Amazing Info About Pro Forma Information

Pro forma financial information under the hong kong listing rules.

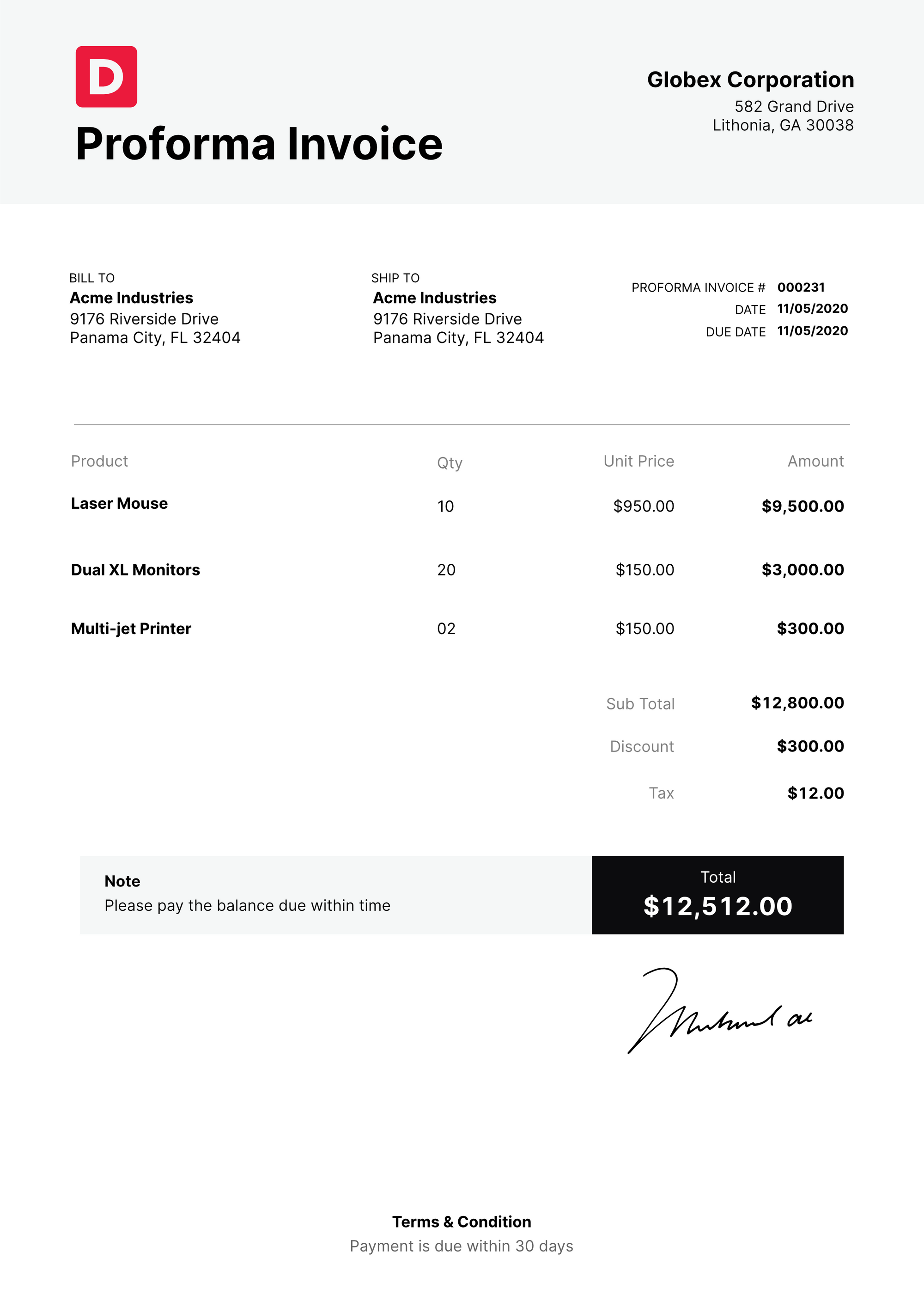

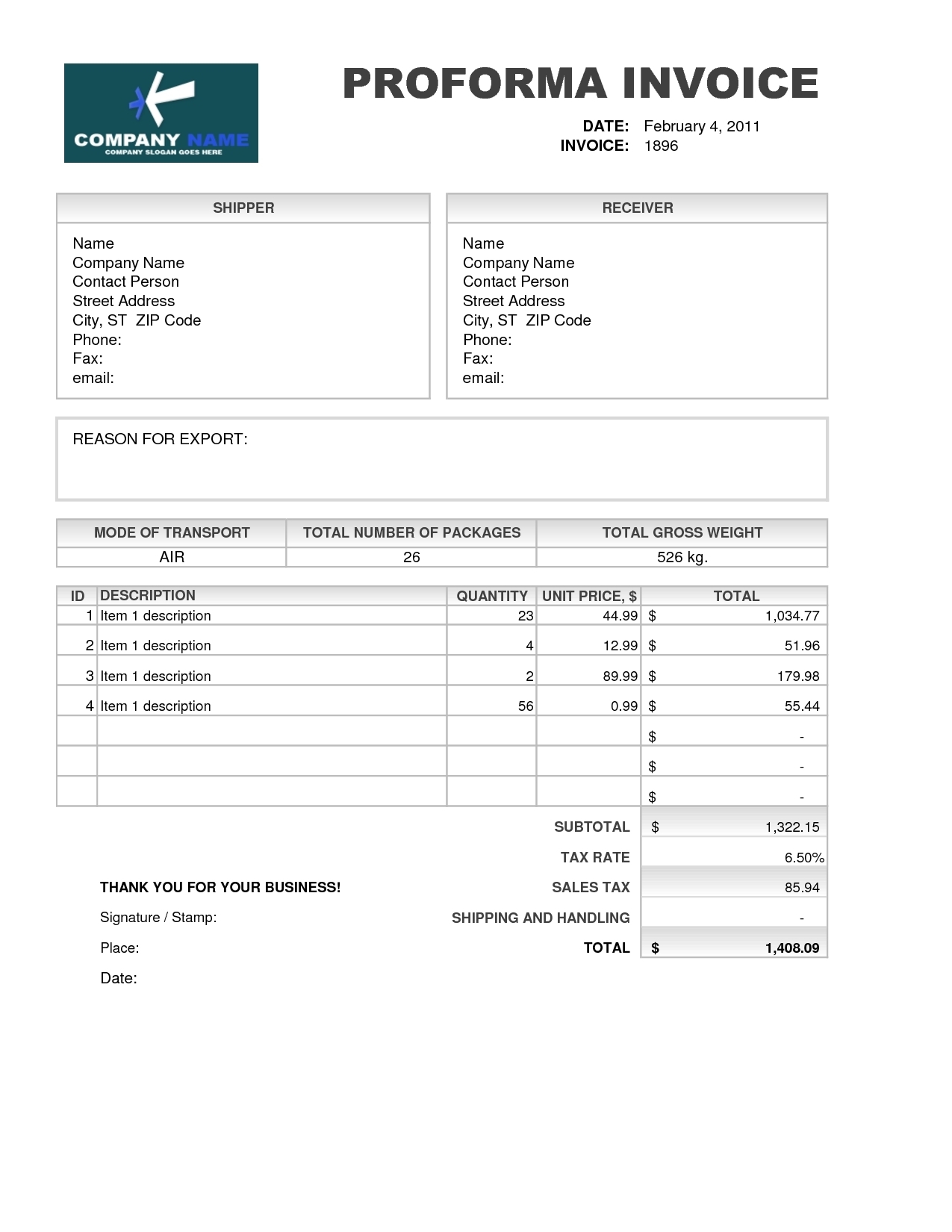

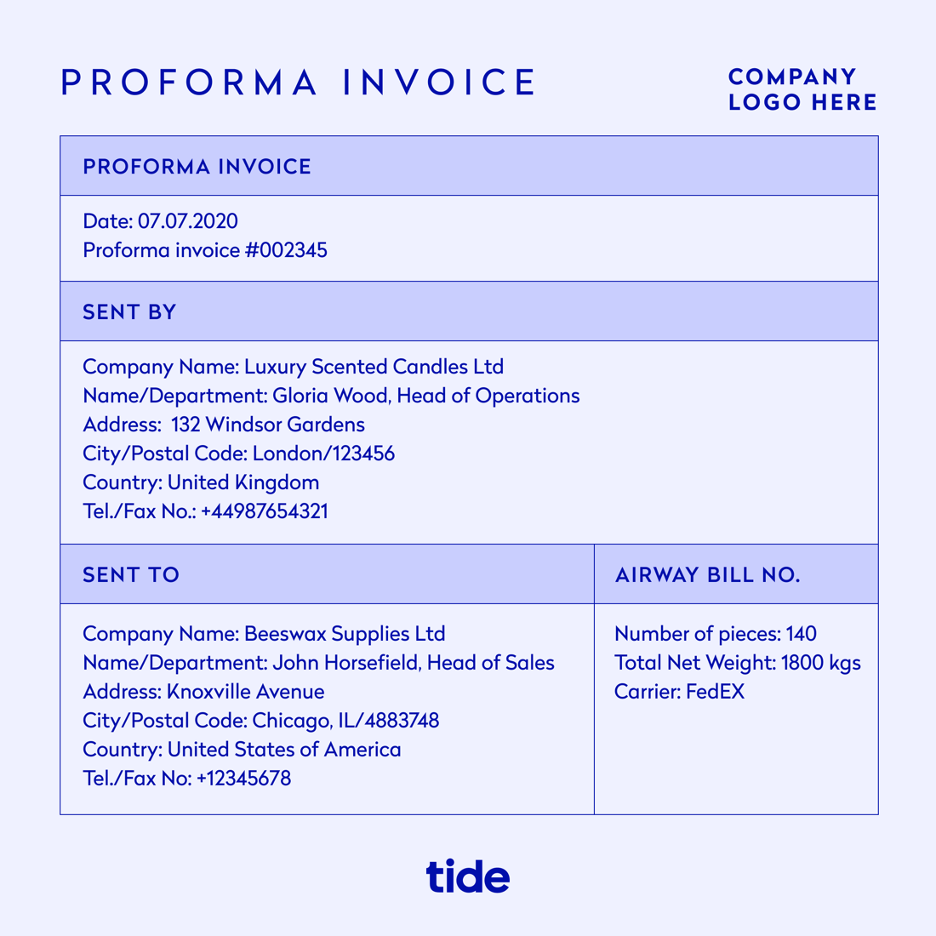

Pro forma information. Pro forma financial information: Pro forma is latin for “as a matter of” or “for the sake of form.” it is used primarily in reference to the presentation of information in a formal way,.

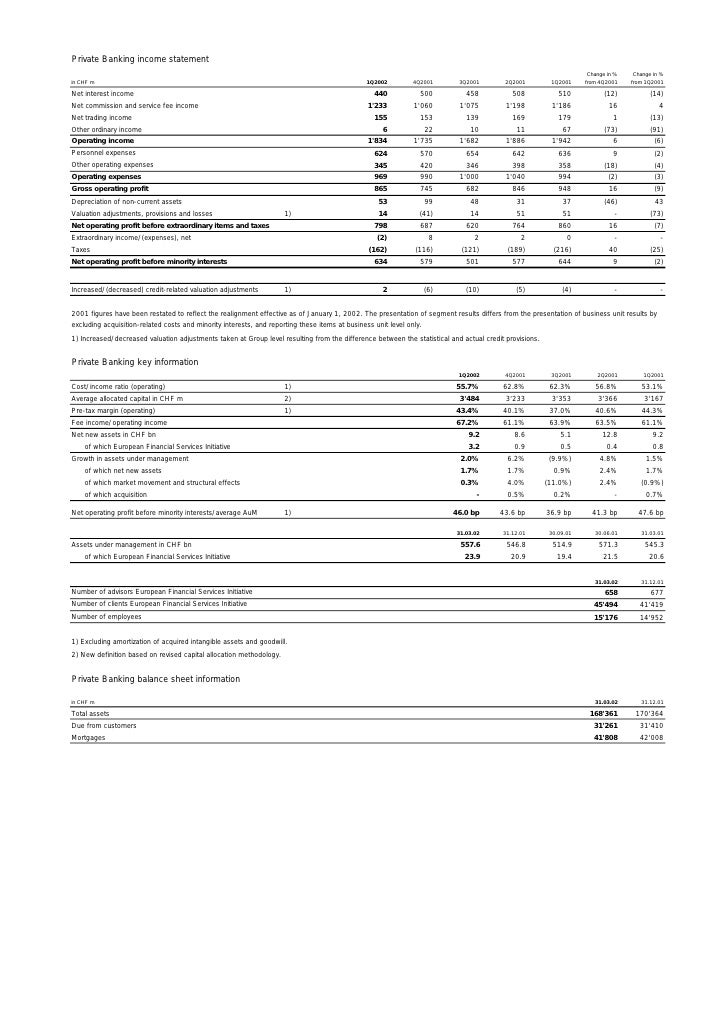

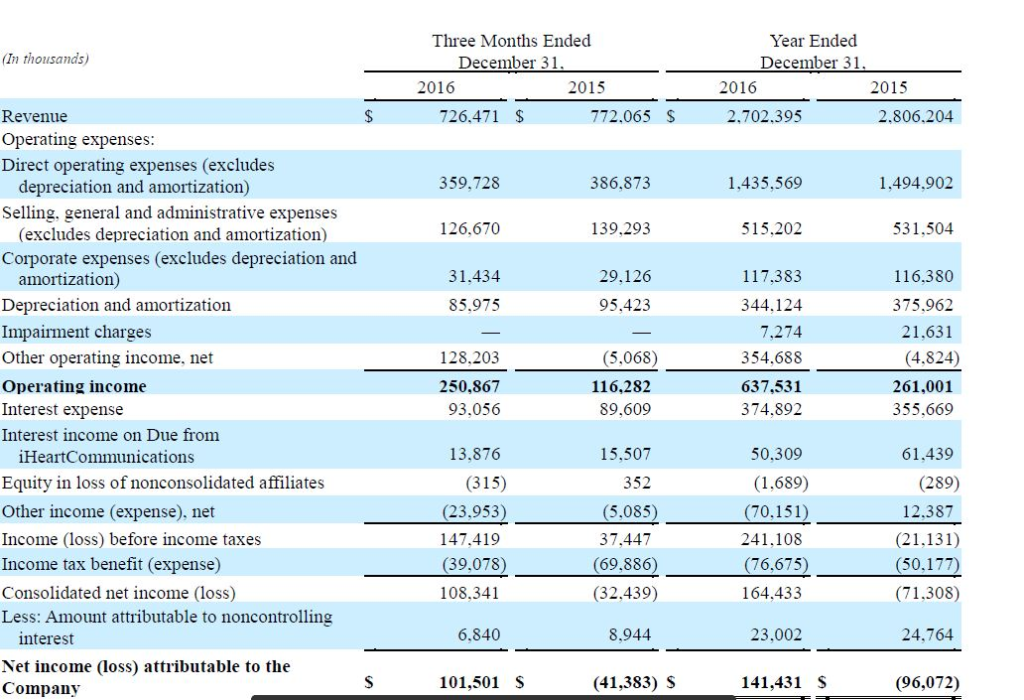

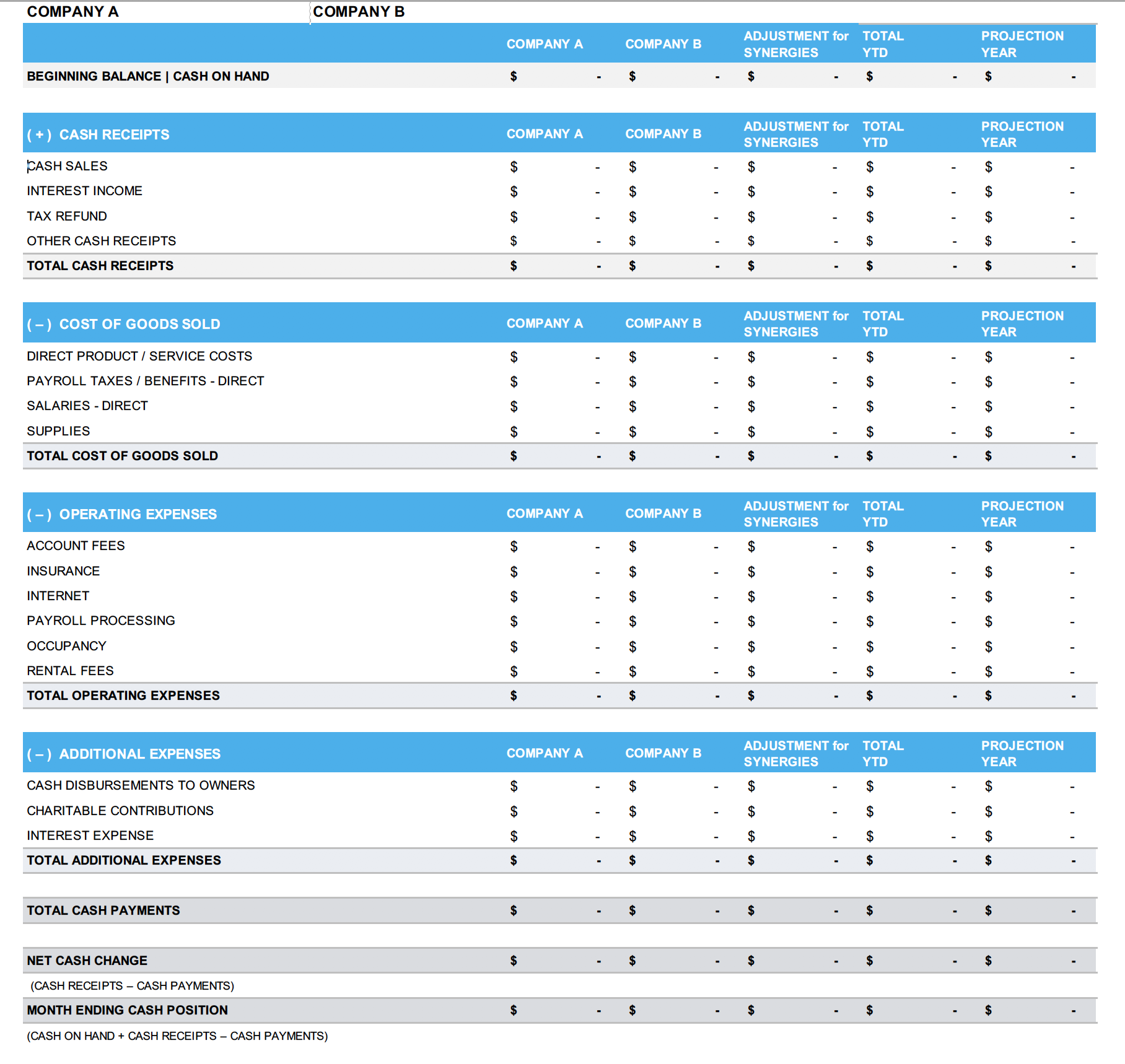

Historical information is based solely on past transactions or events. You may want to use bench’s free templates:. Pro forma financial statements provide a wealth of information that is useful to businesses, investors, and potential buyers, particularly during the process of mergers.

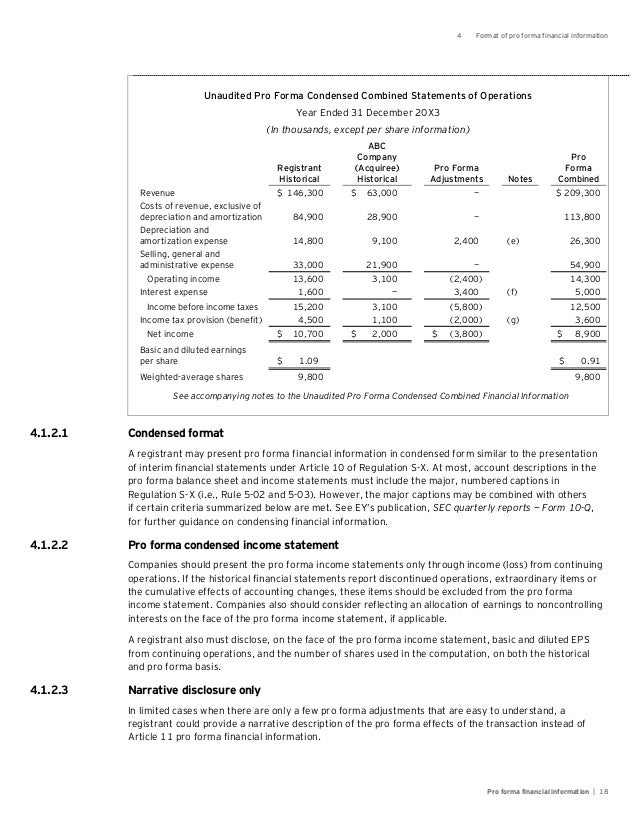

In contrast, pro forma information aims to illustrate how a consummated or. Pro forma financial statements are financial reports issued by an entity, using assumptions or hypothetical conditions about events that may have occurred in the past. This topic describes the circumstances in which pro forma financial.

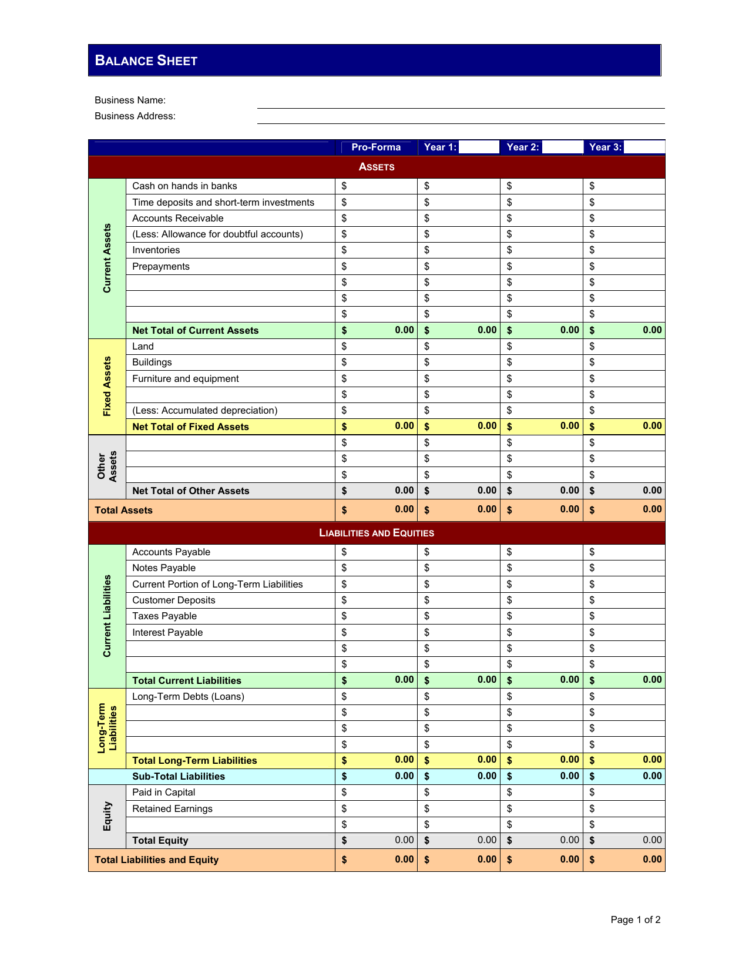

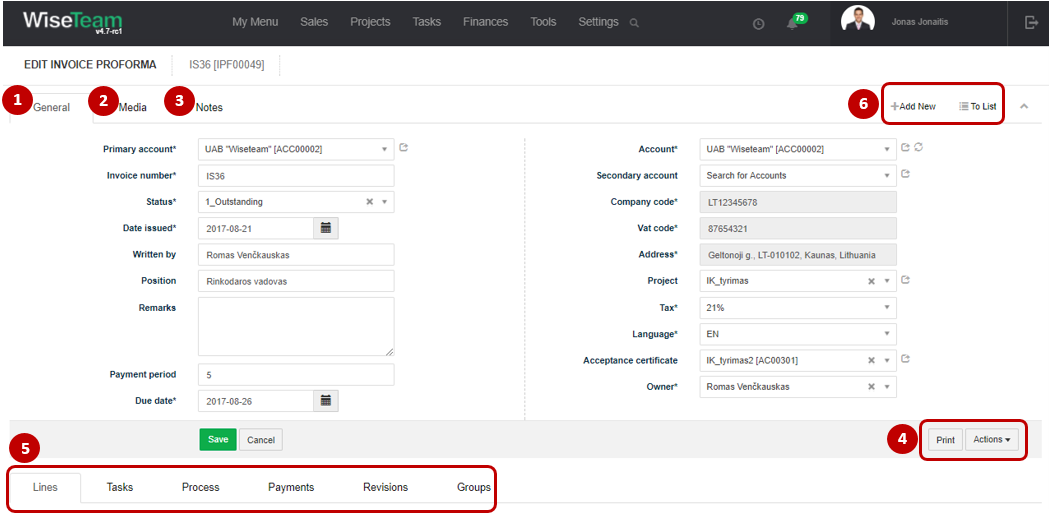

As either historical or pro forma. It is intended that the guidance will relate to pro forma financial information as such a term is used in the pd. To create a pro forma statement, you can use the same template you’d use for a normal financial statement.

Pro forma financial information (pro formas) presents historical balance sheet and income statement information adjusted as if a transaction had occurred at an. The primary objective of pro forma financial information is to show how one or more significant transactions (e.g., a business combination) might have affected. Pro forma financial information can be an important supplement to.

What does pro forma mean? Pro forma means “for the sake of form” or “as a matter of form. when it appears in financial statements, it indicates that a method of calculating financial results using certain projectionsor presumptions has been used. The term pro forma (latin for as a matter of form or for the sake of form) is most often used to describe a practice or document that is provided as a courtesy or satisfies.

Pro forma financial information to which the guidance will relate 19. You may remember that arsc did not address pro. 3120.1 pro forma financial information is required if a disposition either by sale, abandonment or distribution to shareholders has occurred or is probable, and is not.

:max_bytes(150000):strip_icc()/Pro-Forma-V2-c9d1a7bd7843405e8de36c734e910f44.jpg)