Heartwarming Info About Reconciliation Of Cost And Financial Accounts Examples

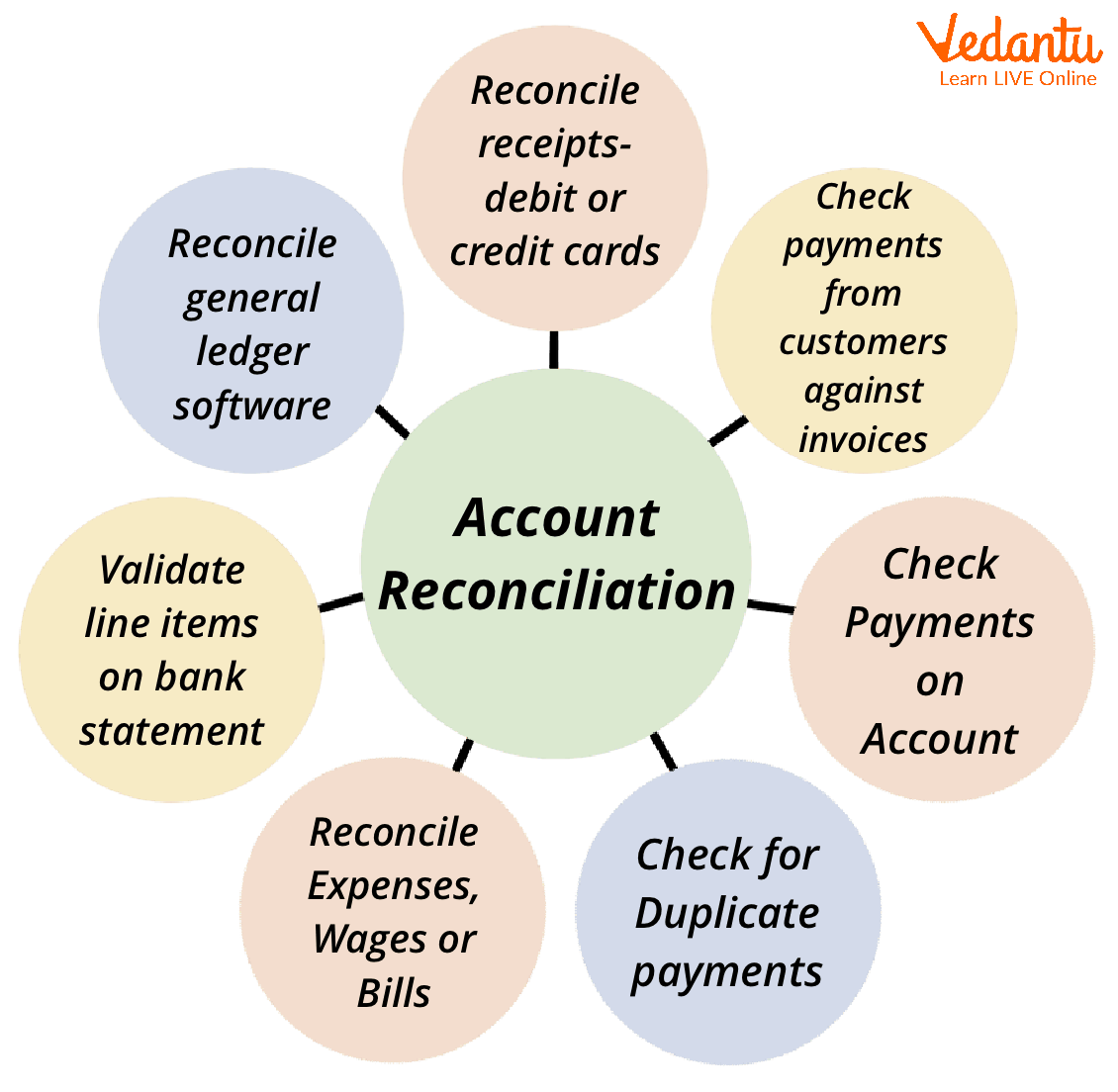

Companies use this method to find out if there are any discrepancies while preparing the accounting statements.

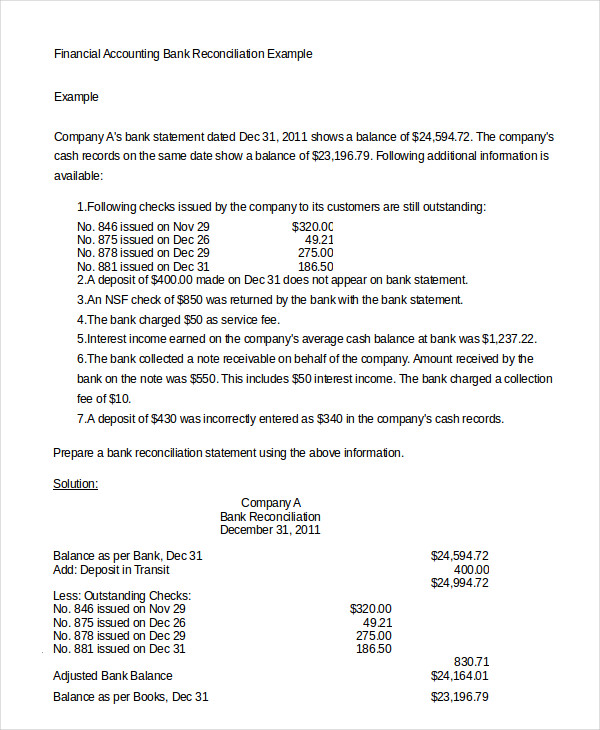

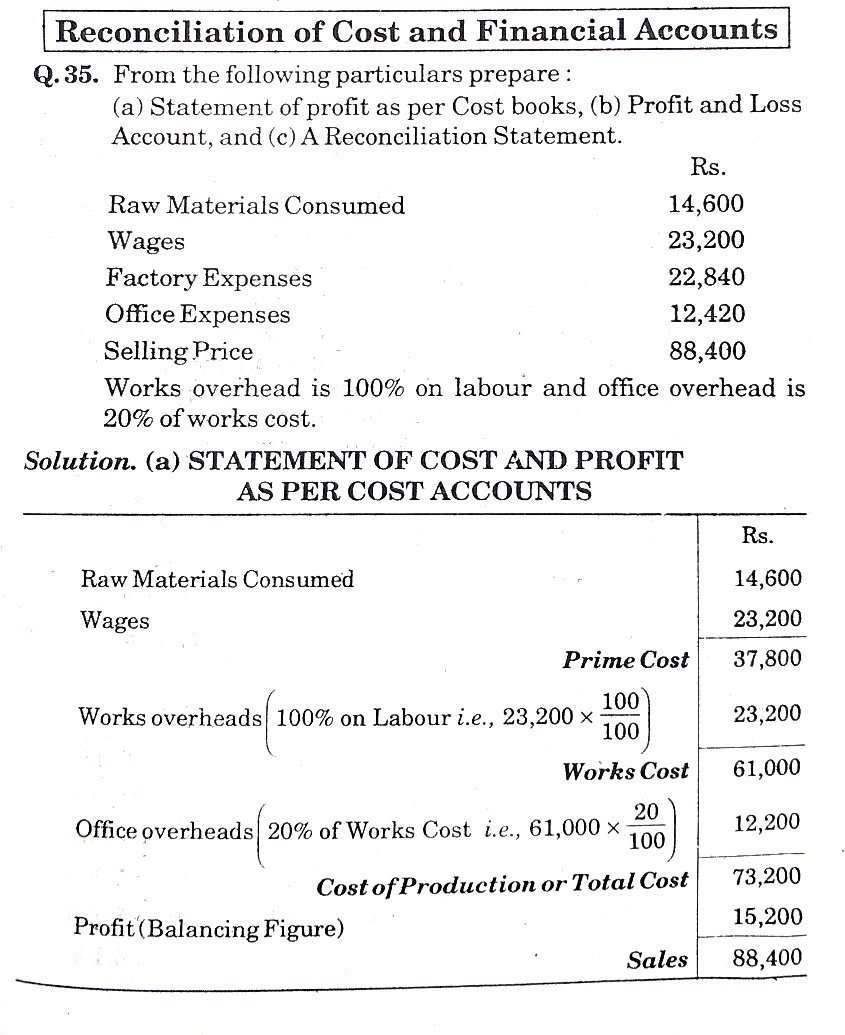

Reconciliation of cost and financial accounts examples. Profit disclosed by a company’s cost accounts for the year was $50,000, whereas the net profit disclosed by the financial accounts amounted to $46,000. Has a balance per pass book of $ 1,000 as of 31st march 2019. Example of reconciliation of cost and financial accounts.

Bank reconciliation comparing the transactions and balances in a business’s bank statement with the entries in the cash book or general. Reconciling the two accounts helps identify whether accounting changes are needed. Further details are listed below:

The cost can be computed either on actual or estimated basis. The cost and financial accounts are reconciled by preparing a reconciliation statement or a memorandum reconciliation account. The core objective of cash reconciliation is to identify mismatches between the cash on hand and the sales transactions recorded, thereby safeguarding against financial inaccuracies in a company's records.

Given below are 5 major types of them: It explains the causes of the profit or loss discrepancy between cost and financial statements. The reconciliation of cost and financial accounts can also be presented in the form of an account prepared on a memorandum basis.

Reconciliation of cost and financial accounts 1. Reconciliation statement particulars profit as per cost accounts add : A cheque of $300 was deposited but not collected by the bank.

List the factors responsible for causing difference in profit or loss shown by cost and financial accounts; Compensation is at management procedure that compares two sets of records to check that the related represent correct and in agreement. (2) start with the profit as per cost account.

Here are the different types of accounting reconciliation: A number of these transactions, like earnings and payments, are then tracked by the bank. The same principles of bank reconciliation will apply here.

We only use the costs incurred during the current period. For example, the internal record of cash receipts and disbursements can be compared to the bank statement to see if the records agree with each other. Depreciation in cost accounts is 3,000 and that in financial accounts is 3,400.

Reconciliation is an accounting procedure that compares pair kits of records to check so the figures am correct and in agreement. (3) (a) regarding items of expenses and losses: Explain the need for reconciliation of cost and financial accounts;

Therefore, no adjustment will be required on this account. Accounting reconciliation involves comparing and verifying financial transactions and balances to identify and resolve discrepancies. Reconciliation of the cost and financial accounts is a process to determine the difference between the profits calculated from financial accounts and cost accounts.