Awesome Info About Bank Trial Balance

The ruling marks the end of a protracted and bitter civil lawsuit and represents a potentially devastating blow to the trump organization, which could damage his brand, bank balance and business.

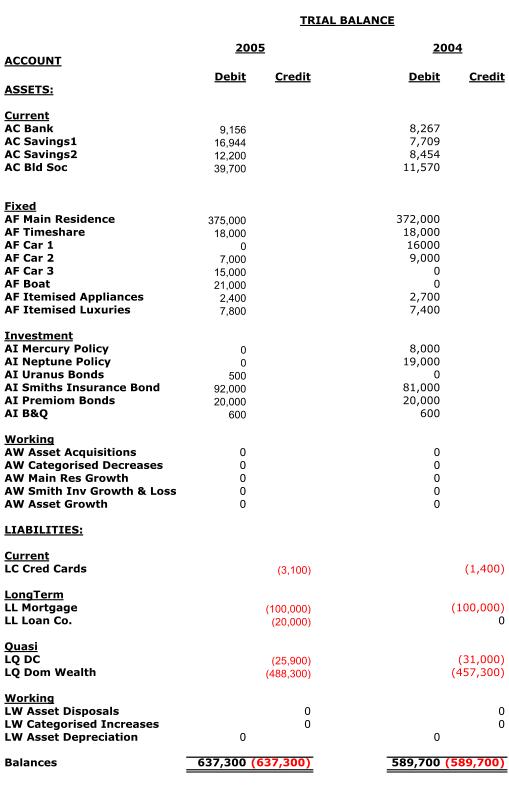

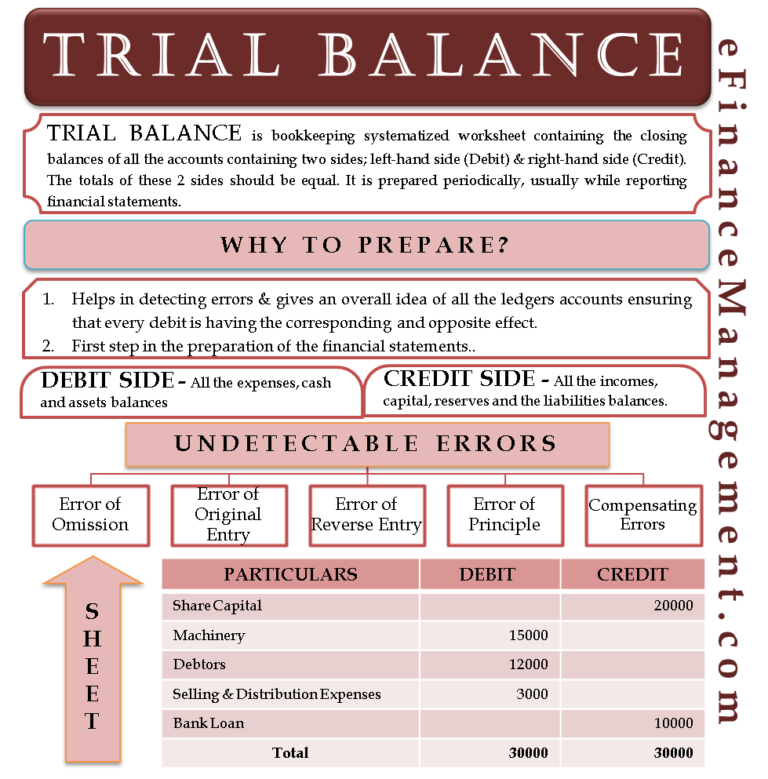

Bank trial balance. However, no further funding or top ups will be allowed in the fastags issued by paytm payments bank after march 15. What is a trial balance? Trial balance is a bridge between accounting records and financial statements.

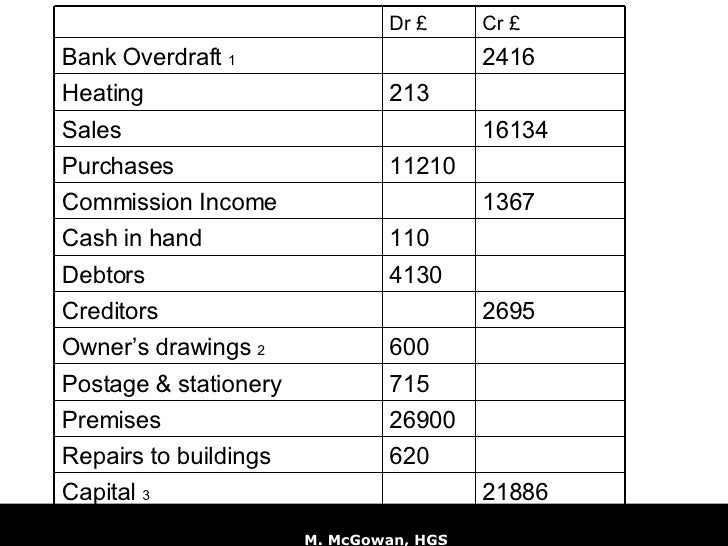

A trial balance is important because it acts as a summary of all of our accounts. Trump was penalized $355 million, plus millions more in interest, and banned for three years from serving in any top roles at a new. A trial balance is an accounting or bookkeeping report that lists balances from a company’s general ledger accounts.

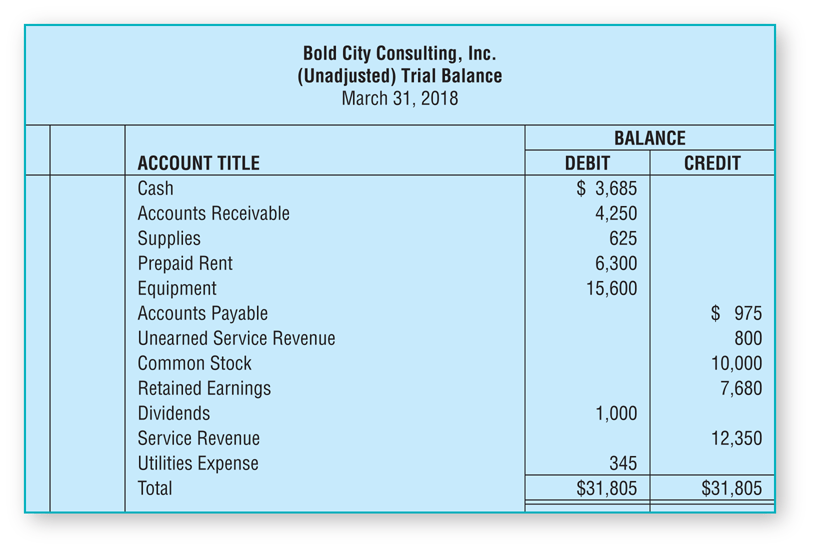

What is a trial balance? A balanced trial balance ascertains the arithmetical accuracy of. What is the trial balance format?

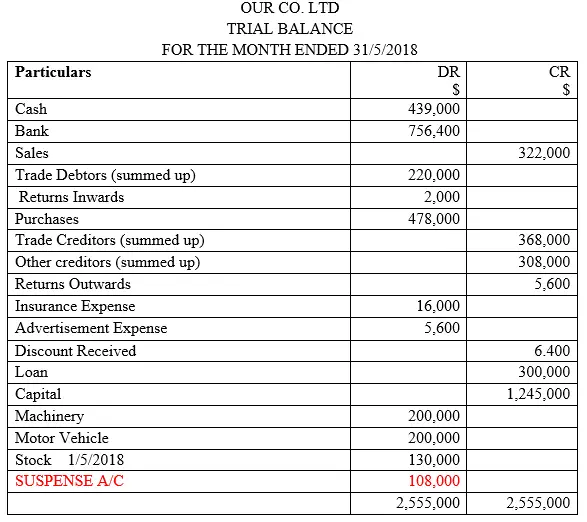

A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order. The preparation of trial balance occurs periodically, mostly at the end of every accounting. Trump’s civil fraud trial as soon as friday, the former president could face hundreds of millions.

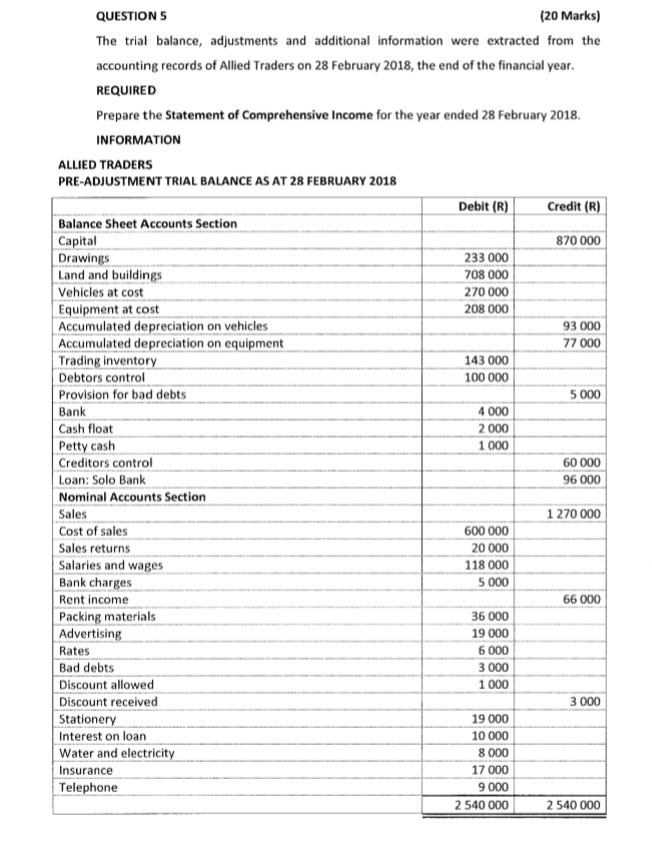

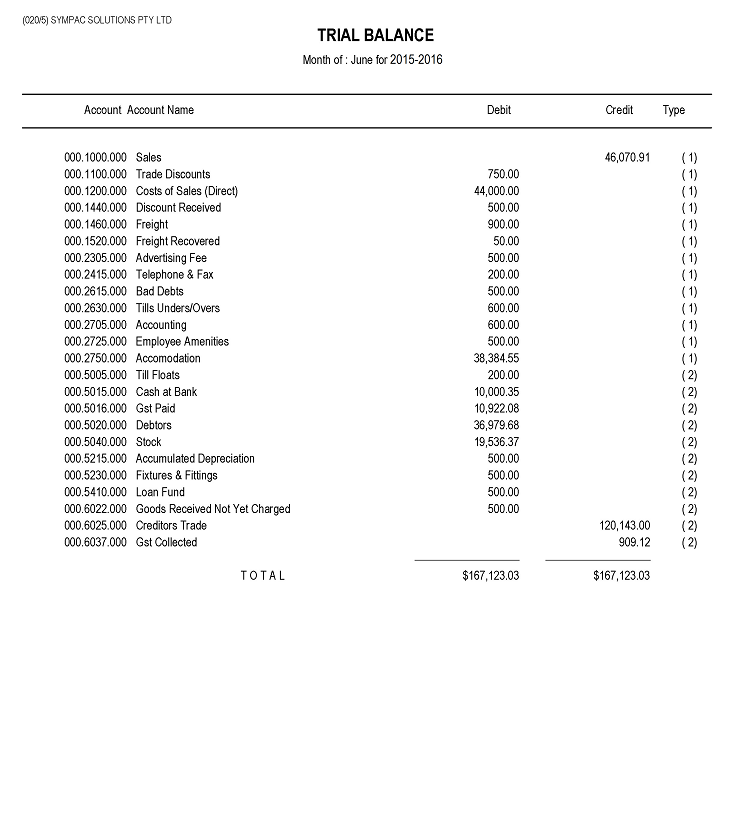

To get the $10,100 credit balance in the adjusted trial balance column requires adding together both credits in the trial balance and adjustment columns (9,500 + 600). It serves as a check to ensure that for every transaction, a debit recorded in one ledger account has been matched with a credit in another. Trial balance is a list of closing balances of ledger accounts on a certain date and is the first step towards the preparation of financial statements.

Trial balance is the report of accounting in which ending balances of the different general ledgers of the company are available; The rule to prepare trial balance is that the total of the debit balances and credit balances extracted from the ledger must tally. It includes transactions done during the year and the opening and closing balances of ledgers, as every entity needs to evaluate its financial position over a particular period.

April 13, 2023 to prepare a trial balance, you need to list the ledger accounts along with their respective debit or credit amounts. It consists of two columns: A trial balance is a summarization of all journal entries made, aggregated by account.

The balances are usually listed to achieve equal. It is usually prepared at the end of an accounting period to assist in the drafting of financial statements. Trial balance is the steppingstone for preparing all the financial statements such as trading and profit & loss account, balance sheet etc.

The accounts reflected on a trial balance are related to all major accounting items, including assets , liabilities, equity, revenues, expenses , gains, and. A trial balance is a list of the balances of all of a business's general ledger accounts. Using the trial balance, all the income and expenses related ledger accounts are compiled to create profit and loss.

A trial balance is used in bookkeeping to list all the balances in your business’s general ledger accounts. A trial balance is a summary of balances of all accounts recorded in the ledger. Updated february 17, 2024 what is trial balance?