First Class Info About Meaning Of Income Statement In Accounting

Accounting income is the profit a company retains after paying off all relevant expenses from sales revenue earned.

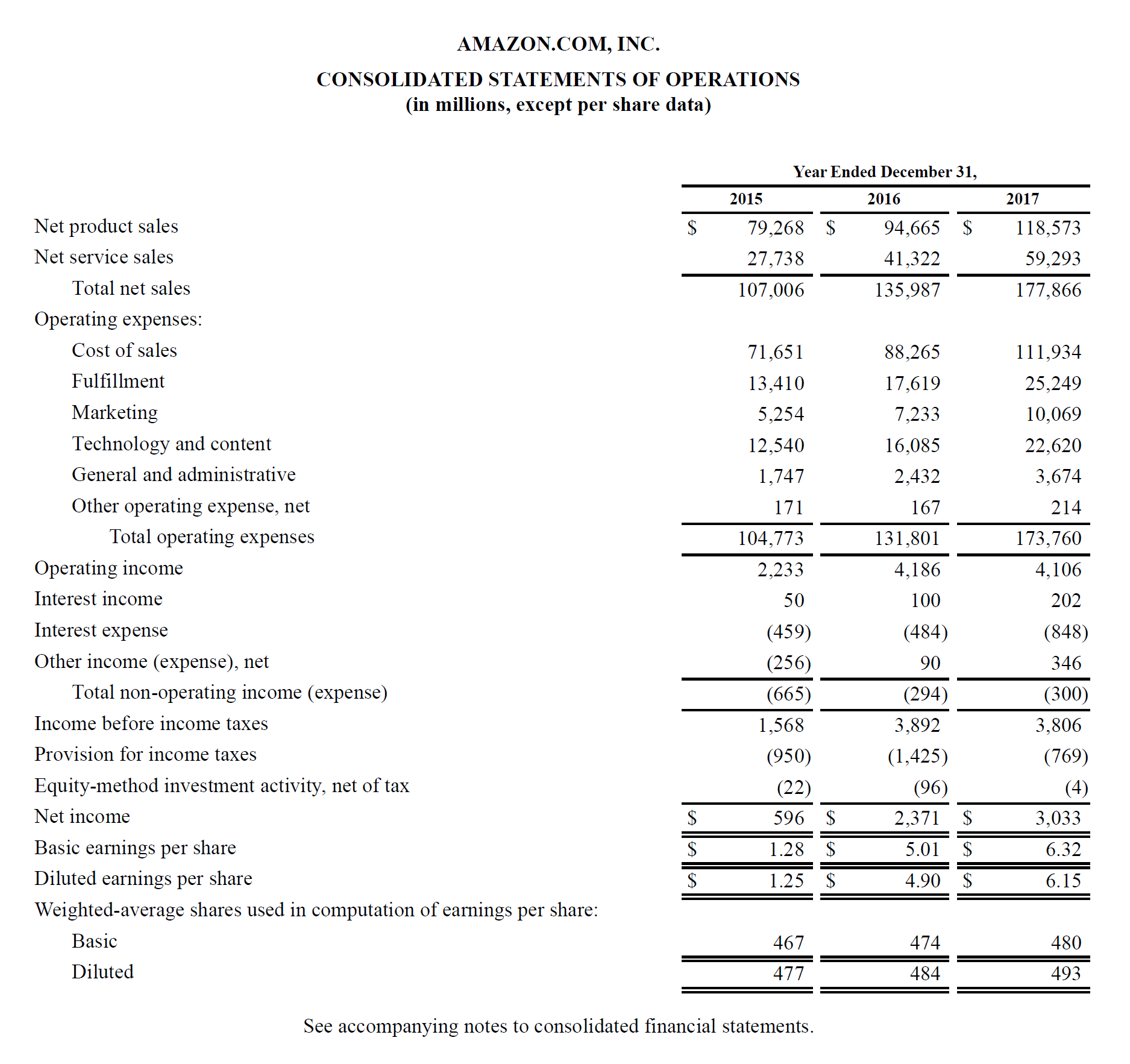

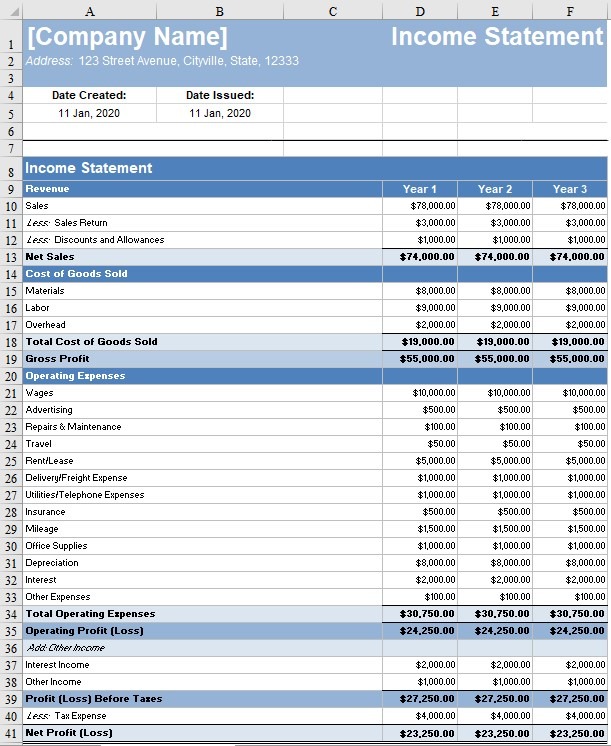

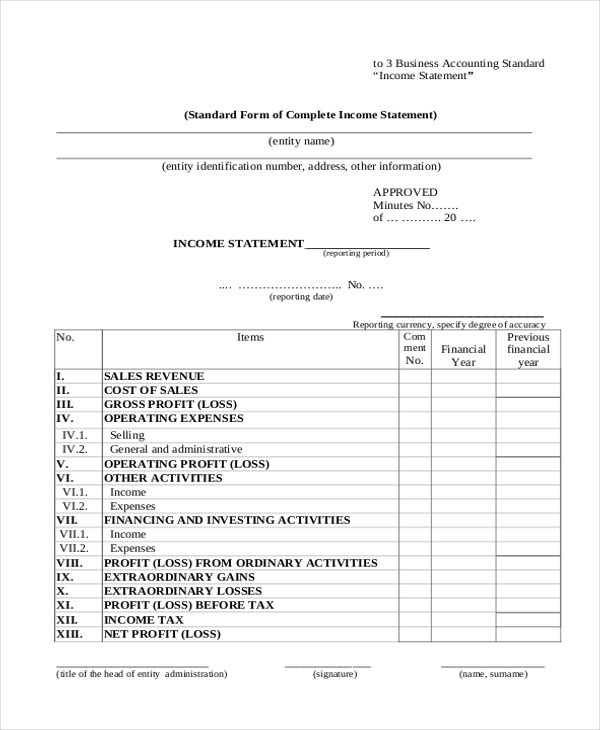

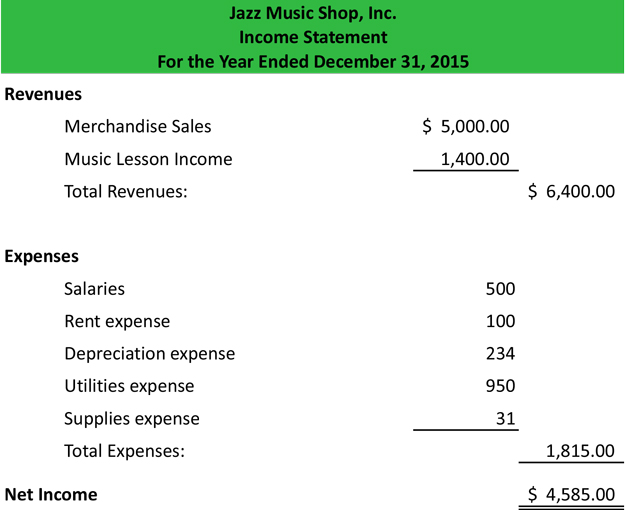

Meaning of income statement in accounting. A january income statement for example would show all the income and expenses for the month. The income statement, sometimes called a statement of earning, or a profit and loss (p&l) shows the results of operations by reporting net income. Income is the revenue a business earns from selling its goods and services or the money an individual receives in compensation for his or her labor, services, or investments.

An income statement, also known as a profit and loss statement or statement of revenue and expense, is a financial statement that provides insights into a company’s financial performance over a specific accounting period. The income statement is a company’s one of the most important financial statement that indicates profit and loss for an accounting year. An income statement summarizes a company's financial performance.

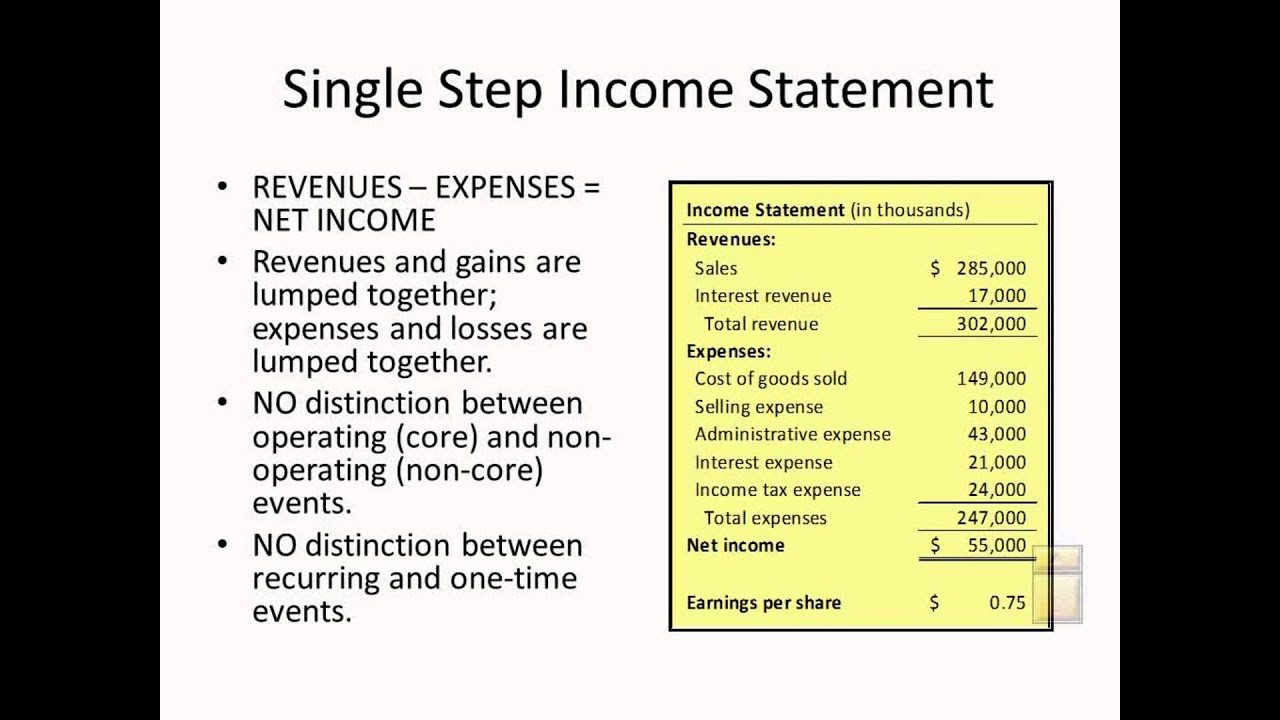

There are two ways of presenting an income statement. A valuation allowance is an accounting reserve (contra account) set against deferred tax assets to ensure that their value on the balance sheet accurately reflects the amount that is more likely than not to be realized. How is revenue recorded on the income statement?

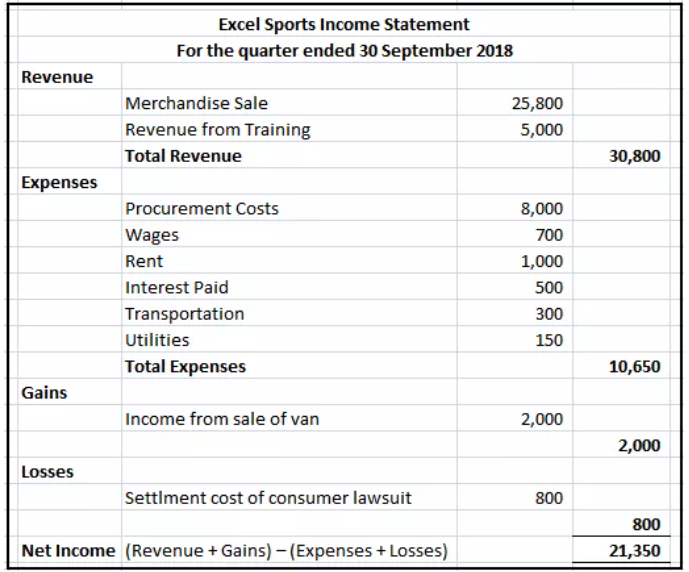

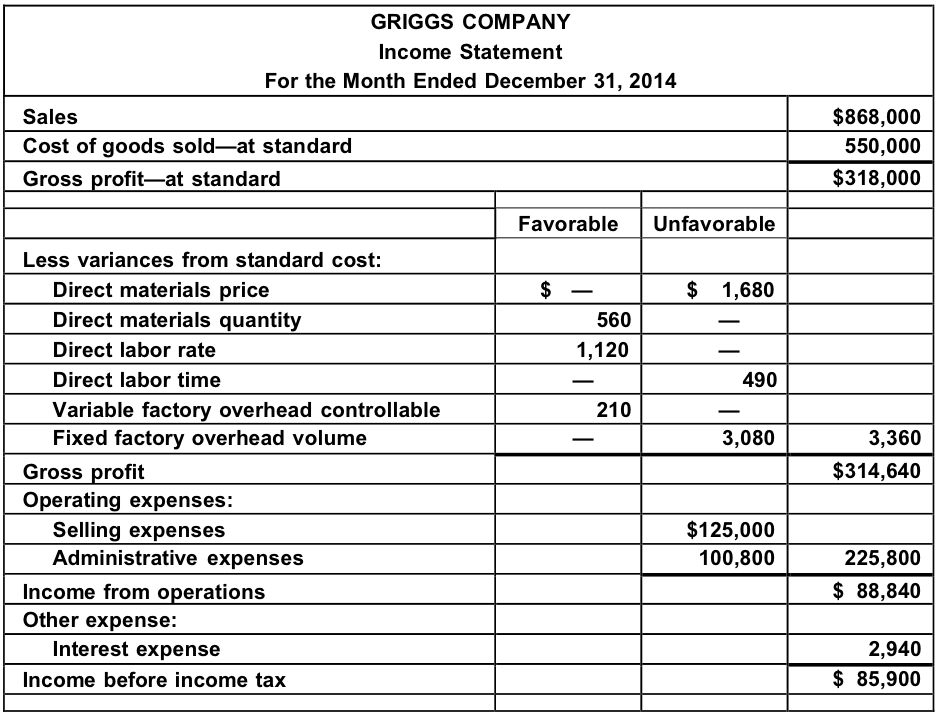

An income statement is one of the three major financial statements, along with the balance sheet and the cash flow statement, that report a company’s financial performance over a specific. Year ended june 30, 2022. The income statement reports the revenues, gains, expenses, losses, net income and other totals for the period of time shown in the heading of the statement.

Year ended december 31, 2022. The income statement is a financial report that shows an entity's financial results over a specific period of time. In other words, when figuring out how profitable a business is, you need to know how much revenue it generates and how much it spends.

The statement quantifies the amount of revenue generated and expenses incurred by an organization during a reporting period ,. Typical periods or time intervals covered by an income statement include: It is synonymous with net income, which is most.

Total income after deducting all expenses. The income statement is also referred to as the profit and loss statement, p&l, statement of income, and the statement of operations. The income statement, also called the profit and loss statement, is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time period.

Depreciation is a financial accounting method used to allocate the cost of tangible assets over their useful lives. It also shows whether a company is making profit or loss for a given period. Start free written by cfi team what is accounting income?

It focuses on the revenue, expenses, gains, and losses reported by the company during that period. The income statement most often used by businesses is the accrual basis income statement. When we compile these reports, we don’t use debits and credits.

The income statement shows income and expenses for a specific period of time. The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time. Businesses report this figure on the income statement whereas individuals report theirs on the form 1040.

:max_bytes(150000):strip_icc()/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)