Fantastic Tips About Cash Flow Statement To Balance Sheet

Consider using accounting software or financial statements for.

Cash flow statement to balance sheet. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. To forecast the income statement, balance sheet, and cash flow statement for amazon for the year 2022, you can use historical data and assumptions to estimate future figures. In the full statement, we can see that clear lake has net cash flow of $20,000.

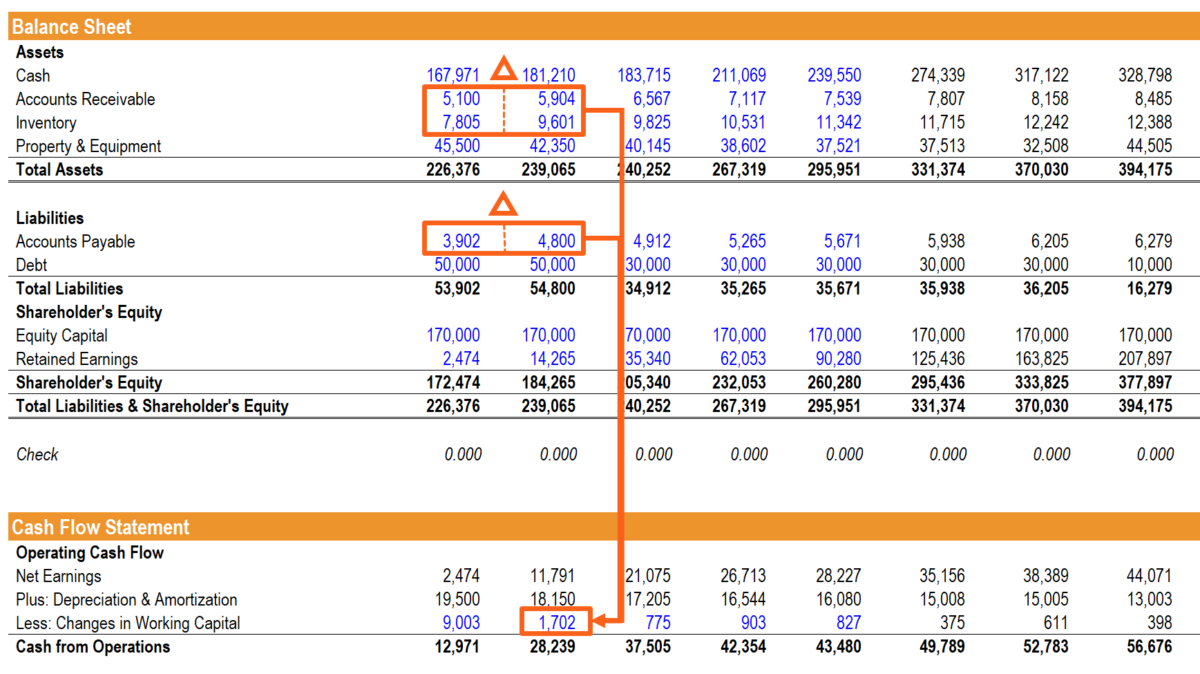

From 2019 to 2021, we will utilize the financial statements provided: Compile financial data for the given period gather all relevant financial data for the specified period. Adjusted income statement, balance sheet and cash flow adjusted income statement (in euro million) fy 2022 fy 2023 % change revenue 19,035 23,199 22% other recurring operating income and expenses (16,724) (20,155) share in profit from joint ventures 97 122 recurring operating income 2,408 3,166 31% % of revenue 12.6%.

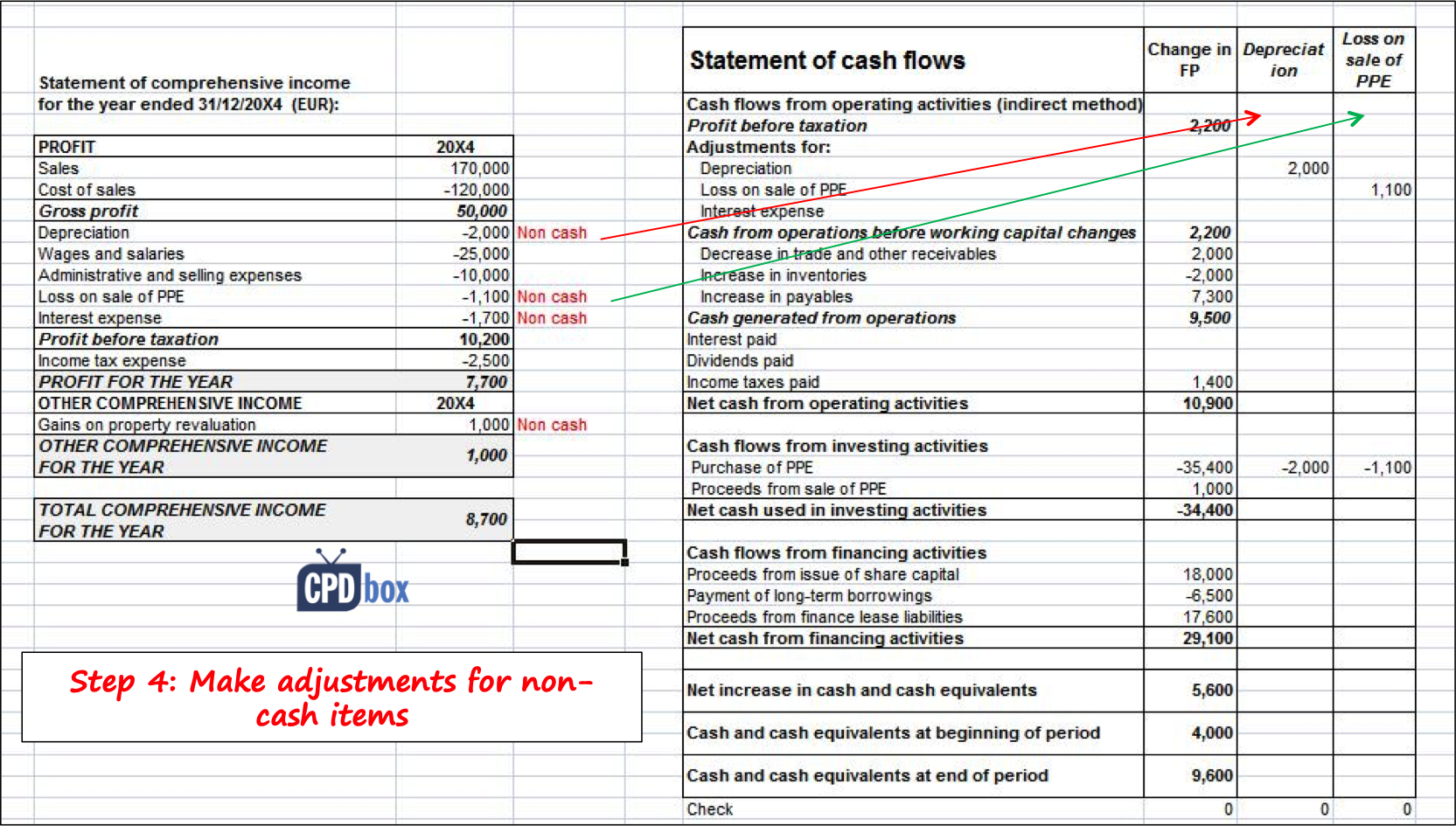

Find the cash and cash equivalent at the beginning and end of the reporting period step 3: Net income from the bottom of the income statement links to the balance sheet and cash flow statement. Make adjustments for non cash transactions step 4:

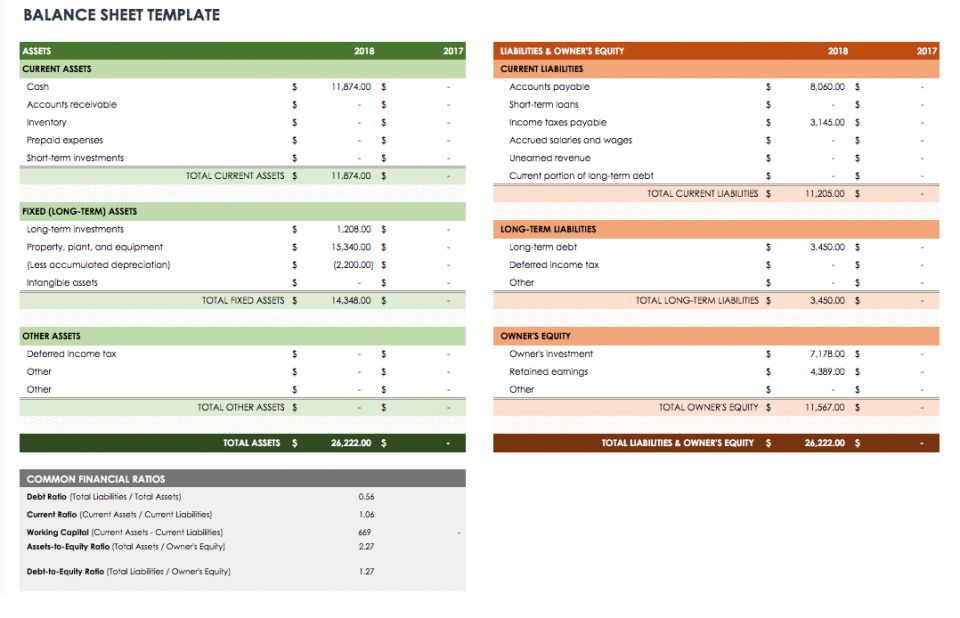

The cash flow statement is required for a complete set of financial statements. The three core financial statements are 1) the income statement, 2) the balance sheet, and 3) the cash flow statement. Cash flow and balance sheet and the accounting equation

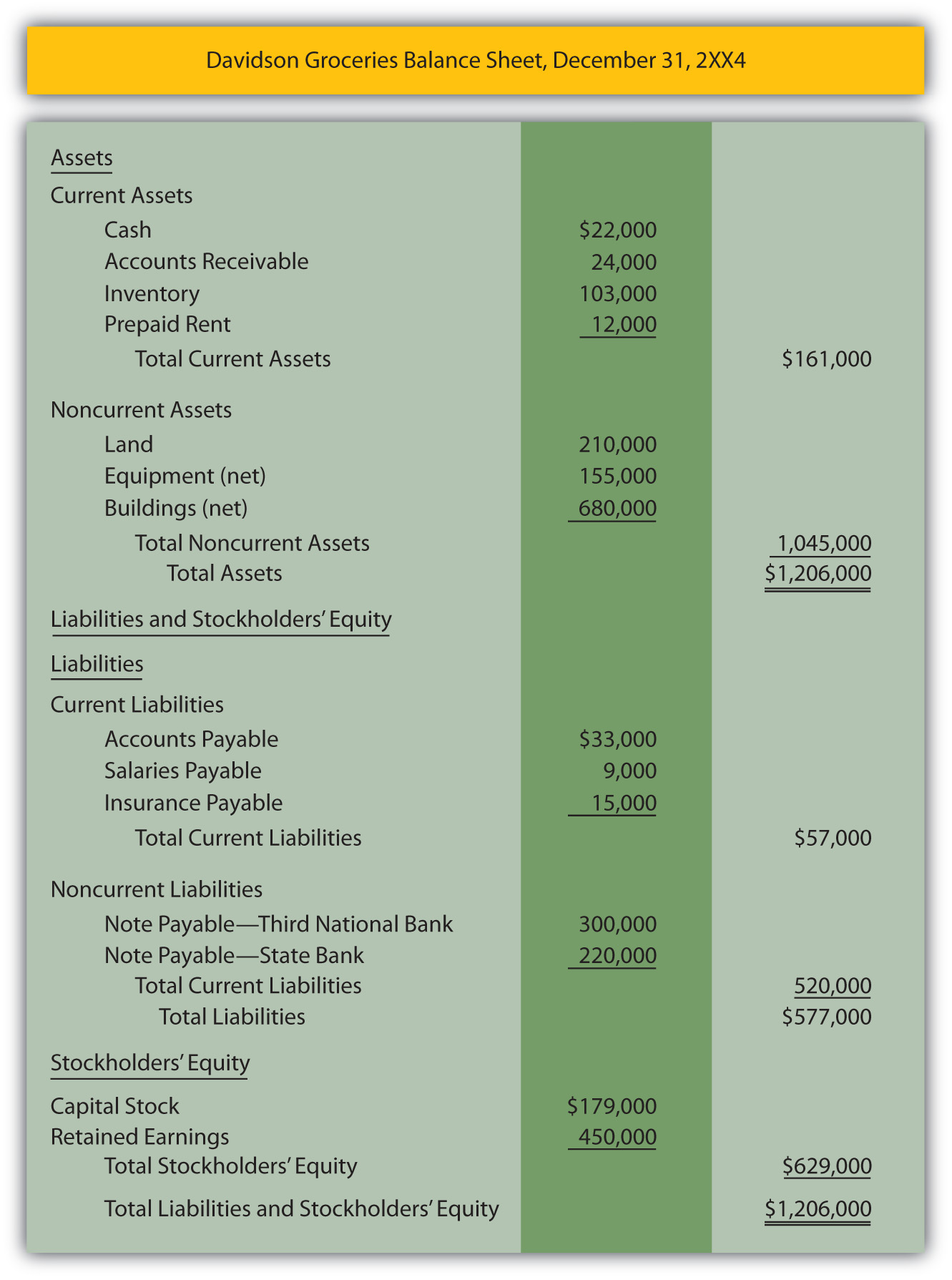

The balance sheet also referred to as the statement of financial. Key highlights since the income statement and balance sheet are based on accrual accounting, those financials don’t directly measure what happens to cash over a period. The balance sheet focuses on managing capital.

The balance sheet on the other hand, is a snapshot showing what the business owns and owes at a single moment in time, i.e. Securities and exchange commission (sec) and the. To conduct a thorough ratio analysis and comparison for bird construction inc.

Calculate the cash flows from investing activities The beginning cash balance was $90,000, making the ending. However, with the sharp increase in free cash flow generation, cash & equivalents on the balance sheet have jumped considerably.

This task is crucial to accurately calculate the company's assets, liabilities, and equity. Overview of the three financial statements 1. The three primary financial statements of a business — the balance sheet, the income statement, and the statement of cash flows — are intertwined and interdependent.

Approach to solving the question: This amount is then used to adjust the beginning cash balance from the balance sheet. Sufficient cash flow is incredibly important to business success.

The cfs measures how well a. Here's how you can approach each statement: If your business hopes to meet stakeholder, investor and peer expectations, hitting your key performance metrics is crucial.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)