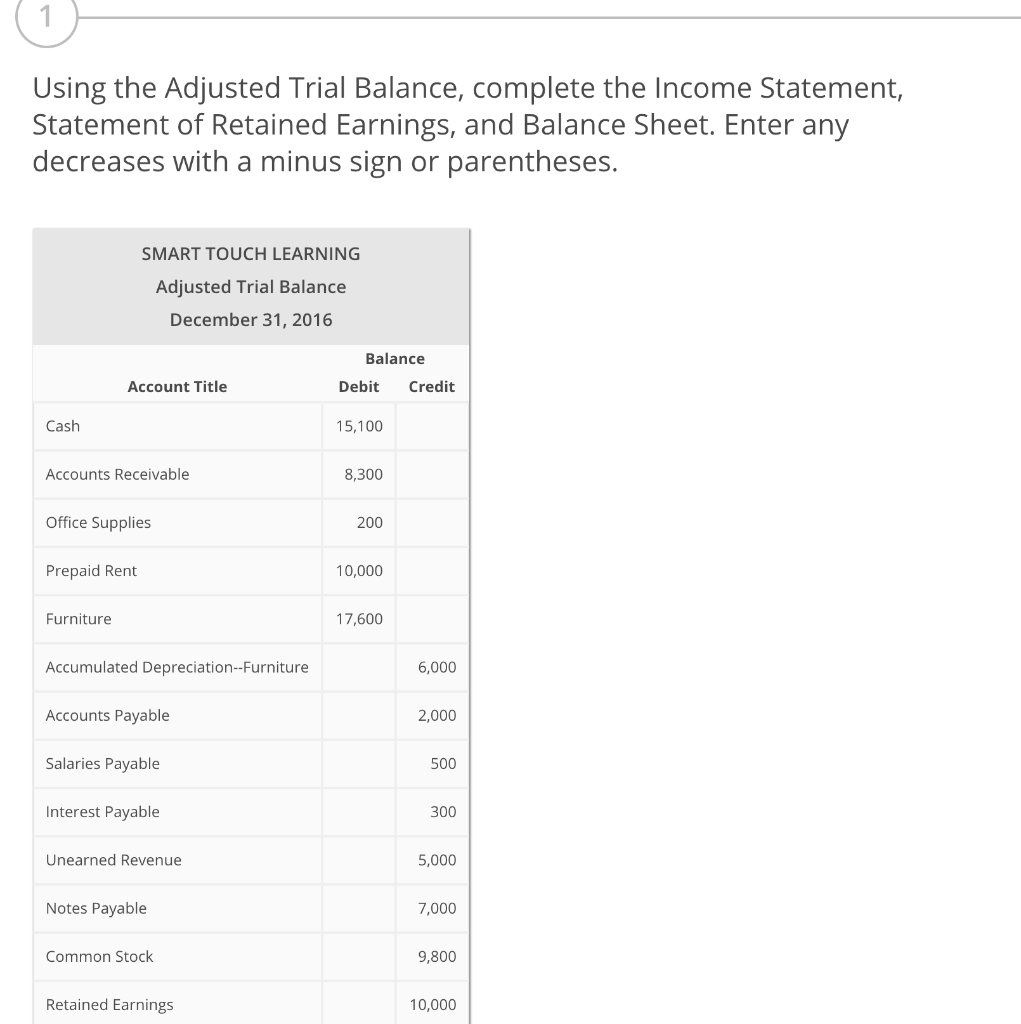

They reflect the residual net income after accounting for any dividends distributed to shareholders. Cash, accounts receivable, office supplied, prepaid insurance, equipment, accumulated depreciation (equipment), accounts payable, salaries payable,. In the trial balance, retained earnings are not “calculated” (the trial balance is just a snapshot of accounting data).

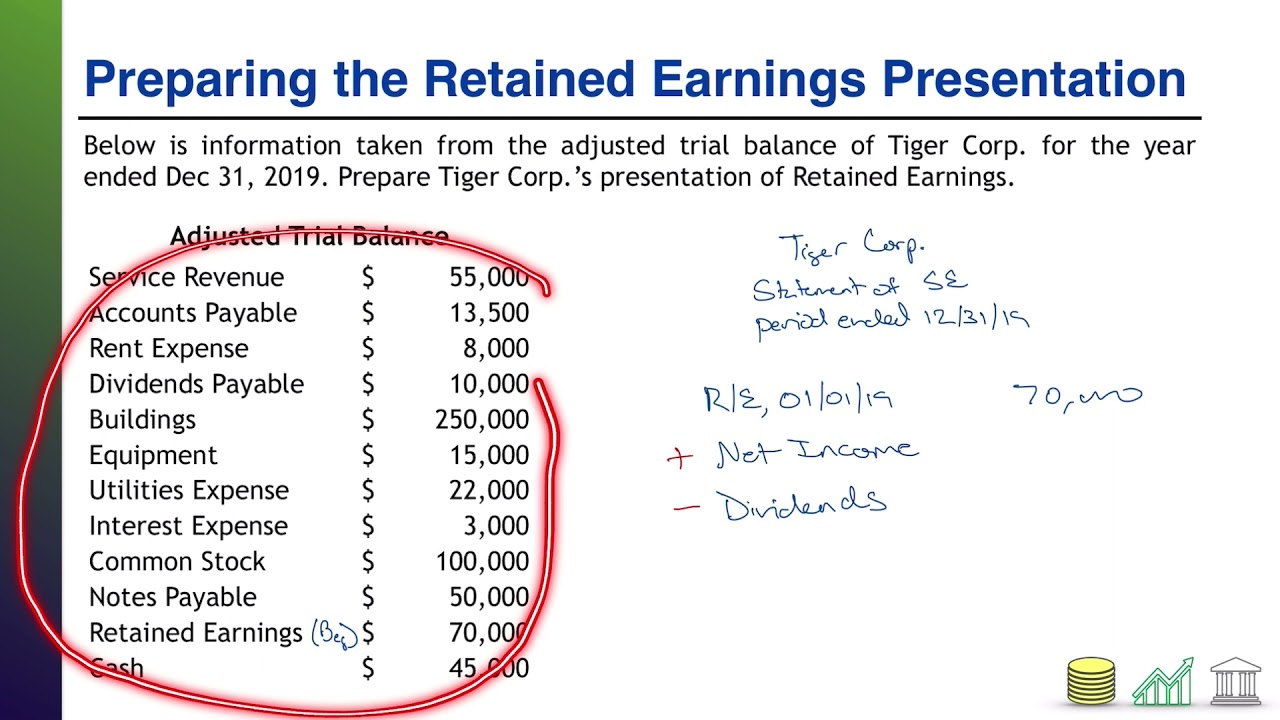

At this point, the accounting cycle is complete,. Let's break down the retained earnings calculation for abc ltd:. On the statement of retained earnings, we reported the ending balance of retained earnings to be $15,190.

However, they are calculated by adding the current year’s net. Cash, accounts receivable, office supplied, prepaid insurance, equipment, accumulated depreciation (equipment), accounts payable, salaries payable,. During the year, the company earned a net income of $200,000 and distributed $50,000 in dividends.

This includes all balance sheet and profit and loss accounts together in one report. Beginning retained earnings corrected for adjustments, plus net income, minus dividends, equals ending retained. First, we record the beginning balance in retained earnings — the amount in the pot at the beginning of the accounting period.

The retained earnings calculation or formula is quite simple. Retained earnings appear on the balance sheet under the shareholders’ equity section. Retained earnings appear on the trial balance as part of equity and represent the link between the income statement and the balance sheet.

Retained earnings refer to the historical profits earned by a company, minus any dividends it paid in the past. Unlike previous trial balances, the retained earnings figure is included, which was obtained through the closing process. The steps to calculate retained earnings on the balance sheet for the current period are as follows.

Determine beginning retained earnings balance add current. The trial balance report is important because it gives you a view of all ledger accounts. Abc company has $12,000 in salaries that were unpaid as of the end of december, as well as $8,000 of earned but unbilled sales.