Can’t-Miss Takeaways Of Info About Cash Flow From Investing And Financing Activities

The main components of the cfs are cash from three areas:

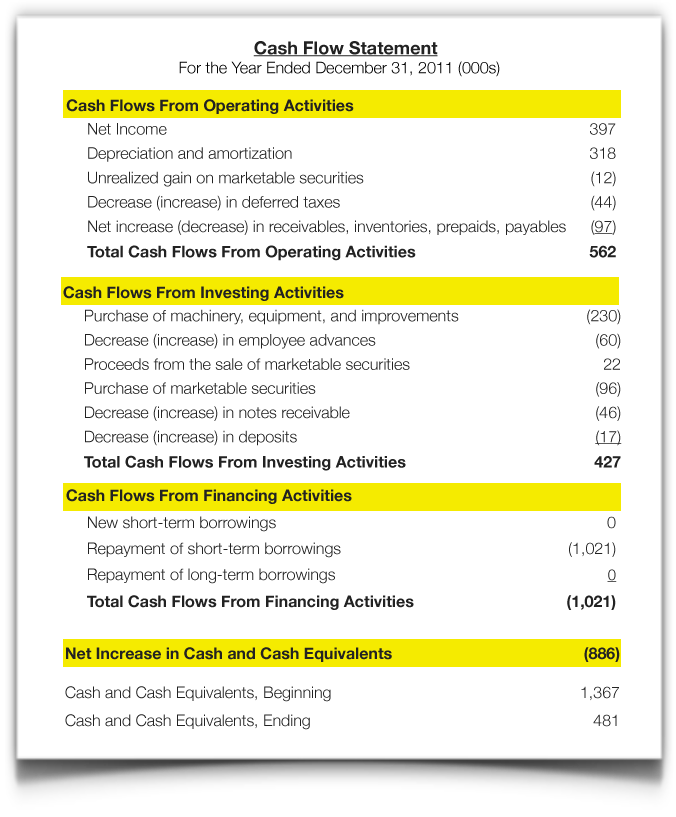

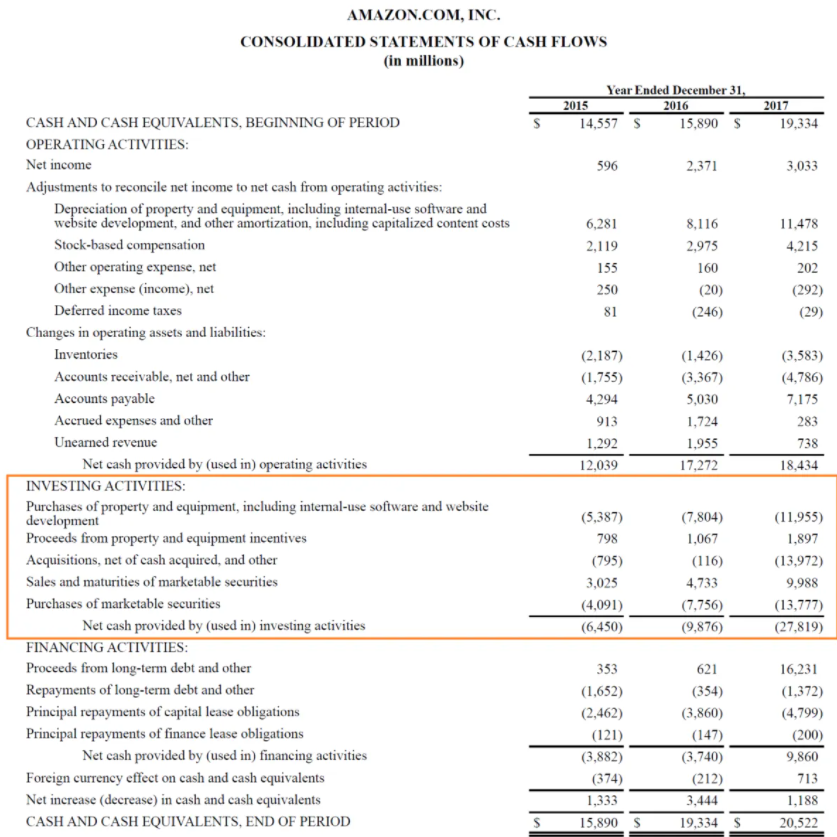

Cash flow from investing and financing activities. Other investing activities, net. The two methods of calculating cash flow are the direct method and. Cash flow from investing activities is part of your company cash flow statement and is used to display investing activities and their impact on cash flow.

Cash from financing activities explains how a firm raises money and covers the return of the cash raised to investors. On a statement of cash flows, this transaction is listed within the financing activities as a $400,000 cash inflow. The md&a section of apple's annual report provides a detailed explanation of the company's financial performance, its cash flows from operating, investing, and financing activities, and the factors that.

Cash flow from operating operations, cash flow from investment activities, and cash flow from financing activities. Finance activities include the issuance and repayment of equity, payment of dividends, issuance and repayment of debt, and capital lease obligations. However, cash payments to manufacture or acquire assets held for rental to others and subsequently held for sale as described in paragraph 68a of ias 16 property, plant and equipment are cash flows from operating activities.

Repurchase of common stock — (75) proceeds from issuance of convertible notes, net of issuance costs. The financing activity in the cash flow statement focuses on how a firm raises. Cash flow from financing activities:

Usually, when companies expand they invest in property, plant, and equipment (ppe), and investors or shareholders of the company can easily find all these. In layman’s terms, it tracks the net change in. Cash flow from financing activities is the net amount of funding a company generates in a given time period.

For this assignment, let's consider the company apple inc. For instance, if you decide to launch. Cash flows from investing and financing are prepared the same way under the direct and indirect methods for the statement of cash flows.

This provides information on cash flows that are derived from acquiring or repaying capital. Understand the cash flow statement for ceco environmental corp. Cash flow from investing activities refers to cash inflow and outflow of cash from investing in assets (including intangibles), purchasing of assets like property, plant and equipment, shares, debt, and from sale proceeds of assets or disposal of shares/debt or redemption of investments like a collection from loans advanced or debt issued.

To put it simply, if we receive cash in the transaction we add the cash amount received and if we pay cash in the transaction we sutract the cash amount paid. Cash flow from financing activities refers to the inflow and the outflow of cash from the financing activities of the company like change in capital from the issuance of securities like equity shares, preference shares, issuing debt, debentures, and from the redemption of securities or repayment of a long term or short term debt, payment of divi. Cash flows from investing and financing.

The purchase or sale of a fixed asset like property, plant, or equipment would be an investing activity. Featured here, the cash flow statement for fii btg pactual logistica, showing the changes in the company's cash and cash equivalents, broken down to operating, investing and financing activities. Examples of financing cash flows include cash proceeds from issuance of debt instruments such as.

Incurring the above $400,000 debt raises the note payable balance from $680,000 to $1,080,000. The cash flows relating to such transactions are cash flows from investing activities. Cash flow from financing (cfi):

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

:max_bytes(150000):strip_icc()/cashflowfinvestingactivities-recirc-8787bbde413f4036b2f8cfad5c4c6a99.png)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)