Ace Info About Business Financial Statements

Financial statements are essentially the report cards for businesses.

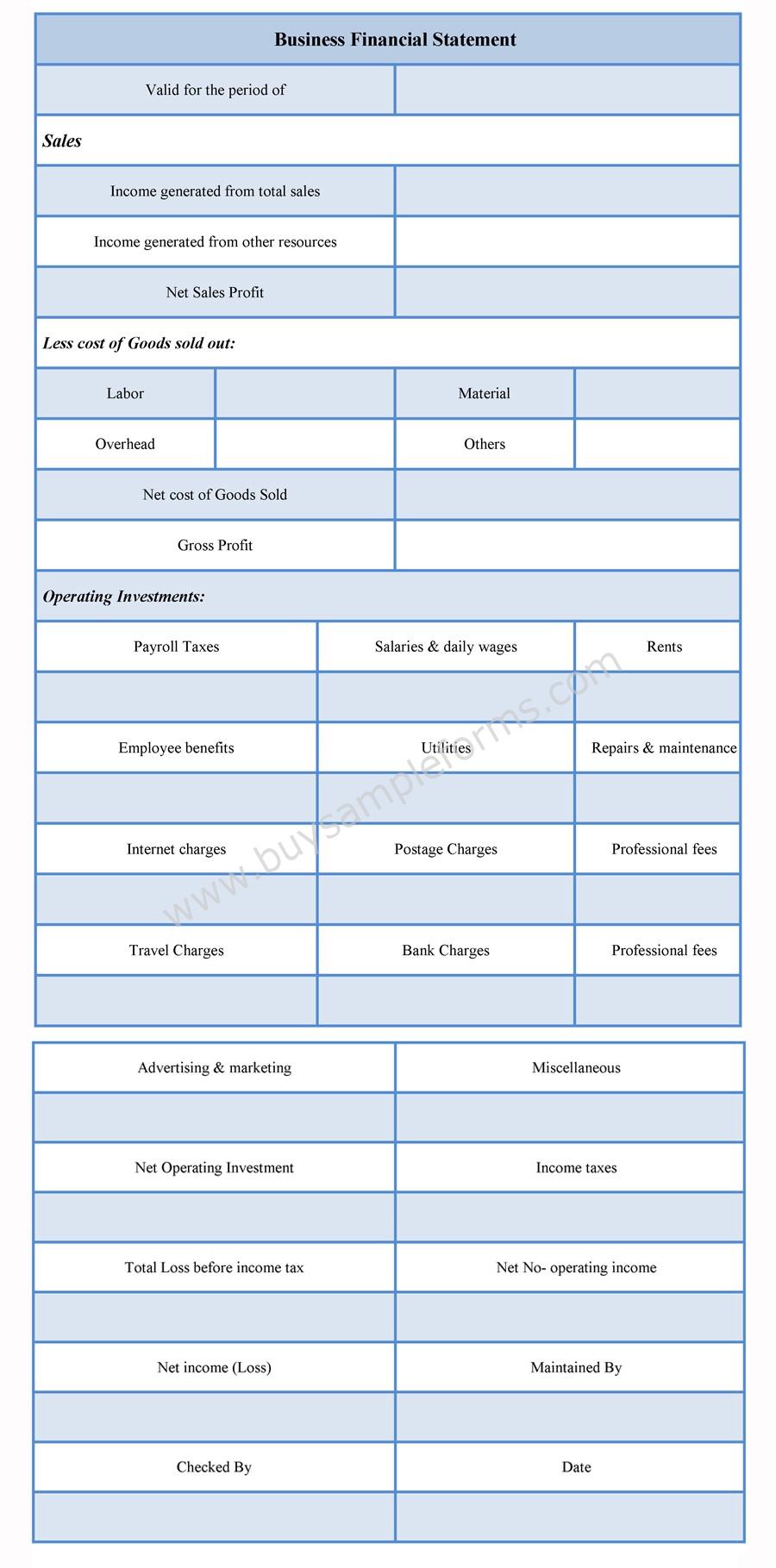

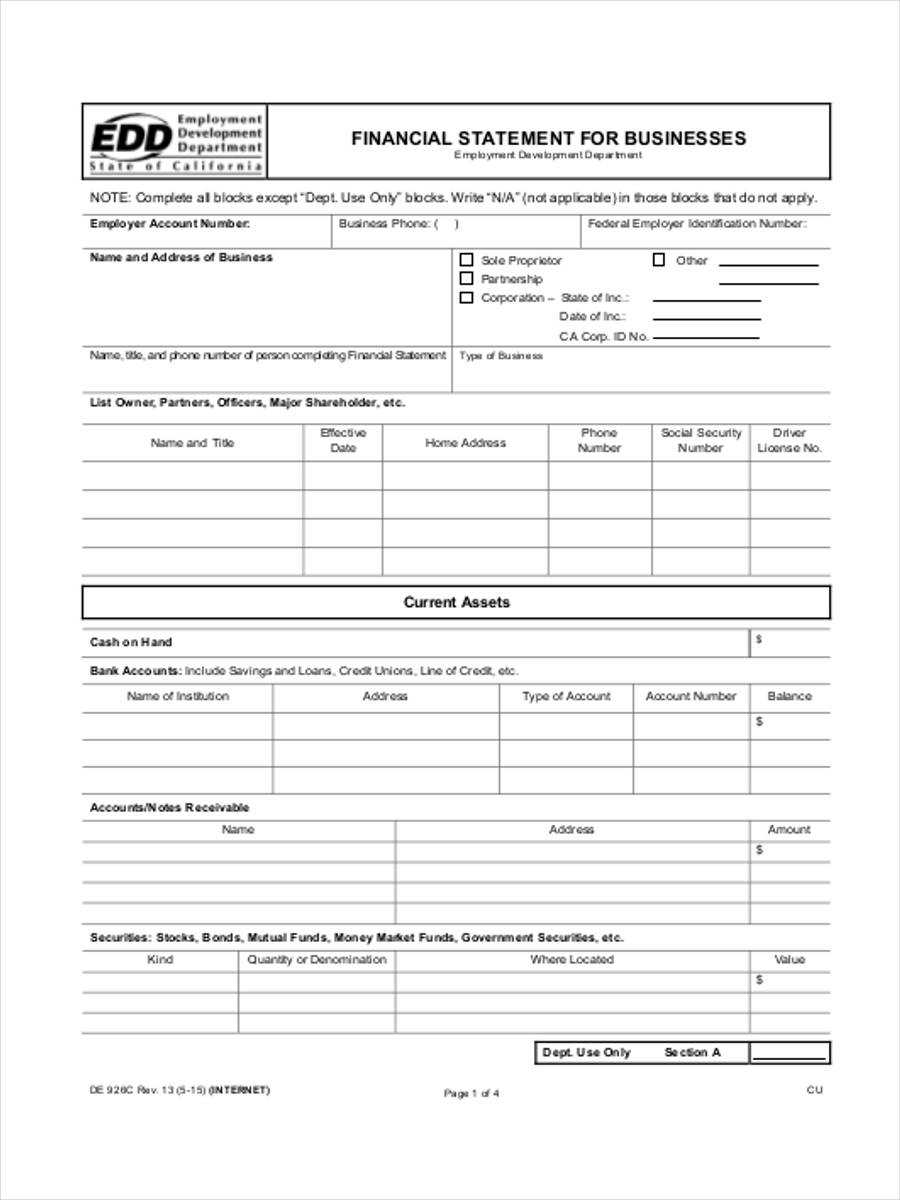

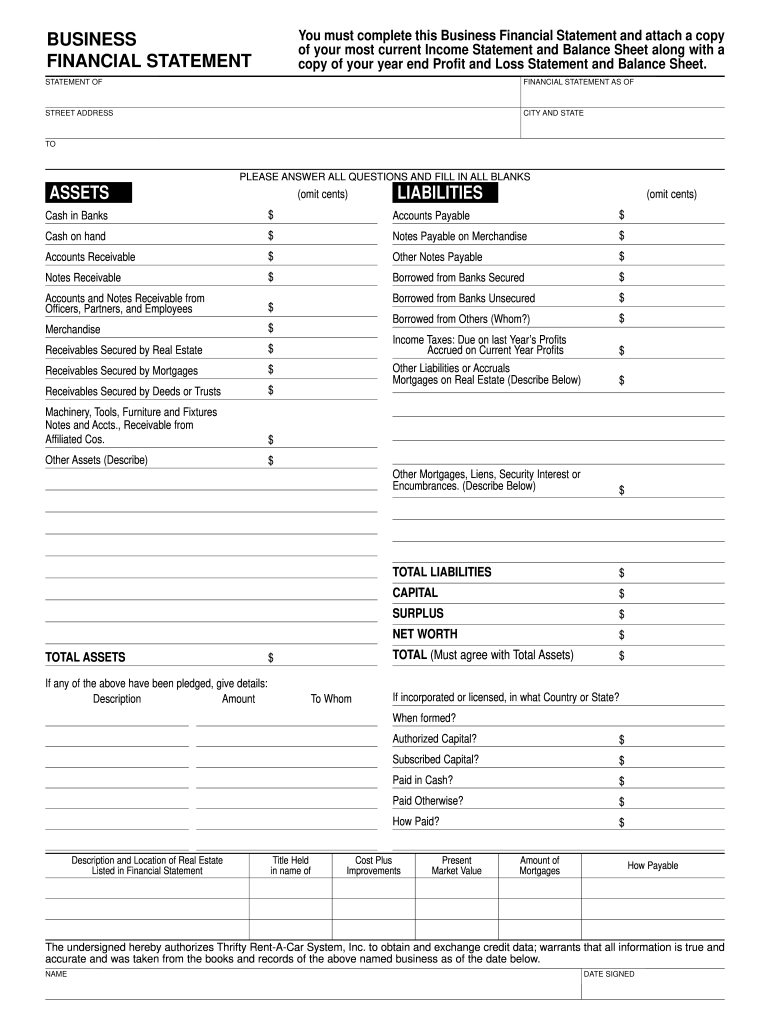

Business financial statements. This financial plan projections template comes as a set of pro forma templates designed to help startups. Something a business owns or controls (e.g. Here’s a look at the three most commonly used by small businesses.

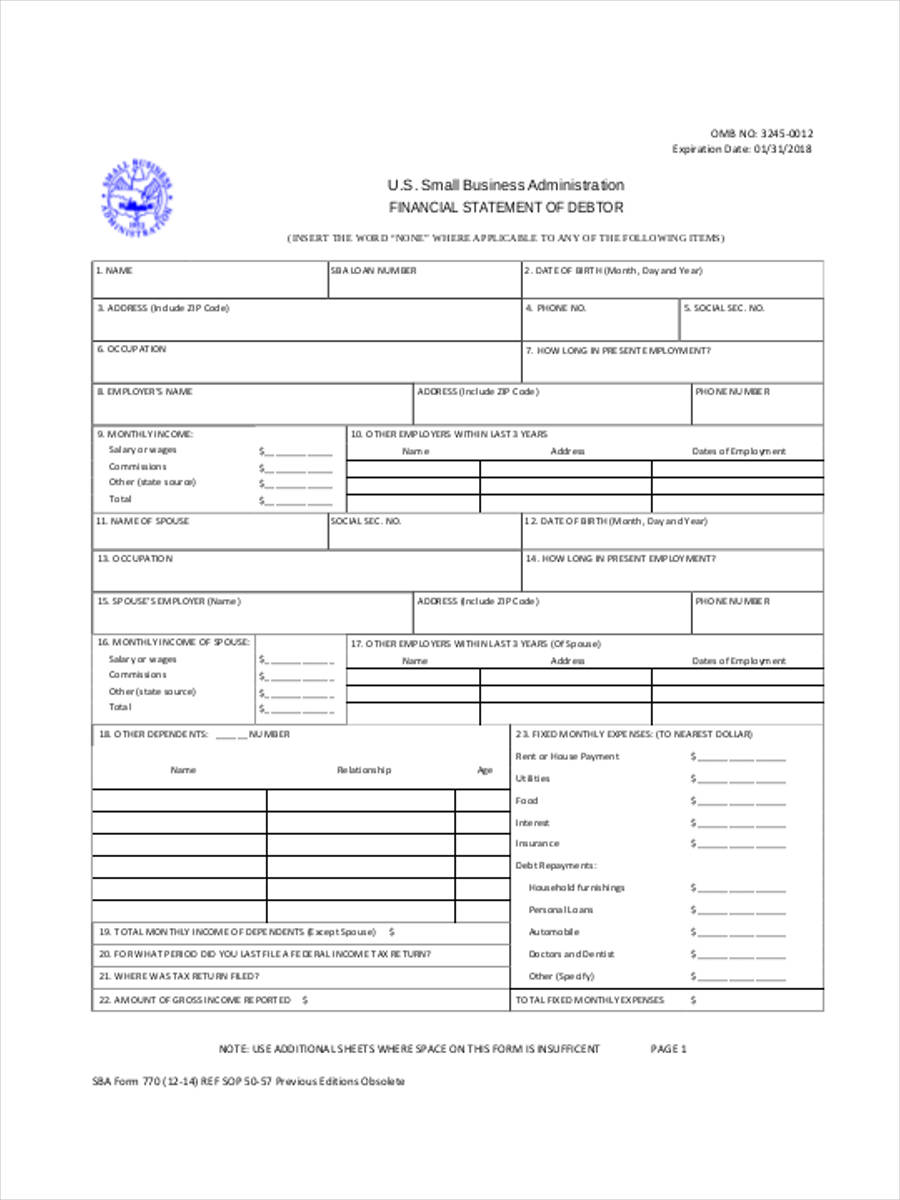

In this free guide, we will break down the most important types and techniques of financial statement analysis. Financial statements provide a representation of a company’s financial performance over time. June 8, 2022 this article is tax professional approved there are three main types of financial statements:

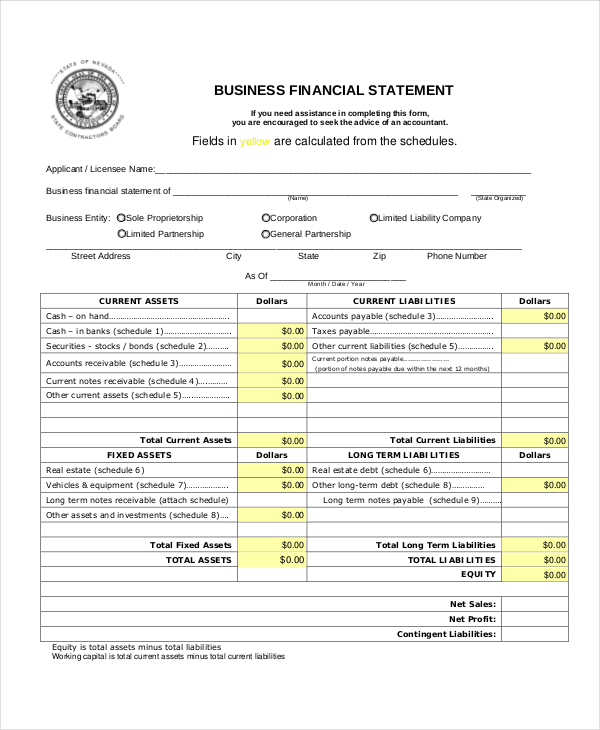

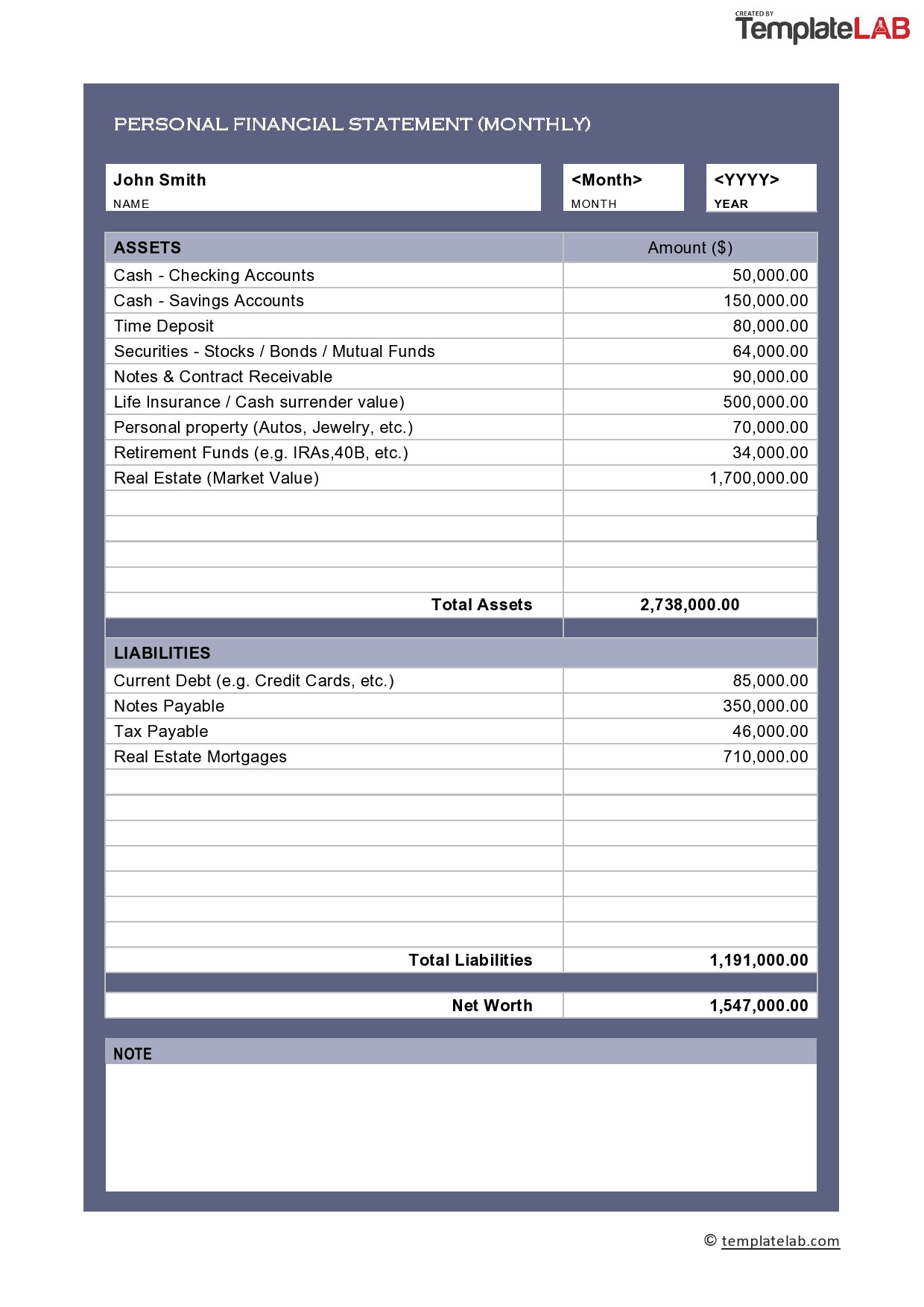

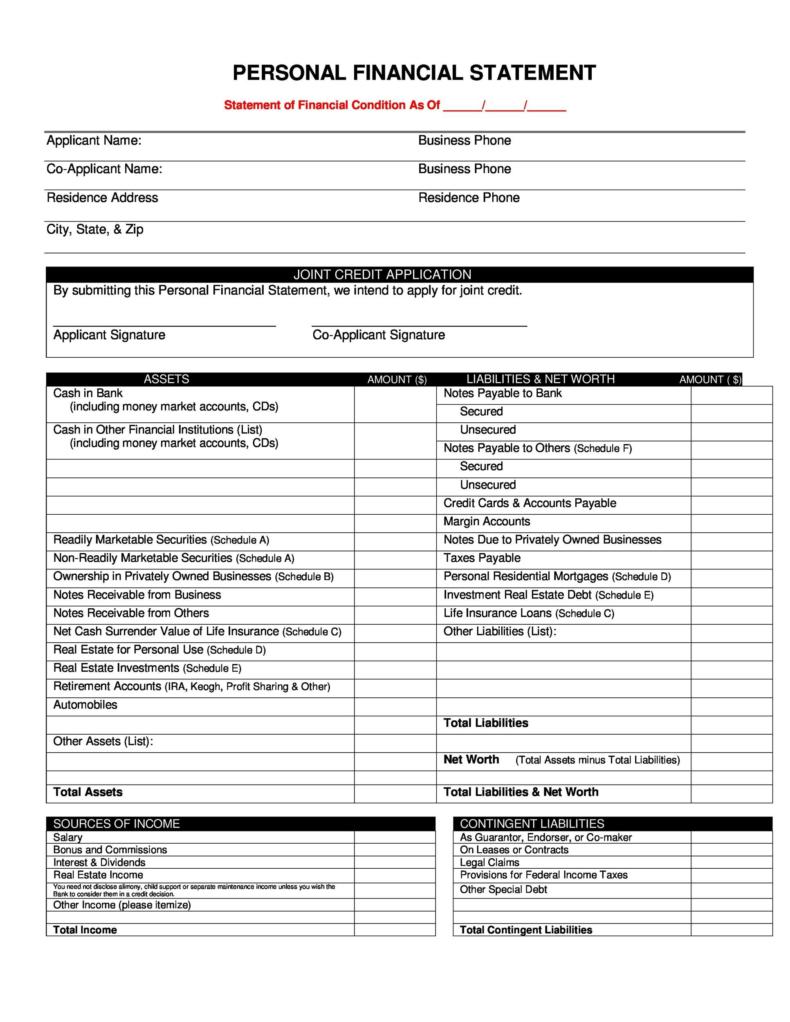

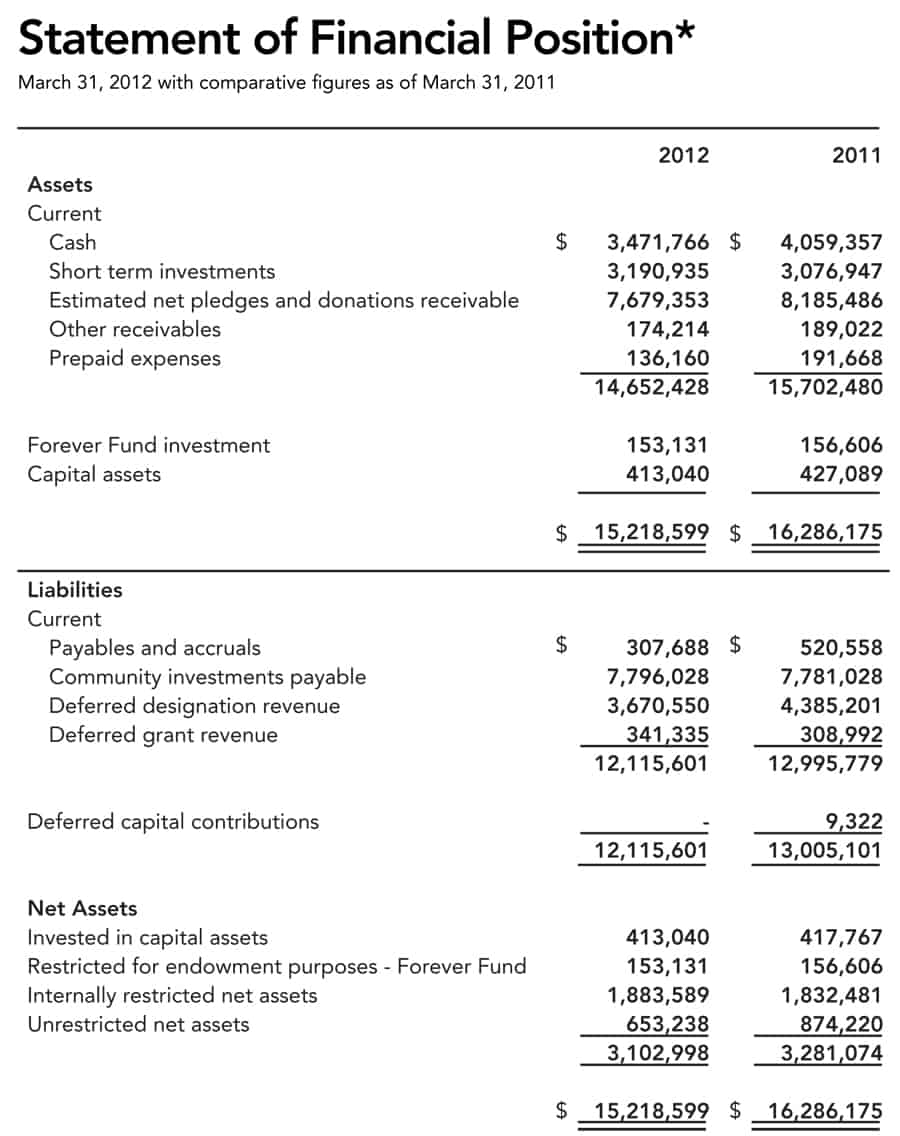

Because it’s called a “balance” sheet, assets must balance (a.k.a, equal) liabilities plus equity. 3.8 the financial statements provided to us must be accompanied by (1) the directors’ report and (2) the oib auditor’s reports in respect of the financial statements and the directors’ report. Financial statements are often audited by government agencies and accountants to ensure.

It is comprised of the following three elements: Vanguard was ultimately excused from the hearing. A current balance sheet, a profit and loss (p&l) statement, and a cash flow statement.

There are three main types of financial statements: Balance sheets show what a company owns and what it owes at a fixed point in time. The value of these documents lies in the story they tell when reviewed together.

There are four main financial statements. Correctly reading a business's financial statements—including profit and loss reports, balance sheets, cash flow statements, and statements of shareholders' equity—can tell you if investing is a good decision. The wall street journal reported that capital one, which already uses visa and mastercard.

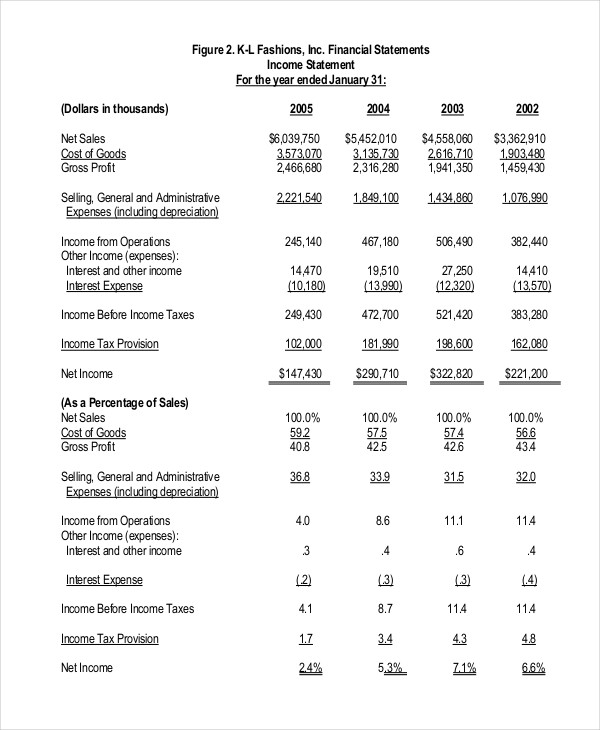

They include key data on what your company owns and owes and how much money it has made and spent. The income statement illustrates the profitability of a company under accrual accounting rules. Wharton has regained its position as the world’s leading provider of mbas in 2024, according to the latest ft ranking of the top 100 global business schools.

The three financial statements are: (1) the income statement, (2) the balance sheet, and (3) the cash flow statement. It lists the assets, liabilities, and equity line by line for.

There are three basic financial statements: A business balance sheet lists your company’s assets and liabilities, and shows your company’s net worth on a certain date. The balance sheet, income statement, and cash flow statement.

Financial statements aid in making decisions about investing in a company, lending money to a company, or providing other forms of financing. External stakeholders use it to understand the overall health of an. When you know how to read your financial statements, you can find ways to make more profit, expand your business, or catch problems before they grow.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/exxonIS09-30-2018-5c5dc83c46e0fb00017dd129.jpg)