Best Of The Best Info About Standalone And Consolidated Balance Sheet

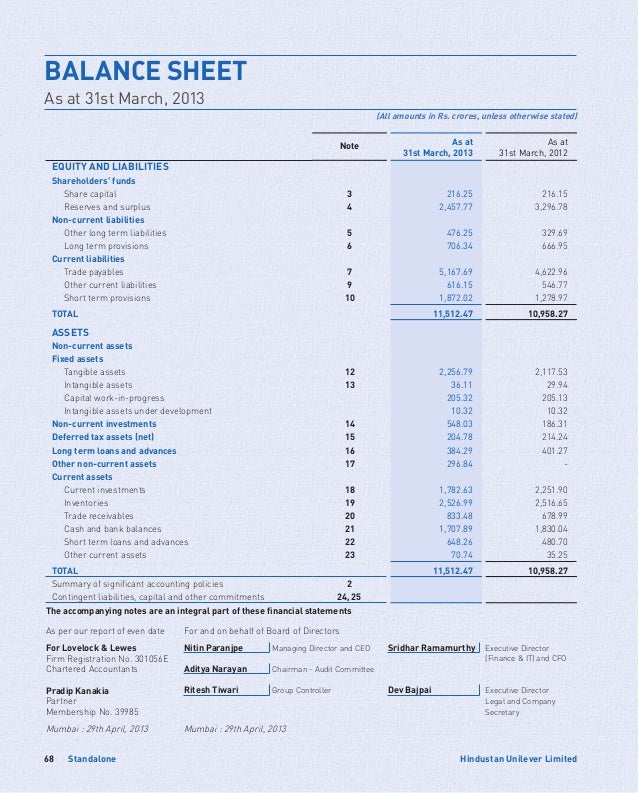

Standalone financials should also be checked and compared with the consolidated financial to get a deeper insight on the functioning of the business.

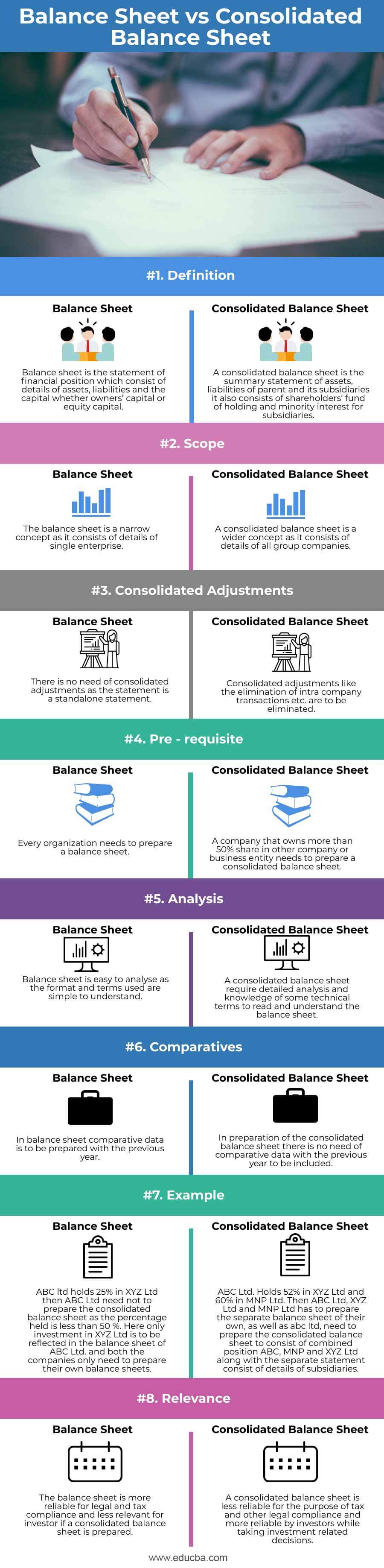

Standalone and consolidated balance sheet. Consolidated financial statements report both its shareholders’ interests and the minority interest of its subsidiaries, where applicable. By analysing the standalone financials the investor will not be aware of the position of its subsidiaries which might affect its investment decisions. So, let’s look more into the differences between these two balance sheets.

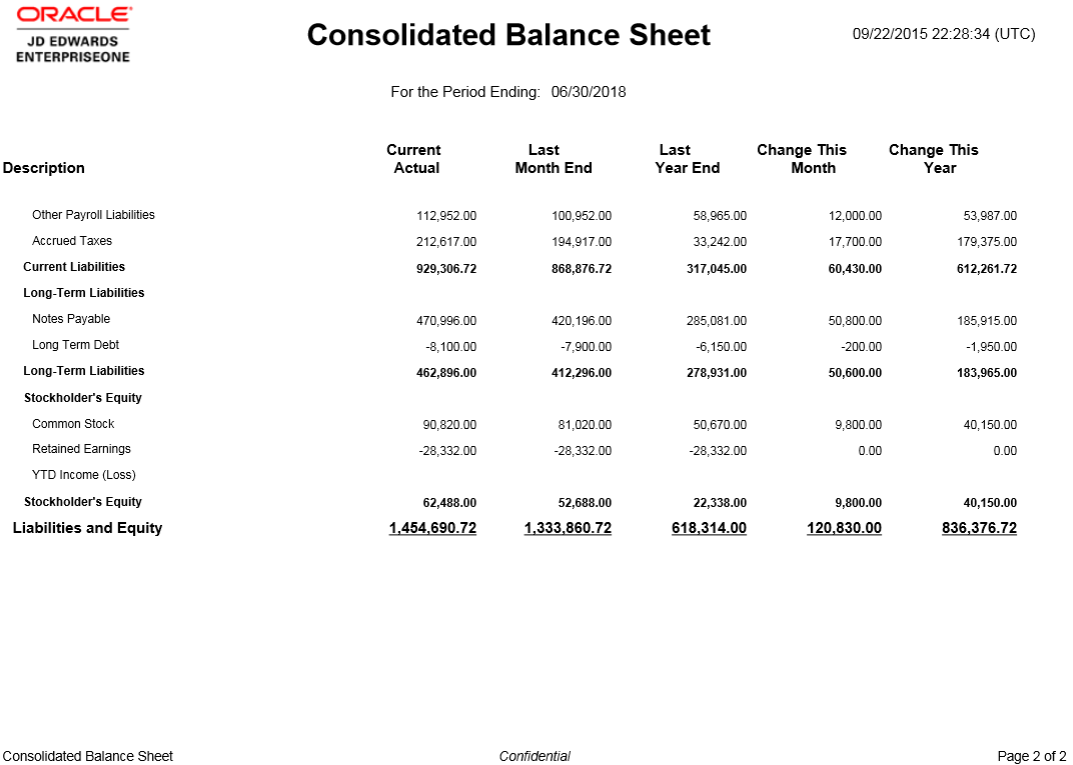

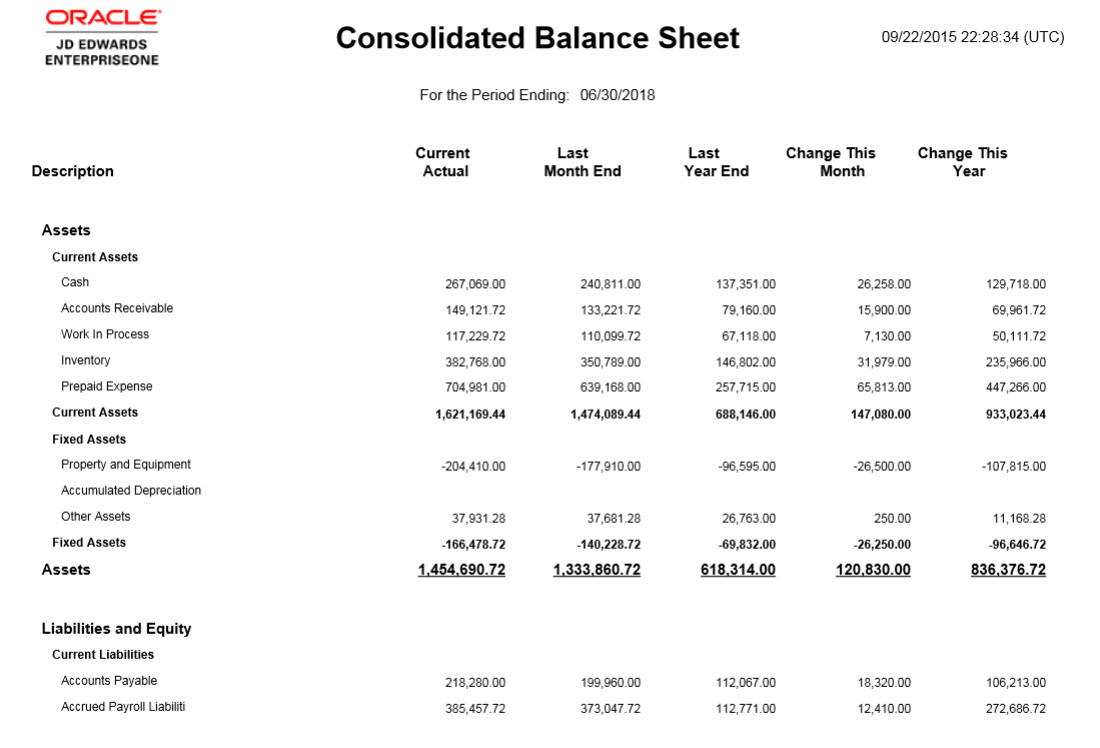

The annual accounts of all the eurosystem national central banks will be finalised by the end of may 2024, and the final annual consolidated balance sheet of the eurosystem will be published thereafter. The company’s management department is liable for preparing consolidated statement balance sheets. Studying the consolidated balance sheet offers a better insight into the company’s financial performance.

Standalone financial statements only report its shareholders’ interest in its balance sheet. Standalone vs consolidated balance sheet. It includes information about its associate.

Based on provisional unaudited data. A few differences between standalone vs consolidated scope of analysis studying the consolidated and standalone balance sheet offers a better understanding of the financial performance of the company. 2) copy the standalone financial data from the “data sheet” of the excel file (quarters, p&l, balance sheet, cash flow, price, the adjusted number of shares) for the particular years e.g.

For fy2007, 2008, 2009, 2010 in case of omkar. Consolidated balance sheet is that a balance sheet is one of the company’s financial statements that present the company’s liabilities and assets at a particular point in time. 1) download both the standalone & the consolidated financials separately.

Back to the topic, the ‘consolidated profit and loss statement’ or ‘consolidated balance sheet’ would always be more important than ‘standalone’. However, this need not always be true. As an individual investor being thrown into the world of investing may be a wild experience.

Key differences standalone and consolidated reports are very different in terms of the areas they cover. The main difference between standalone financial and consolidated financial statements is that the consolidated form reports all activities of a company and its subsidiaries as a combined entity. A standalone statement gives financial information about a single company alone.

Let’s take a closer look at each of them below. Standalone financial statements pertain solely to the financial performance and position of a particular entity and exclude any financial data of its subsidiaries or other entities it may possess. And after learning that there are various financial reports kinds, including consolidated and standalone.

A standalone balance sheet focuses solely on an individual company's finances. A balance sheet provides information on a company's assets, liabilities, and equity. The key differences between standalone and consolidated financial statements:

Entering the universe of investing as an individual investor may be a wild journey. The primary difference between a balance sheet and vs. In contrast, standalone financial statements report these findings as a separate entity.