Recommendation Info About Accounting Ratios Explained Real Estate Balance Sheet Sample

A brief insight into how an investor, bank, or company thinks.

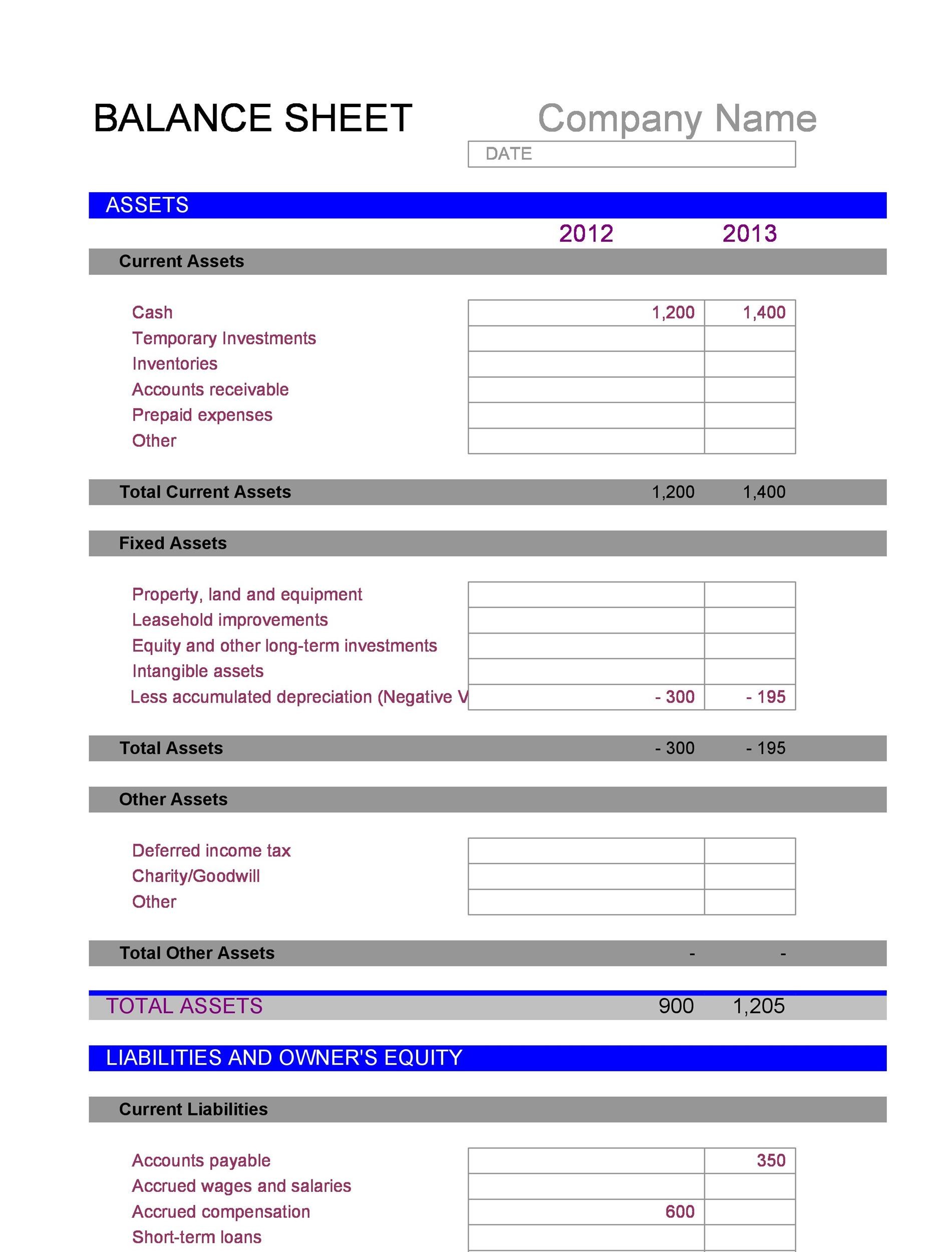

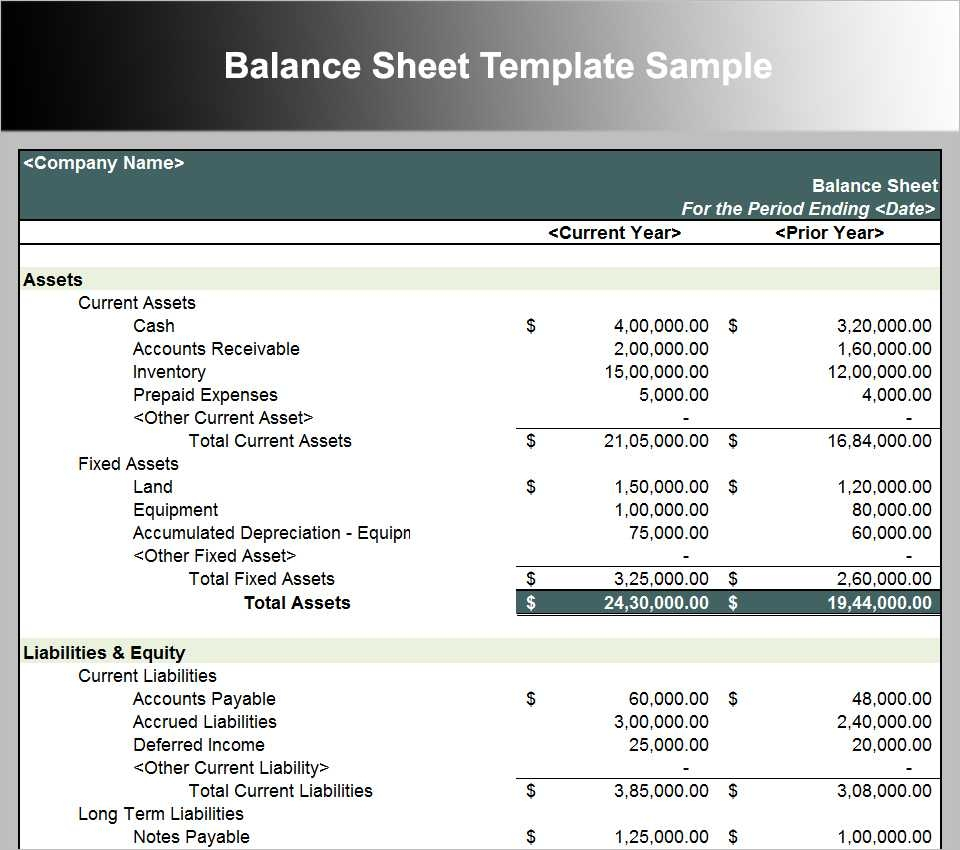

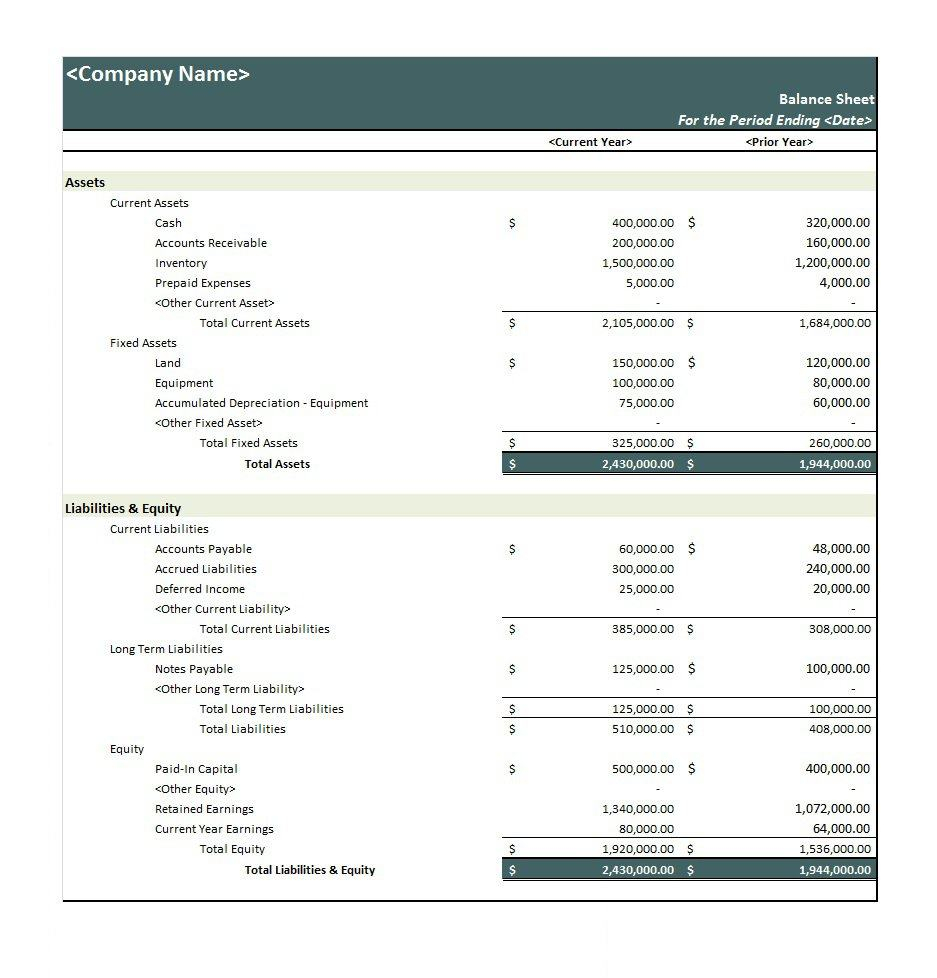

Accounting ratios explained real estate balance sheet sample. Accumulated real estate depreciation appears on the assets section of a balance sheet, as shown in the following example. How vital the ratio is in gauging a company’s health. Equity investments and financial liabilities the fasb issued a new accounting standard that significantly changes the income statement effect of equity investments held by an entity and the recognition

They are effective tools of analysis used by the management. Real estate accounting explained. Real estate accounting is an accounting type that specializes in managing and reporting on the financial aspects of real estate transactions and investments.

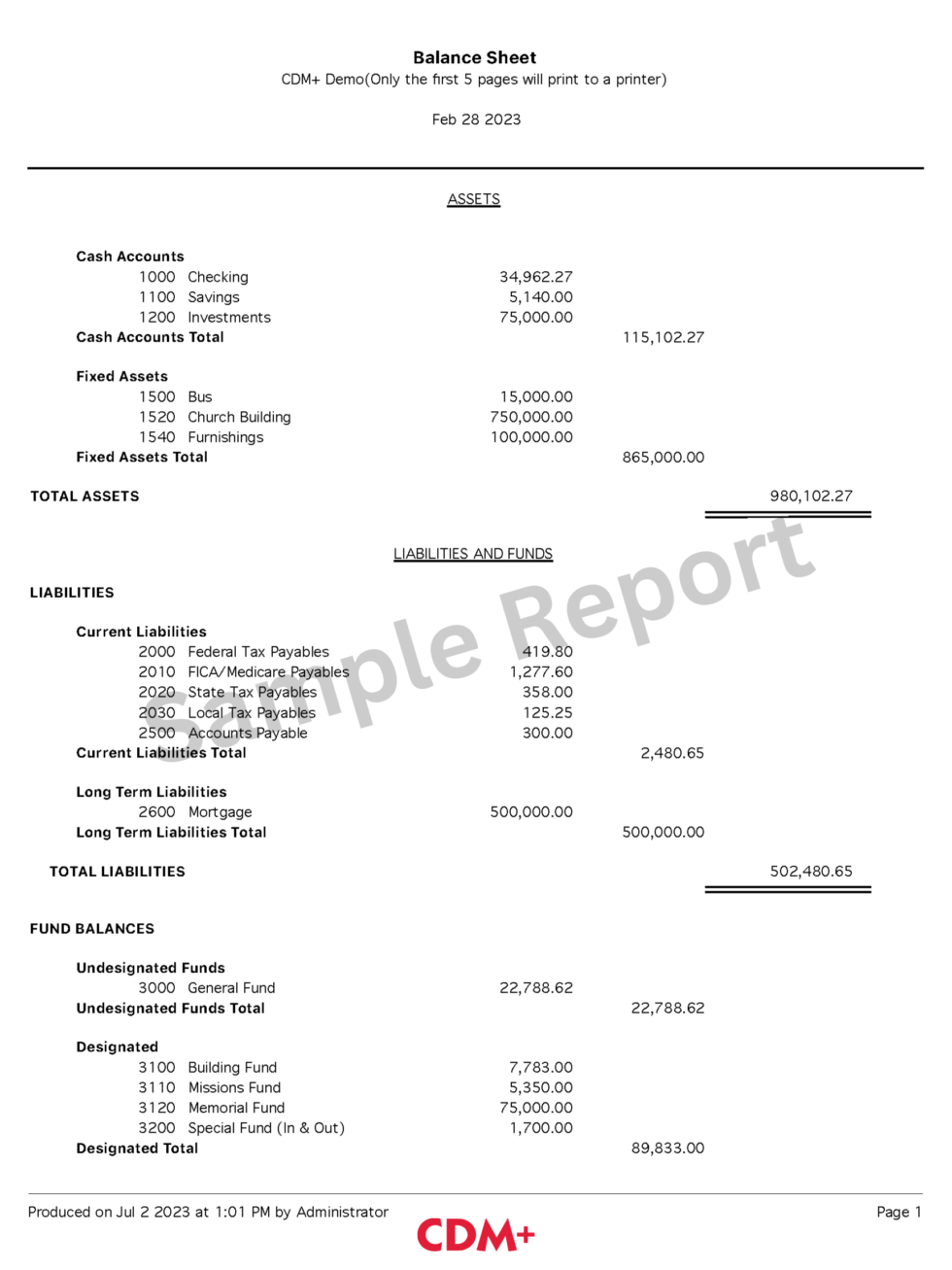

A rental property balance sheet provides a quick look at the equity you have in each property at a given point in time, on both a property and portfolio level, and makes it much easier to determine your own net worth. Balance sheet ratios formula and example definition. An accounting ratio compares two line items in a company’s financial statements, namely made up of its income statement, balance sheet, and cash flow statement.

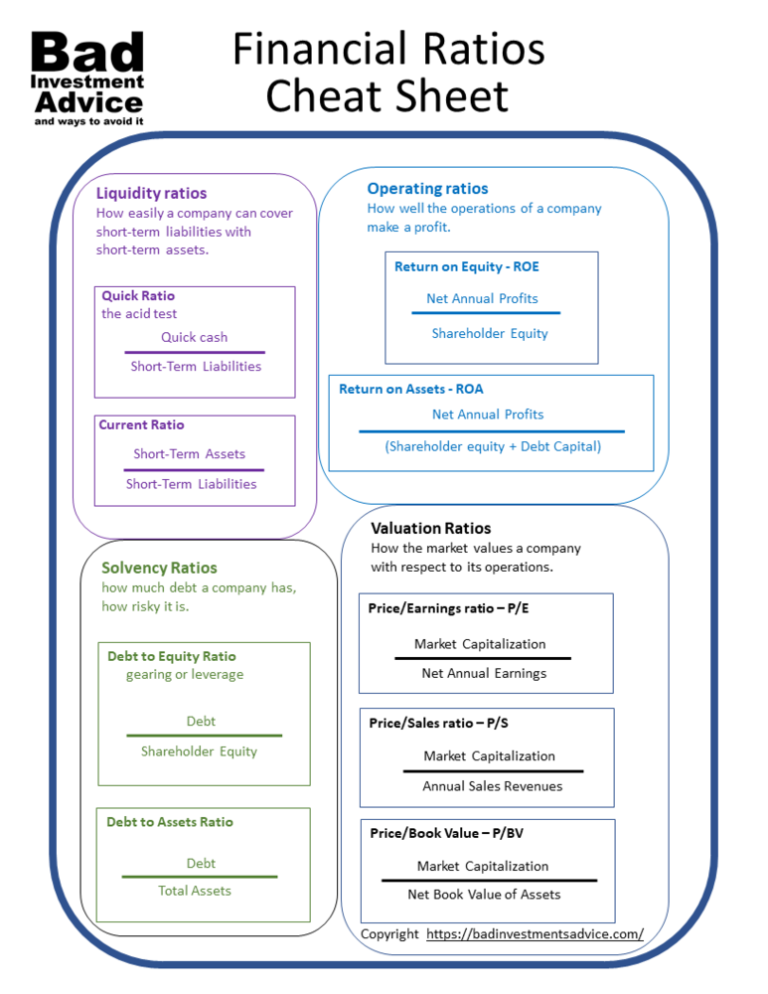

It can also be referred to as a statement of net worth or a statement of financial position. Accounting ratios, also known as financial ratios signify the relationships between figures of the balance sheet and the profit & loss account. Accounting ratios indicate the company’s performance by comparing various figures from financial statements and the results/performance of the company over the last period, suggesting the relationship between two accounting items where financial statement analysis performs using liquidity, solvency, activity, and profitability ratios.

These ratios usually measure the strength of the company comparing to its peers in the same industry. It comprises several economic activities. You pay for your company’s assets by either borrowing money (i.e.

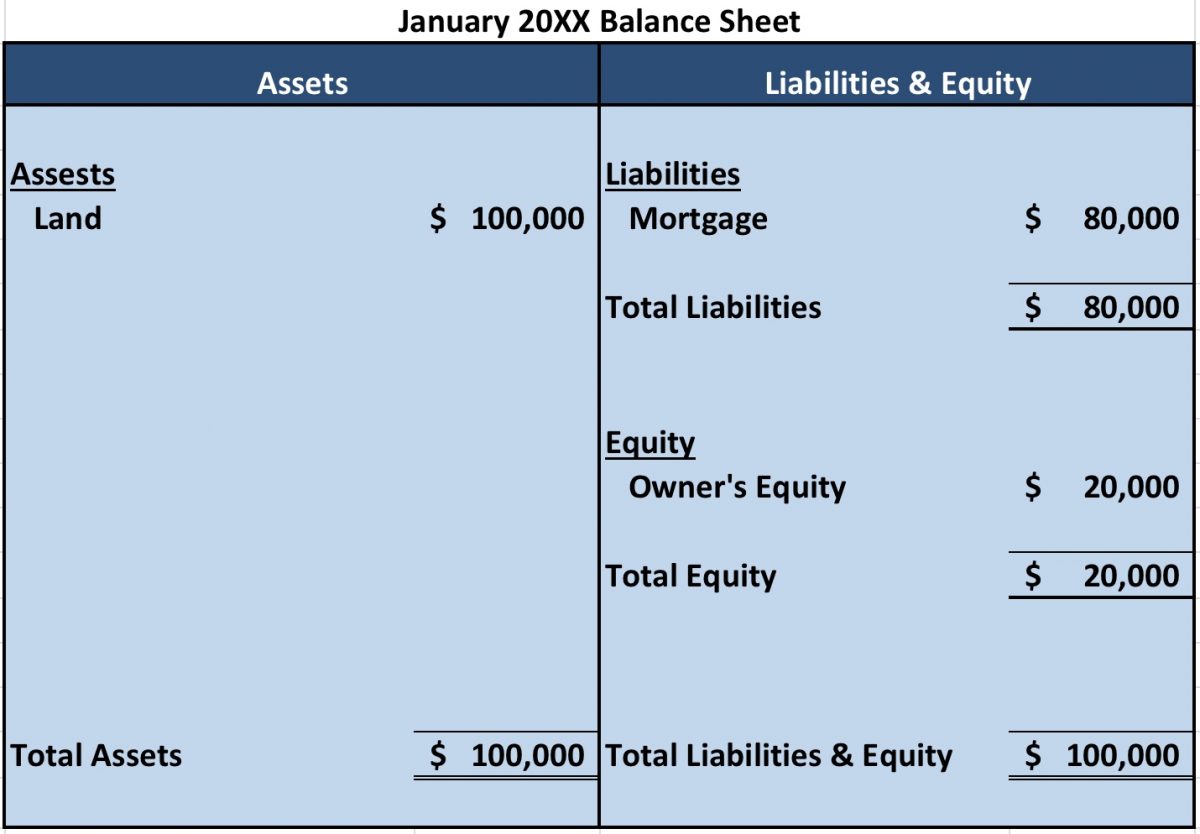

Assets = liabilities + equity. Real estate accounting guide 2022 | accounting of real estate investment investment property is defined in ias 40 as follows. The main objective of any liquidity ratio is to measure the company’s short term solvency status of the company.

Example 1 calculate the quick ratio from the balance sheet shown below. Accounting ratios measure the overall health of a company. Financial ratios are powerful tools for interpreting financial statements and gaining deeper insights into a real estate entity's performance and financial condition.

Shareholders, creditors and other such stakeholders of the company. Increasing your liabilities) or getting money from the owners (equity). By law, 90% of an reit’s profits must be distributed as dividends to.

Track company performance determining individual financial ratios per period and tracking the change in their values over time is done to spot trends that may be developing in a company. The ratios calculate the liquidity, leverage (debt level), efficiency, profitability, and market value of a company. The two sides must balance—hence the name “balance sheet.”.

Return on assets = net income/total assets To sales of real estate. Balance sheet ratios are the ratios that analyze the company’s balance sheet which indicate how good the company’s condition in the market.