Impressive Info About Principles Of Trial Balance

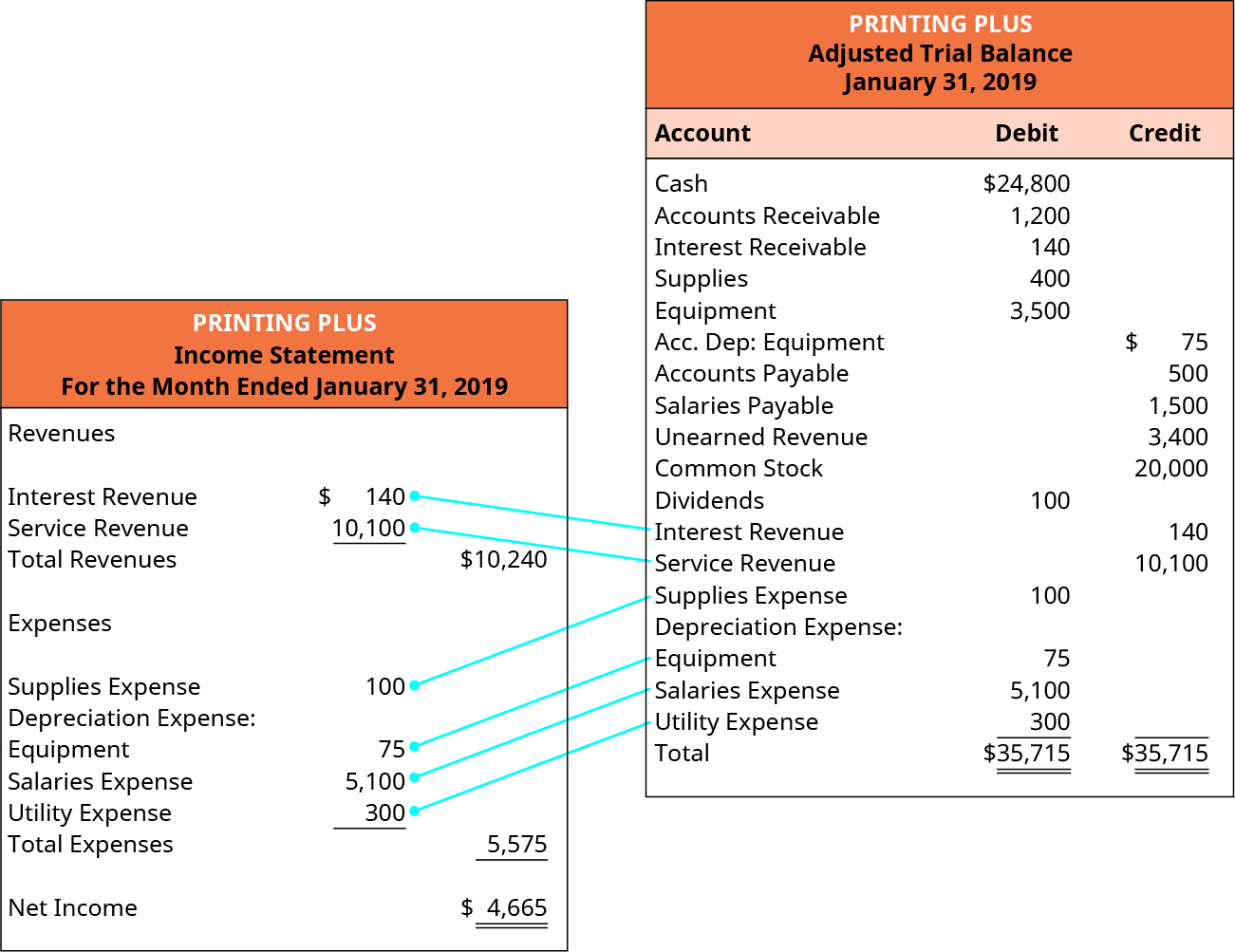

You are preparing a trial balance after the closing entries are complete.

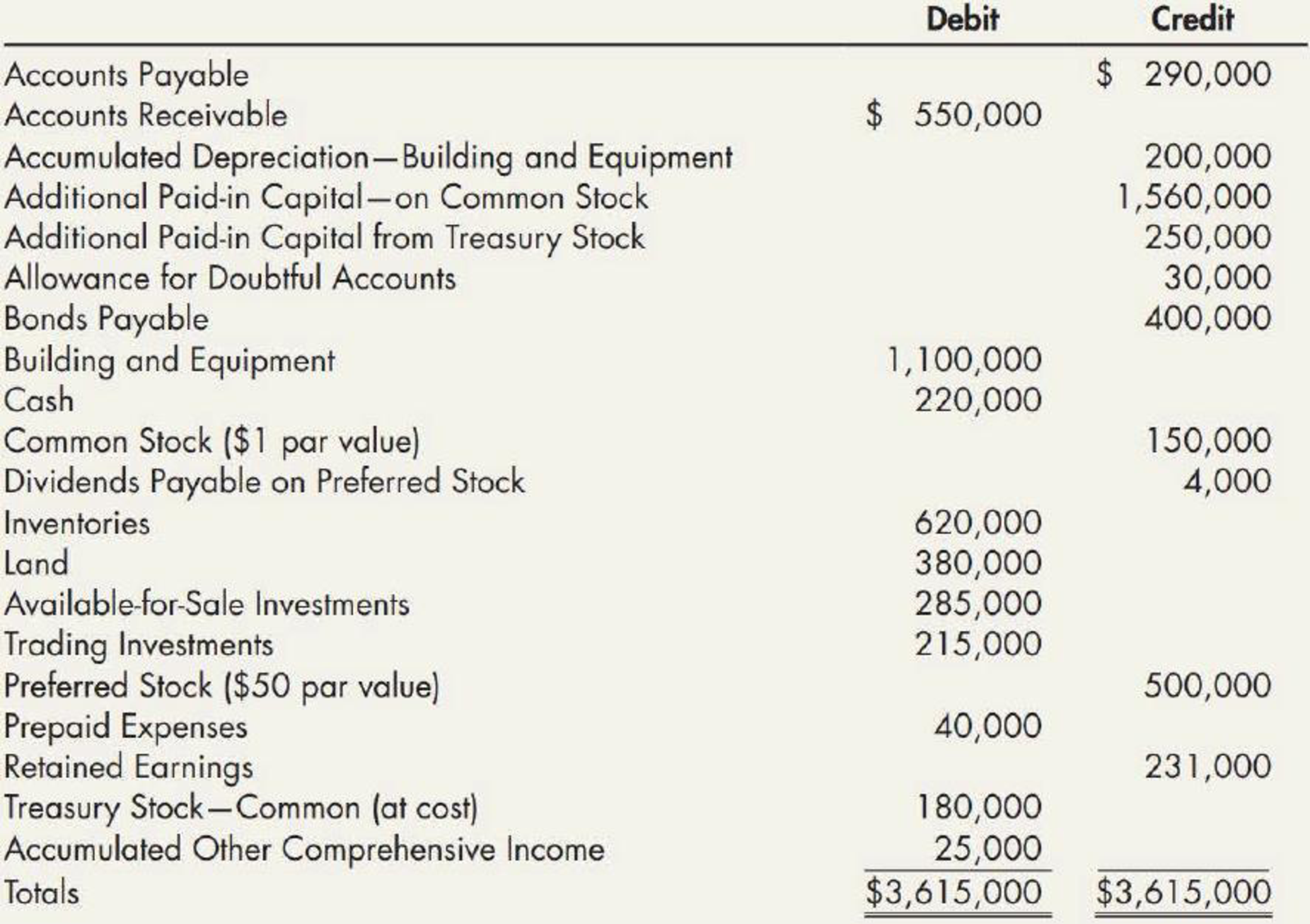

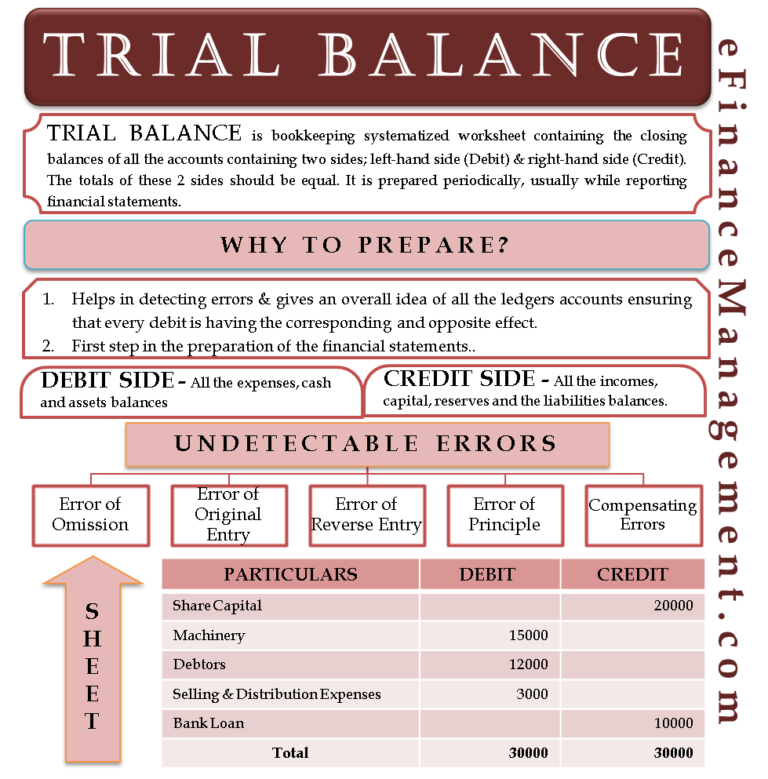

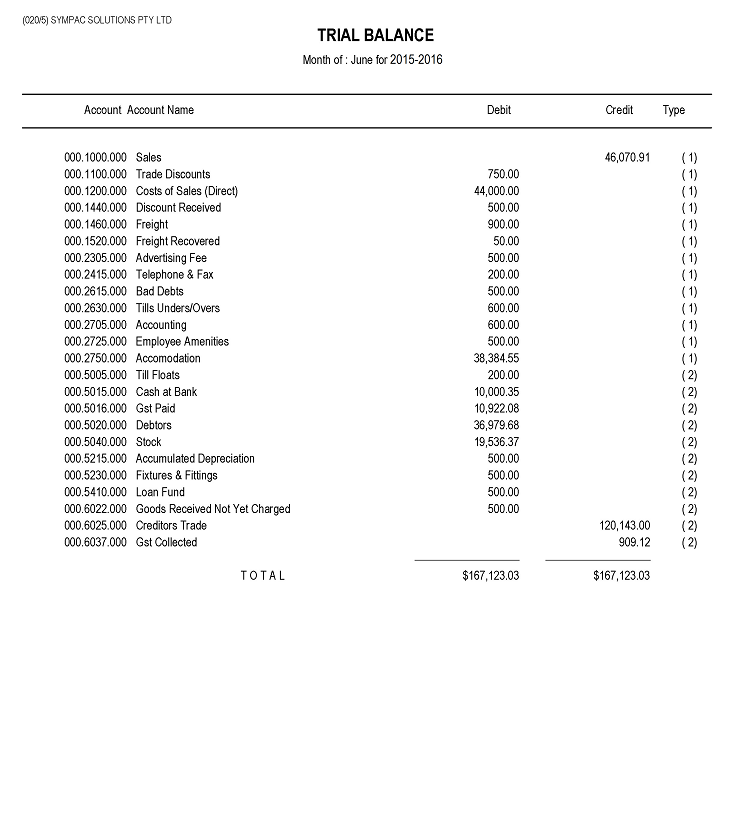

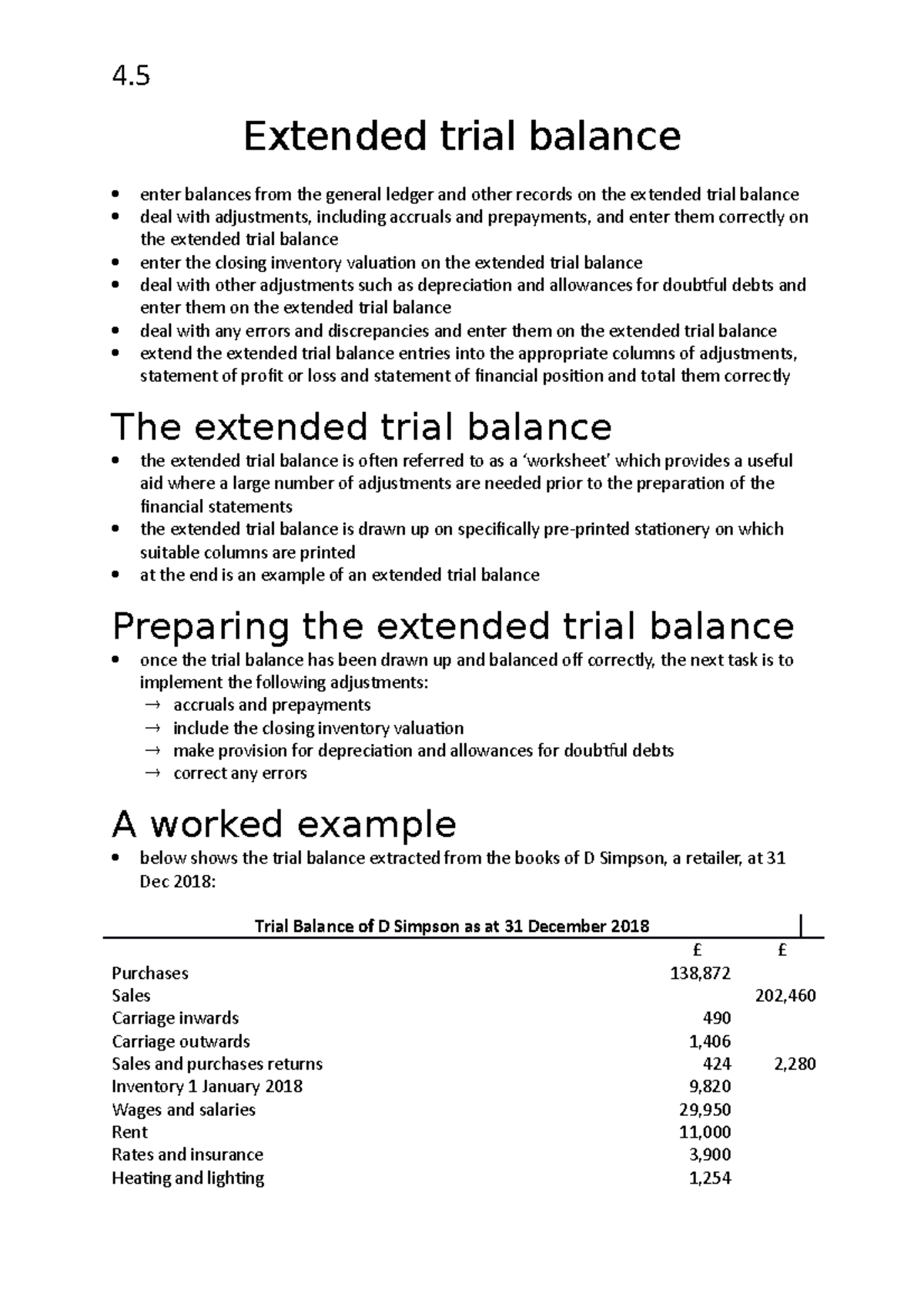

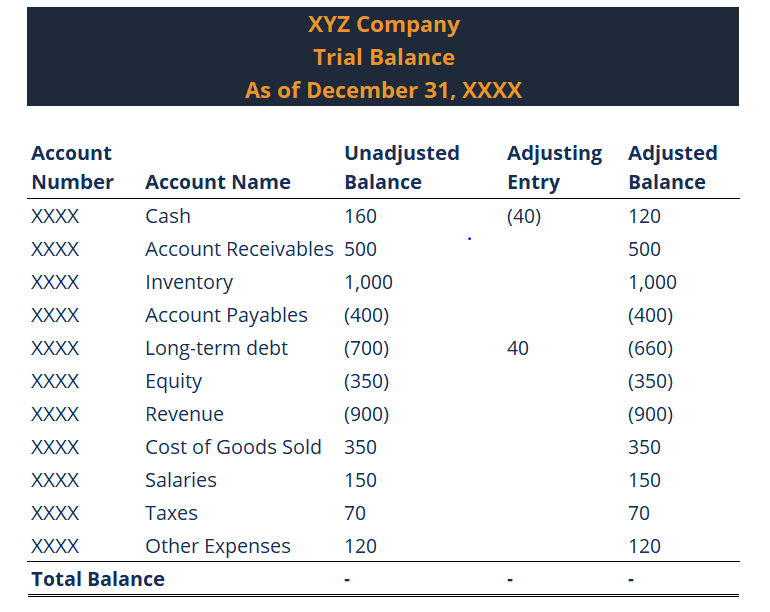

Principles of trial balance. A trial balance is a list of all accounts in the general ledger that have nonzero balances. Trial balances are a vital auditing technique used to ensure whether the total debit equals the total credit in the general ledger accounts,. Once you have prepared the adjusted trial balance,.

The balance is the difference between the total credits and the total debits of an account. Used to check initial accuracy before adjustments. This trial balance is an important step in the.

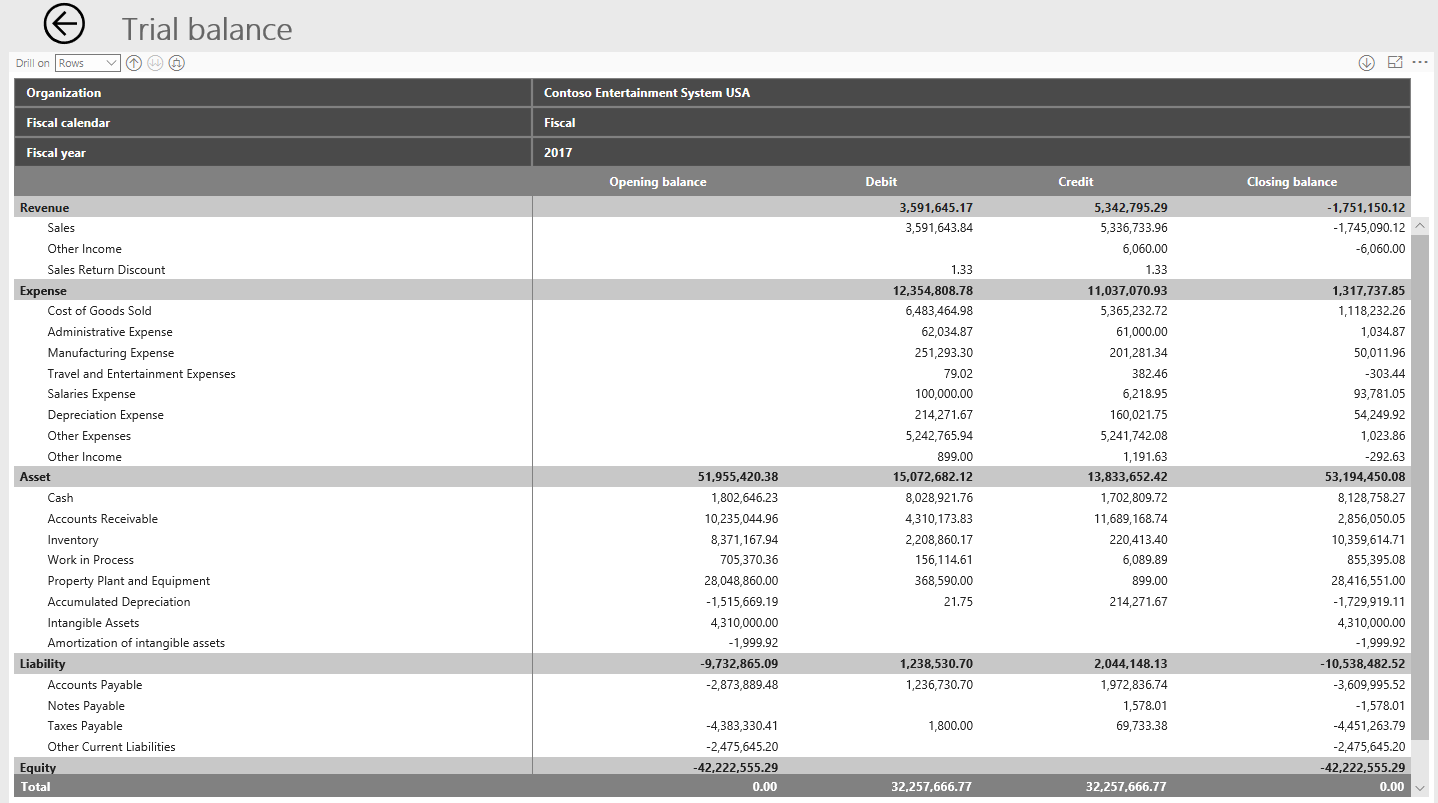

Lo 4.5 prepare financial statements using the adjusted trial balance mitchell franklin; Common ledger accounts include inventory, utilities, loans, rent and wages. Although you can prepare a trial balance at any time, you would typically prepare a trial balance before preparing the financial statements.

Trial balance can be defined as the schedule or list that shows the debit and credit balances which are extracted from the ledgers, to show the arithmetical accuracy of the. What is a trial balance? Multiple trial balance problems and solutions are available here.

This statement comprises two columns:. How each type is used within the accounting cycle: Preparing an unadjusted trial balance is the fourth step in the accounting cycle.

You are preparing a trial balance after the closing entries are complete. An adjusted trial balance is a list of all accounts in the general ledger, including adjusting entries, which have nonzero balances. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company.

Trial balance is a initial summary for books of account. On the trial balance the accounts.

:max_bytes(150000):strip_icc()/trial-balance-4187629-1-c243cdac3d7a42979562d59ddd39c77b.jpg)