Underrated Ideas Of Tips About Journal Entry For Distribution Of Profit

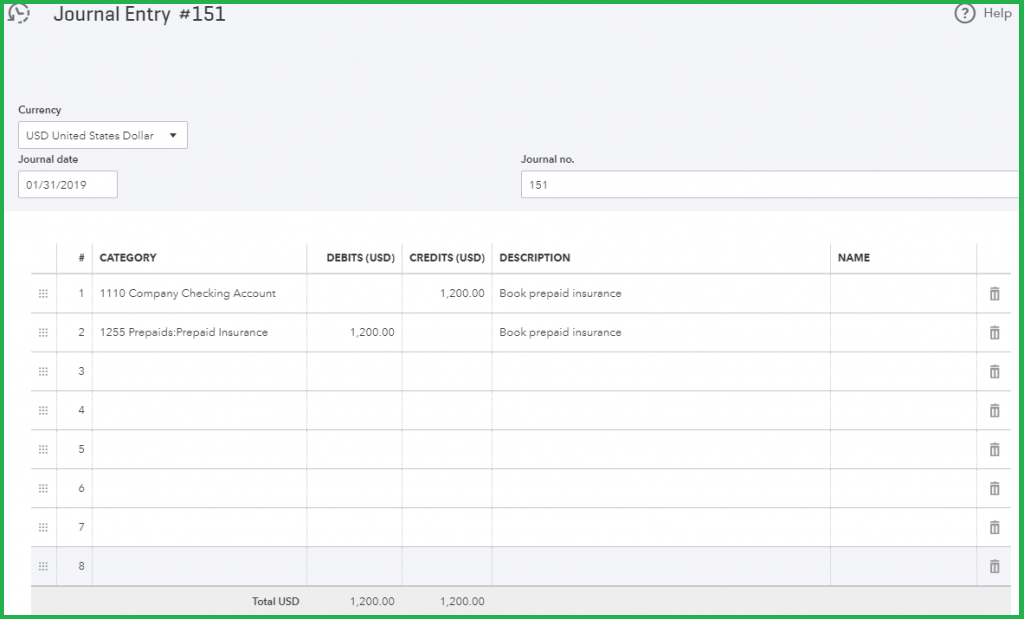

That is already what you would enter on the check or banking transaction that pays you the amount.

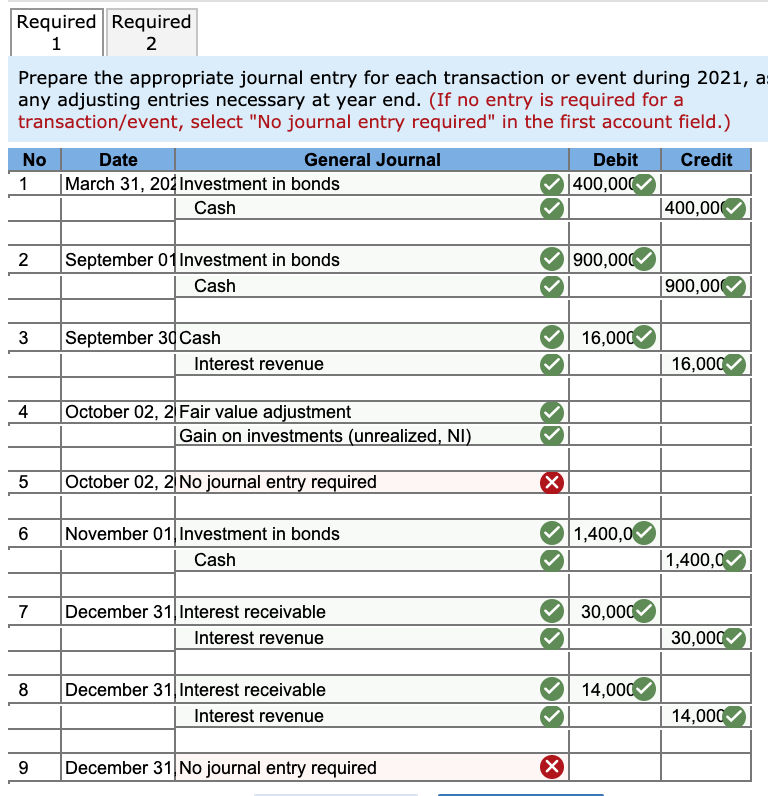

Journal entry for distribution of profit. The journal entry to record remi’s admission to the partnership and the allocation of the bonus to dale and ciara is as shown. Journal entry for cash distribution to shareholders shareholders. Investment of cash by diaz;

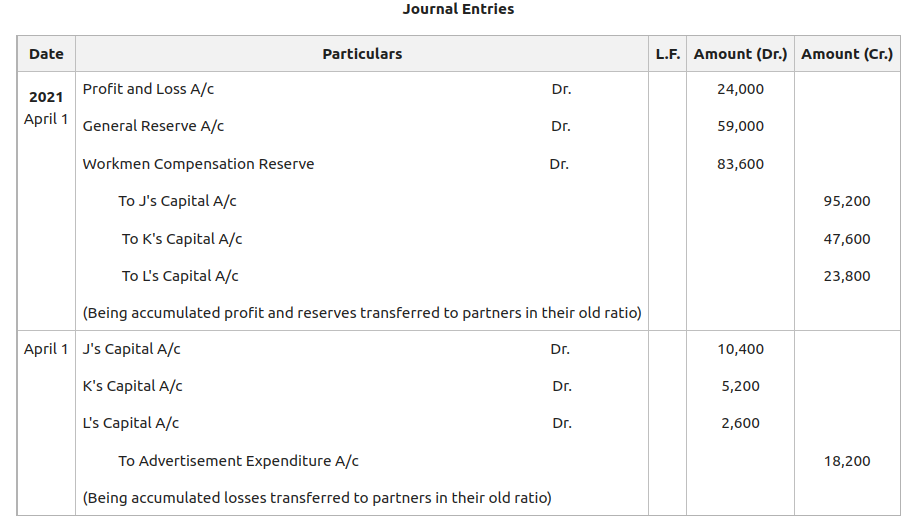

The partners agree on a profit and loss sharing ratio of 3:2:5. Journal entry for the distribution of reserves and accumulated profits: By obaidullah jan, aca, cfa and last modified on nov 3, 2012 net income earned by a partnership is distributed.

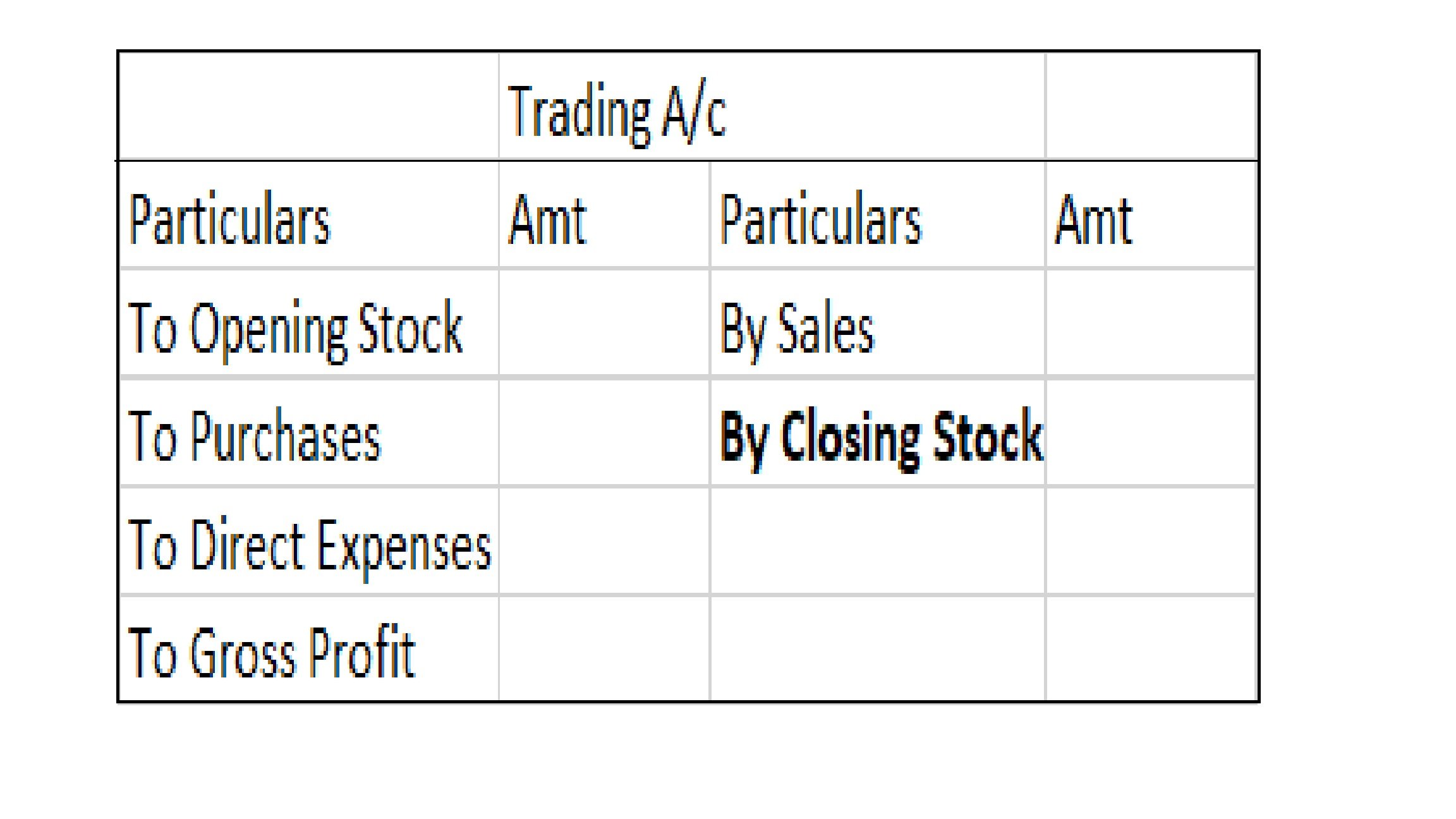

Profit & loss a/c (credit balance) dr. As such, it covers all of. 1 before you start 2 set up accounts for distribution of income 3 map report codes to the accounts 4 create and post a manual journal 5 run reports for the period what's next?.

If the llc is taxed as a partnership (form 1065) then you book. Record the following transactions as journal entries in the partnership’s records. There is no journal entry for taking a distribution.

Llc is not important, how the llc is taxed for federal income is the key. Journal entries for distribution of profit 1. Journal entry for distribution of profit among partners.

There are two options here. The partnership deed is the document that offers an insight into the process of delivering the profits and losses to. When the company process the.

To partners capital/current a/cs (individually) (partners salary is. The purpose of this article is to assist candidates to develop their understanding of the topic of accounting for partnerships. Transfer of the balance of profit and loss account to profit and loss appropriation account.

The journal entries to close net income or loss and allocate to the partners for each of the scenarios presented in the video would be (remember, revenues and expenses are. Profit distribution amount partner is the process which businesses share the profit with all partners base on their share ownership. Admission of new partner—bonus to new.

The company accumulated profit will include in the accumulated retained earnings on balance sheet. Pay partnership liabilities in cash. Journal entry for distribution to owner.

Shareholders have the right to receive distributions of cash from a company’s profits. The journal entry for this distribution would be: Allocate the gain or loss from realization to the partners based on their income ratios.